Tirachard/iStock through Getty Photographs

Major Thesis / Background

The aim of this text is to judge the ProShares On-line Retail ETF (NYSEARCA:ONLN) as an funding on the present market value. This fund takes an method to personal retailers that principally promote on-line or by way of different non-store channels, relatively than conventional brick and mortar retailers.

That is an ETF I’ve usually cautioned readers towards shopping for for a while, together with once I coated it on the finish of final 12 months. In hindsight, this outlook is vindicated to a level. Whereas avoiding it was completely the best transfer, I ought to have been extra bearish with that outlook. The reason is that ONLN has hit bear market territory since that evaluation was printed:

Fund Efficiency (Looking for Alpha)

With this drop, ONLN has formally entered “bear market” territory if we use the publication date of my final article as the bottom. That is worrisome, after all, nevertheless it additionally presents alternative. At this juncture, I really feel the fund and the underlying holdings inside it most likely have extra upside than draw back going ahead. Merely, this transfer appears a bit unjustified once I contemplate a few of the positives, particularly with regards the highest holdings. In consequence, I really feel an improve to “purchase” for ONLN is warranted, and I’ll clarify why intimately beneath.

Inflation and Curiosity Charges Stay Headwinds

To start, I wish to spotlight a few of the causes behind the decline in ONLN over the previous few quarters. As I discussed above, I believe the steep losses the fund has seen provides a possibility for purchasing now. That stated, it is very important perceive the why behind these losses, so readers can resolve for themselves of their agree with my thesis or in the event that they imagine there’s extra ache to come back.

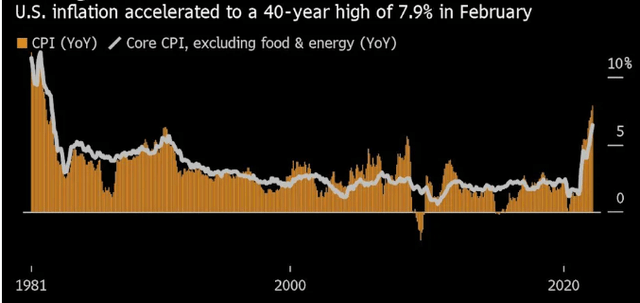

A key purpose behind the overall weak point in retail, whether or not for e-commerce centered performs like these in ONLN or throughout the retail sector extra broadly, is inflation. It is a sore spot for a lot of the market – save for commodity, materials, and vitality performs which have thrived on this setting. Whereas many market pundits continued the road of “transitory” for fairly a very long time (regardless of little to no proof supporting that view), the precise inflation story has completed nothing however get worse over time. Whereas buyers, households, and economists had been hoping 2022 may deliver some aid, the precise outcome has been accelerating inflation, as seen beneath:

Inflation (Yahoo Finance)

This broad inflation metric helps clarify the weak point in retail and consumer-oriented performs of late. Inflation is consuming away at take-home pay and financial savings, whether or not it’s on the fuel pump, eating places and grocery shops, or discretionary attire and malls. Rising costs are usually adopted by declining or stagnating retail gross sales, and that has been the case in the previous couple of months.

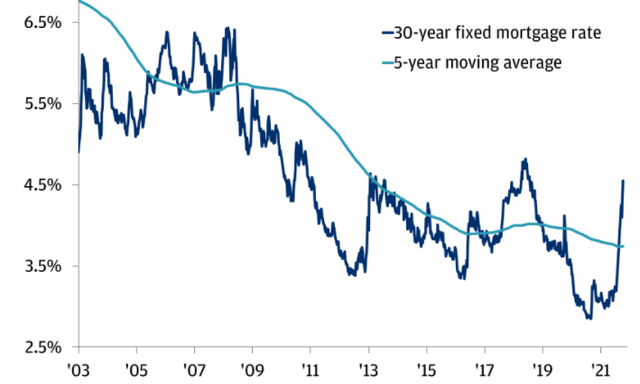

Except for macro-metrics like this, American households are feeling the pinch nearer to house as nicely. It isn’t simply on the retailer or the fuel station the place Individuals are having to shell out more money. As inflation has risen, so have yields and rates of interest. This has trickled all the way down to the mortgage market as nicely. In truth, mortgage charges are rising at a quicker tempo than central banks have acted, with the 30-year mortgage within the U.S. nearing 5%:

Mortgage Charges (JPMorgan Non-public Financial institution)

The purpose right here is that American, and world, customers are in a tricky spot. Wages and employment are rising, sure, however inflation and rates of interest are rising a bit quicker. That is pressuring client sentiment and ahead spending plans, which has been a problem for funds like ONLN, and lots of others.

Retail Gross sales Have Been Inconsistent

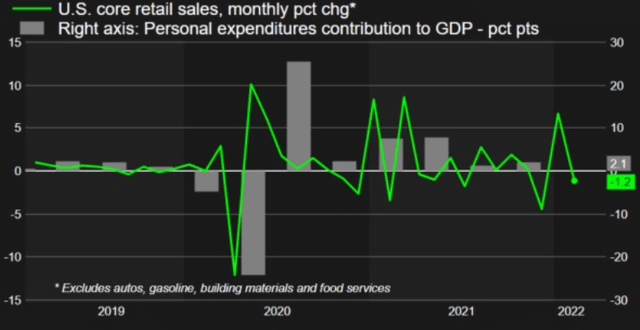

One other relative ache level has been the inconsistent retail image over the previous 12 months. Merely, retail gross sales progress has not been in a position to preserve a development in both course. This isn’t too shocking, given strained supply-chains, inflation metrics, and geo-political dangers in Europe and Asia. Whereas the development has not been too unhealthy, is not hasn’t been too good both, which has stored buyers from bidding up retail shares within the short-term:

Retail Gross sales (Reuters)

I take a look at this graphic a number of methods. One, it suggests the U.S. client has really been pretty resilient given how troublesome the macro-environment is. This helps holding on to publicity to this key demographic. Additional, whereas the forwards and backwards is a bit unnerving for buyers, the truth that the development is just not in a constant downward trajectory suggests to me that maybe the sell-off in retail funds like ONLN is a bit unjustified. That is on the crux of my “purchase” thesis in the meanwhile. Is the retail image difficult? After all. Are American customers nervous and frightened concerning the future? After all. However are retail gross sales actually that poor to counsel a 20% decline in ONLN for the reason that begin of the 12 months is a legitimate response? I believe not.

Others might disagree right here, however my takeaway is that ONLN’s efficiency has not been precisely mirrored by situations on the bottom. This is the reason I see a purchase case rising, though challenges undoubtedly stay in place.

Shopping for The Dip In The Prime Holdings

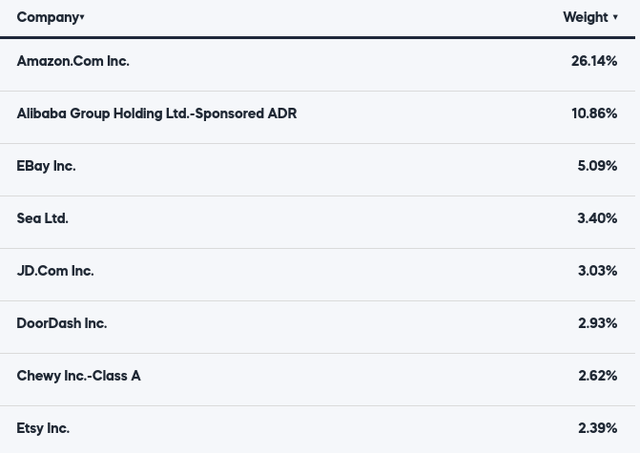

I now wish to shift the dialogue to a few of the underlying holdings in ONLN. Whereas this can be a diversified ETF that holds 39 corporations, readers ought to notice after they purchase this fund they’re shopping for fairly a little bit of publicity to 2 corporations. This is a little more high heavy than I personally like in an ETF, nevertheless it has been the case since I started following it years in the past. Within the case of ONLN, this implies buyers are getting greater than 37% publicity to Amazon (AMZN) and Alibaba Group (BABA):

ONLN’s Prime Holdings (ProShares)

Now, whether or not or not this can be a “good” factor is determined by every particular person buyers. What their outlook is for these corporations, their danger tolerance, and whether or not or not they view shopping for a concentrated fund as a optimistic factor.

