[ad_1]

Have you ever ever set your utility invoice to auto-pay? Cut up a dinner invoice by sending your pal money by means of Venmo? Had the IRS drop a pleasant, juicy tax refund straight into your checking account? If that’s the case, you’ve already skilled the advantages of ACH fee.

And also you’re undoubtedly not alone. In reality, 2021 noticed 29.1 billion ACH funds protecting $72.6 trillion of worth, in keeping with knowledge from Nacha. That works out to round 87 transactions for each particular person in America. ACH funds contact our lives in so many ways in which prospects now count on the comfort that they provide. That’s excellent news for you as a result of ACH funds may save what you are promoting cash and scale back the danger of fraud. ACH additionally makes it simple to supply subscriptions and recurring funds– releasing up time for each your prospects and gross sales staff.

What’s ACH fee?

An ACH fee is a sort of digital transaction that transfers cash from financial institution to financial institution.

ACH stands for “Automated Clearing Home”, which is a community that connects all banks inside the USA. This connection permits the switch of cash instantly between banks, with out counting on paper checks, wire transfers, or bank card processing.

The clearinghouse is maintained and ruled by a company known as Nacha (previously NACHA or the Nationwide Automated Clearing Home Affiliation). Nacha additionally units the principles and rules that defend your and your prospects.

Some widespread examples of ACH funds embrace:

- PayPal or Venmo

- Direct deposit payroll

- Direct deposit tax refunds

- Computerized invoice pay

ACH isn’t the one kind of digital fee although, so it may get confused with different fee strategies. Let’s check out a couple of widespread questions you might have.

Is ACH fee the identical as EFT?

EFT, or digital funds switch, is a catch-all time period for any kind of digital fee. An ACH fee is one kind of EFT, however there are numerous different sorts, together with bank cards, ATMs, and wire transfers.

Is ACH fee the identical as wire switch?

Wire transfers and ACH funds are each examples of digital transactions, however they’re not the identical.

The largest distinction is that wire transfers are particular person requests that occur in real-time. ACH transactions are processed in batches at set occasions all through the day. Which means that funds from wire transfers are sometimes obtainable on the identical day, whereas ACH funds could take as much as 3-5 enterprise days to finish.

That top pace comes with a excessive price ticket although. The second greatest distinction is that wire transfers common round $25 per transaction. Evaluate that to the common ACH payment of round $0.29.

The final vital distinction is that ACH funds are reversible, whereas wire transfers are everlasting.

| Wire Switch | ACH Cost | |

| Cadence | Actual-time | Batched |

| Timeline | Identical day | 3-5 bus. days |

| Avg. Price | $25 | $0.29 |

| Reversible? | No | Sure |

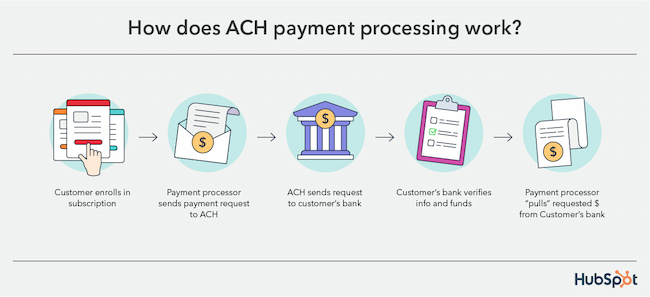

How does ACH fee processing work?

An ACH fee begins once you ship a fee request to your financial institution or fee processor. A number of occasions a day your financial institution will ship all the requests it’s gathered to an ACH operator. The ACH operator forwards your request to the receiving financial institution to confirm it. The 2 banks can now instantly deposit or withdraw the funds in keeping with the request.

Varieties of ACH Cost

There are two sorts of ACH funds: credit score and debit. The distinction between them is by which course the transaction goes.

ACH Credit score – Utilized by a enterprise to “push” cash into one other checking account.

Instance: Direct deposit paychecks.

ACH Debit – Utilized by a enterprise to “pull” cash from a buyer’s checking account.

Instance: Auto invoice pay

A Nearer Take a look at an ACH Cost

To raised perceive how ACH fee processing works, let’s take an instance of an ACH debit.

- Your buyer enrolls in a month-to-month subscription. They provide you their checking account info and fee authorization.

- When fee is due, your fee processor sends a request to the clearinghouse. (In Nacha phrases your processor is the Originating Depository Monetary Establishment or ODFI.)

- The clearinghouse processes that request as a part of a batch of requests after which sends it to your buyer’s financial institution. (Your buyer’s financial institution is the Receiving Depository Monetary Establishment or RDFI.)

- Your buyer’s financial institution receives the request and verifies that your buyer’s info is correct. And that they manage to pay for to cowl the invoice.

