[ad_1]

It’s estimated that the healthcare insurance coverage market would develop at a compound annual charge of round 10% within the subsequent 5 years. UnitedHealth Group, Inc. (NYSE: UNH), a market chief in healthcare insurance coverage, is well-positioned to faucet into that chance. The corporate appears to be on monitor to attain its long-term earnings per share development goal of 13-16%, supported by numerous initiatives targeted on the important thing development areas.

UNH is likely one of the few shares that remained unaffected by the macro headwinds and up to date market selloff. It reached a brand new excessive final week forward of the earnings launch, shrugging off the weak point skilled within the early weeks of the 12 months. Regardless of a 37% rally over the previous 12 months, it appears to be like just like the inventory remains to be buying and selling at an affordable low cost to honest worth.

Valuation

Nonetheless, some observers consider the valuation is simply too excessive, and there are issues that there’s not a lot room for additional development within the neat future. Whereas these fears are justifiable to some extent, the Minnetonka-based healthcare service supplier has what it takes to hit the high-growth path. That makes the inventory a compelling purchase for the long run. Additionally, the regular uptick in payout ratio is nice information for revenue buyers, which additionally alerts continued dividend development. The 1.2% yield nearly matches the market’s common.

Key highlights from Walgreens Boots Alliance Q2 2022 earnings outcomes

UnitedHealth ended fiscal 2021 with a money steadiness of about $21 billion, which is a testomony to the power of its enterprise mannequin. The corporate has expanded the client base continually over time, bringing it to greater than 50 million on the finish of 2021.

Throughout his post-earnings interplay with analysts, UnitedHealth’s CEO Andrew Witty on Thursday stated, “In Medicare Benefit, our strategic steadiness of profit stability and enhancements as soon as once more helped to ship robust development. We stay properly on monitor to serve an extra 800,000 individuals in 2022, according to the expectations we set final November. Within the industrial advantages market, our progressive choices equivalent to physician-led and virtual-first plans have grown to serve 350,000 extra individuals over the previous 12 months.”

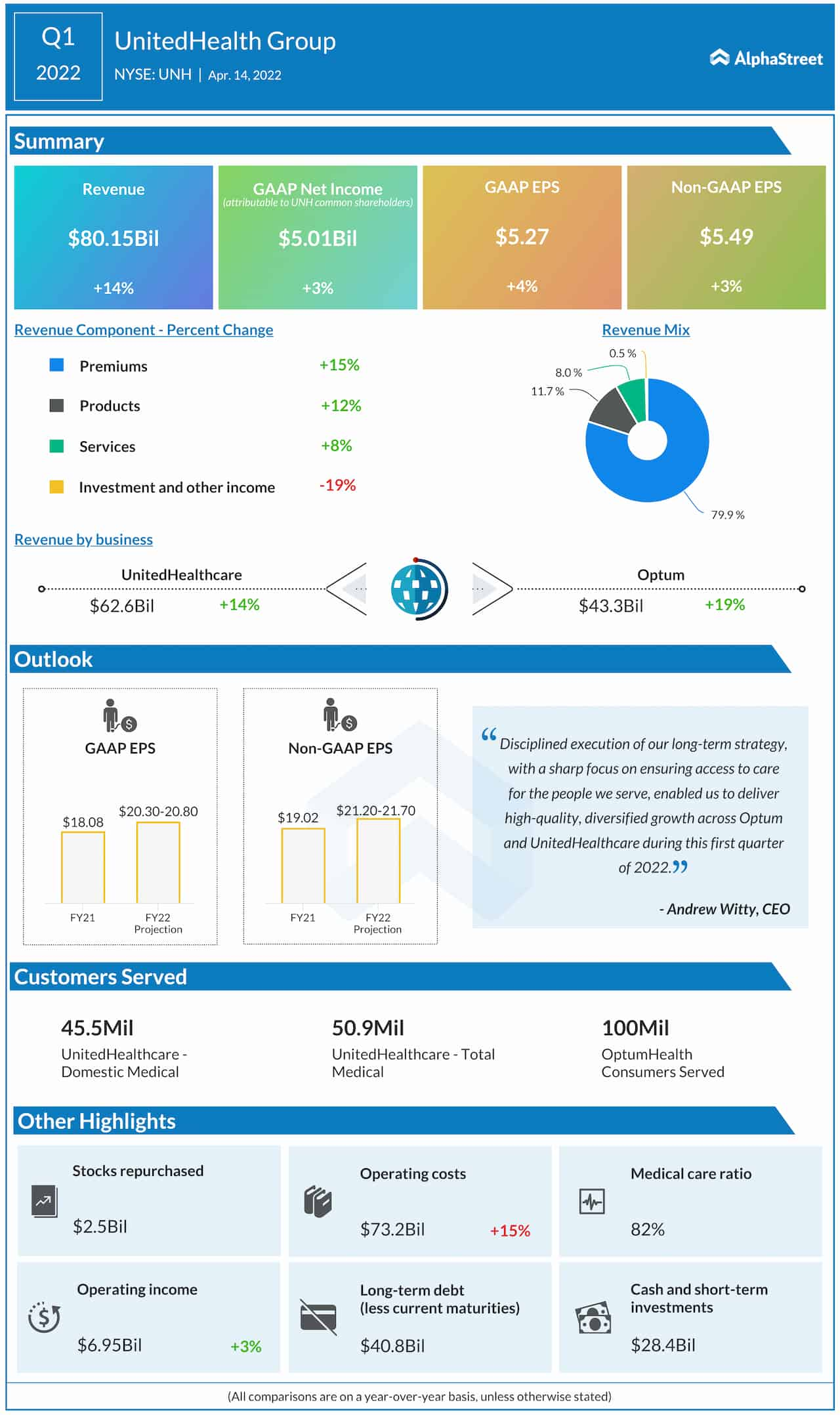

Underscoring the sustainability of the enterprise and robust fundamentals, UnitedHealth’s quarterly earnings both beat or matched consensus estimates persistently over the previous a number of years. Within the first three months of fiscal 2022, revenues and web revenue elevated year-over-year and topped expectations whilst all the primary working segments registered robust development.

Good Begin to FY22

First-quarter web revenue, excluding one-off objects, rose to $5.49 per share from $5.31 per share final 12 months. Earnings benefitted from a 14% improve in revenues to $80.15 billion, which additionally exceeded the market’s projection. Buoyed by the upbeat outcomes, the administration raised its earnings steering for fiscal 2022.

Learn administration/analysts’ feedback on quarterly outcomes

Whereas the corporate’s development prospects are fairly encouraging, the administration must take particular care to take care of a balanced medical care ratio and be sure that the pricing is favorable.

Shares of UnitedHealth traded larger all through Thursday’s common session, hovering close to final week’s peak. They’ve gained about 28% prior to now six months, largely outperforming the market.

[ad_2]

Source link