Sundry Pictures/iStock Editorial through Getty Pictures

The Residence Depot (NYSE:HD) is the world’s largest dwelling retailer with a 17% market share in an business with an addressable market of over +$900B. In 2021, they reported +$151B in web gross sales and generated +$14B in free money flows (FCFs). Moreover, the dividend was elevated by 15% and it’s now rising at a 10-YR CAGR of 20%. The long-term strategic purpose of the corporate is to succeed in +$200B in gross sales, which is actually attainable, given the elemental backdrop of the corporate.

Regardless of core strengths, shares are promoting off on fears of rising charges and the potential of slowing financial development. Opposite to present perceptions, the outlook for the house enchancment market is favorable to HD. The growing variety of getting older houses within the U.S. is supportive of continued development within the restore and rework market. As well as, the underlying monetary place of households is powerful, and they’re considerably much less indebted than in prior years.

As rates of interest proceed to extend, potential homebuyers will get extra selective. Since previous houses do not renovate themselves, sellers should put money into the enhancements to make the sale. The latest pullback has offered a pretty alternative for long-term buyers who consider within the continued longevity of the housing market.

The Charts

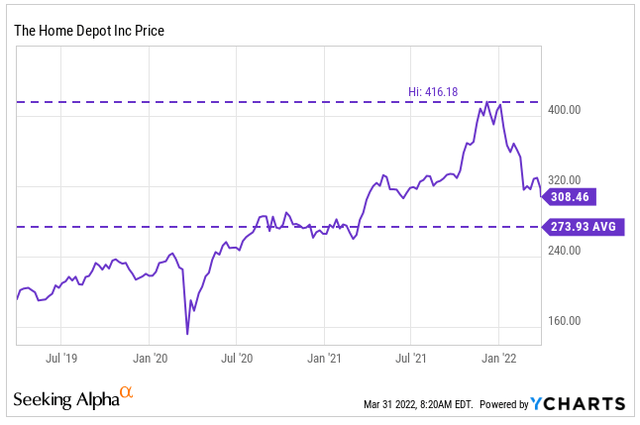

HD is at present buying and selling at about $310. That is down about 25% from their excessive of $416 and about 13% above their common ranges for the previous a number of years.

Y-Charts – HD Worth

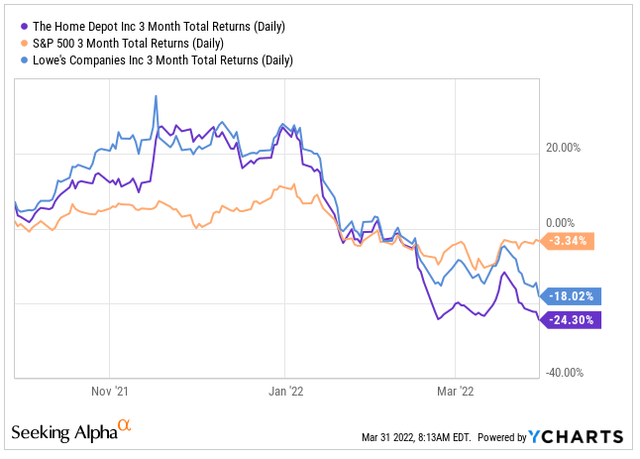

Prior to now three months, HD is down 24% versus a decline of 18% for Lowe’s and solely 3% for the broader market.

