[ad_1]

“Whoooaaa!”

That was my 7-year-old’s response as we reached the outskirts of Cincinnati to go to household over Easter.

Simply as we turned the nook, curler coasters from Kings Island reached into the sky in an amalgamation of metal.

Now it’s been some time since I’ve been on one of many rides, however I benefit from the thrill as a lot as my youngsters.

Nevertheless, there’s one place the place I haven’t loved the curler coaster trip, and that’s been within the inventory market.

The ups and downs, twists and turns … and I’m afraid the trip isn’t over but.

In actual fact, listed below are two components that would ship the inventory market coaster lurching much more within the coming weeks … and three widespread shares you gained’t wish to tackle the trip.

Issue No. 1: Revenue Revisions Are Headed Down

We’re simply now getting into prime-time earnings season, with corporations like Tesla and Apple reporting quarterly outcomes over the following a number of weeks. And it’s the outlook that will probably be essential.

That’s as a result of traders will uncover how a lot provide chain points, inflation and tight labor markets are impacting the underside line trying forward.

It’s nonetheless early, however analysts at Morgan Stanley level out that earnings revisions are collectively approaching adverse territory for corporations which have already reported.

Which means there are extra corporations decreasing estimates for future earnings versus rising projections, and it might simply be the beginning.

Issue No. 2: Credit score Threat Rises With Charges

Members of the Federal Reserve preserve attempting to “speak” their approach right into a tightening cycle, and it’s working.

The yield on the 10-year Treasury is at 2.9% as I’m scripting this. That’s up from 2% in just a bit over a month. In the meantime, the 30-year Treasury hit 3% … the very best stage in three years!

But Fed members preserve hinting that it might simply be the start … making excessive stakes even greater forward of the Fed’s subsequent assembly in simply two weeks.

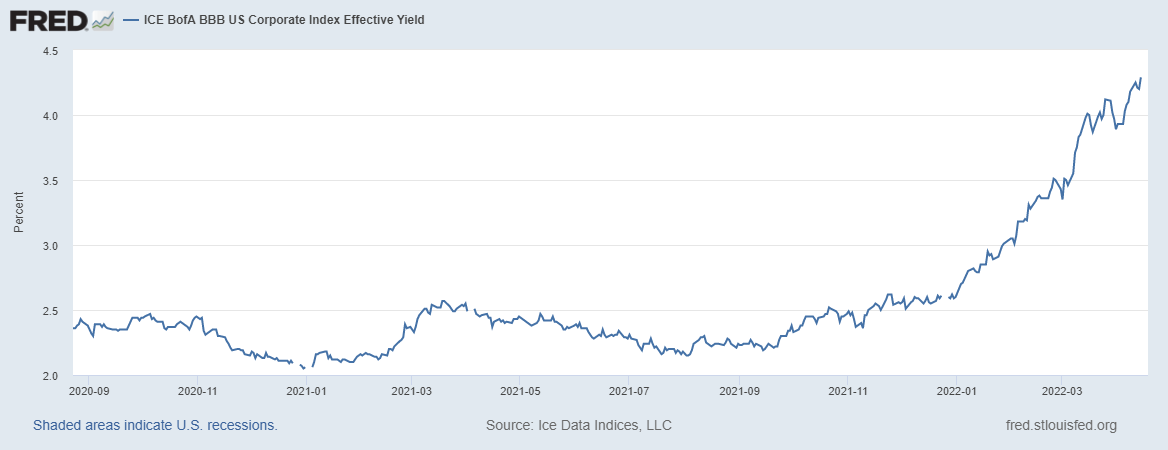

That’s necessary as a result of yields within the $10 trillion company debt sector are surging greater as effectively. You may see that within the chart of BBB-rated bond yields beneath.

For corporations that have to refinance all that debt, it interprets to elevated borrowing prices. These greater bills slowly eat into earnings, which might drive the revisions I discussed earlier even additional into the crimson.

And for closely indebted corporations, a big sufficient soar in curiosity expense can result in default and basically wipe out stockholders.

Keep away from These 3 Curler Coaster Shares

Not all curler coasters are unhealthy. My youngsters positively respect that truth!

However given these considerably unpredictable components, it is sensible to keep away from corporations that would ship traders for a “trip” after seeing downward revisions to their revenue forecasts and working high-risk steadiness sheets. Utilizing quantitative evaluation, it’s straightforward to display for corporations that might be susceptible to these catalysts. These similar components have been confirmed in again testing to pinpoint corporations that outperform or path the market.

As we enter this pivotal earnings season, I checked out which corporations within the S&P 500 rank poorly if you mix adverse analyst revisions and excessive credit score threat, and listed below are three that stand out among the many lowest scores:

It’s form of stunning that every one three are family names — however they’ve additionally all been deeply impacted by the worldwide pandemic. However the numbers don’t lie.

So when you’re not searching for a pulse-pounding thrill trip over the following few months, you may wish to keep away from these widespread client manufacturers.

Finest regards,

Clint Lee

Analysis Analyst, The Bauman Letter

[ad_2]

Source link