solarseven/iStock by way of Getty Pictures

Cathie Wooden, CEO of ARK Make investments, expressed her considerations over the worldwide financial system on Tuesday, contending that worrisome knowledge out of China and Europe might level to the early levels of a downturn. The favored fund supervisor acknowledged in her newest month-to-month market webinar: “We expect we might be in a worldwide recession.”

Wooden highlighted considerations across the metrics popping out of China and Europe, arguing that sentiment indicators out of Germany have been “fairly regarding.”

Forward of Wednesday’s CPI print, Wooden additionally shared her ideas across the state of inflation, saying that some progress has been made. “We’re seeing commodity costs beginning to high out on the very least,” she stated.

She added: “We’re seeing different inflation indicators, new and used automotive costs are falling. Used automotive costs falling fairly dramatically over the previous three months… In order that’s enhancing.”

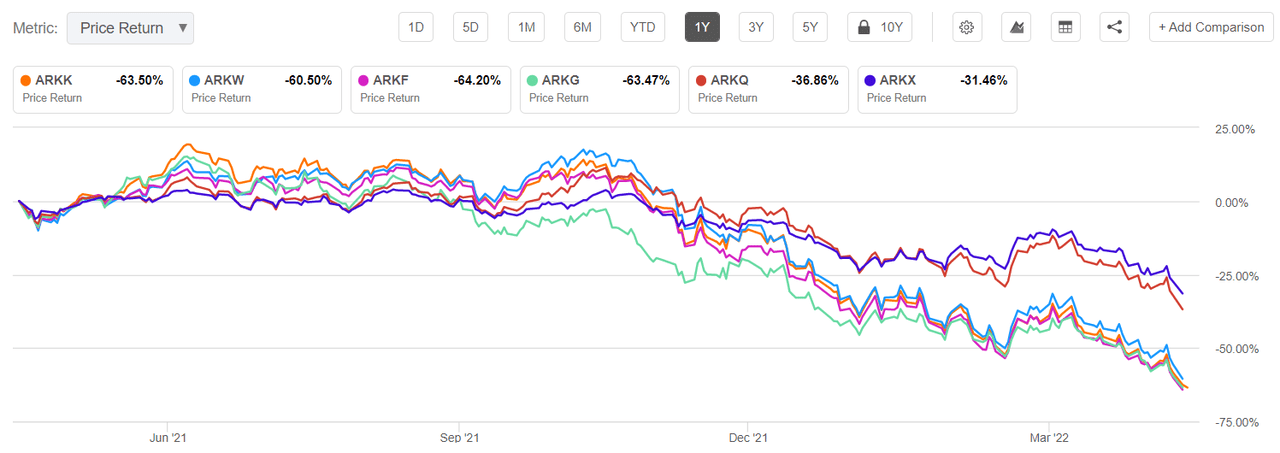

Wooden’s commentary comes as her suite of innovation- and growth-focused funds have suffered large declines in latest months, as considerations about rates of interest, inflation, geopolitical tensions and the state of the financial system have put strain on shares.

12 months-to-date value motion on all six of ARK’s actively managed ETFs: (NYSEARCA:ARKK) -58.2%, (NYSEARCA:ARKW) -56.5%, (ARKF) -58.5%, (BATS:ARKG) -51.7%, (BATS:ARKQ) -35.6%, and (ARKX) -27.2%.

Wooden’s flagship ARK Innovation ETF is down practically 60% YTD, nearly 4 occasions that of the benchmark SPDR S&P 500 Belief ETF (SPY), which is down 15.4% in 2022. Nonetheless, whereas considerably underperforming SPY, ARKK has additionally gathered $1.35B in investor flows YTD, outdoing SPY, which has watched $26.67B exit the door.

Furthermore, see an extended one-year interval chart of how all six trade traded funds fared towards one another.