Michael Burrell/iStock by way of Getty Photos

There’s a purpose why dividend progress traders covet dividend champions. These corporations have elevated their dividends constantly for over 25 years. Which means these corporations have grown distributions by a lot adversity, together with the dot-com bust, the Nice Recession, and the continuing Covid pandemic. Many corporations on the champions record have been elevating the dividend for for much longer.

The dividend champion record is a superb start line for locating dividend progress corporations that can proceed to lift distributions effectively into the long run. The late David Fish created the record, and Justin Regulation at present maintains it. It’s generously supported as a free useful resource and doubtless probably the greatest accessible instruments for dividend progress traders.

At current, there are 142 corporations counted as dividend champions. Resulting from fluctuating alternate charges with international corporations, the record is sort of solely maintained with US corporations. With such numerous corporations, an honest purchase or two is sort of at all times accessible.

Philosophy

As a dividend progress investor, I do not imagine selecting shares must be difficult. In any case, the general objective of most dividend progress traders is to develop an revenue stream over time. Merely selecting corporations off the dividend champions record might be the primary approach to make sure this happens. Nonetheless, shopping for overpriced corporations impacts long-term revenue progress.

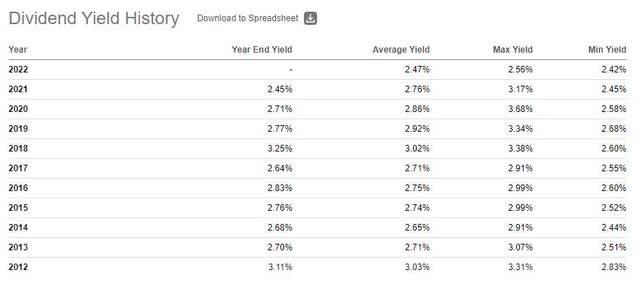

For instance, Pepsi (PEP) frequently hits a 3% yield. The chart under reveals Pepsi’s max, min, and common yield for the final ten years. In eight out of the earlier ten years, Pepsi has hit at the least a 3% yield (together with the two.99% years). The typical yield throughout this time-frame is about 2.75%. The distinction seems slight till you start placing numbers to it.

Looking for Alpha

Pepsi has a long-term dividend progress price of about 7%. An investor who purchased on the common yield of two.75% won’t obtain a yield on value of three% till experiencing two will increase. Right now, the corporate yields about 2.5%. Shopping for at right now’s worth means ready for 3 will increase to achieve the three% yield. The corporate will doubtless hit a 3% yield by worth fluctuation earlier than ready for dividend will increase.

For that reason, a DGI investor ought to at all times be conscious of not simply the beginning yield they’re getting, however the frequency with which it happens and what number of years of a head begin they’re receiving over accepting the common yield. So, in different phrases, we should always take into account each the magnitude of the yield and the frequency of which it happens.

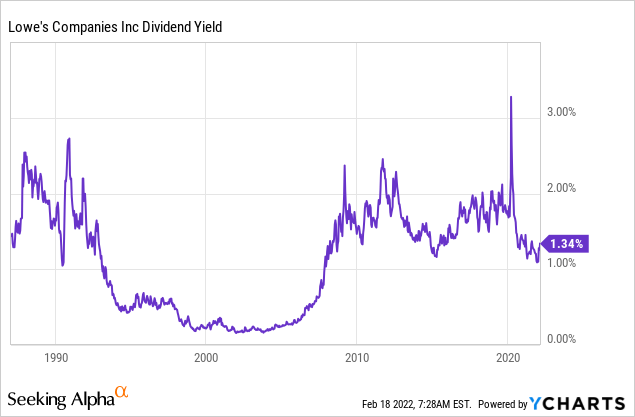

An ideal instance of this precept was Lowes (LOW) within the flash crash of 2020. Whereas there have been bargains all over the place, Lowes was at an excessive. As proven within the chart under, the corporate topped a 3% yield, which had not occurred in over 30 years! I take into account Lowe’s one of the crucial excessive dividend progress bargains of the flash crash.

Basically, deviation from historic dividend yields and historic PE’s are my favourite approach of figuring out the magnitude of a possible cut price. Nonetheless, these metrics do not say a lot concerning the continuation of dividend progress.

Whereas it’s usually protected to imagine a dividend champion will proceed rising the dividend, I like to take a look at different metrics to find out the chance of an organization matching or exceeding its present 5-year dividend progress price. Whereas avoiding dividend cuts is a precedence, most dividend progress shares are usually not high-yielding. For that reason, the dividend progress piece turns into of prime significance to dividend progress traders.