Y-Charts – 3MTH Complete Returns Comparisons

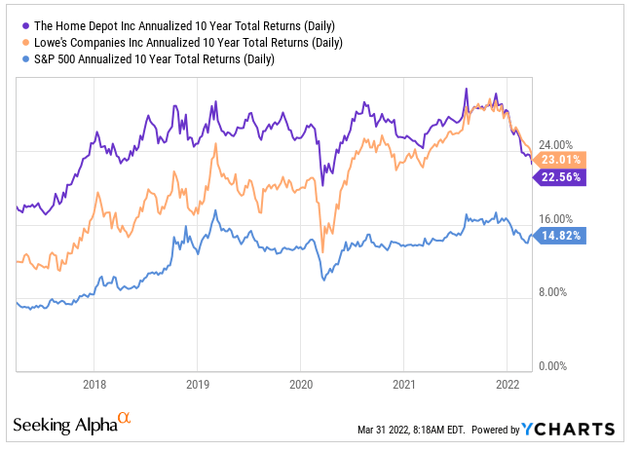

The declines in HD seem overdone in comparison with their historic efficiency towards each the broader market and Lowe’s. Prior to now ten years, HD has constantly outperformed on annualized returns. The inventory has been on a downtrend just lately, however its drop is greater than that of Lowe’s, who, traditionally has lagged or carried out on par, at greatest, with HD.

Y-Charts – Annualized Complete Returns Comparisons

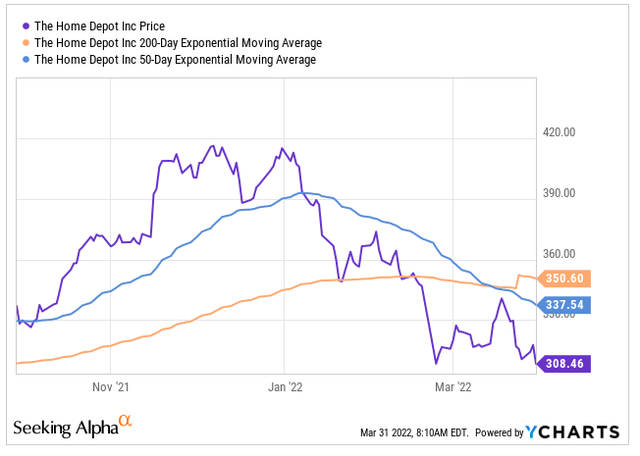

Not too long ago the 200-day transferring common of HD surpassed the 50-day transferring common. This means bearish sentiment and will probably sign additional losses forward. On days during which the inventory strikes increased, it will likely be essential to watch whether or not the inventory can maintain above its resistance degree. If HD frequently retreats after assembly resistance, deeper losses are doable.

Y-Charts – 200/50 Day Shifting Common

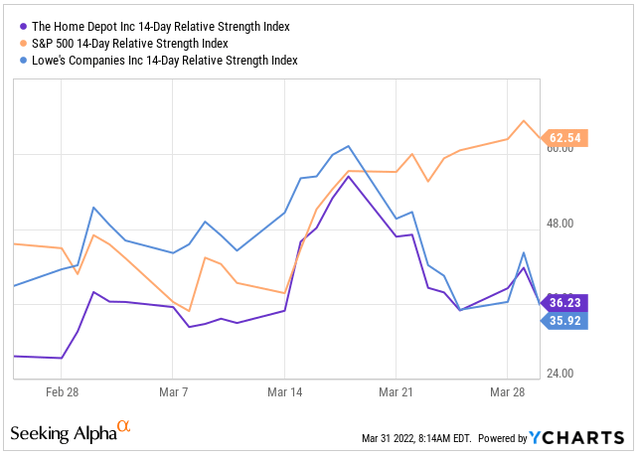

From a relative energy perspective, HD seems to be nearing oversold territory. This additionally seems to be the case with Lowe’s. The S&P alternatively is heading up in the direction of overbought territory. Maybe HD and Lowe’s are ahead indicators of what’s to return within the broader market. Or, it is doable that these two shares actually are oversold.

