[ad_1]

by David Stockman on Worldwide Man:

Not too long ago, it was reported that US industrial manufacturing rose in April for a fourth consecutive month, and owing to a bounce in auto assemblies was up 1.1% from March and 6.4% versus prior yr. So the same old suspects have been out beating the Wall Avenue tom-toms about financial power and no recession on the horizon.

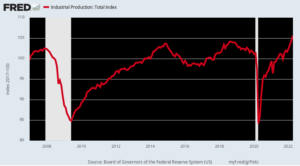

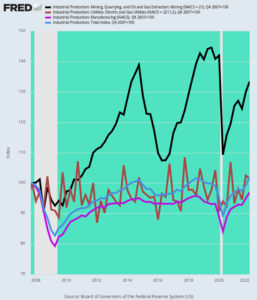

However as demonstrated within the chart beneath, what we’re primarily getting as soon as extra is born-again manufacturing, not web progress. That’s, take away the April 2020 Lockdown swoon and scroll again to the interim excessive in December 2014 and what do you get?

Nicely, what you get is a piddling 0.26% every year progress price over the previous 7.5 years. And for need of doubt, dial again to the pre-crisis peak in November 2007 and also you get a every year progress price of simply 0.21% over the previous 14.5 years.

US Industrial Manufacturing Index, November 2007-April 2022

So, no, the US industrial financial system isn’t robust—it’s been flatlining for the higher half of the present century. And that’s one thing new underneath the solar, not in a great way.

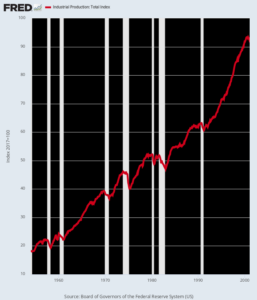

Previous to the flip of the century, in reality, industrial manufacturing was the muscular heart of the US financial system. Between January 1954 and January 2001, whole output grew by 3.52% every year, and that determine is compounded over a 47-year interval that skilled seven non permanent recessionary setbacks.

Nonetheless, industrial manufacturing through the interval grew almost 17 instances quicker every year than it has since November 2007. We’d say that’s nothing wanting a shocker and calls for way more severe consideration than do some latest month-to-month deltas from a synthetic backside.

US Industrial Manufacturing Index, 1954-2001

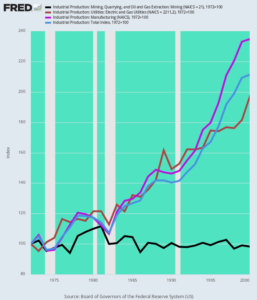

Once you look at the composition of the historic industrial manufacturing information, the reason for the drastic downshift in progress is strikingly evident. The constituent information return to 1972, however through the subsequent 28-years the manufacturing sector clearly led the commercial progress parade.

Per Annum Progress, 1972-2000

- Mining and Vitality: -0.06%;

- Gasoline and Electrical Utilities: +2.45%;

- Manufacturing: +3.10%;

- Complete Industrial Manufacturing: +2.71%

As is obvious above, the one laggard was mining and power, primarily owing to the fading of the home fuel and oil trade that might not compete with the low-cost producers within the Persian Gulf, North Sea, West Africa and different newly developed power provinces.

Nonetheless, when it got here to utility and manufacturing output, progress was strong. The latter remained fairly aggressive in world markets, whereas the expansion of home trade and family counts generated regular growth of fuel and electrical utility manufacturing.

For sure, the manufacturing and utility sectors are capital intensive turbines of excessive labor productiveness progress and financial value-added. Sturdy progress on the industrial heart of the financial system, in flip, unfold prosperity to the providers periphery and lifted actual dwelling requirements and sustainable nationwide wealth.

