[ad_1]

Work when you’re awake to earn cash when you sleep

Noah Kagan is a 40-year-old entrepreneur who constructed sumo.com, one of the vital standard e-mail seize instruments on the market. He additionally has a Youtube channel the place he usually posts money-making concepts and entrepreneurship suggestions for individuals who need to observe in his footsteps.

Noah not too long ago posted a video the place he breaks down his “passive” earnings channels as an entrepreneur and Youtuber, and the way they make him over 350K per thirty days. The factor is, a variety of his earnings streams aren’t passive in any respect. Fairly, they’re the accumulative results of years of onerous work and dedication, which now permits him to take a step again, calm down and revel in his success. However to be clear, he would by no means be making this amount of cash “passively” if he hadn’t labored his butt off earlier than that.

On this article, I need to go over the caveats of Noah’s so-called passive earnings and break down what it actually takes to earn cash when you sleep (trace: to work when you’re awake).

Noah makes $2,227 per thirty days because of 2 digital merchandise he created over 8 years in the past. The primary one is a ebook he wrote after he was fired from Fb. It’s nonetheless netting him $227 in amazon royalties each month.

The second is a enterprise course he created together with his group, and that also makes round $2,000 per thirty days. It’s vital to notice that though this earnings stream is now 100% passive (individuals simply come to his web site, buy, and devour it) it took an entire group and some huge cash to make this course occur. Noah did make his a refund because the course generated over $1 million in gross sales the primary 12 months it launched, however this goes to indicate there’s a huge upfront funding in work and folks.

Noah observed that movies he shot together with his group over a 12 months in the past are solely now beginning to make first rate cash (he has 368K subscribers on his channel). The large caveat is that his studio spent round $400,000 on making content material that very same 12 months, so he’s within the adverse right here. Noah additionally doesn’t go into the small print of how a lot his channel is making now versus how a lot he’s spending on it (I assume this quantity is adverse as nicely).

Later, when he grows his viewers and his movies begin making much more cash, the funding in money and time might be 100% value it, as a result of he’ll be capable of recoup his manufacturing prices. However proper now, saying his previous Youtube movies are making “passive earnings” is a little bit of a stretch.

The amount of cash Noah makes from his e-mail checklist is negligible in comparison with the remainder of his earnings streams, however he does have a really attention-grabbing tackle it:

“This has in all probability been one of the vital priceless passive and energetic earnings streams I’ve had in my life. It launched me to essentially the most superb individuals. An instance of that is I used to be capable of meet Tim Ferriss who’s develop into a superb buddy of mine over many a few years. I believe this is without doubt one of the best to begin, the place you will get a weblog on so many various websites, you can begin a e-newsletter tremendous simply.”

As a blogger and entrepreneur myself, I can 100% relate to what he’s saying right here. Constructing an e-mail checklist and responding to emails from individuals who learn and like my content material has been among the finest methods to find nice work and keep in contact with individuals on-line.

Simply by getting in contact through e-mail, I’ve additionally had the chance to interview 75 individuals on the matters of productiveness, entrepreneurship, and on-line writing. The wealth of knowledge, information, and motivation I acquired by these interviews has been completely invaluable, value much more than what I could make from my e-mail checklist.

That is how Noah makes most of his cash, and once more it’s not 100% correct to say that is passive earnings, for two essential causes:

- Operating and sustaining a enterprise requires a variety of work, even when you get extremely rewarded for it.

- That is enterprise earnings, not private earnings. It doesn’t go instantly into Noah’s pocket and doesn’t embody all of the bills (staff, workplace house, and different working prices…)

This earnings channel is break up into 3 subcategories:

Lifetime offers on appsumo.com

Noah based appsumo.com in 2010. It’s a day by day offers web site for digitally distributed items and on-line providers, and you will get loopy offers on superior merchandise there (like paying as soon as for lifetime entry). Noah offers the instance of Sendfox, an answer to mechanically ship personalized emails that makes over $27,500 per thirty days.

Sumo.com

Noah additionally created and owns sumo.com, one of the vital standard e-mail seize instruments on-line. It’s subscription-based and revamped $1.62 million from April 2021 to March 2022.

