Daria Nipot/iStock Editorial by way of Getty Pictures

Article Thesis

Amazon (AMZN) has introduced that it’ll break up its shares 20:1. The market has reacted very positively to that announcement. On this report, we’ll present why inventory splits ought to theoretically not matter for the underlying worth of the corporate. We’ll additionally spotlight why they do nonetheless matter for traders to a point – choices, liquidity, index inclusion are noteworthy.

What Amazon Introduced

On Wednesday night, Amazon introduced that it will break up its inventory at a 20 to 1 ratio. The inventory break up will, in keeping with Amazon’s 8-Ok submitting, happen in late Might, following approval by shareholders on the firm’s annual assembly, which is able to happen on Might 25.

A 20-1 inventory break up implies that every share of Amazon immediately will flip into 20 shares, 1 present one and 19 further ones, following the inventory break up. Somebody holding 10 shares immediately would personal 200 shares in Amazon following the inventory break up.

Amazon additionally introduced a $10 billion share repurchase program throughout the identical information announcement, extra on that later.

Why Inventory Splits Should not Matter – In Idea

The underlying worth of an organization is decided by elements such because the earnings and money circulate the corporate generates, the property it owns, whereas debt ranges, development, patents, branding power, and many others. additionally play a task. Neither of those is affected by a inventory break up.

A inventory break up does not change what proportion of an organization one owns. Suppose somebody holds 10 shares of Amazon immediately, that is ~0.000002% of the corporate’s share depend of 510 million. The investor on this situation thus has a declare on 0.000002% of the money flows and earnings that Amazon generates. Ought to AMZN ever begin to make dividend funds, 0.000002% of the corporate’s whole dividends would circulate to the investor from our instance.

Following the inventory break up, the identical investor will personal 200 shares of Amazon. However for the reason that share depend has risen 20-fold as properly, from 510 million to 10.2 billion, the proportion is identical, at 0.000002%. The inventory break up does neither end in a bigger declare in relation to the corporate’s money flows or earnings, nor does it have an effect on any future dividends, all else equal.

It additionally appears affordable to imagine that the change within the firm’s share depend, all else equal, doesn’t translate into increased earnings or money flows for Amazon. It additionally doesn’t enable for quicker enterprise development, a stronger model, and so forth. From a basic foundation, inventory splits (and reverse inventory splits) ought to thus not have a cloth impression on an organization’s share worth. And but, AMZN is up 10% on the time of writing, following the announcement of its inventory break up.

That is possible on account of hypothesis, to a point, however there are additionally another elements at play that we should always contemplate.

Why Inventory Splits Nonetheless Matter – To Some Diploma

The underlying worth of an organization isn’t depending on its share depend. However share depend adjustments, or inventory splits, can however have an effect on the perceived worth within the eyes of traders.

Fractional shares

First, if an organization has a excessive share worth, which holds true for Amazon, shopping for complete shares isn’t attainable for everybody. Somebody beginning out and investing a few hundred {dollars} at a time cannot purchase an entire share of Amazon at $2,800. With fractional share shopping for being out there by means of many brokers, together with Robinhood (HOOD), this has change into much less of a difficulty lately.

Nonetheless, some traders cannot purchase fractional shares by means of their brokers. And even amongst people who may accomplish that, some are inclined to keep away from this characteristic, as an alternative deciding to purchase spherical heaps solely. With AMZN splitting its shares at a 20-1 charge, which is able to convey down the share worth to round $140, shopping for spherical heaps or complete shares will probably be means simpler for a lot of traders.

Possibility methods

A decrease share worth is also necessary in relation to using choices. Amazon does, like many different tech shares, not make any dividend funds. For somebody looking for publicity to Amazon’s sturdy enterprise development, writing coated calls could possibly be a solution to generate some revenue from their funding by means of the choices which are created by this technique. However promoting coated calls requires proudly owning at the least 100 particular person shares in an organization.

With AMZN at $2800 per share, meaning that there’s a minimal place dimension of $280,000 — which possible interprets right into a 7-figure portfolio (assuming at the least some diversification). Promoting coated calls on Amazon is thus not attainable for a lot of traders. However following the introduced inventory break up, promoting coated calls on AMZN will solely require a minimal funding of round $15,000, which makes this technique much more accessible to many traders.

Usually, the identical precept additionally holds true in relation to promoting cash-secured places with a purpose to enter a place at a reduced worth — that may also be rather a lot simpler for many traders following the inventory break up. Final however not least, shopping for requires leveraged upside potential, and shopping for places to hedge positions may also be simpler following the inventory break up.