Y-Charts – RSI Comparisons

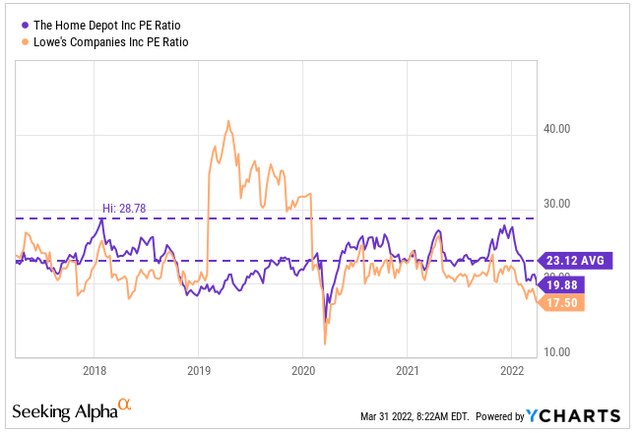

The decline in HD has resulted in a barely discounted pricing a number of. In 2018, its P/E reached a excessive of 29x. However the inventory has traditionally trended at about 23.1x. At present, the a number of is nineteen.9x. A return to the historic common would yield a inventory worth of roughly $360.

Y-Charts – P/E Ratio Comparisons

HD has declined a lot additional than the broader market, and there’s at present bearish sentiment on the inventory based mostly on its transferring averages. Nonetheless, the inventory seems to be approaching oversold territory. Moreover, the present pricing a number of is at a reduction to historic averages. HD has constantly outperformed the S&P in prior years, and there’s little indication that’s about to alter.

The Alternative

The main indicator of transforming exercise initiatives development in enchancment and restore expenditures to stay regular by 2022. Whereas DIY exercise is anticipated to gradual from pandemic-era ranges, householders are nonetheless anticipated to provoke bigger discretionary renovations that had been postponed throughout the pandemic. One estimate predicts massive initiatives persevering with double-digit development all by 2022 and 2023, earlier than really fizzling out. As folks spend extra time away from their houses, any declines in DIY ought to be offset by a rise within the PRO market, who are likely to spend greater than the common DIYer.

At John Burns Actual Property Consulting (JBREC), one statistic acknowledged that those that have transformed prior to now had been 3.7% extra more likely to rework once more, spending a mean of 11% extra. As well as, one other statistic states that 80% of options in a house change into outdated inside 15-20 years. Since most houses within the U.S. are older than 20 years, this gives a positive inhabitants for future remodels.

With family web price at all-time highs, the flexibility of present householders to faucet into their fairness to finance massive initiatives is as robust because it’s ever been. Moreover, favorable demographics help continued development in enchancment spending. Typically, transforming expenditures rise sharply amongst homeowners age 35 and over, attributable to increased incomes and rising households. Spending then stays at this elevated degree till householders method their retirement years. This means a protracted runway of enchancment initiatives within the years forward.

Board of Governors of the Federal Reserve System (US), Households; Internet Price, Stage [BOGZ1FL192090005Q], retrieved from FRED, Federal Reserve Financial institution of St. Louis![Board of Governors of the Federal Reserve System (US), Households; Net Worth, Level [BOGZ1FL192090005Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL192090005Q, April 1, 2022](https://static.seekingalpha.com/uploads/2022/4/1/49921492-16488111294758239.png)

Whereas present householders are seeing massive features of their web price, rising dwelling costs continues to push homeownership out of attain for a lot of Individuals. The worth for present houses rose 15% in February, alone. But, the will increase have but to gradual dwelling shopping for exercise. In actual fact, functions submitted by potential homebuyers have risen for the previous three out of 4 weeks, in accordance with the Mortgage Bankers Affiliation.

S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. Nationwide Residence Worth Index [CSUSHPISA], retrieved from FRED, Federal Reserve Financial institution of St. Louis![S&P Dow Jones Indices LLC, S&P/Case-Shiller U.S. National Home Price Index [CSUSHPISA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CSUSHPISA, March 31, 2022.](https://static.seekingalpha.com/uploads/2022/4/1/49921492-16488111300091505.png)

With charges rising and projected to persevering with rising, there are considerations that general exercise will gradual. For instance, common mortgage charges just lately hit 4.67%, in accordance with the weekly launch from Freddie Mac. This was the very best studying since December 2018. In the beginning of the 12 months, charges had been 3.22%. On a $400K home, that will lead to a yearly improve of roughly $4,000 on a family mortgage fee. Regardless of the rise, nonetheless, mortgage debt service funds as a proportion of disposal private earnings are nonetheless at an all-time low, accounting for lower than 4% of disposal private earnings in 2021.

