[ad_1]

As a Actual Property Tax Strategist, I evaluation hundreds of tax returns yearly. All through my profession, I’ve detected a typical space for errors: depreciation.

Depreciation is a basic software for actual property traders. Improperly reporting it in your tax sheets might result in paying hundreds of {dollars} further in taxes. That’s why on this article, I’m offering 5 vital objects you will need to evaluation in your depreciation schedules to make sure you’re getting probably the most out of your properties.

Reporting Depreciation

First, in case you have any revenue generated by a long-term rental property owned by you or by a single-member LLC, you will need to report it on Schedule E of Type 1040.

All strange and mandatory bills associated to your property, together with depreciation, might be deducted.

However what’s depreciation, anyway?

Briefly, depreciation represents a rental property’s declining worth over time. We all know that actual property tends to understand, however depreciation nonetheless applies and truly helps us pay much less on our taxes. There are a number of depreciation strategies, however it’s vital to abide by what the IRS permits. The IRS prescribes a protracted algorithm and laws on depreciating belongings, together with a typical helpful lifetime of 27.5 years for many residential rental properties.

Like I stated, depreciation is nice as a result of it offsets among the prices you incur all year long and lowers your tax foundation. That’s why reviewing these subsequent 5 subjects are so vital!

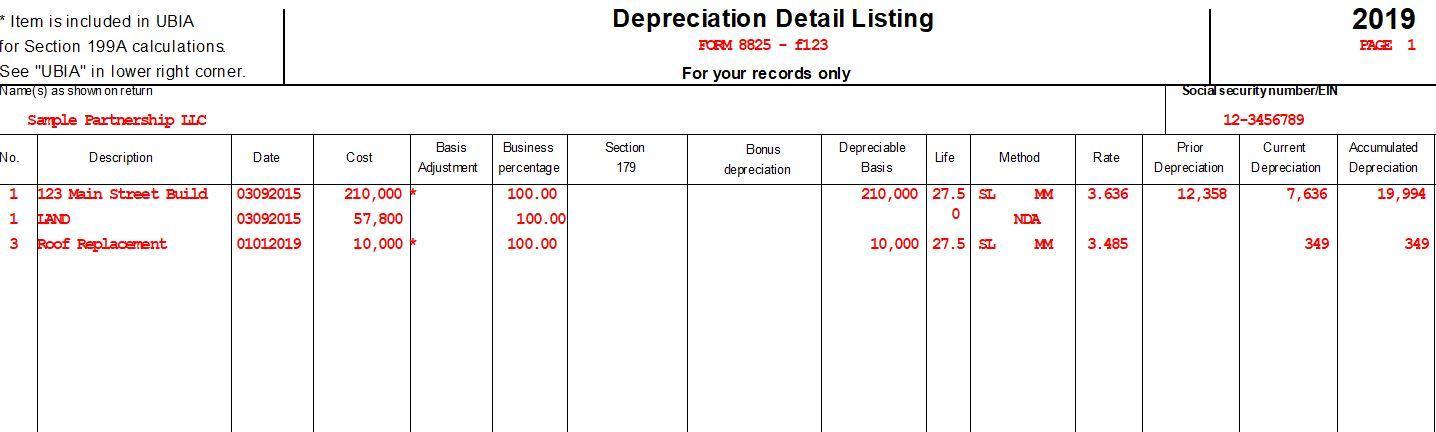

Earlier than we get began, right here’s a visible of what a depreciation schedule appears to be like like:

5 Gadgets To Evaluate On Your Depreciation Schedule

1. Evaluate All Listed Totals

It appears apparent, however the very first thing you will need to do is test the property’s whole depreciable worth. For probably the most half, you’re simply ensuring the entire is lower than the acquisition value. Understand that some prices reminiscent of inspections, due diligence charges, and extra can be included in your depreciable foundation however the whole ought to by no means equal or quantity to greater than your buy value.

As an illustration, if the depreciable worth equals $200,000 however your buy value totaled $150,000, it’s best to seek the advice of along with your tax skilled.

Errors over depreciable worth happen all the time, particularly in figuring out land values. Since land isn’t depreciable, the answer is to make use of a ratio towards the entire worth of the property, then multiply by the acquisition value for a decrease land worth that helps cut back the tax foundation. This is identical methodology a county tax assessor makes use of.

However say, for instance, a tax preparer makes use of an precise land worth of $50,000 as a substitute of making use of a ratio. With the constructing included, the entire tax foundation equals $160,000.

The issue? The shopper paid $120,000 for the property. This error by accident gave the shopper an additional $40,000 on their foundation!

An terrible mistake like this may be prevented by merely being vigilant concerning the numbers posted in your depreciation schedule.

2. Make Positive Land Is Accounted For

To increase additional on the subject of land, it’s vital that your depreciation schedule accounts for it, regardless of it not being depreciable.

