Shipments of desktop PC CPUs fell by greater than 30 p.c in the course of the first quarter of 2022, in response to Mercury Analysis. That’s the most important drop in desktop CPU gross sales in historical past.

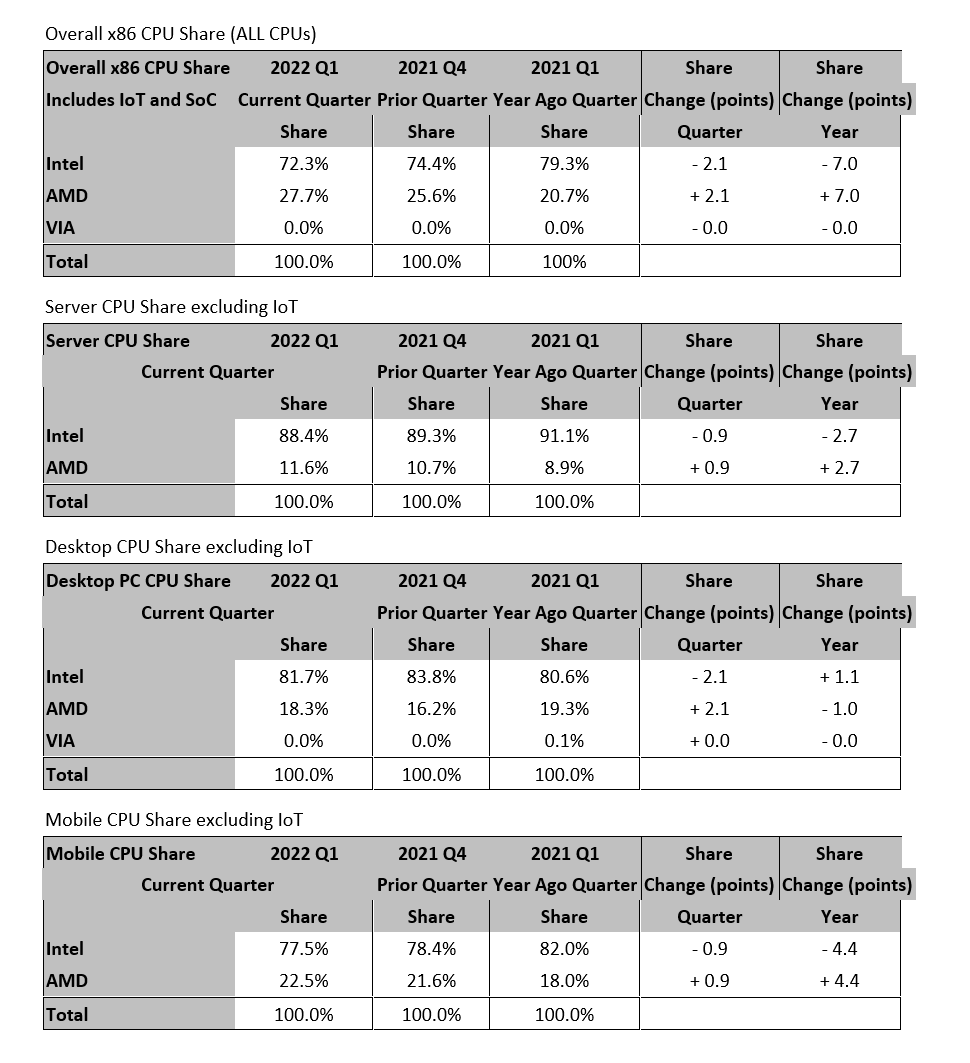

The drop hit Intel far more durable than AMD. AMD’s “all-inclusive” unit share, which incorporates PC CPUs, server CPUs, and the semi-custom processors utilized in gaming consoles, topped 27.7 p.c, a file excessive for the corporate that handily exceeds the file 25.6 p.c share that it recorded final quarter, Mercury added.

Common costs for the mixed pocket book and desktop market additionally set a file at $138, the very best mixed common value ever recorded, Mercury mentioned.

“Each Intel and AMD noticed steep declines in desktop CPU shipments within the first quarter, however AMD’s declined at a decrease fee than Intel’s, leading to AMD gaining desktop share for the quarter,” Mercury’s principal analyst, Dean McCarron, wrote in a observe to shoppers and reporters. “Since a part of the decline within the first quarter was as a result of extra CPU stock, it’s seemingly that Intel was extra impacted by the stock than AMD. Intel’s desktop development remained increased than AMD’s on an on-year foundation, so Intel gained share in comparison with a 12 months in the past in desktop CPUs.”

In cell CPUs, each Intel and AMD noticed declines, however AMD’s declines had been smaller and resulted in share acquire for AMD, McCarron reported.

In an e mail, McCarron mentioned that he believed that the desktop CPU drop was certainly the most important in historical past, although he mentioned that he has tracked market-share knowledge starting in 1993.

“There’s an opportunity there was a much bigger proportion drop in X86 processors in 1984 when the PC market imploded, although actually not in unit phrases because the drop in Q1 2022 items was multiples of the dimensions of the complete marketplace for the 12 months means again then,” McCarron wrote.

AMD lately reported file first-quarter revenues whereas including an extra “Dragon Vary” chip. Intel, for its half, introduced a extra cautious outlook ruled by the uncertainty of COVID lockdowns

ARM CPU gross sales continued to climb, helped by Apple’s M1 Macs. Mercury estimated the ARM PC consumer processor share at 11.3 p.c, up from 10.3 p.c final quarter and virtually double the 5.9 p.c development the section recorded a 12 months in the past.

Mercury Analysis