Board of Governors of the Federal Reserve System (US), Mortgage Debt Service Funds as a % of Disposable Private Revenue [MDSP], retrieved from FRED, Federal Reserve Financial institution of St. Louis![Board of Governors of the Federal Reserve System (US), Mortgage Debt Service Payments as a Percent of Disposable Personal Income [MDSP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MDSP, March 31, 2022.](https://static.seekingalpha.com/uploads/2022/4/1/49921492-16488111305291677.png)

General family debt service funds are additionally at all-time lows. Whereas general debt is on an uptrend from the lows, the proportion continues to be low by historic requirements. Previous to 2010, households had been spending over 12% of their disposable private earnings on debt service. That has since fallen to only above 9%.

Board of Governors of the Federal Reserve System (US), Family Debt Service Funds as a % of Disposable Private Revenue [TDSP], retrieved from FRED, Federal Reserve Financial institution of St. Louis![Board of Governors of the Federal Reserve System (US), Household Debt Service Payments as a Percent of Disposable Personal Income [TDSP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/TDSP, March 31, 2022.](https://static.seekingalpha.com/uploads/2022/4/1/49921492-16488111307685227.png)

HD has benefitted from the uptick in DIY dwelling enchancment initiatives ensuing from COVID-related lockdowns. With extra folks embarking on different actions exterior of their houses, there’s a notion that dwelling enchancment initiatives will steadily decline. Rising charges are creating further uncertainties. Regardless of the considerations, the outlook is optimistic. The underlying energy of shoppers’ stability sheets is powerful, and plenty of have entry to document fairness of their houses. The inhabitants of older houses within the U.S. continues to extend and most would require modernization to retain their worth, particularly in an period of rising charges. These structural traits will proceed being tailwinds for HD.

The Fundamentals

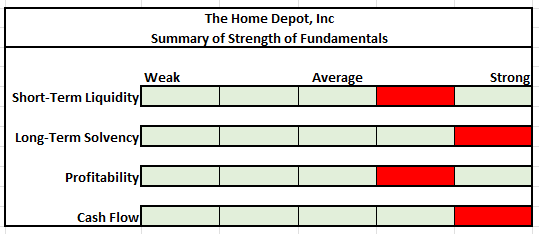

Writer’s Evaluation of Power of Fundamentals

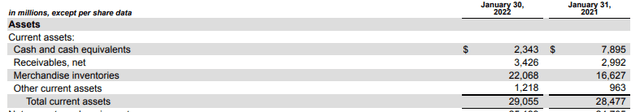

The corporate’s stability sheet consists principally of stock, which accounted for 75% of complete present property on the finish of 2021. Inventories did improve considerably in 2021 attributable to elevated purchases. The impact of the purchases could possibly be seen within the drop within the money stability from +$7.9B on the finish of January 2021 to +$2.3B on the finish of January 2022.

Complete Present Property – Type 10-Okay

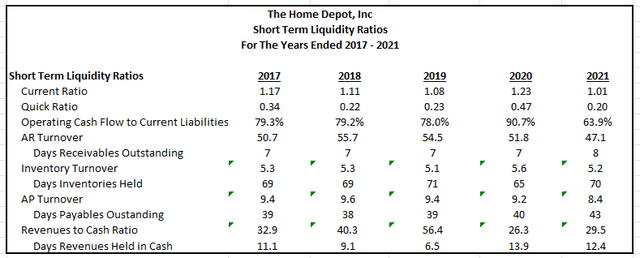

Stock acquired by the corporate is constantly turned over on a well timed foundation. On common, it takes between 65-70 days to unload stock. Since inventories account for a lot of the firm’s present property, stock turnover is vital, particularly as a result of the low fast ratio signifies the corporate does not have sufficient liquid property to cowl their complete present liabilities.

