metamorworks/iStock by way of Getty Photos

Google (NASDAQ: GOOG) has agreed to purchase Mandiant (NASDAQ:MNDT) for $5.4 billion. This can be a big sum of cash because it values the cybersecurity play at 11 instances its 2021 revenues.

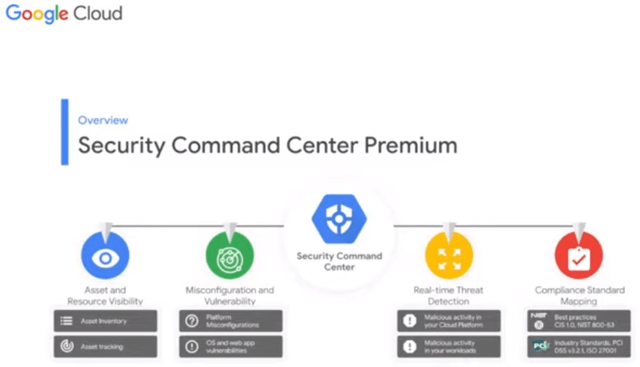

Additionally, the Chrome browser utilized by tens of millions all through the world to entry the web and the Google cloud platform (“GCP”) already incorporates a number of security measures, both developed organically or obtained by means of earlier acquisitions.

Google Cloud Safety video (www.youtube.com/watch?v=dUhfkLaLSFg)

Nonetheless, this isn’t sufficient in a extremely aggressive cloud surroundings the place the corporate faces two highly effective rivals within the type of Amazon’s (NASDAQ:AMZN) AWS and Microsoft’s (NASDAQ:MSFT) Azure, and, with this thesis, my goal is to evaluate the acquisition synergies.

First, I begin with the heightened risk stage and, for this goal, based on a analysis paper printed by Google in November 2021 and entitled Cloud Menace Intelligence, many corporations usually are not migrating their IT workloads to the cloud over safety considerations.

Increased stage of risk going through the cloud

First, there may be the altering nature of labor itself as corporations worldwide speed up the shift to work-from-home. This requires distant enterprise continuity as hackers reap the benefits of blurred company boundaries to develop new viruses and commit acts of cybercrime, inspired by some governments who should not have the identical geopolitical or financial pursuits because the U.S.

In consequence, organizations, particularly in North America and Western Europe are going through unprecedented cybersecurity threats as refined assaults that have been beforehand directed at governments are actually getting used to focus on massive companies. The issue has been exacerbated with ransomware as hackers encrypt company information and monetize their hacks by asking to be paid in bitcoins in change for the decryption key.

As a matter of reality, there was a 105% surge in ransomware cyberattacks throughout 2021. Determined CEOs don’t have any various however to pay blackmailers as their IT safety departments discover it tougher to detect threats hidden within the monitoring software program of corporations like Solarwinds (SWI), whose merchandise are typically considered as being protected. These so-called software program provide chain assaults are very troublesome to detect.

Second, the risk is even larger for giant cloud suppliers like Google which, because of being world, and internet hosting the digital infrastructures of hundreds of companies, have a really massive floor space of assault. Now, GCP already has a cybersecurity motion crew and incorporates zero-trust options whereby nobody is supplied entry to mission-critical information till authenticated. These allow some stage of information safety.

Given the growing variety of threats detected each day and the necessity for Google’s safety crew to research every of them only for detection functions, the duties of research can shortly change into cumbersome. This requires extra effectivity and optimization in the way in which threats are handled which explains why Google acquired Siemplify in January 2022 for $500 million, so as to add automation and speedy response options to its Chronicle cloud safety operations.

Google Chronicle (chronicle.safety/)

Siemplify allows Google’s safety analysts to deal with threats extra quickly and thus avert incidents, however, it’s not sufficient as hackers have additionally been rising in sophistication.

Thus, Google’s subsequent step was to additional improve its data pertaining to risk patterns by means of the acquisition of Mandiant which is considerably analogous to an plane provider (Google) putting in a sonar system to detect submarine threats along with the present radar for airborne surveillance.

The Mandiant proposition

Empowered by 600 consultants and analysts, Mandiant has a stable popularity within the cybersecurity house and, in 2013, the 12 months it was acquired by FireEye, the corporate issued a publication that closely marked the cybersecurity trade, specifically by incriminating sure state actors as nicely alerting authorities as to the emergence of teams of elite hackers.