As soon as once more, I discover that holding it easy is greater than ample. I take into account the next metrics when evaluating dividend progress corporations:

Payout ratio – I like to take a look at earnings and money payout ratios. Whereas the general payout ratio is commonly mentioned as an indication of dividend security, I’m primarily wanting on the change within the payout ratio over time. For instance, an organization that has grown its dividend quickly however expanded its payout ratio from 30% to 60% within the course of is just not almost as prone to preserve the identical price of dividend progress sooner or later.

In fact, the general magnitude of the payout ratio does come into consideration sooner or later. A really low payout ratio firm might have loads of room to develop the dividend by increasing the ratio. In distinction, an organization with a excessive payout ratio will doubtless solely develop the dividend by precise earnings.

Credit standing – This can be a easy metric. I would like an investment-grade firm. I have a tendency to make use of this extra when evaluating to corporations. As an illustration, if two corporations look equally interesting, I choose the one with a better ranking.

Debt metrics– Like credit standing, I primarily use this to check corporations and decide total high quality. Decrease debt is best, however I additionally evaluate debt ratios to the corporate’s friends.

Lengthy-term earnings forecasts – Take these with a considerable amount of skepticism. No one is superb at predicting the long run. However it’s good to see a forecast that exceeds my dividend progress objectives. It is uncertain that dividend progress will exceed earnings progress over an extended interval.

2 Dividend Champions to Contemplate

I’m continuously reviewing my favourite dividend progress shares for bargains. This contains corporations I personal and firms I would wish to personal. Whereas final 12 months did not provide many offers, the market downturn is creating many thrilling alternatives. Beneath I define two dividend champions, T. Rowe Value (TROW) and Medtronic (MDT), which can be crushed down right now.

T. Rowe Value

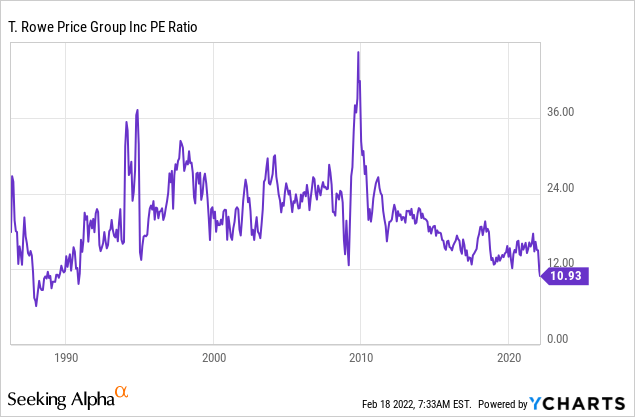

T. Rowe Value has just lately been featured in lots of dividend progress articles, and with good purpose. The corporate is at an excessive valuation. The PE is presently decrease than in 2009 on the backside of the GFC market. Half of the present low valuation is simply being in a beaten-down neighborhood; financials usually are at low valuations. The opposite latest antagonist was an earnings report that did not excite merchants. In fact, dividend progress traders aren’t involved about short-term fluctuations, and the long run nonetheless appears shiny for TROW.

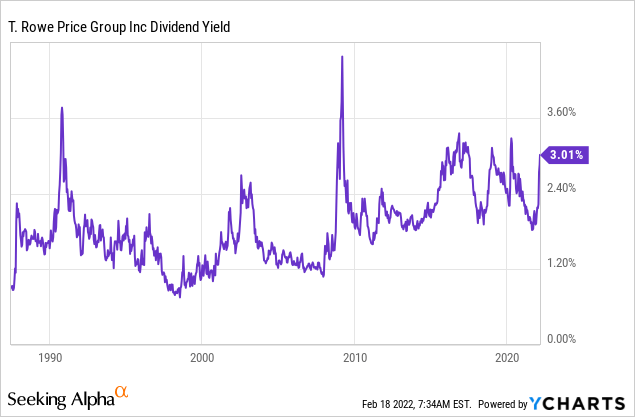

For over 35 years, TROW has been elevating dividends like clockwork. In contrast to many long-term dividend growers, they’ve a 5-year dividend progress price of almost 15%! The corporate’s most up-to-date enhance of 11.1% occurred in early February and pushed the ahead yield effectively above its historic averages. Moreover, the corporate pays periodic particular dividends, the final of which was $3 per share in 2021.

