ozgurdonmaz/iStock Unreleased through Getty Photographs

By Brett Friedman

Current developments in cryptocurrencies because the starting of the Ukrainian battle are shocking, to say the least, and should point out whether or not cryptocurrencies are certainly a viable buying and selling and hedging car for the long run, states Brett Friedman of Winhall Threat Analytics.

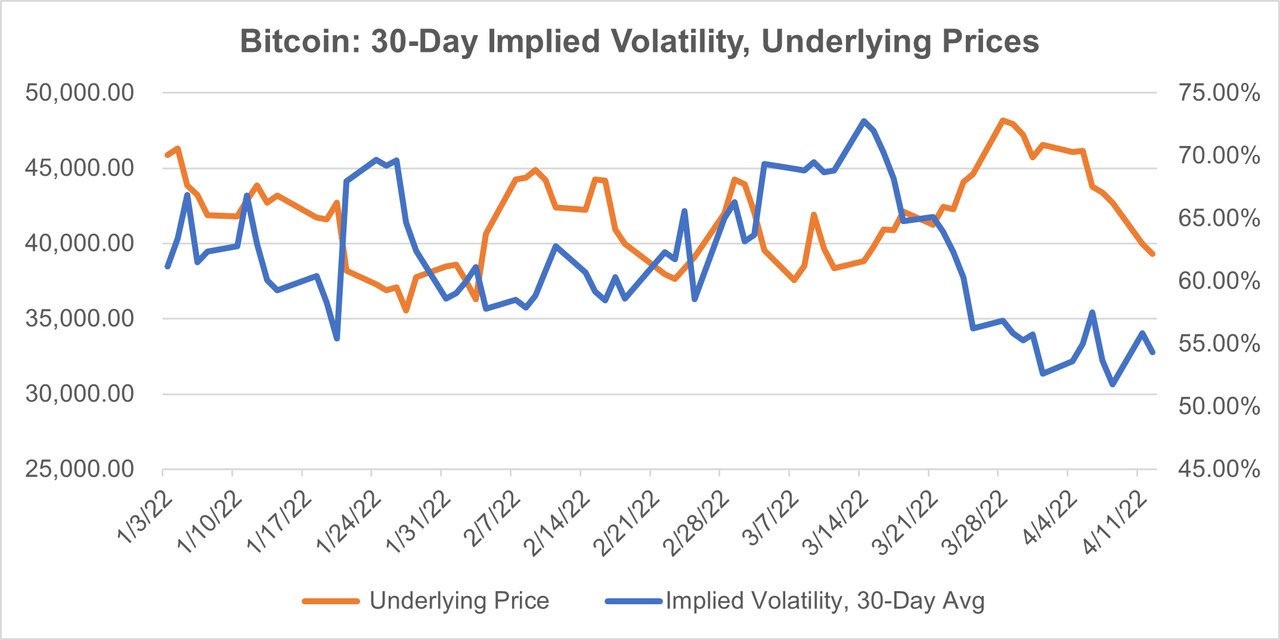

Surprisingly, early indications are that it won’t be. First, a present chart of Bitcoin’s implied volatility and underlying costs (CME futures and choices) because the begin of 2022:

OptionMetrics

When Bitcoin (BTC-USD) and its crypto cousins have been first launched, they have been touted because the libertarian antidote to authorities laws and monitoring, forex devaluation, inflation, battle, and sanctions. All of those components have been magnified by the battle in Ukraine. Inflation has accelerated, the SWIFT system has been weaponized, and sanctions proceed to restrict commerce flows. In brief, the right time for cryptocurrencies and the right setup for a formidable rally.

And but, nearly two months into the battle, cryptocurrency adoption, and worth motion have been unimpressive. Take Bitcoin. To this point this yr, it is averaged roughly $41,750 and has traded principally between $35,000 and $45,000. After rallying in late March to $48,190, it has since settled again all the way down to $39,295 as of April 13. Its implied volatility has adopted an identical development and has declined from a peak of 72.9% in early March to 54.3% presently.

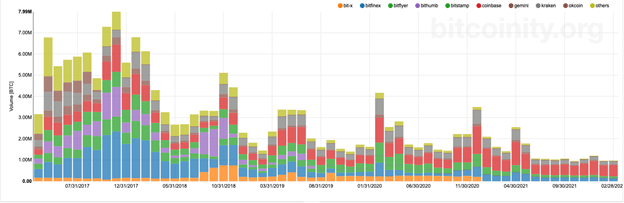

Lastly, and on a longer-term foundation, money Bitcoin quantity has been declining since roughly 2017:

information.bitcoinity.org

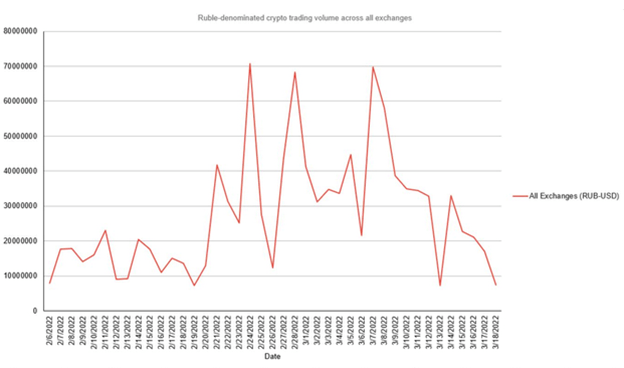

As a aspect be aware, one would have anticipated that the war-related crash within the ruble would have led to extra cryptocurrency utilization amongst Russians and Ukrainians. Unexpectedly, and after spiking early, the ruble-denominated quantity has declined to pre-war ranges:

Bloomberg

In brief, this needs to be Bitcoin’s Golden Age, however clearly, it isn’t behaving as anticipated. That’s, if the unique justifications for cryptocurrencies have been ever true within the first place. Present developments appear to point that they weren’t. A couple of feedback:

- Since crypto has didn’t capitalize from the present surroundings, it means that it might be primarily a distinct segment speculative product, not a hedge in opposition to inflation, corruption, forex devaluation, or sanctions.

- Whether it is certainly a speculative car, then its lackluster efficiency is because of the truth that speculators are merely buying and selling merchandise with higher liquidity and ease of execution. In different phrases, merchants aren’t flocking to purchase crypto as a result of it is simply simpler to commerce different merchandise which have higher potential and during which institutional traders can commerce enough measurement to “transfer the needle.”

- Regardless of the eye that Bitcoin and its crypto cousins get within the press, quantity continues to be comparatively restricted and a fraction of what’s current in additional established markets. Think about the quantity figures beneath for 04/13/2022:

|

Product |

Quantity |

|

E-mini S & P 500* |

1,255,845 |

|

10-Yr T-Be aware* |

1,835,697 |

|

Crude Oil (WTI)* |

863,496 |

|

Japanese Yen* |

132,883 |

|

Gold* |

147,601 |

|

Bitcoin + Bitcoin Mini Futures* |

20,030 |

|

Bitcoin, Money** |

25,114 |

Supply: CME & information.bitcoinity.org

Even accounting for the truth that crypto buying and selling is comprised of extra than simply CME Bitcoin futures and their money equivalents, quantity continues to be comparatively low. For sure, main, high-volume speculators is not going to be attracted by Bitcoin’s low-volume figures.

All of this presents an issue for crypto’s long-term future as a viable, traded asset class. If it isn’t an efficient hedge and can’t appeal to institutional traders on account of comparatively restricted quantity, then cryptocurrencies won’t ever reside as much as their potential.

Initially revealed on MoneyShow.com

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.