Industrial Manufacturing Index And Its Constituents, 1972-2000

For the reason that pre-crisis peak in 2007, nonetheless, the commercial manufacturing image has turned the other way up. The one contributor to industrial manufacturing progress since November 2007, in reality, is the mining and power sector, which boomed on the again of the shale revolution and the provision of low-cost funding capital from the speculative precincts of Wall Avenue.

Per Annum Progress Fee, This fall 2007 to Q1 2022

- Mining and Vitality: +2.04%;

- Gasoline and Electrical Utilities: +0.10%;

- Manufacturing: -0.21%;

- Complete Industrial Manufacturing: +0.14%

That’s proper. The every year progress price of business manufacturing (blue line) plunged by 95% over the last 14 years in comparison with the 1972-2000 common as a result of manufacturing output (purple line) turned detrimental and fuel and electrical utility (brown line) progress slowed to a crawl.

With respect to the latter, the abrupt slowdown within the price of inhabitants progress and family formation was a big contributor to the disappearance of significant utility output progress. Thus, throughout 1972-2001, the expansion price of family formation was 1.68% every year, which price slowed by 53% to only 0.79% every year since 2007.

Nonetheless, the actual perpetrator in pushing utility output progress to the flat-line was the whole stagnation of producing manufacturing.

By Q1 2022, the index for manufacturing output was truly 3% decrease than it had been in This fall 2007. And if you toss in power effectivity enhancements within the interim, self-evidently the underside dropped out of demand for utility provides from the manufacturing sector.

Industrial Manufacturing Index And Its Constituents,This fall 2007-Q1 2022

The query recurs, subsequently, as to why manufacturing output progress plunged from +3.10% every year over 1972-2001 to -0.10% for the reason that pre-crisis peak in late 2007.

The reply, in fact, is globalization—the off-shoring of huge quantities of the US manufacturing sector to a budget labor value venues of China, Mexico and their world provide chains. That course of developed a head of steam within the mid-Nineties, when China went all-out constructing export factories and their supporting infrastructure.

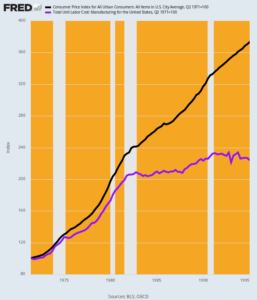

The consequence, in fact, was the best labor value arbitrage in historical past. Between 1995, when China’s exports to the US started to increase, and April 2022, US nominal hourly wages in manufacturing rose by 103% (brown line, proper axis). So doing, they steadily widened the greenback value hole with China, thereby intensifying incentives for US distributors to off-shore manufacturing or sourcing.

On the identical time, nonetheless, US staff who managed to retain their jobs gained solely 6% in inflation-adjusted wages (purple line, left axis) over the identical 27 years interval.

That’s to say, the Fed’s silly 2.00% inflation focusing on insurance policies generated the worst of all attainable worlds: Whereas crushing home employee paychecks with ever increased inflation, it despatched hundreds of thousands of excellent paying manufacturing jobs overseas. The related utility progress profit of sturdy manufacturing output features, in flip, additionally migrated to China, in contrast to the spillover to home utilities, as was the case earlier than 2000.

Indexes of Common Nominal and Actual Hourly Earnings, 1995-2022

The breathtaking magnitude of the Fed’s silly inflation focusing on coverage is obvious when the identical info are considered from the lens of a sound cash regime on the free market. To wit, a dollar-linked to gold would have prompted a curtailment of financial institution lending and credit score progress with a view to stem the US present account deficits.

In flip, restrictive credit score and demand progress would have prompted a gradual home deflation of wages, costs and prices in response to tighter home monetary circumstances. The choice would have been an enormous drain on reserve belongings (gold).

Because it occurred, nonetheless, the Keynesian Fed jettisoned the requisites of sound cash, which had operated efficiently over lengthy stretches of historic prosperity, in favor of financial autarky, The latter is the silly perception that it might stimulate the home bathtub of GDP to the brim with out dislocating the huge flows of US merchandise commerce, capital and funds with the remainder of the world.