What do I imply?

In case you paid $200,000 for a rental property and all $200,000 is listed because the depreciable quantity, one thing is mistaken. You’re basically stating that you’re, the truth is, depreciating the land, for the reason that buy value is the same as the depreciable quantity.

You can’t do that. As talked about earlier, it’s best to use the county tax assessors ratio to find out a correct land worth in depreciation.

Within the occasion you fail to do that and proceed to deduct depreciation year-over-year, you’ll be dealing with severe again pay when the error is discovered and corrected.

3. Make Positive Renovation Bills Are Damaged Down When Attainable

In case you had a significant renovation, see whether it is listed as a lump sum quantity on the depreciation schedule. In case you spend $40,000 on a renovation that included $10,000 value of landscaping and $5,000 on new home equipment, there could also be a extra advantageous approach of reporting it.

A serious renovation is assumed to be a 27.5-year enchancment, the identical helpful lifetime of a rental. Nonetheless, there are specific belongings which have been particularly assigned shorter lives.

Landscaping, for instance, falls right into a class referred to as land enhancements, which have a lifetime of 15 years. Moreover, any belongings with a lifetime of lower than 20 years can probably be expensed within the first yr of possession utilizing bonus depreciation.

There are many potential financial savings with renovations. I extremely advocate having a dialog about it along with your tax skilled.

Watch out for errors, although.

As an illustration, we as soon as had a shopper who was thought of an actual property skilled (which means they might deduct limitless rental losses). That they had been shopping for 2-3 new leases annually, finishing main renovations on every. Their prior depreciation schedule listed “$82,000 Renovations ? 27.5-years” for each property. This resulted in a depreciation deduction of about $2,980 for the yr.

Nonetheless, once we broke down the elements of the renovations, there was loads of depreciation left on the desk:

- $8,000- Landscaping

- $6,200- Home equipment

- $2,000- New fencing

- Whole: $16,200 – Belongings with a lifetime of fewer than 20 years, qualifying for yr one bonus depreciation

- Whole worth: $63,800

With these numbers, the shopper might have taken a depreciation deduction of $18,520 for the yr.

4. If You’re Utilizing Delayed Financing Strategies, Make Positive Your Tax Execs Know

In case you run a delayed financing technique the place you place your renovation prices into escrow once you buy, your tax skilled could also be shorting you on depreciation. It’s because many tax professionals don’t understand the construction of one of these transaction. They’re doubtless taking the total renovation quantity and lumping it into the acquisition value, then allocating the entire quantity between land versus constructing.

That is incorrect as a result of the allocation ought to solely apply to the acquisition value. The renovation quantity must be accounted for individually.

Let’s say a shopper’s prior CPA took the total quantity of his HUD property — the place they pay as you go renovation prices to permit for earlier refinancing through the BRRRR methodology — as their buy value. The totals would present $30,000 for the acquisition value and $40,000 for the renovation escrow (ignoring miscellaneous closing prices).

Their preliminary depreciation was calculated as:

$70,000 Buy value * 82% constructing worth (per the tax assessor’s ratio) = $57,400 depreciable worth at 27.5 years for a deduction of $2,087 per yr.

Nonetheless, due to the technique the shopper used, the depreciation ought to have been:

$30,000 buy value * 82% constructing worth = $24,600 depreciable worth at 27.5 years for a deduction of $895 per yr and a $40,000 renovation worth (which might have doubtless been damaged down additional as we did earlier) at 27.5 years for a deduction of $1,454 per yr. That quantities to a complete annual depreciation deduction of $2,350 per yr.

This won’t seem to be rather a lot, however this shopper had practically ten properties that had been all arrange utilizing the normal, however incorrect methodology. As you possibly can see, it resulted in a misplaced depreciation deduction of near $4,000 per yr, throughout a number of years.

The excellent news is that we had been capable of appropriate it by using Type 3115 and recoup the deduction.

5. Be Conscious Of Service Dates

Your rental is eligible for depreciation when it’s “in service”, which means prepared and out there for hire.

Essential be aware: Regular vacancies or spans of non-occupancy for renovation don’t take a property out of service. In case you had been to purchase a rental with tenants in it, subject them a 60-day discover to vacate, then spend 90 days on a renovation, the property continues to be in service all through that point.

Evaluate the dates listed to your rental asset and any renovation dates. Many preparers will ask for an in-service date, however received’t ask if the rental was occupied when first bought. They’ll simply make the most of the acquisition date.

That’s why it’s vital to notice if a property is bought vacant. In case you purchase on January 1st however require a six-month renovation, the property received’t be in service till the top of these six months.

Conclusion

With tax day rapidly approaching, it’s vital to evaluation depreciation ideas and be sure to’re on high of your submitting necessities.

Hopefully, this guidelines has served as a helpful information for you and your enterprise!

[ad_2]

Source link