jntvisual/iStock through Getty Pictures

Anybody who lives inside their means suffers from a scarcity of creativeness.”― Oscar Wilde

At this time, we take an in-depth have a look at PaySign (NASDAQ:PAYS). The shares of this small cap monetary concern have been punished just lately due to weak ahead steerage. Analysts additionally appear to be adverse on the shares in the meanwhile. Nevertheless, the corporate is at breakeven standing and nonetheless ought to see income development within the mid-teens within the coming fiscal yr. Purchase the dip or keep away from the shares? We try and reply that query through the evaluation beneath.

Firm Overview:

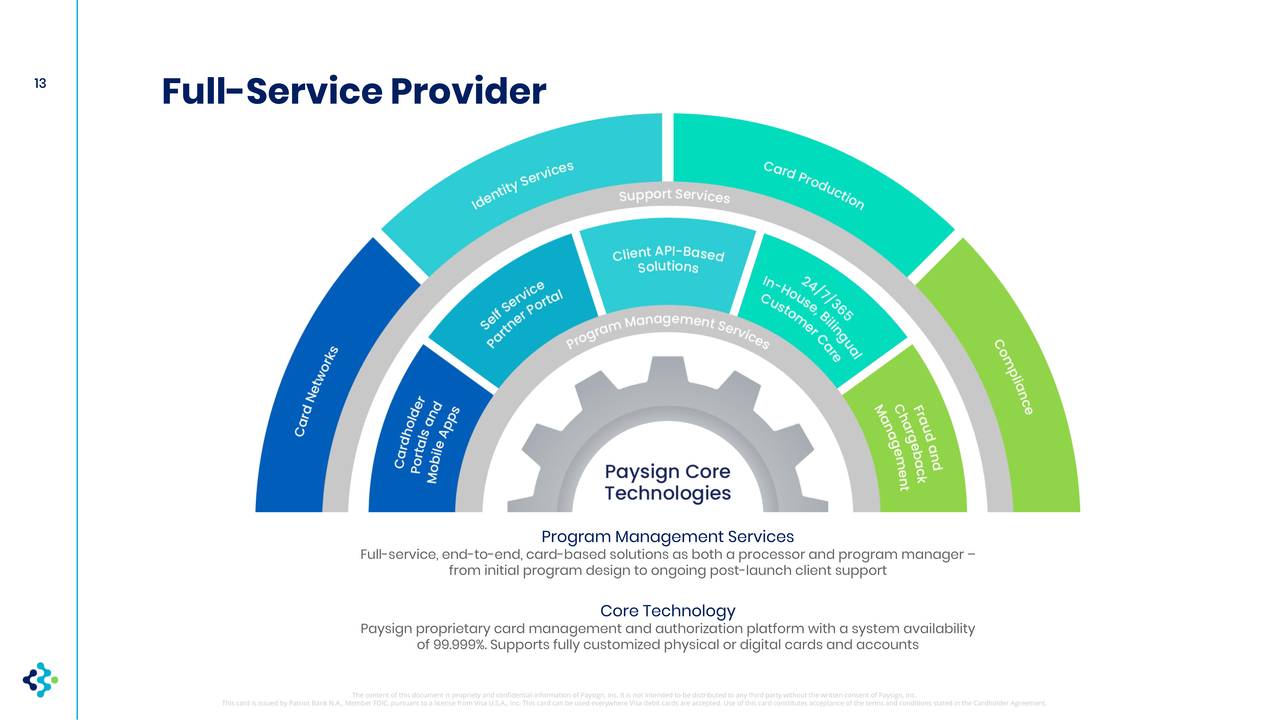

PAYS – Firm Capabilities (November Firm Presentation)

PaySign relies out of Las Vegas. The corporate gives pay as you go card merchandise and processing companies underneath the PaySign model for company, client, and authorities functions. PaySign additionally develops pay as you go card applications for company incentive and rewards, together with client rebates, donor compensation, medical trials, healthcare reimbursement funds, and pharmaceutical fee help amongst different functionalities. On the finish of 2021, the corporate had roughly 4.3 million cardholders and 440 card applications. The inventory at the moment trades for slightly below two bucks a share and sports activities an approximate $100 million market capitalization.

PAYS – Firm Historical past (November Firm Presentation)

The corporate’s major product line is concentrated on compensating blood plasma donors through a modest stipend that’s loaded onto a pay as you go card that PaySign gives. The COVID-19 pandemic prompted quite a few plasma middle closures. As well as, the varied stimulus packages signed into regulation throughout 2020 and 2021 diminished the inducement for people to donate plasma for supplementary revenue. The corporate ought to profit from ‘normalcy‘ persevering with to return to the medical house because the pandemic ebbs. That is the huge bulk of PaySign’s present operations/revenues. The remainder consists of a a lot smaller enterprise in pharmaceutical co-pay help and company incentive rewards.

