Bulgac/E+ by way of Getty Photos

On the twenty eighth of January, I introduced a portfolio (spine) that defensive buyers ought to think about to navigating efficiently via turbulent instances. Who would have thought what dramatic occasions would unfold in Ukraine just a few weeks later! Once I was writing the article, I used to be significantly not suspecting that we might be getting ready to a (nuclear) third World Warfare just a few weeks later!

I cannot spend many phrases on my private views and assessments of the state of affairs in Ukraine, I primarily actually hope that they are going to discover a resolution very quickly to cease all of the violence!

The state of affairs in Ukraine additionally triggered a storm on the monetary markets. With hindsight, this introduced an ideal check for the portfolio that I had introduced just a few weeks in the past!

On this article, I assess how the portfolio has carried out towards the broader markets and what this might imply for you.

Recap

A quick recap of the principle choice standards and composition of the portfolio:

The choice course of

The portfolio I composed is properly diversified throughout numerous metrics and consists of frequent shares in 10 completely different corporations. They provide a beautiful dividend plus attributable to a beautiful valuation the potential for capital appreciation on high of the dividend. To pick the ten corporations for the mannequin portfolio I checked out a number of dimensions and elements.

The person 10 corporations:

- Excessive-quality firm with a confirmed observe report of stable monetary efficiency and that I count on to be nonetheless round and performing properly within the subsequent many years.

- Enticing dividend yield and/or dividend development

- A valuation that’s round honest worth and even undervalued

- Beta ideally decrease than the general market, to cut back volatility

- I’m sufficiently satisfied of the corporate to personal it my very own funding portfolio. (eat your individual pet food 🙂 )

Combining the businesses into the portfolio:

- Diversification throughout foreign money (max 50% in a single foreign money)

- Diversification throughout industries (max two corporations from the identical business)

- Aggregated Beta of the portfolio <1, so much less unstable than the general market.

- General portfolio dividend yield must be considerably greater than the general markets, a minimum of 3-4%

- Equally weighted positions

Presenting the portfolio

Following the choice standards, I arrived on the portfolio:

| Firm | Ticker | Sector | Foreign money |

| Algonquin | (AQN) | Multiline Utilities | CAD |

| BASF SE | (OTCQX:BFFAF) (OTCQX:BASFY) | Chemical substances | EUR |

| Bristol Myers Squibb | (NYSE:BMY) | Prescription drugs | USD |

| Broadcom Inc. | (AVGO) | Semiconductors & Software program | USD |

| Enbridge | (ENB) | Vitality & Pipelines | CAD |

| Essity | (OTCPK:ESSYY)(OTC:ETTYF) | Private & Family Merchandise | SEK |

| Lockheed Martin | (LMT) | Aerospace & Protection | USD |

| Realty Revenue | (O) | Residential & Industrial REIT | USD |

| Unilever | (UL)(OTCPK:UNLYF)(OTCPK:UNLVF) | Private & Family Merchandise | EUR |

| W. P. Carey | (WPC) | Residential & Industrial REIT | USD |

Supply: writer desk

As you may see the listing consists of a mixture of very completely different corporations from completely different industries and areas.

Efficiency of the general monetary markets

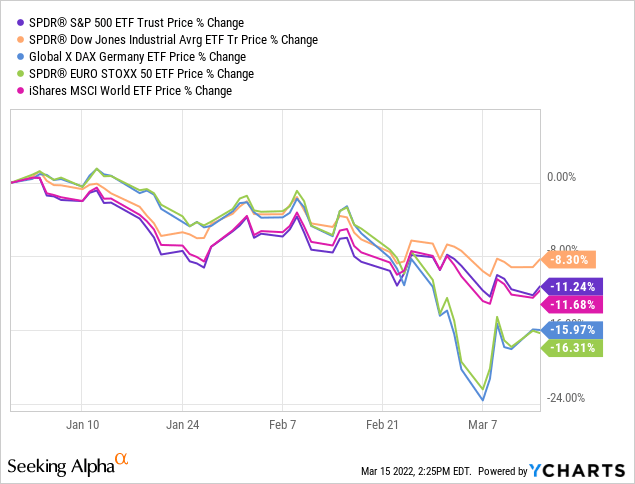

From the second tensions began to construct up round Ukraine buyers began to de-risk. Particularly in the intervening time the state of affairs received began on the twenty fourth of February, the monetary markets received shocked. Predominant indexes went down (particularly in Europe), happening greater than 20% and are nonetheless down 8-16% year-to-date:

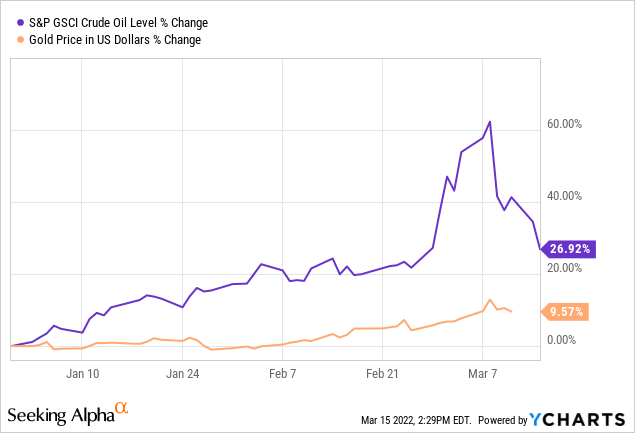

In distinction, oil costs skyrocketed (SPGSBR)and buyers fled into conventional protected havens like Gold (XAUUSD:CUR).

This isn’t a simple atmosphere for buyers (particularly in case you are solely invested in shares) and lots of people I personally know and meet on e.g. In search of Alpha have been severely hit by this. I hope they stored their nerves and did not press the promote button, locking of their losses. I’m fairly positive lots of them didn’t sleep that properly. Not simply in regards to the state of affairs in Ukraine, but in addition due to monetary stress seeing their investments nose-dive.

Efficiency of the proper portfolio (spine) for turbulent instances

Right here you may see the efficiency of the portfolio during the last month and in addition YTD.

| Image | Beginning funding | 1M Perf | YTD Perf | Worth if invested 1 month in the past | Worth if invested at 1 |

| AQN | 2,000 | 5.89% | 2.01% | 2,118 | 2,040 |

| AVGO | 2,000 | -1.86% | -14.67% | 1,963 | 1,707 |

| BFFAF | 2,000 | -21.68% | -16.12% | 1,566 | 1,678 |

| BMY | 2,000 | 3.64% | 11.05% | 2,073 | 2,221 |

| ENB | 2,000 | 5.96% | 12.38% | 2,119 | 2,248 |

| ESSYY | 2,000 | -12.00% | -21.00% | 1,760 | 1,580 |

| LMT | 2,000 | 14.85% | 25.05% | 2,297 | 2,501 |

| O | 2,000 | -3.00% | -9.37% | 1,940 | 1,813 |

| UL | 2,000 | -14.05% | -17.55% | 1,719 | 1,649 |

| WPC | 2,000 | 4.59% | -3.35% | 2,092 | 1,933 |

| Whole | 10,000 | -1.70% | -3.16% | 19,647 | 19,369 |

Supply: In search of Alpha

Sure, there are important variations between the person shares, with some down double-digit and others up double-digit. Nevertheless, on a portfolio stage, they’re solely down 1.7% during the last month and down 3.16% YTD. As you may see the portfolio did certainly carry out significantly better than the general markets, that are down 8-16% YTD. The portfolio truly outperformed the general markets with 5-13%!

That is what I actually name a passing a stress check.

Funding thesis

Contemplating the efficiency of the Excellent Portfolio for Turbulent Occasions and the actual fact it represents a big spine in (and is relatively consultant for) my very own portfolio, it’s no shock my private funding portfolio additionally did maintain very properly during the last weeks and months.

12 months thus far I’m taking a look at a efficiency (excl. dividend) of -1.5% and the worst I noticed throughout the previous couple of weeks was minus -3% or so. Sure, I’ve a big variety of European shares in my portfolio like E.ON (OTCPK:EONGY) and BASF ( (OTCQX:BFFAF) (OTCQX:BASFY) that did get significantly hit. I nevertheless even have a considerable variety of Vitality funds like Enbridge (ENB), Shell (OTCPK:RYDAF) and Algonquin (AQN) that benefited from the upper power costs and did carry out very properly. I even have some Protection firm shares like Lockheed Martin (LMT) and L3Harris (LHX) that additionally helped so much. Additionally, the foreign money combine with a considerable portion (35-40%) of my portfolio in USD did assist for the reason that greenback strengthened round 3-4% towards most different currencies.

I hope this replace on the efficiency of the Excellent Portfolio for Turbulent Occasions exhibits how strong the portfolio is and the way it might help you deliver extra stability to your portfolio. I additionally hope some readers have been impressed by the unique article and did add these funds to their portfolio and slept significantly better via all of the turbulence. Lastly, the present relative weak spot of -3.2% YTD would possibly supply you a chance so as to add this spine to your individual portfolio.

Conclusion

The state of affairs in Ukraine has been and nonetheless is horrible. I actually hope they discover a solution to cease the violence and struggling quickly!

With hindsight, it nevertheless additionally represented an ideal real-life check for the Portfolio to Navigate Turbulent Occasions that I had introduced just a few weeks in the past. I’m very completely satisfied to see the portfolio did maintain up properly and has considerably outperformed the broader monetary markets. I hope it conjures up you to additionally think about including this spine to your portfolio.