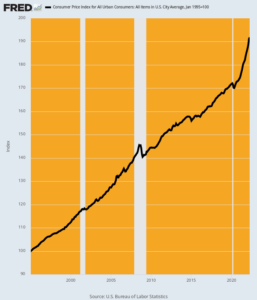

The consequence was that through the 27 yr span proven beneath, the US worth degree as measured by the CPI rose by 92%, when underneath a regime of sound cash it will elevated by 0.0%, or truly fallen considerably.

The labor and manufacturing off-shoring triggered by the Fed fostered inflation proven beneath, is what introduced industrial manufacturing progress to a halt, most particularly after the Eccles Constructing went full retard with the printing presses in 2008 and past.

CPI Listed To January 1995

For sure, when Mr. Deng pronounced within the early Nineties that “to be wealthy is wonderful”, a US coverage of home deflation was desperately wanted owing to the inflationary follies of the Seventies and past. In any case, these shiny new export factories, bedecked with cutting-edge tools and know-how, could be manned by draining a close to limitless provide of ultra-cheap labor from China’s huge rice paddies.

On this context, it wants be recalled that between mid-1971, when Nixon shit-canned a sound gold-backed greenback through the notorious Camp David weekend, and January 1995, the home worth degree (black line) rose by a staggering 273%. That clearly levitated your entire home value construction together with wages, utilities, transportation and all different downstream actions.

There was not a snowball’s probability within the scorching place that productiveness enhancements might even remotely sustain with these hovering value pressures. Accordingly, unit labor prices rose by 124% throughout the identical interval.

And that’s what sunk US manufacturing. That’s what despatched items manufacturing and their utility inputs scurrying to China, Mexico and numerous different low labor-cost venues.

CPI And Unit Labor Prices, 1971-1995

The query thus recurs. If all that cash printing throughout latest many years didn’t enhance industrial progress however truly resulted in its off-shoring, pray inform what did it accomplish?

In a phrase, it prompted an enormous, capricious redistribution of wealth from savers to debtors and speculators. And in that there is no such thing as a financial advantage as a result of the majority of society didn’t acquire, whereas the better-off and extra aggressive discovered that the simple solution to wealth is debt and playing.

Within the case of the savers, the info leaves nothing to the creativeness. Utilizing a $100,000 financial savings account at common nationwide charges, the chart beneath makes evident that in almost the whole lot of this century up to now, savers have been underwater: Throughout 17 of the final 20 years, the meager charges proven within the black bars beneath have been lower than the speed (blue dashes) wanted simply to maintain up with inflation.

So are you able to say, wealth confiscation?

That’s what it quantities to as a result of on the free market rates of interest on financial savings accounts would by no means run beneath the inflation charges for almost 20 years constantly. And most particularly, the circumstances extant in 2022 could be thought of a laughingstock.

As proven beneath, to maintain up with inflation at current you would wish to earn$6,436 in curiosity yearly on that $100,000 financial savings account, whereas the precise price at present on provide quantities to $80 every year in curiosity.

Sure, that’s confiscation on steroids. However right here’s the factor: The Fed didn’t truly begin letting short-term rates of interest off the zero sure till a run price of $6,356 in stolen funds from savers had materialized; and it intends to take it candy time over quarters and years getting again to its 2.00% goal.

In the mean time, in fact, trillions extra could have been stolen from essential avenue savers by a central financial institution that’s within the financial central planning enterprise, not the superintendence of sound cash.

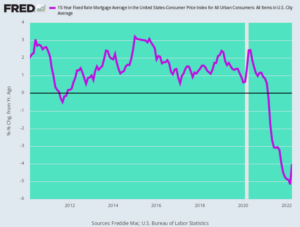

In contrast, mortgage debtors have been on simple avenue. Since 2010 the inflation adjusted fastened price on a 15-year mortgage has oscillated between simply 1-2% and by March 2022 when the Fed lastly lifted rates of interest, it stood at a daft -5.2%.