It’s attention-grabbing to notice that on the screenshot Noah shares, you possibly can see his gross quantity is down 25% (highlighted in orange) from the 12 months earlier than April 2021. If this pattern continues, his income will shrink within the years to return.

This is essential to contemplate when working a enterprise, particularly Saas (Software program As A Service). Within the first part of this text, we talked about how Noah made $1 million within the first 12 months he launched his on-line course, and the way he’s now making “solely” $2,000 per thirty days from it. That is what occurs if you don’t replace and preserve your providing.

I used sumo.com for years for my weblog, earlier than switching to a different platform. The rationale for my alternative was quite simple: as Noah says himself, his answer has stayed the identical for years, and the group doesn’t do any updates. I’m all for easy, environment friendly instruments, however I’ve discovered that sumo.com’s UX and design clearly want a refresh, which hasn’t come but. If the group doesn’t replace the device, I anticipate his income to maintain dropping.

Wage as founder

Noah additionally mentions he personally makes a further $80,000 per thirty days from sumo.com. Whereas it’s not clear how precisely he makes that cash, he appears to suggest it’s his compensation because the founding father of the corporate.

“Once I created this firm 12 years in the past it took a variety of work, and for the primary 3 years I made virtually 0 {dollars}. However by many a few years of consistency and placing within the work, discovering a enterprise mannequin and superior prospects, constructing a group, I’ve been capable of create an organization the place, whether or not I’m concerned or not concerned, it’s been capable of do rather well for me as a passive earnings enterprise.”

As for most of the earnings streams talked about on this article, the principle caveat for all of Noah’s cash coming from his enterprise is that he needed to work for 12 years to get right here. You don’t go from making $0 to $1.6 million in gross sales in a number of months.

We are actually entering into the “investments” a part of the article: issues like actual property, index funds, and… cryptocurrency. It’s vital to do not forget that most individuals don’t have $20,000 and even $10,000 mendacity round that they’ll afford to speculate and lose if issues go south.

Whereas it’s correct to say that these earnings streams are 100% passive (in contrast to the 4 ones above), the money required to put money into these choices normally comes from precisely the other of passive earnings: years of onerous work, dedication, and dedication (just like the 4 choices talked about above).

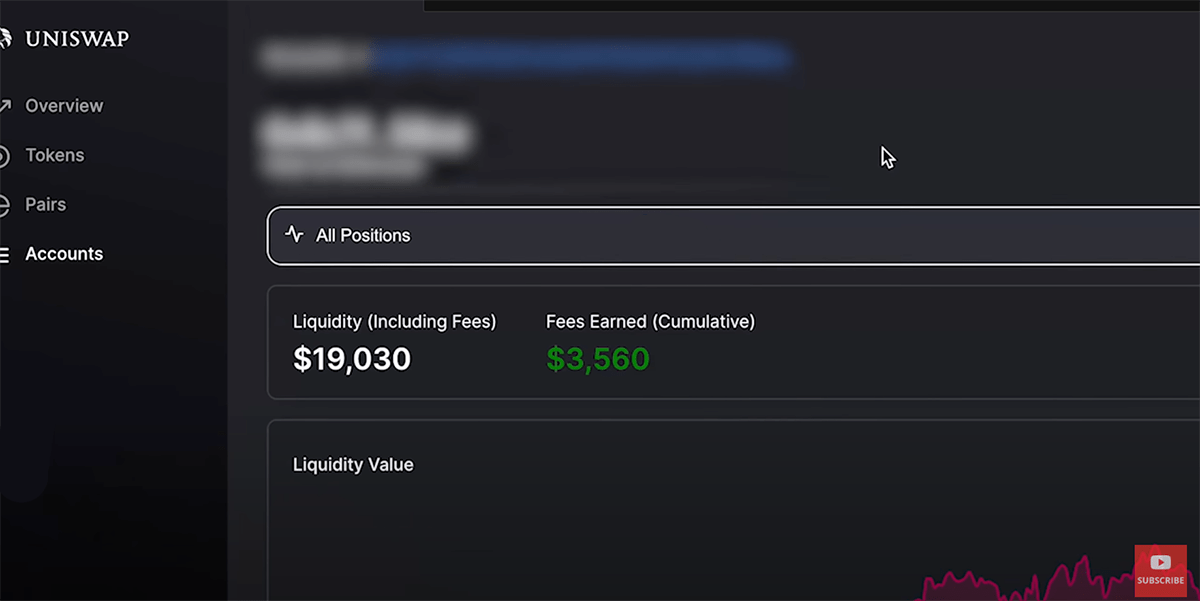

Uniswap liquidity swimming pools — $323

A liquidity pool is a crowdsourced pool of cryptocurrencies or tokens locked in a wise contract that’s used to facilitate trades between the belongings on a decentralized trade. — Cryptopedia.com