As seen within the chart above, at the moment 3.3% ahead yield, the corporate is providing a place to begin effectively above the historic common. Whereas the present yield has been matched a couple of instances within the final couple of years, the latest being the flash crash in 2020, it’s effectively above regular. The corporate has solely hit a 3.5% yield thrice previously 30 plus years! I might be trying to again up the truck ought to it attain that time.

Impressively, the corporate has a payout ratio within the mid-30s, down from near 40% a decade earlier. The flexibility to keep up and even cut back the payout ratio with such a robust and prolonged dividend progress historical past may be very unusual. Along with sustaining a constant payout ratio, analysts undertaking the corporate’s long-term progress to be within the low double digits indicating stable dividend progress is prone to proceed. Nonetheless, a consideration is that forecasts are presently falling for the corporate.

Medtronic

With over 44 years of dividend progress, Medtronic has raised the dividend by many challenges. The well being care sector is one other one which has lagged the general market in recent times, though medical system producers, equivalent to MDT, have performed higher. Resulting from some setbacks in its diabetes enterprise and muted steerage, Medtronic has taken a beating recently; Nonetheless, to the long-term investor, that is simply noise.

Lengthy-term progress forecasts predict a progress price within the excessive single digits to low double digits over the following 5 years. Traders ought to count on the dividend progress price to match earnings progress for essentially the most half, given the payout ratio historical past. Medtronic has had a creeping payout ratio over the past twenty years, going from the excessive teenagers to the mid 40’s right now. This elevated considerably through the pandemic; nevertheless, it was simply absorbed with a comparatively low beginning payout ratio. Count on payout ratios to drop nearer to 40% once more as earnings get better.

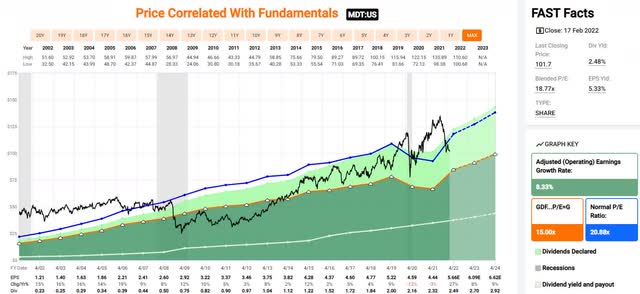

Medtronic has traded at a premium for many of the final twenty years, as proven within the Fastgraph under. Whereas the last few years’ returns have been lower than stellar, the dividend progress has maintained its constant march greater. For the previous couple of years, the market has assigned a major premium to Medtronic. Because of this, the latest drop has solely introduced the worth into honest worth vary.

fastgraphs.com

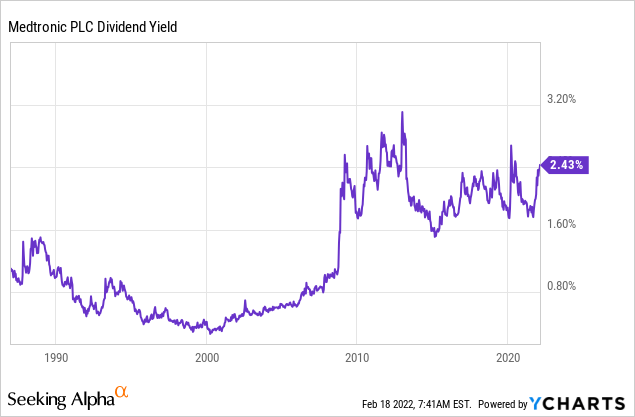

The present yield of virtually 2.5% is one not often supplied. Whereas this will appear paltry to high-dividend traders, the dividend will double each 9 years at MDT’s constant dividend progress price of 8%. As proven within the chart under, Medtronic has reached a yield this excessive solely a handful of instances within the final 30 plus years. In fact, greater yields have change into extra frequent in recent times as progress has slowed, and it is attainable in an growing price setting, the corporate might attain a 3% yield.

The final time Medtronic supplied a 3% yield was the early 2010’s. At the moment, the PE ratio was half of what it’s right now. So proper now, there are conflicting alerts on the inventory. Dividend yield signifies a possible cut price, whereas PE ratios point out the corporate is nearer to honest worth.

With an A credit standing and 44 years of dividend progress, an investor choosing Medtronic up at honest worth can hardly go fallacious. Nonetheless, given the creeping payout ratio, I imagine a conservative investor ought to need a clear cut price. Ready for a 2.75% yield or a PE of 16 could be a significantly better start line, and it would not seem that seeing a 3% yield is out of the query ought to we enter a bear market.