In a phrase, till Powell & Co might see the headlights of the inflationary freight prepare barreling down the tracks straight towards the Eccles Constructing, they have been fortunately confiscating from savers to the tune of 6.3% with a view to pleasure mortgage debtors with a 5.2% subsidy

For the lifetime of us, we don’t see any Congressional mandate, nor canon of financial logic and justice that might justify such capricious redistribution.

Inflation-Adjusted 15-12 months Mortgage Fee, 2010-2022

Certainly, the one factor it has achieved within the housing sector is one other dwelling worth bubble. However that the 2020-2021 Covid-Lockdowns introduced financial calamity to tens of hundreds of thousands of US households and small companies, dwelling costs shot the moon owing to the Fed’s ridiculously low charges, enforced alongside your entire yield curve by its manic $120 billion per thirty days of bond-buying.

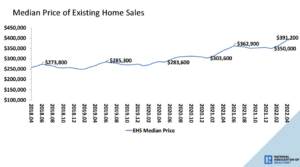

Consequently, the median current dwelling worth soared from an already frisky $285,300 in mid-2019 to $391,200 at current, representing a 37% acquire.

So extra caprice: Present householders have been tickled pink, whereas first-time patrons and trade-up patrons had their noses pressed onerous upon the glass.

After all, Housing Bubble 2.0 is about able to hit the skids. Again in January 2021, the 30–yr mortgage price was 2.65% and common new dwelling worth (excluding current items) was $401,700. In contrast, at present the 30–yr mortgage price is 5.30% and common new dwelling worth is $523,900.

Should you assume a 20% down cost, subsequently, the month-to-month mortgage cost will rise by 80%, growing from $1,294 to $2,327. Accordingly, already the amount of housing transaction is weakening, which means that one other spherical of crashing dwelling costs is simply across the nook—particularly because the Fed is compelled to tighten excess of now assumed with a view to get the inflation genie again within the bottle.

In a phrase, what the Fed gaveth, it’s fixing to take again. So what was the purpose of the cheap-mortgage fueled housing bubble?

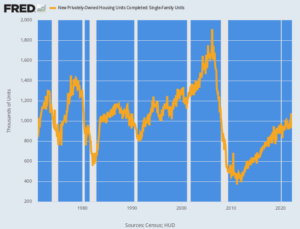

It actually didn’t create a corresponding increase in new dwelling development. As we discovered this week, new single household completions in April posted at 1.001 million. That’s 40% beneath the 2005 peak, and really beneath the 1.028 million degree posted manner again in April 1971.

That’s to say, housing completions at the moment are on the degree first attained 51 years in the past—an interval during which the variety of households has risen from 83 million to 130 million. And now dwelling development is fixing to keel over once more because the Fed’s belated price normalization coverage kicks into excessive gear.

New Single Household Residence Completion, 1971-2022

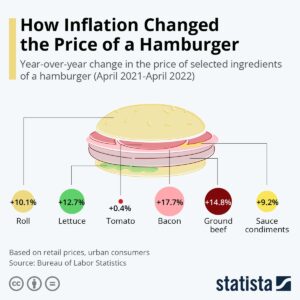

After all, each Wall Avenue and far of Washington are already singing from the “Inflation has Peaked” hymn guide, however that’s belied by the truth that shelter, meals and power costs are nonetheless rising strongly.

So what the politicians hypocritically name “kitchen desk” speak when pretending to empathize with their constituents, may higher described as “who mugged the hamburger”?

That’s what the Fed’s huge cash printing has truly achieved over the past a number of many years.

To wit, no boon to industrial progress, no wealth features for almost all of Individuals accompanied by a perverse redistribution to the highest and no features in housing development—one of many essential causes for financial stimulus in instances lengthy gone.

Assist Assist Unbiased Media, Please Donate or Subscribe:

Trending:

Views:

19

[ad_2]

Source link