Writer’s Calculations of Varied Liquidity Ratios

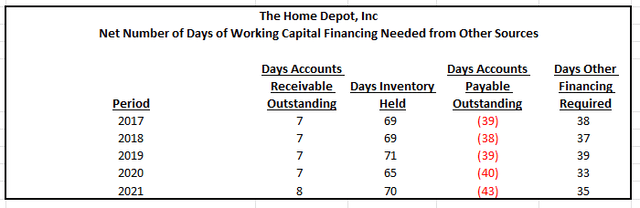

The effectiveness of the corporate’s working capital administration is indicated by the variety of days of different financing required by the corporate after accounting for short-term provider supplied financing. In 2021, there have been 78 days during which money conversion was pending from the sale of stock and the gathering of A/R. On this timespan, the corporate held off fee to their suppliers for 43 days. Thus, there have been solely 35 days during which HD wanted to faucet into present money readily available or different financing sources to fund their present working capital wants.

Writer’s Calculations of Days of Different Financing Required

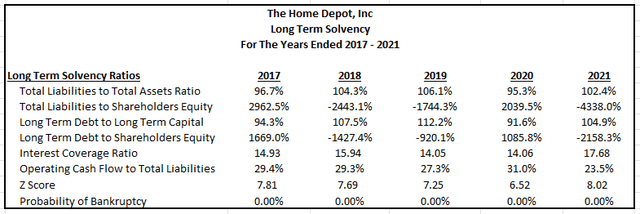

From a long-term standpoint, HD operates on a excessive diploma of debt to property and fairness. This isn’t a priority, nonetheless. Their web debt/EBITDA was 1.3x on the finish of 2021, and their curiosity protection ratio of 17.7x signifies a powerful potential to fulfill their curiosity obligations. As well as, the Z-Rating of 8 suggests a 0% likelihood of chapter.

Writer’s Calculations of Lengthy-Time period Solvency

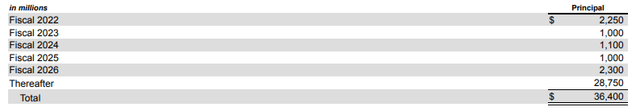

Along with simply masking their curiosity funds, the corporate additionally has minimal compensation danger. Practically 80% of the corporate’s complete obligations are due after the 2026 fiscal 12 months, and the quantities due previous to then are unfold out evenly every year.

Abstract of Debt Maturities – Type 10-Okay

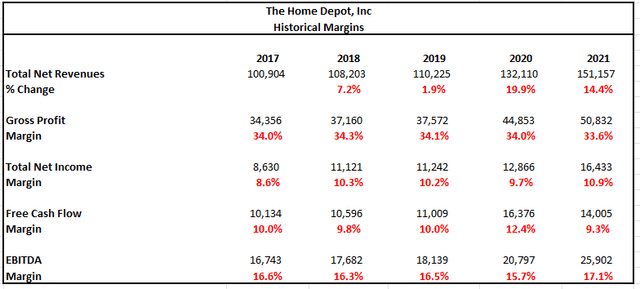

The energy of the corporate’s stability sheet is strengthened by their constant potential to generate optimistic returns and money flows. In 2021, income development slowed from 2020, nevertheless it was nonetheless up by double-digits. Moreover, their web earnings and EBITDA margins each surpassed ranges achieved for the previous 5 years. Shifting ahead, development is anticipated to reasonable, however margins will stay robust, regardless.

Writer’s Calculations of Historic Margins

FCF margins had been down, however that’s partly because of the stock construct within the present 12 months. Nonetheless, even with the stock construct, FCF got here in at +$14B, which was decrease than 2020, however 27% increased than in 2019. If purchases of stock had been at extra normalized ranges, FCF would have been roughly +$18B, which is 10% higher than 2020 and 64% higher than 2019.