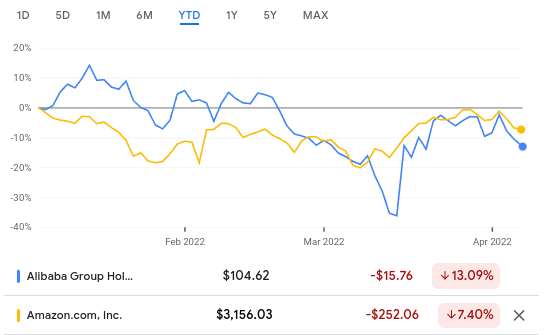

For me, I do not usually view such focus favorably. But, I believe at this juncture the purchase case is simply too obvious to let this deter me. Corporations like AMZN and BABA have been rising for a very long time, and the weak point in 2022 has gotten me fascinated about each of them:

YTD Efficiency (Google Finance)

Taking a look at BABA first, readers ought to notice that is reflective of a broader development of promoting Asian, and particularly Tech-oriented Asian, shares. Whereas BABA’s decline is just not too comforting, if we take a look at the broader Hold Seng Tech index, we see it’s close to bear market ranges for the 12 months. This accompanies to the broader Hand Seng Index, whose drop has been lower than half on a year-to-date foundation:

YTD Efficiency (Yahoo Finance)

To be truthful, readers might absolutely take a look at this graphic as a purpose to keep away from Asian tech, BABA, and ONLN by extension. However I’m taking the contrarian view right here. Bear markets stage usually get me , particularly when the broader development continues to be in-tact. On-line shopping for / e-commerce is one such development that isn’t going away, and that helps shore up my confidence for each AMZN and BABA, and ONLN as a complete.

Additional, there are a pair different causes I believe BABA particularly. One, administration has proven a dedication to return capital to shareholders through share buybacks. In truth, their buyback program has been accelerating over time, coinciding with the inventory’s drop in value. This tells me administration is pretty assured the value is undervalued:

BABA Share Buybacks (Bloomberg)

Now, an informal take a look at this graphic would counsel shopping for as a result of BABA has been conducting buybacks has not be a profitable technique. And I’d agree. Regardless of the preliminary announcement, in addition to steady boosts to the buyback plan, the inventory has continued to fall. However that lies on the coronary heart of the inherent disconnect between the worth administration sees, and the market sees.

In fact, a number of BABA’s decline most likely stems from macro-factors which have affected Chinese language shares, particularly Tech shares, as a complete. So whereas that is related to BABA, it extends past the corporate. That’s the reason I see worth right here, as a result of the market could also be unduly punishing this specific firm, particularly with such an aggressive share buyback program underway.

For many who might not comply with the Chinese language market as intently, a recap of why there was such a broad decline stems from various components. One, Chinese language regulators have been extra aggressive in doling out fines, arrests, and tighter guidelines for the longer term. Two, the U.S. authorities has a renewed curiosity in forcing Chinese language corporations to delist within the U.S. in the event that they don’t meet accounting transparency legal guidelines. This could be a serious blow, as it will most likely soften demand right here, and elsewhere world wide, for these shares. Three, a surge in Covid-cases has prompted lockdowns throughout China, which has clouded the short-term outlook for large-cap companies. That is very true of consumer-oriented companies (i.e. BABA) as customers have locked down once more.

