[ad_1]

Crypto-calypse? Apoca-crypto?

Screw it; we’ll hold workshopping that one.

Nice Ones … the way you doin’ on the market in the present day?

Usually, I’d be placing some pithy assertion right here. Some rallying cry within the face of volatility, your normal lyrical shenanigans besides. Possibly a couple-a three Sopranos jokes simply to moist the whistle.

However in the present day, Nice Ones, we’re speaking in regards to the tank-sized elephant within the room. Sadly.

Oh, so it’s an Irish espresso kinda morning, huh? Brb.

Don’t fear, we’re not going all Hen Little on ya. That is Nice Stuff, in spite of everything. Somebody’s gotta deliver the levity.

However — and also you knew there was a “however” — we ought to in all probability point out that entire “collapse” factor that’s taking place.

Collapse of diplomatic motive. Collapse throughout the indices in the present day. Collapse of principally any inventory that’s not an oil baron or protection contractor — nicely, apart from Boeing’s sell-off. What’s the cope with that one? Y’all neglect Boeing can be a protection contractor?

This has obtained a bit heavy … can we return to the gifs and memes, please?

All in good time, Nice Ones. I don’t learn about you, however I’m in a mighty high quality temper to dive into the cryptoverse! (That might be the cryptocurrency market, for all y’all outdoors the Ian Dyer/Paul Mampilly-verse.)

Following Russia’s invasion of Ukraine, bitcoin and different cryptos joined the broader market in, nicely, collapsing. BTC, that so-called digital gold and holiest of hodler holies, crashed 6% yesterday afternoon and one other 5% this morning, reaching a low of $34,338.

And what about actual gold? The tangibly auriferous, non-crypto kinda gold?

A lot as you’d anticipate, given the huge quantity of uncertainty hitting the markets this morning … gold costs soared as buyers flocked to stockpile the shiny stuff. I imply, don’t you have a personal gold reserve at house the place you’re stockpiling your prized ingots? No?

To be truthful, my bunker cache is full of peanut M&M’s and Cheez-Its, the actual shops of worth, however that’s neither right here nor there…

Anyway, Neil Wilson, chief market analyst for Markets.com, chimed in in the present day and stated the quiet half out loud about bitcoin’s golden goose:

Gold spiked to $1,950, its highest because the finish of 2020. Bitcoin plunged 5% to $35k … suppose we’re discovering out which of the 2 is the true haven.

When you’ve tuned into Nice Stuff for any size of time, you’ll know that we’ve mentioned crypto buyers’ willingness to lump bitcoin in with gold as a safe-haven asset — that’s, the place you stash your money earlier than you make a splash.

Russia’s dashing, bitcoin’s crashing … and solely gold’s eternal like a Gobstopper. A lot for bitcoin’s digital gold comparability — that’s kaput. Irrelevant. Completed-zo.

Don’t get me fallacious: Bitcoin, cryptocurrencies, crypto exchanges, the blockchain expertise behind crypto … these are all very worthy of investing in. And you’ll wager your backside bitcoin that crypto buying and selling isn’t going away. However…

Bitcoin merely isn’t the brace-for-uncertainty protected haven that everybody (even Nice Stuff) thought it was. So, what’s a crafty crypto coin connoisseur to do?

Properly … nothing.

What?! Do nothing? We now have to panic out of respect for the gravity of the state of affairs!

Certain, when you had your coronary heart set on bitcoin being the subsequent gold? Hand over the ghost. That investing angle is previous and busted now.

However for all y’all who purchased into crypto since you consider in digital currencies or a decentralized world of finance … that’s all nonetheless legitimate.

Heck, scoop up some extra of your favourite cash on a budget when you’re that gung-ho on ‘em. Nice One James S. might be shopping for up half the crypto market as we converse.

I get it. Cryptos and bitcoin aren’t for everybody … similar to investing in gold isn’t for everybody. However based on Ian King, one thing a lot larger is coming for the crypto market than in the present day’s tank-driven crash…

An thrilling new third wave in cryptocurrencies that might launch one of many biggest transfers of wealth the world has ever seen.

Ian King’s revealing the main points behind “Crypto’s Third Wave” — probably the most thrilling improvement in cryptocurrencies because the launch of bitcoin 13 years in the past. Click on right here to maintain studying…

Wayfair Wavers

Wayfair’s (NYSE: W) wider-than-expected loss had shareholders seeing double this morning — and its lack of 2022 steerage didn’t do something to alleviate W buyers’ fears about rising inflation consuming into the corporate’s revenue margins.

Gross sales had been down $419 million yr over yr, which wasn’t too shocking contemplating the home-furnishing retailer reported a 26.7% lower so as deliveries over the identical time interval.

You imply to inform me fewer orders equaled fewer gross sales? And that is the hard-hitting inventory evaluation I don’t pay you for…

As we stated again in 2020 when the pandemic spun W inventory into the stratosphere:

Wayfair is nothing particular. It provides merchandise that yow will discover just about in all places else. The one motive it will get consideration is as a result of individuals can’t store outdoors. As such, I totally anticipate Wayfair to see a pointy drop in gross sales as soon as this lockdown is over. And that’s unhealthy information for W shares.