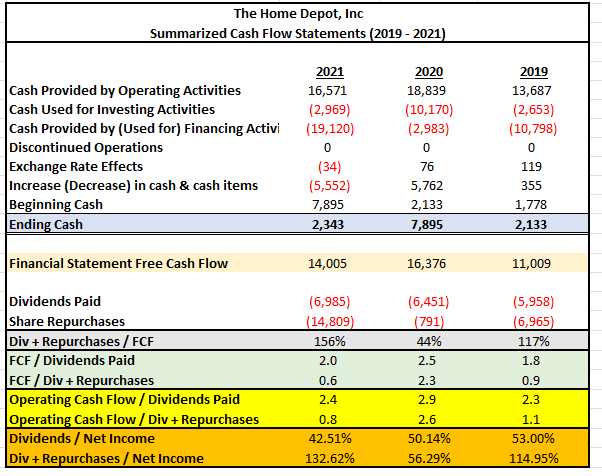

Robust money movement era is leading to important shareholder payouts. Dividends have been rising at a CAGR of 18% over the previous 5 years and the corporate has practically +$10B remaining on their share repurchase authorization. Each FCF and working money movement cowl the dividends by greater than 2x and the payout is lower than 50% of web earnings, indicating robust protection. At current, there are not any indications that future payouts are in danger.

Writer’s Abstract of Money Circulate Assertion

The general fundamentals of HD are robust. The corporate is efficient at managing their working capital, and so they have satisfactory money readily available to cowl their working capital wants. As well as, their long-term viability is stable with no important near-term debt maturities and no danger of lacking their curiosity obligations within the interim. The stability sheet is anchored by a historical past of delivering robust earnings and producing important FCFs. Lastly, funds not invested into the enterprise are returned to shareholders within the type of totally coated dividend funds and share buybacks.

Goal Share Worth

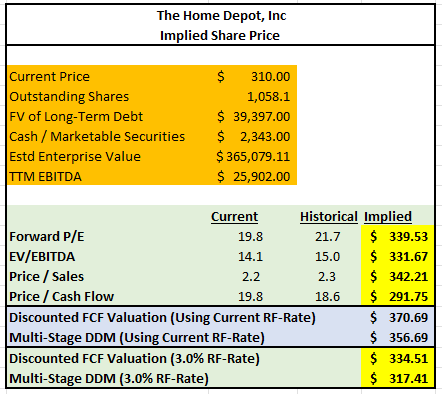

Varied methodologies had been utilized to acquire a sign of the intrinsic share worth of HD. The outcomes are supplied within the chart beneath. The quickest strategies concerned merely making use of the historic multiples to present pricing. Doing so yielded goal costs with a low of $292 to a excessive of $342.

When making use of fashions involving future money flows, outcomes got here in at a low of $317 and a excessive of $371. With these fashions, the speed on 10-YR U.S. Treasuries is a vital variable within the computations. Since charges are projected to extend, the mannequin integrated the present fee, which was 2.5% on the time of research, as reported in The Wall Road Journal. And for hypothetical functions, the evaluation additionally utilized a fee of three%.

When contemplating the outcomes of all strategies, the common goal worth labored out to be $335.

Writer’s Abstract of Outcomes of Varied Valuation Methodologies

For illustration functions, an additional rationalization is supplied beneath of the methodology used for the DDM.

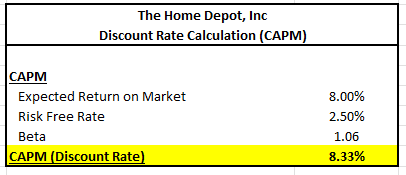

Step one within the mannequin was to find out the low cost fee to make the most of within the mannequin. For this, use of the capital asset pricing mannequin (CAPM) was preferable. The mannequin is a operate of the inventory beta and the danger premium, which is the distinction between the anticipated return in the marketplace and the risk-free fee. The beta of the inventory is 1.06, as reported in Morningstar. The danger-free fee was the speed on 10-YR U.S Treasuries, which was 2.50%, as reported in The Wall Road Journal. The historic danger premium is 5.5%. Thus, the anticipated return on market is 8.00%. After inputting these variables into the CAPM, a reduction fee of 8.33% was obtained.