- If every thing checks out, your buyer’s financial institution (the RDFI) permits your processor (the ODFI) to “pull” the requested funds.

An ACH credit score works the identical manner, besides that the ODFI “pushes” the cash to the RDFI as a substitute.

How lengthy do ACH funds take?

ACH funds usually take between 3-5 enterprise days to finish. Nacha guidelines name for ACH debits to be processed by the following enterprise day, and ACH credit in 1-2 enterprise days. That stated, the timeline will depend on what time of day your batch was despatched. The receiving financial institution may additionally maintain the funds so long as they’re allowed for safety causes.

Some ACH funds could also be eligible for same-day, next-day, or 2-day processing, however this can bump up the price.

Is ACH fee protected?

In keeping with a examine completed by the Federal Reserve, ACH funds have the bottom price of fraud by worth, averaging solely $0.08 of fraud for each $10,000. That makes ACH safer than bank cards, debit playing cards, and even ATM withdrawals.

That’s as a result of Nacha has strict guidelines and tips for threat administration. These guidelines require all banks or companies concerned to take “commercially affordable” steps to confirm buyer info and defend delicate knowledge.

That stated, “affordable” can imply various things for various companies. It’s vital to guarantee that your fee processor makes use of up-to-date safety measures.

For instance, HubSpot funds ensures all fee credentials are each encrypted and tokenized. By utilizing a number of layers of safety, your prospects can belief that you simply’re protecting their delicate info protected.

How a lot does ACH fee price?

Nacha doesn’t set the charges related to ACH funds, so the price will depend on the financial institution or fee processor you utilize.

Some processors cost a flat payment, which usually ranges from $0.20 to $1.50 per transaction. Others could cost a share of the transaction quantity, and this usually falls between 0.5% to 1.5%.

Third-party processors may additionally cost additional charges upfront or month-to-month to make use of their service, so ensure you’re evaluating all prices when selecting a supplier.

With HubSpot funds, you pay 0.5% of the transaction quantity, with a cap of $10 per transaction. There aren’t any month-to-month charges, setup prices, or hidden expenses, so that you solely ever pay for the service once you want it.

Is ACH fee proper for what you are promoting?

Whether or not ACH is best for you comes right down to the wants of what you are promoting. An organization that depends on month-to-month billing can save some huge cash through the use of ACH as a substitute of bank cards. Alternatively, ACH could not make sense for a retailer with out a variety of repeat prospects.

Listed below are a couple of causes you would possibly use – or not use – ACH funds.

When to Use ACH

- Your enterprise entails recurring funds or subscriptions.Accepting ACH funds means your prospects don’t have to recollect to dig out their wallets each month.

- You’re bored with sending paper invoices. ACH funds are dealt with solely on-line. In reality, HubSpot funds lets you settle for fee straight from your individual web site. Or create safe, shareable fee hyperlinks that your prospects can entry by telephone, electronic mail, and even on-line chat.

- It’s good to save on bank card charges. Bank card processing charges typically run 2-3% or extra.

- Your prospects’ funds are getting declined. ACH funds come instantly out of your prospects’ financial institution accounts. This implies fewer rejected funds than bank cards, which may expire or get misplaced or stolen.

- Your prospects’ safety is a high precedence. ACH funds expertise much less fraud than some other fee processing technique.

When to Not Use ACH

- You might have a variety of worldwide prospects. Though ACH will nonetheless work nice for purchasers within the U.S. or U.S. territories.

- Your prospects must make high-dollar funds.Though Nacha has raised the per-transaction restrict to $100,000, your financial institution or fee processor could impose their very own limits.

- You’ll be able to’t wait 3-5 enterprise days for fee. ACH funds are slower than bank card processing or wire switch.

The way to Settle for ACH Cost

If you wish to begin accepting ACH funds usually, you’ll need to work with a third-party fee processor. Whilst you can deal with ACH transactions by means of your financial institution, they seemingly gained’t give you a safe technique of accumulating your prospects’ account info.

Gross sales Hub customers can join ACH transactions in minutes, and usually begin accepting funds inside 1-2 enterprise days.

And HubSpot funds integrates instantly along with your CRM, so your prospects could make safe funds straight by means of your web site, electronic mail, or on-line chat. Or put safe, shareable hyperlinks proper into your quotes.

Leveraging ACH Funds for Your Enterprise

In fact, selecting ACH funds isn’t an either-or resolution. Many fee processors, together with HubSpot, assist you to settle for ACH and bank cards from the identical software. Providing your prospects a number of fee choices makes it simpler for them to make a purchase order. And which means more cash in your financial institution.

[ad_2]

Source link