Index inclusion

Most indices are market-cap weighted, which is, I consider, probably the most affordable solution to assemble an index. That doesn’t maintain true for all indices, nonetheless. The Dow Jones Industrial Common (DIA) is a price-weighted index, which implies that the share worth, and never the corporate’s market capitalization decides about an organization’s weight within the index. Naturally, firms with very excessive share costs cannot be included within the index, as this might distort weightings to a big diploma.

Because of this Amazon is, up to now, not a member of the Dow Jones Industrial Common, regardless of being one of many largest and most dominant firms within the US. We now have seen, following the 7-1 inventory break up of Apple (AAPL) in 2014, that index inclusion within the Dow Jones Industrial Common can occur in a short time as soon as a big firm has introduced its share worth to an acceptable stage. This may most certainly be the case with Amazon as properly, which is why traders can anticipate index inclusion in 2022, I consider.

As a consequence of the truth that some ETFs replicate the Dow Jones index, index inclusion will result in compelled shopping for, which may alter the supply-demand image for shares of Amazon — at the least for some time.

We are able to thus summarize that although Amazon isn’t turning into a greater firm by splitting its shares, there’s some impression for shareholders. Liquidity will probably be increased, utilizing choices will probably be means simpler, and index inclusion may result in some compelled shopping for. That being mentioned, traders should not purchase based mostly on a inventory break up alone. As a substitute, I consider that choices to purchase or promote needs to be based on fundamentals and contemplating a inventory’s valuation.

AMZN: Sturdy Firm, However Not Low-cost

Amazon is a dominant firm in its trade, and due to the rise of AWS, it has change into fairly worthwhile lately. In comparison with the opposite FAANG+M shares, Amazon remains to be relatively pricy, nonetheless.

Shares are at present buying and selling for round 55x ahead web earnings, which represents an enormous premium relative to how Meta (FB), Alphabet (GOOG), (NASDAQ:GOOGL) and co. are valued. A 50+ earnings a number of additionally appears fairly excessive relative to how the broad market is valued immediately (19x 2022’s anticipated web revenue).

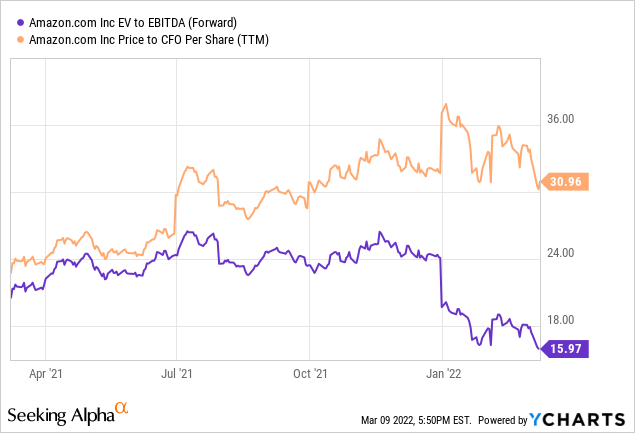

That being mentioned, Amazon appears to be like extra moderately valued based mostly on its enterprise worth to EBITDA a number of of 16. This is not particularly low however doesn’t characterize a excessive valuation, both. Notice that enterprise worth accounts for debt utilization and money being held on the stability sheet, making it a extra telling metric in comparison with market capitalization. Amazon’s money circulate a number of is 31, which interprets right into a money circulate yield of barely above 3%. That is not low, however doesn’t appear outrageous, both, after we assume that Amazon continues to develop its enterprise at a powerful tempo for the following couple of years.

Takeaway

Amazon is a powerful firm at a valuation that could possibly be affordable, however that certainly is not low. The corporate’s $10 billion buybacks program is a constructive, however versus a market capitalization of $1.4 trillion, it will not actually transfer the needle – that is only a 0.7% buyback. Nonetheless, if AMZN have been to do buybacks extra frequently going ahead, there in the end could possibly be a extra significant impression for somebody holding shares for a few years.

The inventory break up is an effective determination, I consider. It’s going to make AMZN extra accessible and permit extra shareholders to make use of choices simply. On the similar time, shopping for solely on account of a inventory break up isn’t a good suggestion, I consider. General, I charge Amazon a maintain immediately, because the valuation isn’t low sufficient to make it an outright nice deal at immediately’s costs.