[ad_1]

From Sounding Line:

With the struggle in Ukraine and imminently tightening financial coverage consuming most of traders’ bandwidth, it’s straightforward to miss the historic meltdown taking place proper now in Chinese language monetary markets.

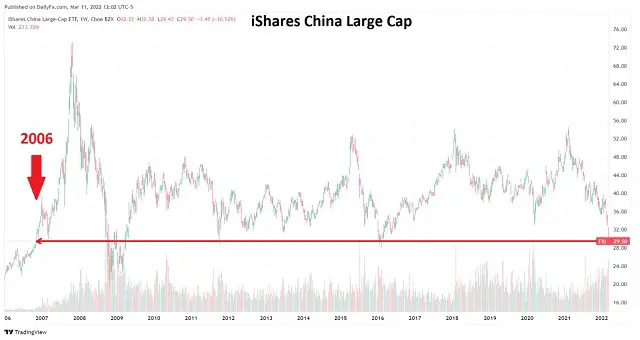

China’s benchmark Shanghai Composite is down about 37% from its 2015 excessive and is down over 47% from its 2007 all-time-high. The iShares China Giant Cap ETF (FXI), one of many largest and most liquid China ETFs, is buying and selling for $29.50 on the time of writing. It first hit that worth on November sixth, 2006. It’s down almost 50% from its highs final 12 months and, amazingly, is down about 60% since its 2007 excessive. This can be a World-Monetary-Disaster-like massacre for Chinese language fairness traders.

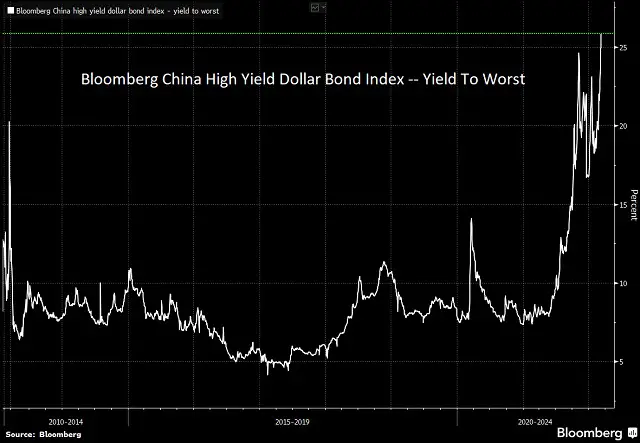

In the meantime, Chinese language junk dollar-bond yields have surged above 25%, the best since not less than the World Monetary Disaster.

The difficulty in China is the end result of many issues.

Its workforce, delivery price, and shortly total inhabitants are shrinking, posing monumental issues for an financial mannequin that’s nonetheless extremely depending on actual property growth and the exploitation of low cost labor.

The choice to take a vibrant monetary hub that was Hong Kong, a gateway for overseas capital flowing into China and a possible mannequin for democratization, and deliberately destroy precisely that which made it a vibrant monetary hub didn’t assist confidence both. Nor does the dawning realization that Xi Jinping actually is a real totalitarian Marxist intent on cracking down on seemingly every thing and something.

China’s publicity to Russia, the complexity of coping with the sanctions on Russia, and the spike in the price of China’s commodity imports don’t assist both.

Something down this a lot is finally due for a bounce, possibly even a giant one. Nevertheless, historical past has proven time and again precisely the place the Marxist-dictator-for-life governance mannequin leads and that’s precisely the place China is now galloping in direction of.

Click on right here to subscribe to the Sounding Line mailing listing

463 views

[ad_2]

Source link