On this holiday-shortened week, extra information will present simply how sizzling the residential actual property market is. The S&P Corelogic Case-Shiller dwelling value index for December comes out on Tuesday and January new dwelling gross sales might be launched on Thursday.

The ever-rising dwelling costs, although, aren’t serving to residential actual property brokerages as actual property brokers compete for a dwindling provide of houses on the market. As well as, mortgage charges are creeping up, making a house buy much less reasonably priced, particularly for first-time patrons.

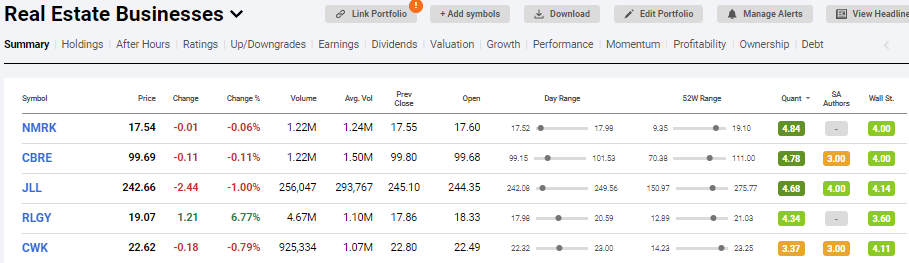

The place are the alternatives in actual property? Look to industrial actual property corporations and associated firms. Screening a listing of 14 actual estate-related firms, industrial actual property providers corporations Newmark Group (NASDAQ:NMRK), CBRE (NYSE:CBRE), and Jones Lang LaSalle (NYSE:JLL) rank the best by Looking for Alpha’s Quant score.

Do not depend residential out fully. Realogy (NYSE:RLGY), which owns the Century 21, Coldwell Banker, and Higher Properties and Gardens Actual Property manufacturers, places in a good fourth-place exhibiting on the checklist.

That is adopted by industrial actual property providers agency Cushman & Wakefield (NYSE:CWK) at No. 5.

Wall Avenue analysts provide you with a special rating, placing Walker & Dunlop (NYSE:WD), which arranges and funds actual property offers, on the high, adopted by residential brokerage agency eXp World Holdings (NASDAQ:EXPI) at second, and Jones Lang LaSalle (JLL) at third.

Notice that Opendoor Applied sciences (NASDAQ:OPEN) will get a Sturdy Promote by the Quant score, whereas the typical Wall Avenue analyst score stands at Purchase. Redfin (NASDAQ:RDFN) additionally screens poorly by Quant score and will get a Impartial score by Avenue analysts.

Prior to now 12 months, industrial actual estate-related shares have been outperforming the residential actual property brokerage shares. On this graph, Newmark (NMRK), Jones Lang Lasalle (JLL), and CBRE (CBRE) all outperformed the S&P 500 index, whereas Re/Max (NYSE:RMAX) and Realogy (RLGY) lagged the broader indes.

Earlier in February, Redfin’s forecast sees dwelling value progress slowing from a double-digit charges for the reason that summer time of 2020 to an annual price of seven% this 12 months.