Fourth Quarter Outcomes:

On March twenty second, the corporate posted fourth quarter outcomes. PaySign reported quarterly Non-GAAP EBITDA of $0.02 ($1.3 million) a share as revenues elevated barely over 21% on a year-over-year foundation to $8.8 million. Plasma gross sales accounted for $1.3 million of the $1.5 million enhance in gross sales from 4Q2020 throughout the quarter. Internet revenue elevated $4.4 million from a revenue of $105,000 in 4Q2020 primarily to a $3.7 million revenue tax provision. For all of FY2021, PaySign recorded a loss from operations of $2.7 million. This was a rise of $5.6 million from the working lack of $8.3 million in FY2020. For the yr, the corporate signed six new plasma shoppers and onboarded an extra 26 internet new plasma facilities to finish the yr with 366 facilities. The corporate averaged $6,800 of income month-to-month per plasma middle.

Management offered preliminary steerage for FY2022 inside the press launch that accompanied fourth outcomes. Administration expects full yr adjusted EBITDA to double over FY2021 ranges to $4 million as revenues rise 20% to 30% to $35.25 million to $38.35 million. Plasma will make up roughly 90% of general gross sales.

Analyst Commentary & Stability Sheet:

The analyst group has not been impressed with the corporate’s fourth quarter numbers and steerage. Since quarterly outcomes posted, BTIG reissued their Maintain ranking on PAYS. Maxim Group maintained its Purchase ranking on the inventory however lowered its worth goal a buck a share to $4. Lastly, Ladenburg Thalmann downgraded the shares to a Impartial from a Purchase ranking.

The corporate ended FY2021 with unrestricted money of $7.4 million. PaySign additionally had restricted money of $61.3 million, that are funds used for buyer card funding with a corresponding offset underneath present liabilities. The CFO offered simply over $55,000 price of shares on March 2nd. That’s the solely insider exercise within the inventory to this point in 2022.

Verdict:

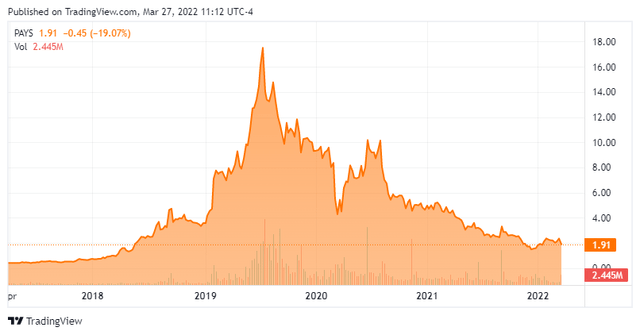

PAYS – Inventory Chart (TradingView)

The principle case for proudly owning PaySign is the inventory rebounds to the place it was buying and selling earlier than the pandemic swept onto our shores. The inventory did commerce above ten bucks a share late in 2019 and commenced 2020 north of 5 bucks a bit. At simply over 2.5 occasions ahead revenues, the shares do not appear costly.

PAYS may advantage a small ‘watch merchandise‘ holding right here, each as a return to normalcy play within the plasma house but additionally as an ‘off the radar‘ stagflation play, which appears the almost definitely situation for the U.S. economic system proper now.

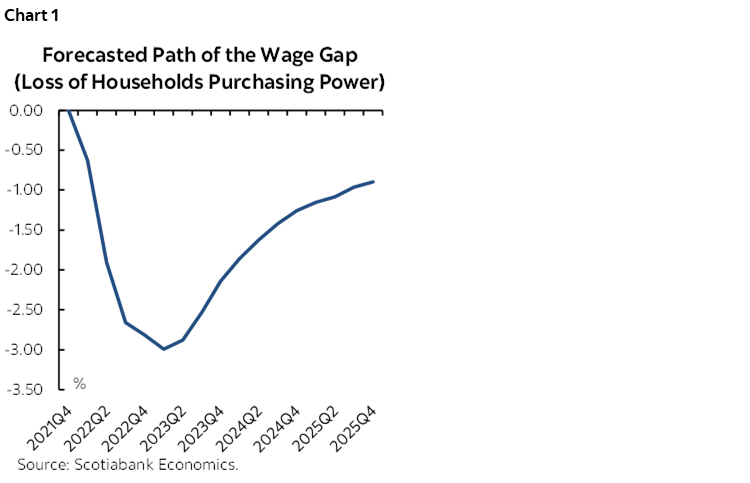

Over the previous yr, the typical client has misplaced almost three p.c of their shopping for energy. That’s if you happen to in contrast common the wage features of the previous 12 months to latest CPI experiences. This pattern is predicted to proceed within the coming quarters. As well as, authorities statistics are likely to undercount inflation in my view.

Avg Wages versus Inflation (Scotiabank)

The state of affairs is considerably worse for those who commute or lease given gasoline was up over 50% over the previous yr earlier than Ukraine occurred and rents have been up within the mid to excessive teenagers on common in 2021. That ought to imply increasingly folks on the low finish of the revenue scale may simply flip to different gigs comparable to giving plasma repeatedly to make ends meet right here in 2022. Albeit considerably of a ‘ghoulish’ funding take, however probably a worthwhile one.

Wealth consists not in having nice possessions, however in having few desires.”― Epictetus

Bret Jensen is the Founding father of and authors articles for the Biotech Discussion board, Busted IPO Discussion board, and Insiders Discussion board