[ad_1]

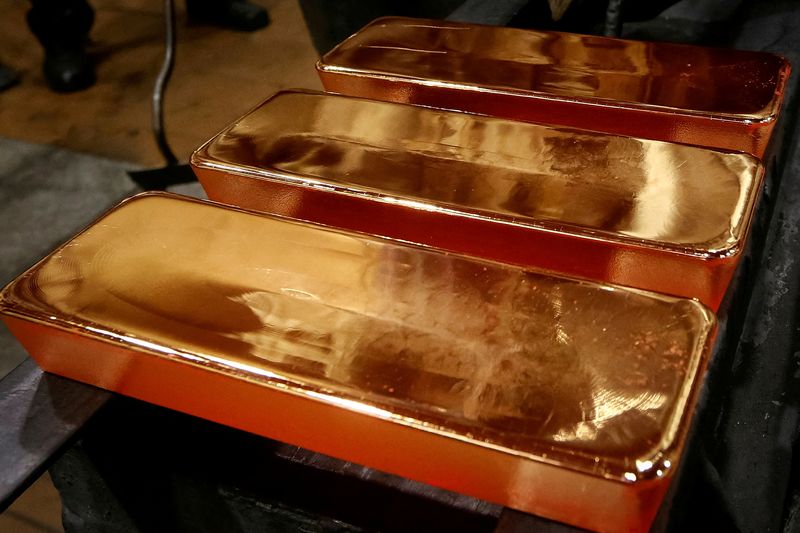

© Reuters. FILE PHOTO: Staff course of ingots of 99.99% pure gold on the Krastsvetmet non-ferrous metals plant within the Siberian metropolis of Krasnoyarsk, Russia November 22, 2018. REUTERS/Ilya Naymushin/File Photograph

2/2

By Lisa Pauline Mattackal and Medha Singh

(Reuters) – A fledgling class of crypto that feasts on threat is outshining a wider market paralyzed by warfare and inflation.

Cash backed by gold are newer variants of “stablecoins”, that are sometimes pegged to the greenback to tame volatility. The biggest, Pax Gold or PAXG, has jumped 7.4% in 2022, whereas primary rival Gold has leapt 8.5%.

Against this, bitcoin has misplaced over 13% and ether is down 20%.

“One of many primary issues that lots of people who’re new to crypto have is that it isn’t backed by something. It simply will get on a display,” mentioned Everett Millman, chief market analyst at Gainesville Cash. “So attaching them or linking them to a real-world commodity, it does make some sense.”

The attain for gold, a conventional hedge towards geopolitical upheaval and inflation, is unsurprising. The demand for gold-backed cryptocurrencies, although, is new.

Stablecoins, a fast-growing breed of crypto, have emerged as a typical medium of trade, typically utilized by merchants searching for to maneuver funds round. It’s simpler to swap main stablecoins for bitcoin or different crypto, for instance, than it’s to swap conventional cash like U.S. {dollars} for bitcoin.

Tether Gold has been buoyed by larger traders, together with “whales” with $1 million or extra of cryptocurrency, utilizing the token to vary a portion of their holdings into gold, based on Paolo Ardoino, Tether’s chief expertise officer.

“Lots of our traders have been already concerned in crypto, however have been thinking about not having their total wealth in cryptos or in {dollars}, and have been searching for extra inflation-resistant belongings like gold,” he mentioned.

But gold-backed cash are nonetheless a distinct segment novelty within the crypto market at current – PAXG and Tether Gold are barely over two years previous – with skinny liquidity and little certainty about their long-term fortunes.

PAXG has seen its market worth nearly double to $627 million this 12 months, whereas Tether Gold has risen 9% to above $209 million. By comparability the latter’s eight-year-old sibling, dollar-pegged Tether – the world’s largest stablecoin – has a market cap of over $83 billion.

In response to information from CoinMarketCap, every day PAX gold buying and selling volumes ranged between $10 million to $520 million over the previous month, in comparison with ether volumes which fluctuated between $8.7 billion and $25 billion in April. Greenback-pegged tether’s 24-hour volumes ranged between $35 billion and $92 billion.

ALL THAT GLITTERS?

Sceptics argue that PAXG, developed by the corporate Paxos, and Tether Gold have merely risen on the coat-tails of a broad rush for gold; certainly they’ve tracked the worth of bodily gold, which is up about 8.5% this 12 months. PAXG is up 4.5% since Feb. 23, the day earlier than Russia invaded Ukraine, versus gold’s 4%.

The SPDR Gold Shares (NYSE:) exchange-traded fund, which is managed by State Road (NYSE:) World Advisors, is up 7.6% in 2022.

“The (crypto gold) tokens themselves aren’t immutable. They’re actually simply IOUs that occur to be utilizing blockchain infrastructure,” mentioned Alex Thorn, head of firmwide analysis for Galaxy Digital in New York.

He mentioned traders must decide whether or not they need to have the identical degree of confidence within the corporations behind PAXG and the gold ETF.

“They’re each principally artificial gold publicity backed by gold holdings. Maybe belief is a part of the factor that folks would contemplate when deciding whether or not we will belief Paxos the identical manner we belief State Road.”

Nonetheless, advocates of such cash say they provide the convenience of proudly owning gold with out having to fret about storing a bodily coin or bar, whereas eliminating the minimal margin necessities typically required to commerce gold on conventional markets.

PAXG, as an example, requires a minimal funding of the equal of 0.01 ounce of gold, roughly $20, versus the $184 an investor would pay for every share of the SPDR Gold ETF.

Millman at Gainesville Cash additionally argued that gold-backed stablecoins bolstered the credibility of cryptocurrencies.

“One of many primary criticisms of cryptos is that they’ve been so extraordinarily risky. Therefore, the thought to again a token with a steady commodity,” he mentioned. “The wedding between these two issues may really additionally bolster confidence in cryptos.”

[ad_2]

Source link