da-kuk/E+ by way of Getty Pictures

This text was first launched to Systematic Earnings subscribers and free trials on Mar. 16

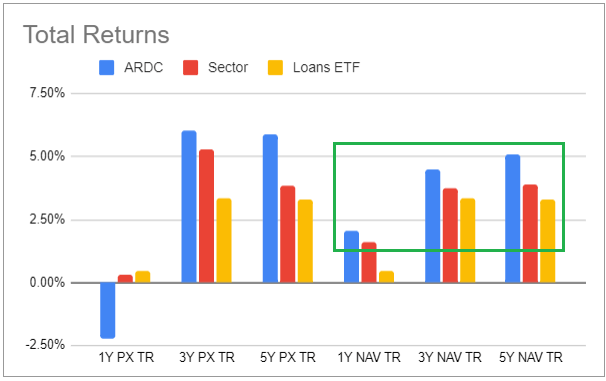

The present interval of market weak point has reset many CEF valuations and made the broader CEF area way more enticing. On this article we spotlight the Ares Dynamic Credit score Allocation Fund (NYSE:ARDC) which trades at a 8.5% present yield and a 11.3% low cost. The fund has outperformed the broader fixed-income CEF area over numerous time durations, is effectively positioned to learn from additional rises in short-term charges because the Fed’s mountaineering cycle will get going, and is buying and selling at a really enticing valuation.

A Bit Of Background

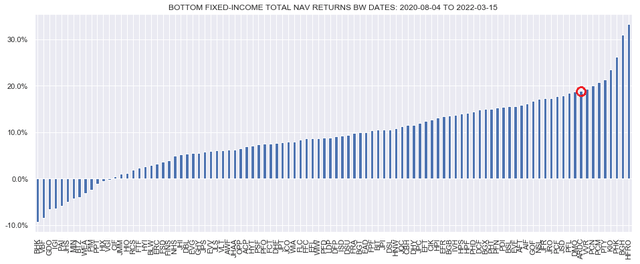

We first mentioned ARDC in early 2020 and have held the fund in our Excessive Earnings Portfolio since August of 2020. Since then the fund has been one of many best-performing credit score funds (encompassing six credit score CEF sectors). The pretty busy chart beneath exhibits the entire NAV return of CEFs in these sectors with ARDC highlighted in crimson, highlighting its robust efficiency in that interval.

Systematic Earnings

A Fast Look At The Fund

ARDC is a part of the broader Ares Credit score Group – an funding agency targeted on credit-linked belongings with round $200bn of belongings beneath administration. The extremely regarded Ares Capital Corp (ARCC) which we highlighted right here is a part of the identical platform.

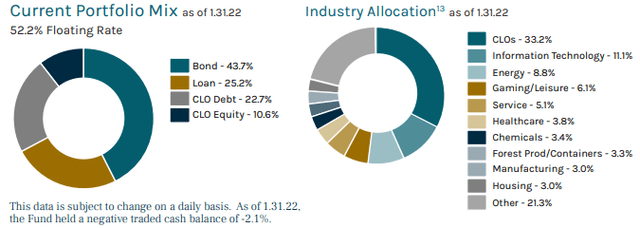

ARDC runs round $600m of whole belongings and is, what we name, a cross-credit fund or a fund that is ready to allocate throughout a wide selection of credit score securities, particularly, high-yield bonds, loans in addition to CLO debt and CLO fairness securities. The fund’s largest sector tilts are to IT and Power.

Ares

The benefit of a cross-credit CEF is that it offers managers’ a wider panorama through which to pursue enticing alternatives not solely from a elementary, but in addition a relative worth perspective. It additionally makes it simpler for managers to place the fund’s period. For instance, a fund that allocates primarily to high-yield bond must both shorten up the maturity of its holdings or use derivatives if it wished to lighten its period profile, each of which might create a drag on its earnings. A fund like ARDC can merely chubby its mortgage and CLO allocations – reducing its period with out essentially sacrificing earnings. Traditionally, cross-credit funds have outperformed the broader fixed-income CEF area which is one thing we’d anticipate to proceed sooner or later.

Earnings Profile And Current Developments

There are three key current earnings dynamics which have an vital affect on ARDC earnings. First, is the current enhance within the fund’s borrowings. Secondly, the addition of a compulsory redeemable most well-liked inventory to its credit score facility. And thirdly, the possible continued rise in short-term rates of interest and its affect on the fund’s cashflows on each the asset and legal responsibility sides.