Add rising inflationary strain to Wayfair’s home-furnishing bonfire, and this inventory is extra more likely to go up in flames than blaze a path of glory. I hate to say we instructed you so (Oh, who am I kidding?) … however we instructed you so.

Do You Even Raise, Bro?

Planet Health (NYSE: PLNT) has given new that means to the “get ‘em whereas they’re younger” advertising and marketing mentality, saying the Gen Z crowd — which incorporates individuals born between the years 1997 and 2012 — represented the fastest-growing health demographic in 2021.

The train fanatic has had a superb bout of success luring youthful health fanatics by its doorways with its $10-a-month membership payment, which incorporates visitor passes and entry to the corporate’s most cancers coffins … erm, I imply tanning beds.

Children flocked by Planet Health’ purple doorways when their college actions and sports activities leagues had been shut down due to COVID.

However not like older, commitment-phobic millennials I do know who take a look at health club memberships as a one-and-done affair, the Gen Z crowd truly caught round after ponying up for health passes.

“This previous September, when college sports activities had been in play and recreation facilities had been again open, that [membership] didn’t drop off,” stated Planet Health’ chief govt Chris Rondeau. “[Gen Z] continues to hitch, fairly a bit above pre-COVID ranges.”

Contemplating we’re coming into that point of the yr when many “new yr, new me” work-out resolutioners both fish or minimize bait — with many selecting the latter — this new Gen Z income stream may very well be precisely what Planet Health inventory must get swole in 2022.

I Guess That Ship Has Sailed…

Norwegian Cruise Line (NYSE: NCLH) would possibly’ve been able to sail the excessive seas because the first week of pandemic lockdowns, however once-carefree cruise-goers continued to emphasize warning about swan diving into worldwide waters … particularly after Omicron began popping off within the firm’s fourth quarter.

Whereas the cruise liner didn’t come proper out and say precisely how many individuals canceled their journey plans due to “Omicron-related disruptions” … it did submit a internet lack of $1.57 billion, or $4.01 a share, within the ultimate three months of the yr.

So … you do the maths.

Including insult to damage, CEO Frank Del Rio’s “Nice Cruise Comeback” initially outlined the corporate’s 28-ship fleet to run at full capability once more by April 1, 2022 … lower than two months from now.

However to this point, simply 75% of Norwegian’s fleet has managed to get its sea legs, making Del Rio’s post-pandemic plans seem like little greater than a pipe dream.

Now, Norwegian is looking for 85% of its ships to set sail by the top of the fourth quarter — with the remainder of the fleet following go well with someday within the second quarter (coronavirus variants prepared).

Norwegian shareholders stated: “Not in the present day, son” upon listening to the candy siren’s name for future profitability … nicely, someday sooner or later … and sunk NCLH inventory by a clear 5% quite than taking place with the ship.

Higher Components; Higher Income?

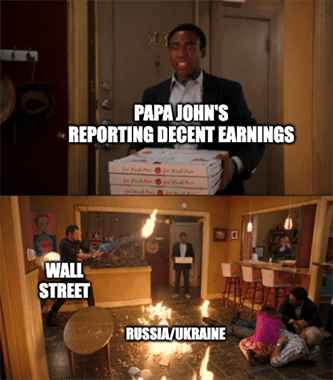

Papa John’s (Nasdaq: PZZA) buyers didn’t get the pepperoni pizza social gathering they had been promised this morning regardless of the pizza chain’s better-than-expected revenue margins within the face of rising meals prices.

Earnings had been served nicely completed at a hearty $0.75 per share on income of $528.9 million — beating analysts’ earlier expectations for $0.72 per share.

Even higher, the restaurant chain reported that working revenue improved 7.2% this previous quarter, despite the fact that the pizza pusher skilled a 9% uptick in whole prices and bills.

I assume when your ‘zas are already overpriced, it’s simpler to cover amongst the rising tide of quick-service competitors prices … however I digress.

To Wall Avenue, the Papa’s efficiency didn’t matter all that a lot anyway, arriving lukewarm within the face of in the present day’s broader inventory market turmoil.

Apparently, Wall Avenue doesn’t stress-eat pizza shares the identical approach everybody else stress-eats pizza when the world’s on hearth … and as such, PZZA inventory slipped beneath the Avenue’s sea of unending pink in the present day.

Editor’s Word: This Easy $50 Transfer Might Mint Fortunes

When you can spare simply $50 in the present day … then you might benefit from a really uncommon alternative to hitch forces with a few of America’s best-connected billionaires.

Lots of in the present day’s moneymakers are staking thousands and thousands of {dollars} on a radical new advance that Inc. journal known as “an important expertise of the last decade.”

It has nothing to do with cryptocurrencies … 5G … blockchain … or inexperienced vitality. But it may maintain the important thing to a $30 trillion market windfall.

Right here’s how one can place your self alongside this superb new tech for simply $50.

When you’re completed that, write to us at any time when the market muse calls to you! GreatStuffToday@BanyanHill.com is the place you’ll be able to attain us greatest.

Within the meantime, right here’s the place yow will discover our different junk — erm, I imply the place you’ll be able to try some extra Greatness:

Till subsequent time, keep Nice!

[ad_2]

Source link