If FOMO is driving you bananas, take a break and know which you can nonetheless take part within the Otherside on the secondary market.

BAYC

Folks throughout the ether went ape this previous weekend after Yuga Labs, creator of Bored Ape Yacht Membership (BAYC), launched its extremely publicized metaverse, the Otherside, which dropped at 9:00 PM ET, on Saturday, April 30. Yuga went as far as to proclaim that it was “the biggest NFT mint in historical past by a number of multiples.” However for a lot of keen traders, system crashes and excessive fuel charges made it something however clean crusing to the Otherside.

What’s the Otherside?

The Otherside metaverse is an normal, numerous and colourful panorama. It consists of 200,000 plots of “land” which can be accessible by means of the acquisition, or minting, of so-called “Otherdeeds” — NFTs that act as title deeds for the plots of digital land. Getting in on this much-anticipated metaverse to mint Otherdeeds requires the acquisition of ApeCoin ($APE), the governance and utility token for the complete Ape ecosystem, and the authorized tender on this new, unique metaverse. The price of minting one Otherdeed was set — simply hours earlier than the 9:00 PM begin time — at a flat 305 $APE, or about $5,847, primarily based on $APE’s per-share value of $19.17 at the beginning of the sale.

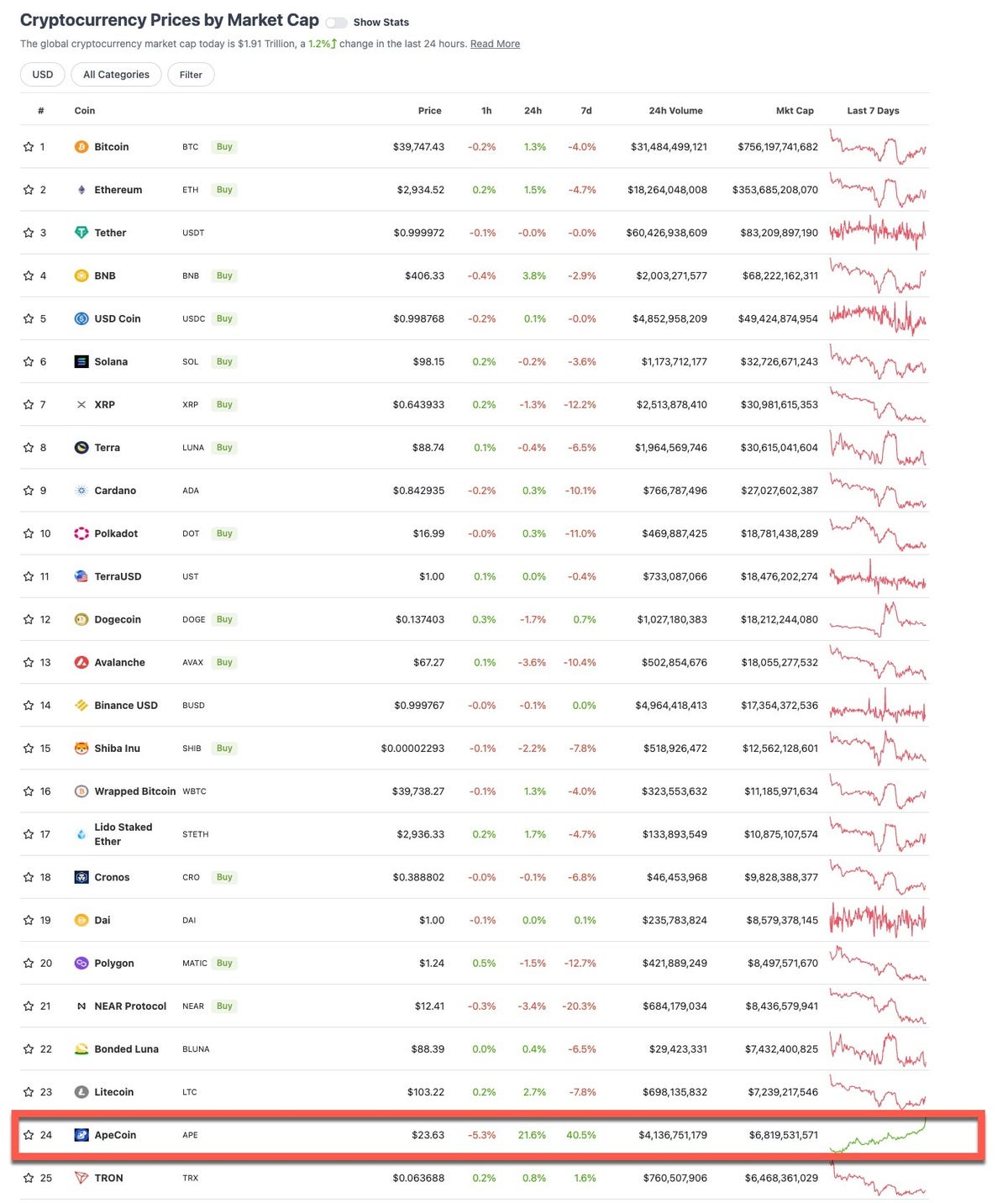

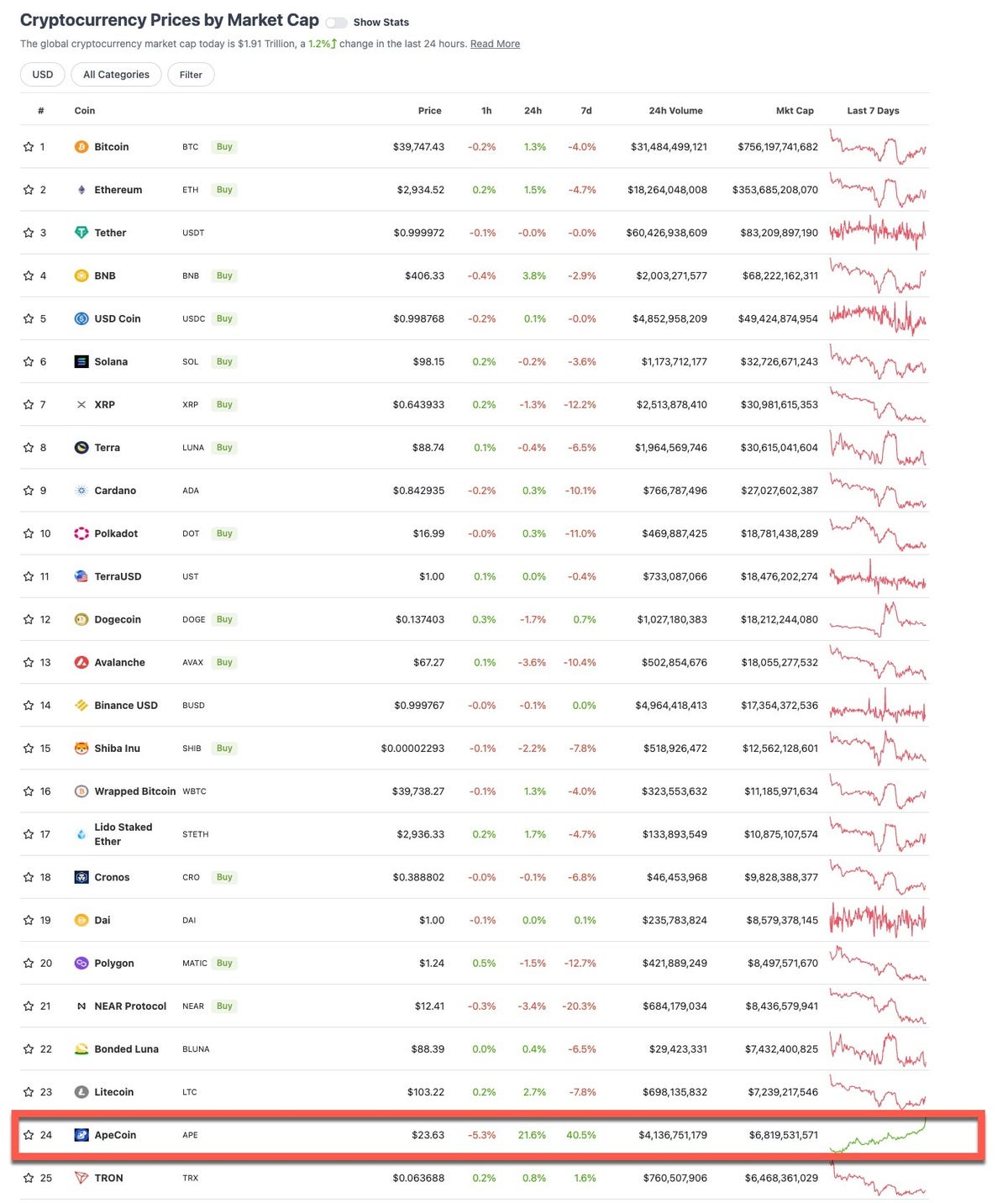

Whereas crypto markets have been within the pink over the week main as much as the Otherside launch, the worth of $APE was going inexperienced in anticipation of BAYC’s metaverse (true to the saying that the grass is all the time greener on the opposite facet). Take into account the market efficiency of the highest 25 cash over that previous week:

Coingecko

On the Thursday earlier than launch, the worth of $APE was $27.44, up 150% since April 18, when rumors first unfold on social media that house owners of NFTs from BAYC and Mutant Ape Yacht Membership (MAYC) collections may get digital land on the Otherside (the worth retreated to $23.68 by 9:00 AM on April 30, 12 hours earlier than the beginning time). These desperate to stake a declare on this new metaverse have realized that it takes extra than simply shopping for ApeCoins to rome about on this magical metaverse…much more.

Additionally: The metaverse is coming, however so are all these safety issues

What you must know earlier than going $APE

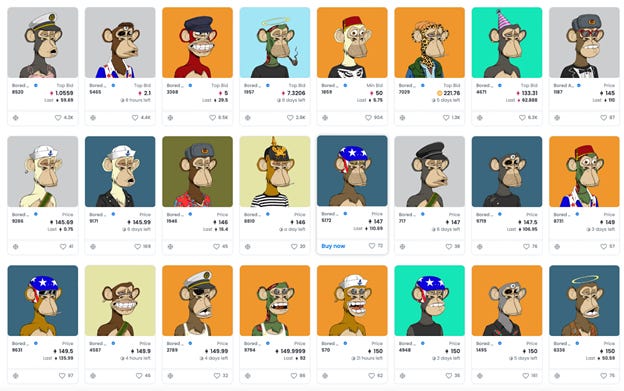

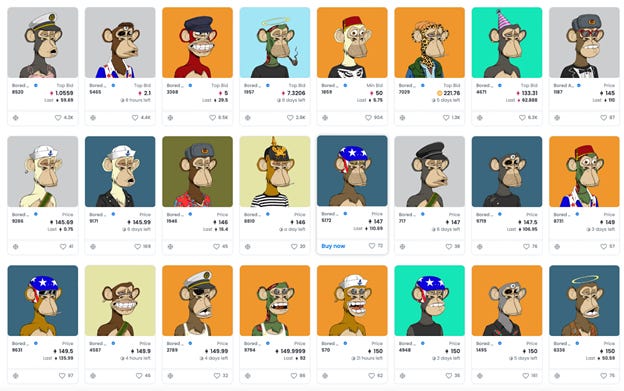

Launched in April 2021, the Bored Ape Yacht Membership is likely one of the hottest — and arguably extremely coveted — NFT collections accessible, consisting of 10,000 distinctive Bored Ape NFTs; distinctive digital collectibles that reside on the Ethereum blockchain. A single Bored Ape, for instance, has a flooring value of 107.8 Ethereum cash, or ETH (roughly $300,500), as of mid-Tuesday, Could 3 (it was 152.4 ETH, or roughly $431,000 hours earlier than opening night time).

Bored Ape Yacht Membership

Over the previous 12 months, the craze (or hype) of Bored Ape has intensified all through the NFT neighborhood as celebrities resembling Colin Kaepernick, Shaquille O’ Neal and Snoop Dogg, and corporations together with Adidas, Google and Samsung, have added a top quality of exclusivity akin to a swanky LA night time membership. And talking of golf equipment, possession of a Bored Ape doubles as a membership card to the Bored Ape Yacht Membership and provides you entry to “members-only advantages”, lots of that are undisclosed however embody entry to a non-public discord server, NFT collectibles which can be airdropped and unique video games. Group power, celeb endorsement and unique utility are the three pillars which have made BAYC one of many strongest crypto cliques within the ether. The one factor lacking is its personal metaverse…till now.

