[ad_1]

Shares of Past Meat Inc. (NASDAQ: BYND) gained 20% on Friday, recovering from the beating it took following the disappointing first quarter 2022 earnings report it delivered earlier this week. The inventory has dropped 53% year-to-date and 71% over the previous 12 months. There’s a bearish sentiment surrounding the inventory and listed here are a number of explanation why:

Income

Past Meat’s income missed expectations and its gross sales progress fee has been slowing down over the previous couple of quarters, elevating issues amongst buyers.

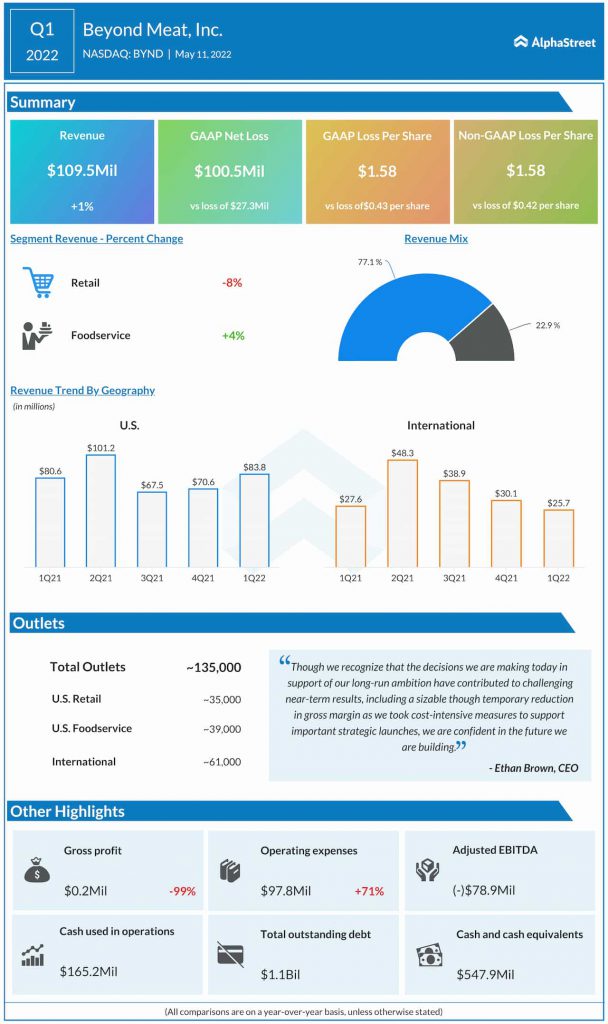

Within the first quarter of 2022, Past Meat’s revenues inched up 1.2% year-over-year to $109.5 million however fell in need of market estimates. Quantity progress of 12.4% was largely offset by a ten% lower in internet income per pound, primarily attributable to elevated commerce reductions, record value reductions within the EU, adjustments in gross sales combine and unfavorable Foreign exchange impacts.

Gross sales additionally declined throughout all segments, barring US Retail which noticed a progress of 6.9%, which in flip helped drive a 4% enhance in whole US internet revenues. The US retail channel income progress was pushed primarily by the launch of a brand new product, Past Meat Jerky, whereas all the opposite merchandise within the class witnessed declines. The 7.5% decline in US foodservice was brought on by the discontinuation of distribution at a sure buyer and better commerce reductions.

Revenues declined throughout the worldwide phase in each retail and foodservice as a result of record value reductions within the EU, elevated commerce reductions, adjustments in gross sales combine and unfavorable Foreign exchange impacts. Past Meat’s gross sales progress has decelerated over the previous few quarters coming right down to 1% in Q1 2022 from 11% within the year-ago interval. For the complete yr of 2022, Past Meat expects internet revenues to extend 21-33% YoY to $560-620 million.

Profitability

The plant-based meals firm has been delivering heavy losses and its margins have additionally taken a success, elevating issues over its progress trajectory. Adjusted internet loss in Q1 widened to $100.5 million, or $1.58 per share, from $26.2 million, or $0.42 per share, within the year-ago interval. The underside line additionally missed analysts’ projections for the quarter. The upper losses have been brought on by elevated investments in advertising and marketing, an increase in non-production headcount ranges, and better SG&A bills.

Gross margin dropped to 0.2% in Q1 from 30.2% within the prior-year quarter, primarily as a result of launch of Past Meat Jerky which includes excessive manufacturing prices. Past Meat expects these prices to considerably reasonable within the latter half of the yr. Margins have been additionally impacted by decreased internet income per pound as a result of increased commerce reductions, adjustments in value and gross sales combine, and better logistics prices. The corporate didn’t present an earnings steerage and this didn’t go down properly with buyers.

Prices

In Q1, Past Meat’s working bills elevated to $97.8 million from $57.4 million within the year-ago interval. Value of products offered elevated $1.15 per pound year-over-year, with Past Meat Jerky accounting for approx. $0.68. Manufacturing prices, together with depreciation, have been up $0.90 per pound with Jerky accounting for approx. $0.36 per pound. Logistics prices elevated $0.32 per pound through the quarter versus final yr. These value will increase have been taking a toll on margins and profitability.

The lagging gross sales, widening losses, declining margins and rising prices have all put Past Meat in a tricky spot. The corporate faces immense strain to rectify these points and provide you with a method to ship sustained income and earnings progress as quickly as potential.

It additionally faces robust competitors within the plant-based meals trade from each its friends in addition to a number of main processed meals corporations which can be venturing into this area with product choices of their very own. Regardless of the present headwinds, the corporate believes its long-term investments will pave the best way for robust progress sooner or later. The Road, nevertheless, prefers to attend and watch.

Click on right here to learn the complete transcript of Past Meat’s Q1 2022 earnings convention name

[ad_2]

Source link