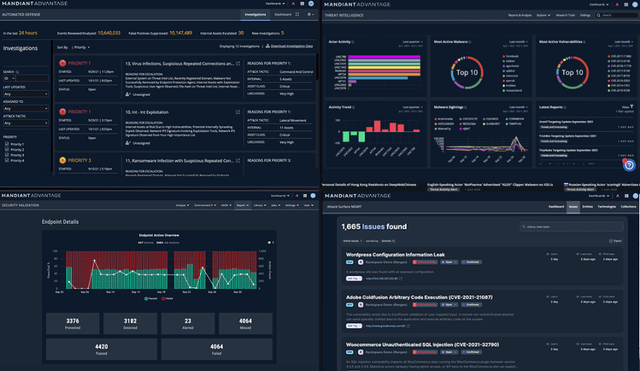

Mandiant web site (www.mandiant.com/benefit)

In October final 12 months, FireEye offered its merchandise enterprise to a consortium of corporations led by Symphony Expertise Group for $1.2 billion and is now centered on the Mandiant Benefit cloud-based platform which primarily seems at safety controls plus cutting-edge experience in addressing threats.

Mandiant helps company safety groups by offering them with the intelligence required firstly, to grasp the risk and second to proactively defend their organizations. The target is to detect potential breaches in an effort to remain forward of attackers.

Now, the sorts of instruments provided by Mandiant already exists available in the market and are largely grouped as a part of SIEM (safety info occasion and administration) and suppliers are Worldwide Enterprise Machines (IBM), DataDog (DDOG), Splunk (NASDAQ:SPLK) simply to call a couple of, however Mandiant seems to present extra of a navy perspective to the character of the risk by going to the extent of enabling shoppers to see their group by means of the very eyes of the attacker.

To attain such a feat, the corporate has a world risk intelligence crew that research hackers’ infrastructure in addition to their funding mechanisms. On this method, Mandiant is ready to deliver a excessive stage of differentiation to its options and infrequently acts as a primary responder to cyber threats.

Financially talking, this superiority has translated into platform and cloud subscription revenues rising by 83% on a year-to-year foundation to $136 million. Thus, for Google, it signifies that the acquisition can be instantly income accretive within the type of subscription and providers, however there may be extra by means of synergies.

Acquisition synergies

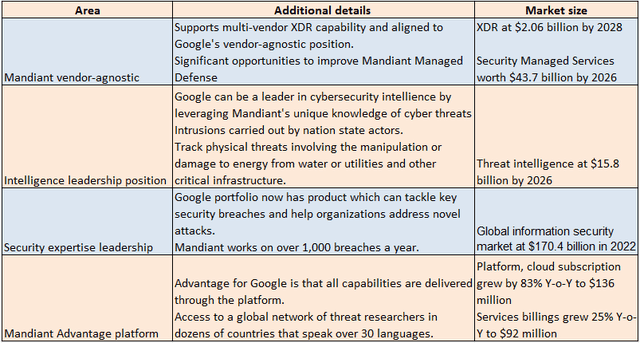

One of many synergistic areas is XDR or Prolonged Detection & Response the place Mandiant stays vendor-agnostic or is ready to work with different distributors. Therefore, even when prospects go to their accustomed service suppliers like Test Level (NASDAQ:CHKP) or Palo Alto (PANW) to guard their info methods, Mandiant stays open to working with them as an extra risk validator. As per its CEO, the target is to “work collectively and collectively defend prospects”. This matches properly with Google’s goal to be vendor-agnostic by way of risk safety for its cloud platform.

As well as, Mandiant additionally has the Managed Protection service, used for twenty-four/7 protection of safety monitoring and escalation level in case of assault and which additionally occurs to be the perfect out there within the trade. Considering aloud, the managed protection may be proposed as an extra add-on for purchasers who’ve opted for GCP’s Infrastructure as a Service (IaaS), as a part of an end-to-end resolution.

Simply XDR and Managed Protection open entry to a market of over $45 billion for Google.

Desk constructed utilizing information from (seekingalpha.com/article/4485328-mandiant-inc-mndt-ceo-kevin-mandia-on-q4-2021-results-earnings-call-transcript)

There may be extra to be gained for Google, specifically by means of cybersecurity intelligence by leveraging Mandiant’s distinctive data of cyber threats particularly as to the way in which intrusions are carried out by nation-state actors. Surveillance alone is a market alternative amounting to $15.8 billion together with safety for very important infrastructures like vitality or water utilities. The target is to keep away from assaults just like the one which crippled Colonial Pipeline in Could 2021.