All of those are severe issues, however I imagine the regulatory pressures and Covid-related pressures will easy out in time. The explanations for the sell-off in these shares are legitimate, however long-term the story appears significantly better. This makes shopping for throughout a time of pessimism the best transfer in my opinion.

How Can One Be Optimistic?

The prior paragraph appeared largely at BABA, however I believe there’s worth in shopping for the weak point in AMZN as nicely. Past that, I see the benefit in retail, particularly on-line retail, at these ranges.

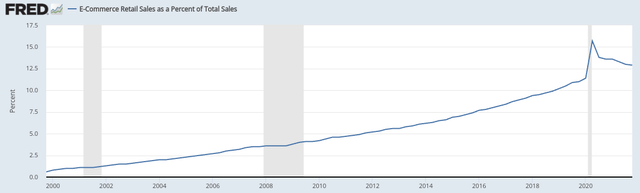

Broadly talking, one development that continues to lend benefit to purchasing in to e-commerce retail performs (of which AMZN is a main participant) is the rising stage of whole retail gross sales being carried out on-line. In equity, this share has come down over the previous two years, however that’s as a result of it noticed such an enormous spike through the worst of the pandemic. If we take a look at pre-Covid numbers, we see the present share of e-commerce gross sales (as a % of whole gross sales) stays nicely above pre-crisis ranges:

E-Commerce Retail Gross sales as a % of Whole Gross sales (St. Louis Fed)

That is an encouraging development if we take a look at the previous decade and never simply deal with the slip from the final two years. For me, I proceed to see a future the place increasingly commerce is carried out on-line. That is merely a rising development that isn’t going to reverse for the foreseeable future. This makes performs like AMZN, BABA, and ONLN the best strikes when you should purchase them throughout occasions of market misery.

One other level I’d deliver up is that whereas rising yields and rates of interest are punishing tech shares and progress names particularly, I imagine this worry is a bit over-hyped. I see a situation the place the Fed strikes its benchmark charge into the two.5% – 3% vary. That is very manageable for large-cap firms which might be time examined, whether or not it’s AMZN or any the common firm within the S&P 500.

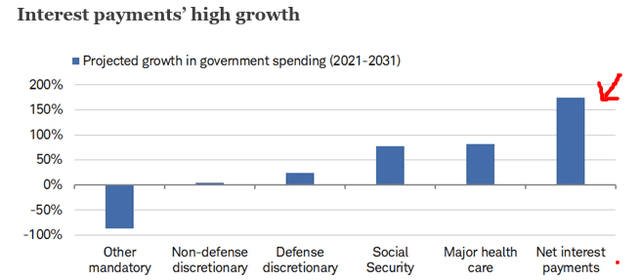

I deliver this up as a result of whereas central banks are getting extra hawkish and buyers are beginning to value in additional charge hikes, I wish to reasonable the outlook on this entrance. Whereas the Fed might have an urge for food for a extra aggressive charge mountaineering cycle, the realities of presidency over-spending are going to hamstring them a bit. If we bake in a modest enhance in rates of interest, we see that over time the U.S. authorities goes to must outlay increasingly of its revenues on servicing debt funds:

Projected Gov’t Spending (Charles Schwab)

It is a macro-fundamental that’s related for the market as a complete. However I see it particularly related for growth-oriented funds/sectors/shares as a result of these are those being pressured probably the most by the hawkish charge modifications. My view is that rates of interest will go up a bit extra, by 1.5-2.0%, after which the Fed goes to must placed on the brakes. The federal government merely can finance its annual borrowing ranges if charges go up rather more than that.

Backside-line

ONLN has had a tough 2022, there isn’t a denying that. Nonetheless, I see sufficient positives in the meanwhile to really feel comfy predicting brighter days are forward. Importantly, the focus of the fund and the tech-heavy nature of lots of the holdings make this a riskier play. However with dangers can come rewards, and I see ONLN posting good points within the months forward. In consequence, I’m placing a “purchase” score on ONLN, and counsel readers give this concept some consideration right now.