“Investing in Ape Coin could possibly be a diamond within the tough,” says Steven Warren, contributing author and ZDNet‘s Crypto Coach, who’s additionally an avid collector of NFTs. “However remember the fact that it is a speculative asset — with wild value fluctuations — and it is best to make investments solely with cash which you can afford to lose.”

Over the previous couple of months, there appears to have been an acute breakout of FOMO all through the crypto universe amongst these keen to interrupt on by means of to the Otherside, primarily from individuals who missed the April 1 deadline to be cleared beneath KYC. Know Your Buyer, or KYC because it’s identified, is a normal validation course of within the crypto neighborhood used to confirm the identification of a buyer, their threat and monetary profiles. It verifies that you’re who you say you’re. The primary Otherside homesteaders to mint Saturday night time, for instance, have been KYC-cleared. However KYC is one in every of 4 standards required for minting. The opposite three are use of $APE for minting, pockets pre-approval and having Ethereum crypto cash, often known as ETH, accessible for buying “fuel” — the price the community expenses for processing a transaction.

The mint was initially to be within the type of a Dutch public sale, whereby the worth of $APE would drop over time. However earlier than the powers-that-be may tweet a beginning value for the public sale, they decided that Dutch auctions are bull and deserted that strategy in favor of creating Otherdeeds a value of 305 ApeCoins. As well as, given demand from the NFT neighborhood, BAYC allotted extra time for customers to set pre-approval for ApeCoin, which began 12 hours earlier, at 9:00 AM ET Saturday morning.

A lot preparation and thought went into the development of this deal. As an instance, Ape coin holders got a number of tips to stick to for opening day. In accordance with Otherside’s official Twitter web page @OthersideMeta, the rules included the next:

- You should be KYCed. “Solely those that are KYC-approved can mint within the public sale,” as said within the official Twitter thread.

- Along with APE, you will want some Ethereum cash (ETH) “for fuel”. “You may need each within the pockets you used for the KYC.”

- BAYC and MAYC holders will have the ability to declare an NFT for 21 days after the sale. You do not have to be KYC-approved to assert, however you do have to be KYC-approved to mint in Saturday’s sale.

- The quantity of ApeCoin earned from this sale can be locked up for one 12 months. “Which means no voting with it within the ApeCoin DAO both.”

- “On Saturday morning, you’ll pre-approve your KYCed pockets on https://otherside.xyz.” This can enable the good contract to make use of your ApeCoin to mint through the sale. BAYC and MAYC holders need not approve their wallets to assert — solely to mint through the sale.”

- You do not have to pre-approve early — you may approve your pockets after the launch at midday jap time, “however doing it a couple of hours earlier will prevent time and fuel charges.”

To stop the danger of being hacked, Otherside’s official Twitter web page inspired these security suggestions:

- Bulletins can be on the next official Twitter accounts solely: @OthersideMeta, @boredapeyc, @yugalabs and @animocabrands, in addition to on discord at http://discord.gg/bayc and http://discord.gg/the-otherside.

- “Nothing can be introduced or cross-posted anyplace else. NO ONE concerned in Otherside can be posting on Instagram.” There can be no contests or giveaways and no shock/early drops. “Every thing will occur on 4/30, and solely on http://otherside.xyz,” in accordance with the Twitter web page.

- “Do not reply to or click on on something from every other accounts, tags, DMs, or emails. Animoca, Otherside, BAYC, Yuga Labs, founders, and mods won’t tag nor DM you first. By no means share or kind your seed phrase.”

- “Once more, solely belief info posted right here first.”

Opening night time

But as quickly as doorways opened, it was something however a clean, orderly expertise. On Saturday night time, 100,000 Otherdeeds have been made accessible, however solely 55,000 have been accessible for buy to these with KYC-cleared wallets. Inside mere minutes, greater than $200 million in digital land was offered. That sudden blast of buying and selling exercise primarily strained the Ethereum blockchain, leading to outlandish fuel charges of upwards of $5,000 per transaction. In accordance with Yuga Labs, “The size of this mint was so massive that Etherscan crashed.”