Writer’s Calculation of Low cost Price

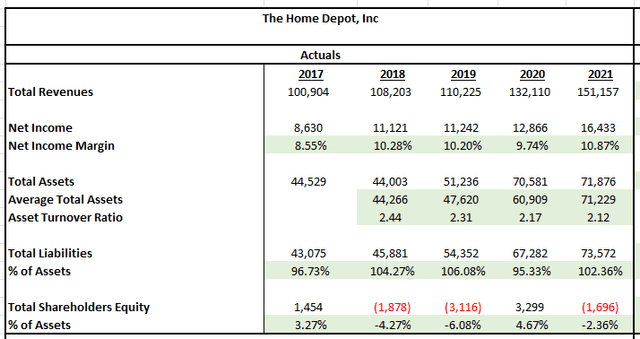

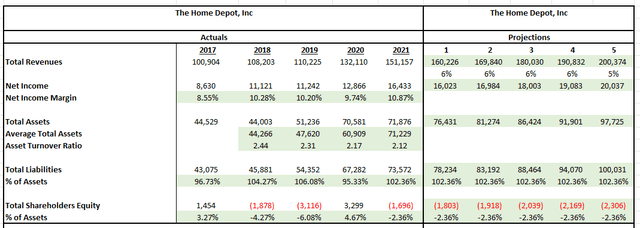

The following step was to enter income and stability sheet associated knowledge from the previous 5 years. The outcomes are supplied beneath. Upon analyzing the outcomes, a number of observations had been made.

- Internet earnings margins are roughly 10%

- Complete liabilities are over 100% of complete property

- Complete shareholders’ fairness is destructive

- The asset turnover ratio is 2.12

Writer’s Inputs of Historic Revenue Assertion and Stability Sheet Knowledge

The observations famous above had been then used to generate a forecast for the subsequent 5 years. By projecting out complete revenues and complete property, web earnings and complete liabilities and shareholders’ fairness had been derived utilizing the relevant percentages famous earlier.

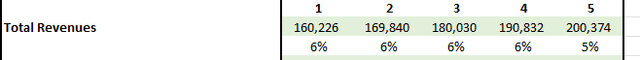

Forecasted revenues are proven beneath. This mannequin assumes that the corporate will attain their purpose of +$200B in complete web gross sales in 5 years.

Writer’s Projections of Complete Revenues

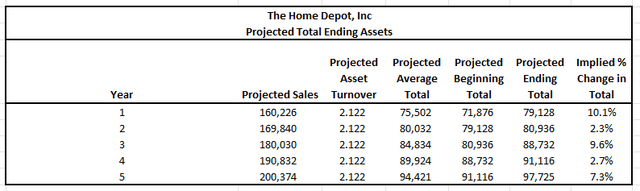

To explicitly hyperlink asset development with gross sales development, the asset turnover fee of two.12 was used to challenge complete future property. The outcomes are proven beneath.

Writer’s Projections of Complete Property

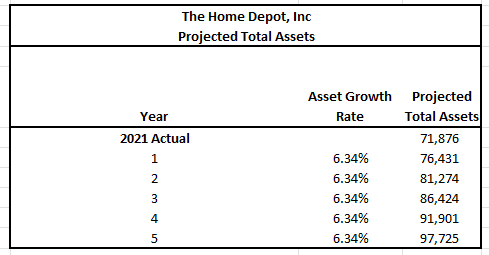

One will discover that the implied % change in complete property fluctuates from 12 months to 12 months, whereas for functions of this mannequin, gross sales had been anticipated to develop easily every year. To easy out these asset fluctuations, the CAGR of complete property was calculated. Within the mannequin above, complete property had been anticipated to develop to $97,725 from $71,876. This represents a CAGR of 6.34%. The ultimate projected totals utilizing this development fee are summarized beneath.

Writer’s Smoothing of Complete Property

The totals above had been inputted into the five-year mannequin beneath. The whole fairness and web earnings in 12 months 5 had been the vital inputs required for the persevering with worth calculation.

