[ad_1]

There’s a number of uncertainty surrounding the economic system, actual property market, and the function of inflation within the financial surroundings.

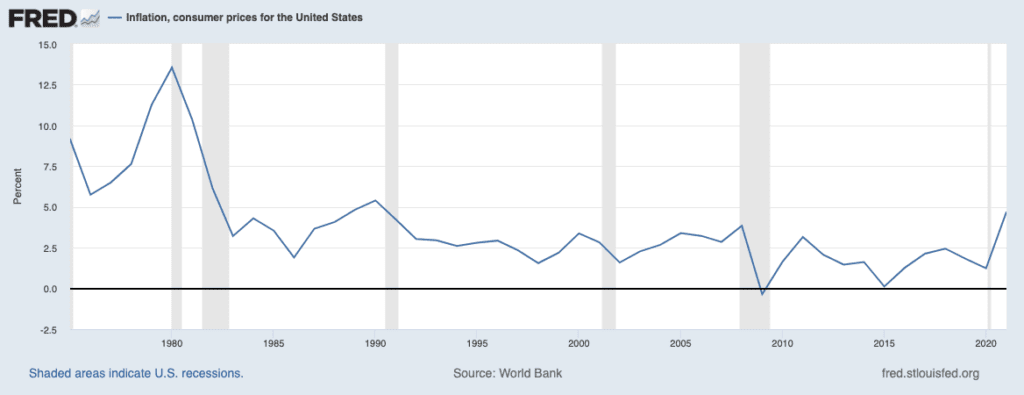

With regards to inflation, it’s necessary to determine how we received right here. By right here, I imply on the verge of an financial downturn with close to report excessive inflation.

The Cyclical Nature of the Economic system

Our economic system is cyclical. It goes up. It goes down. And repeats. Should you’re conversant in historic financial cycles in the US, it must be no shock that after a nine-year bull run, issues have been poised to peak again in 2019 and 2020. That nine-year run was traditionally lengthy and, in some ways, pushed by the truth that inflation was low for many of the decade.

Sometimes, a cycle leads to a downturn after financial progress results in inflation, triggering the Federal Reserve to lift rates of interest. An increase in rates of interest makes it extra expensive to borrow and extra helpful to save lots of, so individuals cease spending, begin saving, and the economic system slows down, which alleviates inflation.

However we weren’t seeing a lot inflation, so rates of interest stayed comparatively regular for a lot of the last decade, and issues saved chugging alongside. Who is aware of for the way lengthy they could have saved going. Then the pandemic occurred.

The economic system got here to a screeching halt, and it appeared like we have been on the verge of an financial melancholy. So the Fed stepped in once more.

The Fed controls rates of interest and the cash provide. They use these two issues to govern the economic system in an try and keep away from massive swings or catastrophic occasions. At the least that’s the purpose.

Sadly, in relation to avoiding financial danger, the Fed traditionally over-corrects. They transfer an excessive amount of or too shortly. That’s precisely what occurred right here. COVID-19 brought about panic over what might develop into an financial disaster, and the Fed reacted by over-correcting.

They lowered charges excessively and shortly, launched a bunch of latest cash into the system, loosened banking laws, and extra.

These actions stimulated financial progress, which led to inflation, which drove the fed to lift rates of interest, which is now (seemingly) main us into the downturn.

A recession at this level ought to shock no person. I’m stunned we didn’t see it sooner. However once more, we weren’t seeing big inflation ranges previous to final yr, so the cycle received stretched out.

Why is Inflation as Excessive as It’s Now?

We got here dangerously near a extreme financial disaster in 2008. Again then, the Fed additionally launched a bunch of latest cash into the system and lowered rates of interest, however we didn’t see sky-high inflation.

What’s the distinction between then and now? Why was inflation at 2% for a lot of the last decade after the Nice Recession and now at 8% a yr after this newest spherical of rate of interest drops and cash printing?

Inflation is all about provide and demand, so there are actually two sides to inflation. The provision aspect—when provide is low, costs go up. And the demand aspect—when demand is excessive, costs go up.

This time round, we’re seeing inflationary stress from either side. On the provision aspect, because of international shutdowns, many small companies going bankrupt, uncooked materials and transportation pipelines getting despatched right into a tailspin, and a bunch of different issues, provide chains have been a worldwide mess for 2 years now.

You is perhaps trying round and saying that the pandemic is over and issues are again to regular, so there shouldn’t be any extra provide chain points. However, the U.S. is a really consumer-centric nation, not a producer-centric nation. We import stuff. We don’t produce stuff.

It doesn’t matter what you see while you look across the nation relating to shutdowns and companies working. What issues is what you see in these nations the place we get most of our merchandise. There are nonetheless lockdowns, conflict, and political unrest in these nations.

Transport logistics are the wrong way up, power costs are within the sky, chip manufacturing is slowed, there are international labor shortages, and whereas we don’t speak a lot in regards to the commerce conflict anymore, that 20-year-old battle continues to be a problem.

Lengthy story brief, provide continues to be constrained, which can naturally drive costs up.

The even larger situation is on the demand aspect, although. The place’s the demand coming from? It’s coming from individuals, firms, and establishments spending the $9T that was created during the last a number of years.

Why is Inflation Greater Now Than It Was After the Nice Recession?

In 2008, the Fed and the Treasury infused a number of liquidity/cash into the economic system. However they did it not directly. They principally gave it to the banks, permitting them to open up their lending to companies and customers. That allowed all the additional cash to trickle into the economic system slowly.

This time round, after the pandemic started, we did issues in a different way. As a substitute of placing cash into the banking system and permitting it to trickle into the economic system over time, the Fed determined that they wanted to get the cash on the market way more shortly.

The Fed pumped a number of that $9T into equities straight, firms by PPP loans, and sending checks to all People.

Injecting straight into the economic system’s bloodstream was efficient for its meant function. Individuals had direct entry to money and didn’t need to work by banks. However, the aftershock is what we’re coping with now. Off the rails inflation, making day-to-day life for the common American an increasing number of tough.

Lengthy story brief, the injection of money straight into the economic system served its function. It successfully stimulated every thing to the purpose that there was no financial collapse. However, as typical, the Fed overcorrected, didn’t let off the gasoline quickly sufficient, and right here we’re.

In fact, there’s a answer, nevertheless it’s not fairly. We should manually contract the economic system by elevating rates of interest, which has already begun. You’ll be able to learn extra about that right here.

Put together for a market shift

Modify your investing techniques—not solely to outlive an financial downturn, however to additionally thrive! Take any recession in stride and by no means be intimidated by a market shift once more with Recession-Proof Actual Property Investing.

[ad_2]

Source link