Valuations and key takeaways

Thus the acquisition paves the way in which for a rise in GCP’s revenues which have been $5.5 billion for the fourth quarter, after a formidable improve of 45% over the identical interval final 12 months. Extra vital, by favoring cross-selling whereby GCP shoppers can add the safety and analytics choice to their subscriptions, it allows worthwhile development into the cybersecurity enterprise for Google. Right here, I’m pondering of turning the cloud’s phase working lack of $890 million into income.

This deal, if authorized, could be the second-largest one for Google and is due to this fact certain to come back underneath scrutiny by regulators. Right here, the truth that the Web search large is without doubt one of the massive techs which might be already underneath antitrust scrutiny won’t assist. For this matter, Mandiant additionally works for the U.S. authorities.

Nonetheless, on a optimistic notice, the truth that Mandiant has already disposed of its FireEye merchandise enterprise and now goals to offer integrations with different safety corporations like Sentinel One (S) for instance could assist in acquiring regulatory approval. Thus, it’s not like Google turning right into a monster cybersecurity play to tackle smaller corporations, however fairly, working along with different market individuals and being open to their merchandise with a view to deal with refined threats. Furthermore, the worldwide info safety market is estimated at $170.4 billion in 2022 and stays extremely aggressive with many gamers.

Moreover, in a geopolitical surroundings characterised by elevated dangers, U.S. regulators could also be much less inclined to complicate issues for the large tech and easily favor Google’s means to deploy Mandiant’s espionage detection instruments at scale and thus defend the nation’s pursuits. Alongside the identical strains, by addressing the safety difficulty, which is the highest concern for cloud adoption, Google ought to improve its picture as a safe cloud supplier in a interval characterised by extra fears of nation state-backed hackers taking part in havoc in opposition to Western pursuits, after Russia was punished with extreme financial sanctions after its invasion of Ukraine.

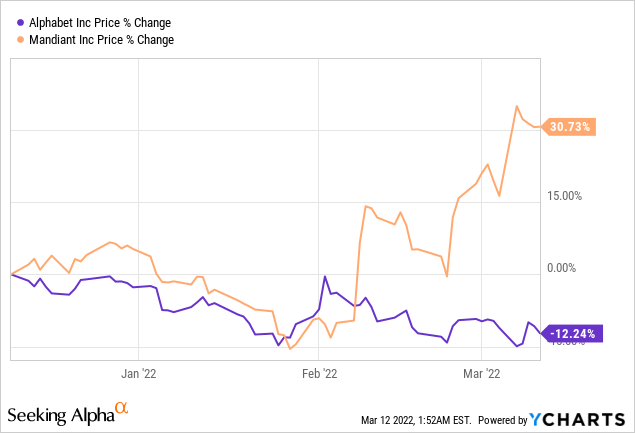

Now, macro-economic uncertainties associated to the battle along with excessive inflation have resulted in Google’s shares (purple chart beneath) struggling a draw back of -12.24% within the final three months. This has lowered valuations multiples to a value to gross sales ratio of simply 6.86x, however in view of inflation considerations now additionally impacting Europe, it will be higher to keep away from shopping for the corporate’s inventory in the meanwhile.

Conversely, Mandiant’s inventory has exhibited a 30% upside after being concerned in acquisitions talks with Microsoft and following Google’s bid. It’s now out there at a trailing value to gross sales a number of of 10.64x or a 150% premium with respect to the IT sector.

This acquisition makes a whole lot of sense for Mandiant’s shareholders as with the worth technique taking the higher hand on development in a rising rate of interest surroundings, the truth that the corporate’s working bills exceed revenues wouldn’t have been nicely digested by buyers. Since Google has fastened the worth at $23/share in an all-cash transaction, Mandiant is obtainable at a reduction to its present share value of $21.8 by about 5.2%. Nonetheless, there may be the likelihood that the deal takes time to materialize and this may induce some volatility within the inventory.

As for Google which is already diversified into search, video sharing, and analytics, an acquisition will see it play a extra outstanding function in secured cloud adoption by means of military-grade risk detection capabilities, as a part of the digital transformation pattern. Lastly, as per the corporate’s announcement in August 2021, it will make investments $10 billion to strengthen cybersecurity. Thus, there could also be different acquisitions alongside the way in which.