Writer’s DDM Mannequin Abstract

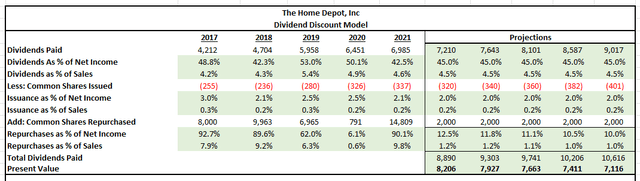

One of many ultimate steps within the mannequin was to enter the historic shareholder payouts and share issuance knowledge of the previous 5 years and put together a projection utilizing the historic averages. The abstract beneath gives the outcomes of this evaluation. HD had practically +$10B left below their present share repurchase program. This mannequin assumes that the remaining repurchases will happen ratably over the subsequent 5 years. Moreover, HD has been issuing inventory at about 0.2% of gross sales, and the dividend funds have been about 4.5% of gross sales. Each are projected to account for a similar share transferring ahead. Utilizing these averages, the projections had been ready, and so they had been then discounted utilizing a fee of 8.33%.

Writer’s Projections of Future Shareholder Payouts

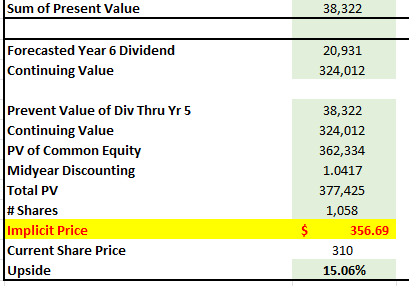

Upon summing the current worth of the online shareholder payouts above, the whole was added to the persevering with worth that was calculated utilizing a projected development fee of 4%.

Writer’s Closing Calculation of Intrinsic Share Worth

As seen above, the outcomes of the mannequin yielded a results of $357. Taken along with the multiples method, a mean worth goal of $335 is acceptable.

Major Dangers

HD’s monetary efficiency relies upon considerably on the steadiness of the housing and residential enchancment markets, in addition to common financial circumstances. Opposed or unsure circumstances within the housing market or the broader economic system on the whole might adversely influence the arrogance or monetary situation of the patron, inflicting them to resolve towards buying dwelling enchancment services and products or impacting their potential to pay for services and products.

Costs of sure commodity merchandise, together with lumber and different uncooked supplies, are risky and topic to fluctuations based mostly on numerous exterior components, corresponding to provide and demand, inflationary pressures, competitors, and market hypothesis. Important will increase in the price of these inputs might have a destructive influence on the corporate if they’re unable to cross by the will increase to their clients.

Along with rising enter prices, provide chain disruptions might adversely have an effect on HD’s potential to obtain and ship their stock in a well timed method. This can lead to elevated transportation prices if the corporate chooses to make the most of expedited delivery or dissatisfied clients if they aren’t supplied their items in a well timed method or if the merchandise they want are frequently out of inventory. This will likely end result within the lack of future enterprise with each present and potential clients.

Conclusion

The present declines in HD look like overdone. Regardless of outperforming the broader markets in prior years, the inventory is at present down 24% over the previous three months. The specter of rising charges and a slowing economic system are credible considerations. The pullback in DIY initiatives after stellar exercise over the previous two years is one other potential actuality. Regardless of the destructive sentiment, the outlook is optimistic.

The house enchancment market is projected to stay regular for the subsequent two years. As well as, most houses within the U.S. are on the age that help the restore and rework market. Document fairness in present houses will present householders with a financing supply for the bigger initiatives that had been delayed attributable to COVID. These initiatives will likely be outsourced to the PRO market, who will spend greater than the common DIYer. Furthermore, as youthful generations progress into their later years, the demand for housing will improve in-turn.

HD’s fundamentals are robust sufficient to seize new alternatives or get by any challenges which will come up within the near-term or down the street. The corporate is efficient in managing and deploying their working capital, and their potential to constantly generate optimistic free money flows is a energy that has rewarded shareholders for a few years. The numerous share worth decline in latest months has offered a possibility for brand spanking new and present shareholders to anchor their portfolios with this dwelling enchancment chief.