Primarily, it’s about offering liquidity on an trade platform, to ensure trades between customers go easily. Change platforms normally reward customers for offering liquidity with a return on their preliminary funding, and that’s how Noah makes his cash there.

He has round $19,000 break up throughout 2 forex pairs on his account, and makes round $323 per thirty days from it:

That’s an annual return of 20%, which is large. However there are very huge caveats to this earnings stream:

- The curiosity earned is paid out in crypto, and since crypto costs change on daily basis, your payout itself will range in worth from sooner or later to the opposite

- The principal ($19,000) is owned in crypto as nicely, so the worth of your preliminary funding will range with the crypto market too, making it extremely unstable and intensely dangerous

- There may be zero assure on the return fee, and between charges and volatility, this selection could very nicely begin shedding cash sooner or later

Staking crypto — $7,200

Staking presents crypto holders a manner of placing their digital belongings to work and incomes passive earnings without having to promote them.

You possibly can consider staking because the crypto equal of placing cash in a high-yield financial savings account. Whenever you deposit funds in a financial savings account, the financial institution takes that cash and usually lends it out to others. In return for locking up that cash with the financial institution, you obtain a portion of the curiosity earned from lending. — Coindesk.com

Besides the cryptocurrency market is NOT a financial institution. Once more, the mixture of crypto volatility and the fluctuation in return charges makes for a really high-risk cocktail. Noah is holding 100 ETH (value round $306,000 on the time the video was shot) and he’s made virtually $10,000 from it doing nothing, however his principal will lose worth if ETH goes down. Because of this, the return fee of staking is normally lower than the marketed quantity.

One other caveat on the subject of crypto: any crypto market can exit of enterprise and take your cash with them. Though that is unlikely to occur with the few most established platforms, it has occurred numerous instances with smaller platforms. I extremely advise towards investing in cryptocurrency except you possibly can afford to lose the cash.

“I’ve been investing in index funds since 2004. All I do is, each single month it goes straight from my paycheck into the [investment] account. I used to be placing 50% of my earnings by these things and lived actually low-cost for a few years, that’s how I used to be capable of develop into a millionaire by 30.”

I’d be very cautious when listening to individuals declare they grew to become millionaires by investing a part of their paycheck in index funds. Actually, Noah revealed one other video the place he explains how he made his first million together with his firm sumo.com, not by investing within the inventory market.

Index funds are usually thought of a secure and dependable approach to earn a constant return in your funding, that’s true. However they normally gained’t make you greater than 5% a 12 months, which is just $5,000 per 12 months when you make investments $100,000. Plus, it’s important to pay taxes if you money it out.

And once more, when you reside paycheck to paycheck this selection is a no-go for you, so that you would possibly as nicely begin by wanting into creating your individual enterprise, turning into your individual boss, getting cash running a blog…

That is the final of Noah’s earnings streams, and he invests in actual property in 3 other ways:

Syndicates — $2,500

Syndicates are non-public individuals who accumulate cash from buyers and use it to purchase buildings. As an investor, you then earn a return in your cash primarily based on how a lot the constructing makes in hire and the way a lot you invested within the undertaking. Noah says he has invested round $300,000 on this and customarily makes a ten% yearly return.

Renting out workplace house — $10,000

Noah purchased workplace house that he’s renting to his firm, which is quite common for founders to do (once more in case you have the liquidity). As an proprietor of your individual enterprise, being your landlord and your tenant on the identical time is a superb deal.

Airbnb — $10,000

Noah has 2 properties managed by a property supervisor, so he doesn’t need to deal with something. Certainly one of his Airbnbs is a home he simply moved out of, and the explanation he was capable of transfer some place else with out promoting is that his web value is excessive sufficient.

[ad_2]

Source link