[ad_1]

by confoundedinterest17

The guide and film “The Large Quick” revolved across the 2005-2007 housing bubble pushed by lending to debtors with subprime credit score (and little or no underwriting). As we all know, Bear Stearns, Lehman Brothers and different funding banks too giant positions in subprime asset-backed securities (SABS) that grew to become extremely poisonous as soon as the demand for high-yield subprime ABS dried up. The decline in US dwelling costs coupled with hovering 90-day mortgage delinquencies led to the failure of Bear Stearns and Lehman Brothers together with Fannie Mae and Freddie Mac being put into conservatorship by their regulator.

Quick ahead to right now. Mortgage originations by credit score scores of 620 or much less have shriveled whereas dwelling value progress YoY is even increased than the subprime mortgage disaster of 2005-2007. So, is the US going through one other “Large Quick” state of affairs? Sure and no.

The reply isn’t any in that lenders have tightened their credit score field sufficiently in order that funding banks are now not shopping for giant portions of subprime credit score paper. The reply is sure if we take into account that the present housing bubble is fueled by extraordinary financial stimulus because of Covid (in addition to rampant Federal authorities stimulus spending).

Following the Federal Reserve of Dallas’ lead, here’s a chart of REAL dwelling value progress YoY towards REAL common hourly earnings YoY. I added REAL Zillow home rents YoY as nicely.

Take a look at the affordability hole throughout the Subprime Bubble of 2004-2006 after which the Fed Bubble of 2020 to right now. Each bubbles present a disconnect between REAL dwelling costs and REAL wages. REAL Zillow dwelling rents aren’t as excessive as REAL dwelling value progress, however nonetheless how an enormous hole in hire affordability.

So, what can upset the apple cart? How about Jay and The Gang jacking up mortgage charges making dwelling affordability even worse (except it slows dwelling value progress).

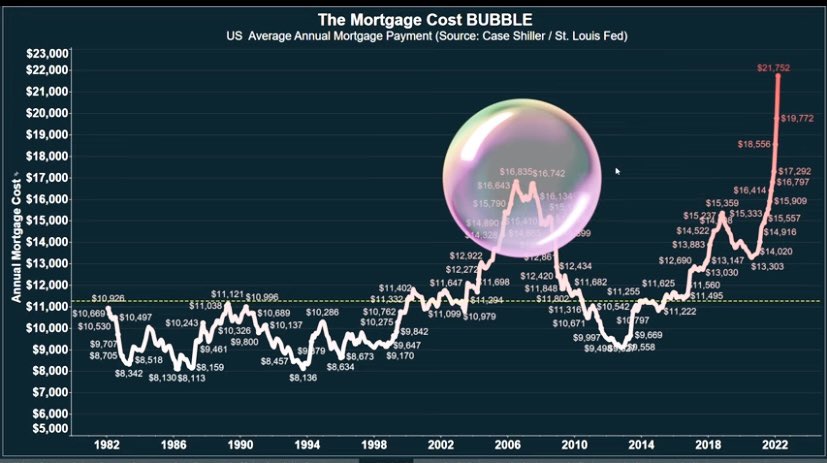

Due to The Fed’s suggest quantitative tightening, mortgage charges are hovering and mortgage prices together with them. Mortgage prices, because of The Fed driving up housing costs AND mortgage charges, are considerably increased than throughout the subprime mortgage housing bubble.

The Fed’s whipsaw method helped crash dwelling costs throughout the subprime mortgage disaster by dropping charges too quick at first (serving to to ignite a housing bubble) then elevating charges too quick (serving to to crash housing costs).

Now, Michael Burry of The Large Quick fame (portrayed by Christian Bale) thinks that The Fed has no intention of combating inflation that means that he doesn’t suppose The Fed will elevate charges all that a lot. “The Fed’s all about reloading the financial bazooka. So it could journey to the rescue & finance the fiscal put,” Burry added.

Yikes! Time for investing in cryptocurrencies like Bitcoin and Ethereum?

This scene from the movie “The Large Quick” received’t be occurring once more. However I agree that nobody is paying consideration … once more.

Assist Help Impartial Media, Please Donate or Subscribe:

Trending:

Views:

49

[ad_2]

Source link