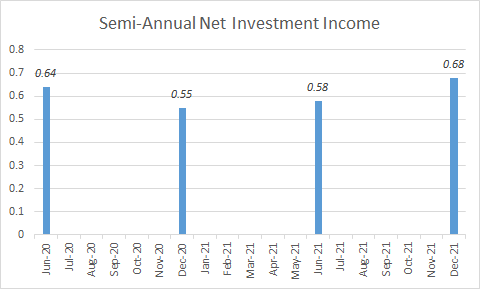

Let’s begin by trying on the fund’s semi-annual web funding earnings numbers. NII rose for the third quarter in a row, rising by a considerable 17% from the earlier semi-annual reporting interval.

Systematic Earnings

A semi-annual NII of $0.68 works out to $0.1133 per 30 days. Relative to a month-to-month distribution of $0.0975 that offers us distribution protection of 116%. That mentioned, that is most likely a marginal overstatement for the straightforward cause that the fund’s leverage value has stepped up which isn’t absolutely factored in but.

This occurred as a result of the fund added a most well-liked to its credit score facility within the final quarter of 2021. As of the final shareholder report for Dec-21 the fund had $119m excellent on its credit score facility and $100m of preferreds or $219m of whole financing versus $153m excellent on its leverage facility for the interval ending June-21. It isn’t clear if this massive $66m borrowing enhance goes to be sustained going ahead or whether or not the fund is just rotating away from its facility to the popular whereas retaining whole borrowings pretty flat.

The fund’s $55m enhance in its whole belongings at value in addition to its enhance in leverage from 28% in June to 35% in December does recommend it’s rotating to the next leverage profile. The knock-on impact right here is that its earnings is more likely to enhance farther from the image we get as of its December report. This might additionally make sense within the context of its most well-liked issuance which provides a way more sturdy type of leverage and is often utilized by funds that run at very excessive leverage ranges such because the PIMCO taxable funds (that sometimes boast leverage ranges of 40-50%) in addition to funds that allocate to pretty illiquid and unstable belongings corresponding to CLO Fairness corresponding to OXLC, ECC and OCCI.

An vital level to focus on is that the curiosity expense of the popular (2.81% weighted-average yield) is increased than that of the credit score facility (roughly 1.5% at Libor + 0.95% plus a small dedication price on an unused portion). This NII overstatement is arguably fairly small because the preferreds have been issued in July and September and so have already partially fed into the curiosity expense in addition to the truth that the fund has added income-generating belongings which might add earnings on the asset aspect of the cashflow assertion. Web web we anticipate distribution protection to be not removed from 105-110% which places the fund in a powerful place to doubtlessly enhance the distribution or, absent this, retain a part of the earnings to additional compound its returns.

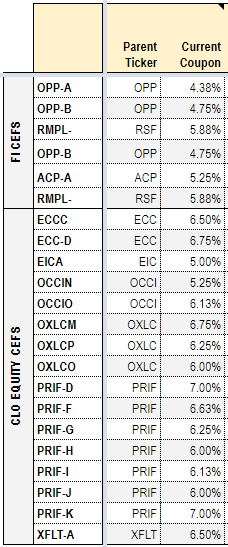

A dividend charge on the preferreds of two.81% may appear excessive within the context of a charge of 1.5% that the fund pays on its credit score facility. Nonetheless, it is vital to make two factors. First, a charge of two.81% on a CEF most well-liked is definitely unusually low. If we have a look at the opposite fixed-income and CLO fairness most well-liked coupons we see that they’re considerably increased – the truth is, no exchange-traded CEF most well-liked even comes near 2.81%. It isn’t clear how the fund was in a position to obtain such a low dividend. One cause is the comparatively short-dated maturities of 5-7 years on its totally different most well-liked sequence, although these aren’t miles from the maturities of the exchange-traded CEF preferreds. It is potential that these shares have extra asset protection redemption necessities above and past these of the 1940 Act.

Systematic Earnings

The opposite key level in regards to the preferreds vs. the credit score facility is that whereas the present most well-liked dividend charge of two.81% is increased than the speed on the fund’s credit score facility of round 1.5%, this hole will shut and sure invert in the direction of the again finish of 2021. It is because the market consensus is for the Fed to boost its coverage charge to round 2% by the top of the 12 months which might make the speed on its credit score facility shut to three% or above the speed on the preferreds.