Suffice it to say, anxious traders went bananas.

On account of the chaos, phrase on the road (er, discord) amongst customers centered across the frustration of excessive fuel charges. (That is ironic given the truth that not solely is inflation affecting American customers at their native fuel stations, however inflationary fuel costs are being felt on the Otherside.) Reddit customers expressed comparable frustration, some putting blame for Saturday’s crash on Otherside’s contract, which precipitated failed transactions. Others blamed Yuga Labs for lack of successfully using primary fuel optimizations, which may’ve saved customers as much as $80 million in fuel charges.

The chaos prompted Yuga Labs to make the formal apology:

“We’re sorry for turning off the lights on Ethereum for some time. It appears abundantly clear that ApeCoin might want to migrate to its personal chain in an effort to correctly scale. We would prefer to encourage the DAO to begin pondering on this route. We’re conscious that some customers had failed transactions as a result of unimaginable demand being pressured by means of Ethereum’s bottleneck. For these of you impacted, we admire your willingness to construct alongside us – know that we have your again and can be refunding your fuel.”

Regardless of the opening day disruption, the Otherside is up and working, with an up to date map and detailed descriptions of the land.

Otherside

The right way to buy ApeCoin

Coinbase

At $19.17 a coin, you may’t purchase $APE for peanuts, however you may nonetheless purchase it (you simply cannot use it to mint Otherdeeds). “No downside,” says Warren, “you may nonetheless purchase into the Ape metaverse on the secondary market.”

To take action, go to the Otherdeeds web page on OpenSea, the official market for NFTs, which gives the market information you must resolve on making purchases. Simply three days after the launch, the amount buying and selling exercise for Otherdeeds is 196,200 trades.

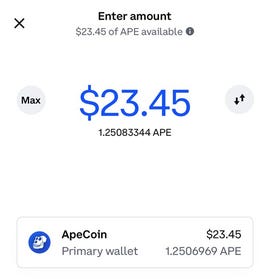

For many who are fascinated about shopping for $APE, you are able to do it in 5 steps. As an instance, we’ll use Crypto Coach Warren’s following instance, wherein he bought ApeCoin utilizing the Coinbase app on his cell phone. Upon logging within the Coinbase App:

- Faucet “Purchase”

- Kind “ApeCoin”

- Enter the quantity you’d prefer to buy ($25, or 1.25 APE)

- Faucet “Preview Purchase”

- Faucet “Purchase Now”

As soon as you’ve got obtained your cash in your account, you have got the choice to both retailer them in a sizzling pockets (on this instance, on-line in a Coinbase pockets) or transfer it to a chilly pockets (a separate, bodily storage machine that is offline the place on-line hackers cannot get to it).

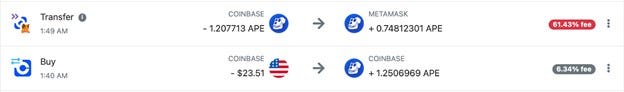

As a result of $APE is an ERC-20 coin — a technical normal that permits interoperability between Ethereum-based cash — it is doable to switch it to a different Ethereum handle for storage. In Warren’s instance, he is capable of take his $APE and switch it to his chilly pockets and retailer the funds. To take action, merely kind “ship” and enter the quantity to ship. Warren says to verify so as to add a bit extra for fuel charges.

The $APE has been saved efficiently within the {hardware} pockets. That is how the transaction appears from a tax perspective:

Coinbase

Gasoline charges do eat right into a portion of the acquisition, as was brutally evident throughout Otherside’s opening night time; that’s the reason it is vital to ship a bigger quantity, or wait till fuel charges are cheaper when shifting funds from Coinbase to your {hardware} pockets, Warren notes. Warren’s instance, is simply that, an instance. In all practicality, no person would ever settle for 61% in fuel charges. “I ate the fuel charges for the publish. In actuality if they’re too excessive it is best to watch for fuel charges to return down,” he says.

Particular thanks to Steven Warren for contributing to this text. You possibly can learn Steven’s Crypto Coach column on ZDNet and his weblog Every thing Crypto.