cyano66/iStock through Getty Photos

Intro

Earlier than writing this text, I calculated that 10 articles about Netflix (NASDAQ:NFLX) have been written on Looking for Alpha simply yesterday. The statistics of suggestions are as follows:

The huge majority of writers who really useful promote or maintain principally wrote that Netflix is now not a development firm. This conclusion follows from the disappointing dynamics of development of subscribers. That is clear. However is that basically all there’s to say about Netflix?

What is basically the present downside of Netflix?

I bear in mind very effectively the wave of optimism about the way forward for Netflix when the pandemic hit. Essentially the most vivid reminiscence for me was an article on Nasdaq referred to as “The Pandemic Will Put Netflix Into Our DNA, Analyst Says”. This prospect was really spectacular.

Then it was tough to think about that customers would get uninterested in video companies through the interval of quarantine measures, and excessive inflation would drive them to cancel subscriptions. However it occurred. And this serves as one other lesson that each development is adopted by a pullback.

So, the important thing purpose why Netflix goes down proper now is just not due to the corporate’s enterprise mannequin or its free money circulation development dynamics, however as a result of the corporate’s subscriber loyalty has been overvalued. However in my view, this doesn’t imply the dying of the corporate.

Is all of it that unhealthy?

The drop in Netflix subscribers was the primary since 2011. This determine takes under consideration the lack of 700 thousand subscribers from Russia. With out taking this under consideration, the rise in subscribers on the Netflix platform on the earth could be 500 thousand subscribers. As well as, Netflix reported greater than 100 million subscribers who use the companies of the platform and don’t pay for them:

…we’re engaged on learn how to monetize sharing. We have been fascinated about that for a few years. However after we have been rising quick, it wasn’t the excessive precedence to work on. And now, we’re working tremendous laborious on it. And bear in mind, these are over 100 million households that already are selecting to view Netflix. They love the service. We simply obtained to receives a commission at a point for them…

Q1 2022 Outcomes – Earnings Name Transcript

For my part, if the corporate develops one thing like two-factor authentication, it can complicate the alternate of passwords and improve the variety of subscribers.

Additional, judging by the earnings name, the corporate is contemplating the introduction of extra tariff plans that embrace promoting:

And one solution to improve the value unfold is promoting on low-end plans and to have decrease costs with promoting. And people who have adopted Netflix know that I have been towards the complexity of promoting and an enormous fan of the simplicity of subscription.

However as a lot I am a fan of that, I am a much bigger fan of shopper selection. And permitting customers who wish to have a cheaper price and are advertising-tolerant get what they need makes plenty of sense.

Q1 2022 Outcomes – Earnings Name Transcript

I feel, it is a very right measure which may improve Netflix income from international base. In any case, the world financial system is now going via laborious instances and most customers are targeted on saving their budgets.

Subsequent. Judging by the feedback within the convention name, Netflix tends to contemplate itself an leisure firm, and never only a streaming one:

…But additionally, very importantly, permits us to usher in income for everybody who’s viewing and who will get worth from the leisure that we’re providing..

Q1 2022 Outcomes – Earnings Name Transcript

Because of this the corporate could effectively diversify its line of companies, for instance, by gaming companies. Be that as it could, the corporate’s worldwide viewers exceeds 191 million customers. This base will be monetized via the video games trade.

What about valuation?

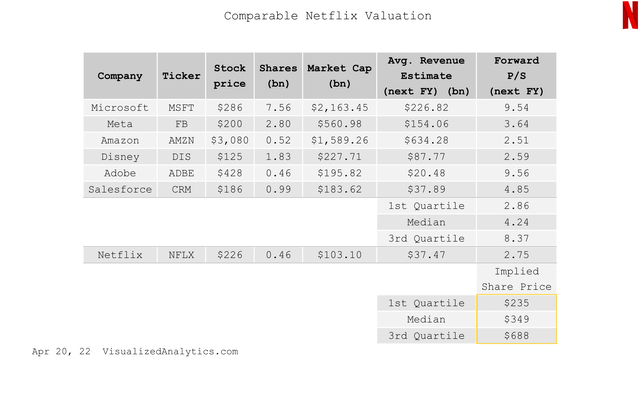

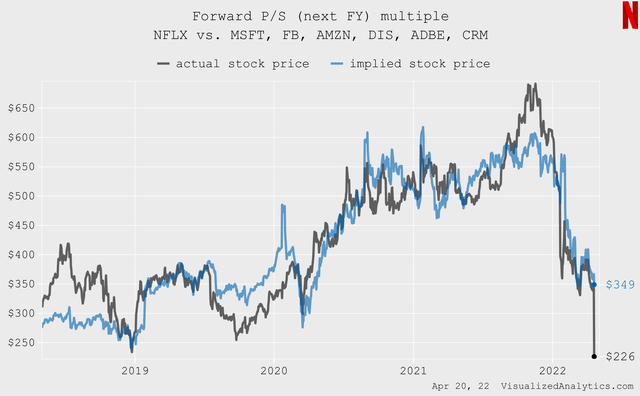

I want time to replace my Netflix DCF mannequin with new views. Later, I’ll undoubtedly introduce it. However now I wish to take note of the mannequin based mostly on the ahead P/S a number of. Regardless of its simplicity, prior to now this mannequin has been a great indicator of the corporate’s balanced value:

VisualizedAnalytics VisualizedAnalytics

As you may see, the value of Netflix is already effectively under its enough degree.

Backside Line

Sure, Netflix is now not a development firm. However since its peak in November, the corporate’s value has fallen by virtually 70%. I feel it is a good low cost for a world leisure firm with ~191 million customers and an enormous quantity of video content material. Typically, I don’t assume that Netflix is a corpse firm. Furthermore, I even assume that one can begin shopping for fastidiously.