The truth that the fund determined to partially repair its leverage value earlier than the Fed received going with its hikes is unlikely to be a coincidence. All in all, this seems to be like a superb outcome for the fund and its frequent shareholders – the fund is ready to make its leverage profile extra resilient whereas doing so in a (possible ultimately) cheaper manner. In fact, there may be some likelihood that the Fed won’t ever get to the two% coverage charge degree and, even when it does, could be very more likely to reduce charges to close zero within the subsequent recession. That mentioned, partially fixing its leverage value whereas making the fund extra resilient and permitting the fund to drive extra earnings, is an efficient outcome even it doesn’t occur in a sustainably cheaper manner.

One other key driver of future earnings that’s vital to say is the truth that short-term charges have already began to rise. ARDC holds roughly $300m of floating-rate belongings versus $119m of floating-rate liabilities which is one other manner of claiming that the fund’s earnings will profit from an increase in short-term charges. An apparent pushback right here is that, effectively, if I wish to have most publicity to rising short-term charges why do not I simply maintain a pure mortgage fund – not a fund that’s roughly evenly cut up between floating and fixed-coupon belongings. One benefit that ARDC has over pure mortgage funds is that it has already began to learn from the rise in short-term charges whereas pure mortgage funds haven’t.

This will appear odd nevertheless it’s actually a results of the character of floating-rate belongings. Particularly, 23% of the portfolio is in CLO Debt and CLO Debt, in contrast to loans, does not have Libor flooring. Which means CLO Debt safety coupons have already elevated from the current rise in Libor from round 0.2% to 0.5% whereas most loans have to attend until Libor exceeds 0.75-1%. That is very more likely to occur, absent an surprising market shock, however it should take a couple of extra months no less than.

From an allocation perspective the partial CLO Debt (23%) and CLO Fairness (10%) allocation has a number of benefits over a conventional mortgage or high-yield bond fund. First, there may be the yield benefit as related rated CLO debt securities have the next yield than loans or bonds (and because it occurs related rated CLO debt has a decrease historic default charge as effectively) whereas CLO fairness securities have efficient yields within the mid teenagers. Second, CLO debt securities do not take losses from the primary few defaults within the portfolio, making them extra resilient throughout typical recessions. And third, CLO fairness securities profit from credit score unfold widening (corresponding to what we’re seeing now) because it permits CLO managers to reinvest mortgage repayments into increased yielding loans, which works straight to the underside line of CLO fairness holders.

In fact these advantages do not come without cost. The place CLO securities can fall down is throughout episodes of maximum defaults. Briefly, if we see a state of affairs that’s on par or worse than what we skilled in GFC, then funds like ARDC which maintain CLO securities can expertise worse efficiency, no less than in mark-to-market phrases.

The apparent query is that if a partial allocation to CLO debt/fairness is enticing why not go all-in with a 100% CLO fairness profile? The quick reply is that historical past has proven that the volatility and illiquidity of CLO fairness securities is an excessive amount of for CEFs to digest. With each sizable drawdown in markets CLO fairness funds find yourself both unwinding their repo/credit score amenities or shopping for again their senior securities, promoting off their belongings at low costs to make this occur. Their excessive volatility additionally makes pure-play CLO fairness funds tough to carry by means of market cycles as their whole historic returns invariably go to zero throughout sharp market drawdowns whereas extra balanced credit score CEFs historic NAV returns sometimes stay effectively above zero.

Takeaways

ARDC stays a pretty alternative within the credit score CEF area. It has outperformed the broader mortgage sector (in addition to the high-yield bond CEF sector) over totally different durations in whole NAV phrases as proven beneath.

Systematic Earnings CEF Instrument

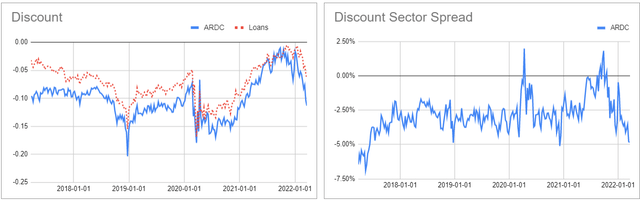

Regardless of this constant historic outperformance it continues to commerce at a wider low cost relative to the sector. The differential between the mortgage CEF sector and the fund has elevated in current weeks – making it a pretty entry level.

Systematic Earnings CEF Instrument

The fund boasts distribution protection effectively north of 100% and is anticipated to proceed to develop its earnings degree because of the current enhance in borrowings and a optimistic NII beta to rising short-term charges.

Lastly, the fund’s leverage profile has been made extra resilient by means of the current issuance of a most well-liked. ARDC stays a part of our Excessive Earnings Portfolio. We’d look to extend the place if credit score spreads transfer above 5% and/or the fund’s low cost widens additional into double-digit ranges.