Luke Chan/E+ by way of Getty Pictures

Shares of social media firm Snap Inc. (NYSE:SNAP) have revalued decrease in 2022 as a consequence of common market weak point and rising dangers of a recession. Nevertheless, Snap is making progress in its enterprise: The corporate is rising day by day energetic customers and revenues quickly and is now free money stream worthwhile. Moreover, a robust income forecast has been submitted by the corporate for the second quarter and I anticipate Snap to develop its free money stream margin going ahead!

Key Metrics Present Enterprise Power

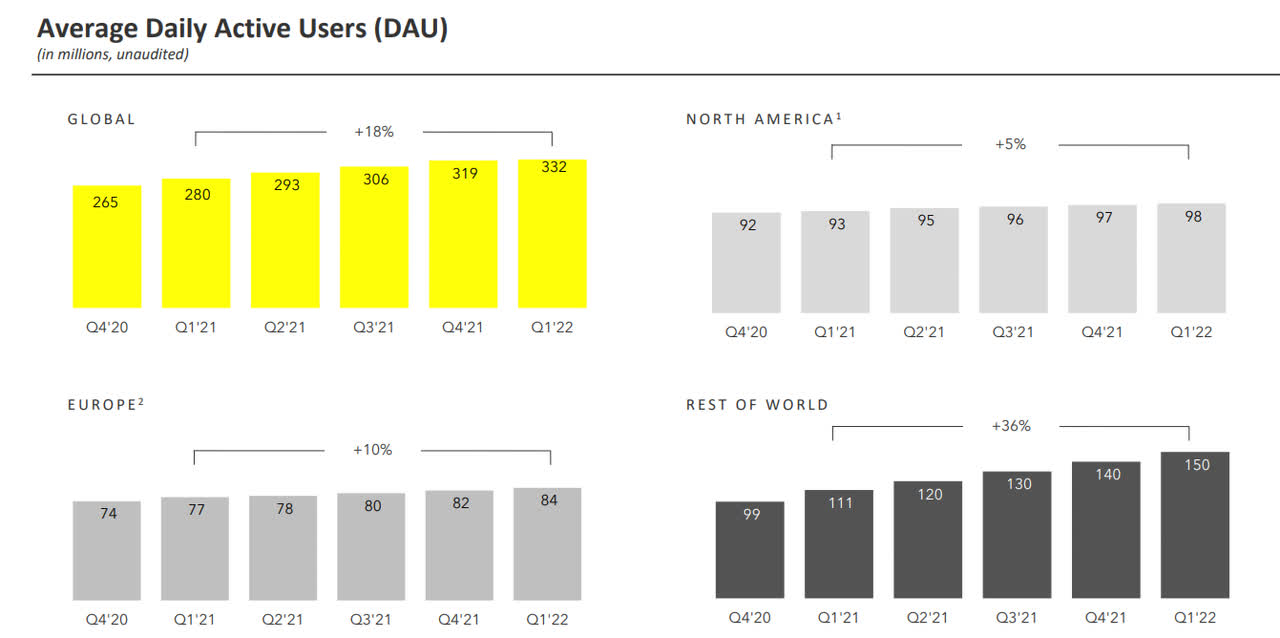

Snap noticed continuous energy on its platform within the first quarter. In Snap’s Q1’22 earnings card, the social media firm revealed that its common day by day energetic customers — an important key metric for platform companies — surged to 332M, displaying a rise of 18% yr over yr. Snap added 52M common day by day energetic customers during the last twelve months and in addition added 13M common day by day energetic customers simply within the final quarter, with 10M of these customers coming from markets exterior North America and Europe. Common day by day energetic person development in North America and Europe stored moderating in Q1’22, implying that almost all of person and engagement development will come from areas exterior of those two saturated markets going ahead.

Snap

Snap is increasing its content material providing and growing its companion ecosystem to develop engagement. In keeping with the social media firm, 250 million Snap chatters engaged with Snap’s augmented actuality on daily basis on common in Q1’22. Augmented actuality merchandise are a approach for Snap to have interaction particularly youthful customers which make up the core viewers for the platform: the vast majority of customers are between 13 and 24 years of age. The usage of Augmented Actuality helps corporations promoting merchandise on the Snap platform enhance conversions and decrease the speed of transport returns.

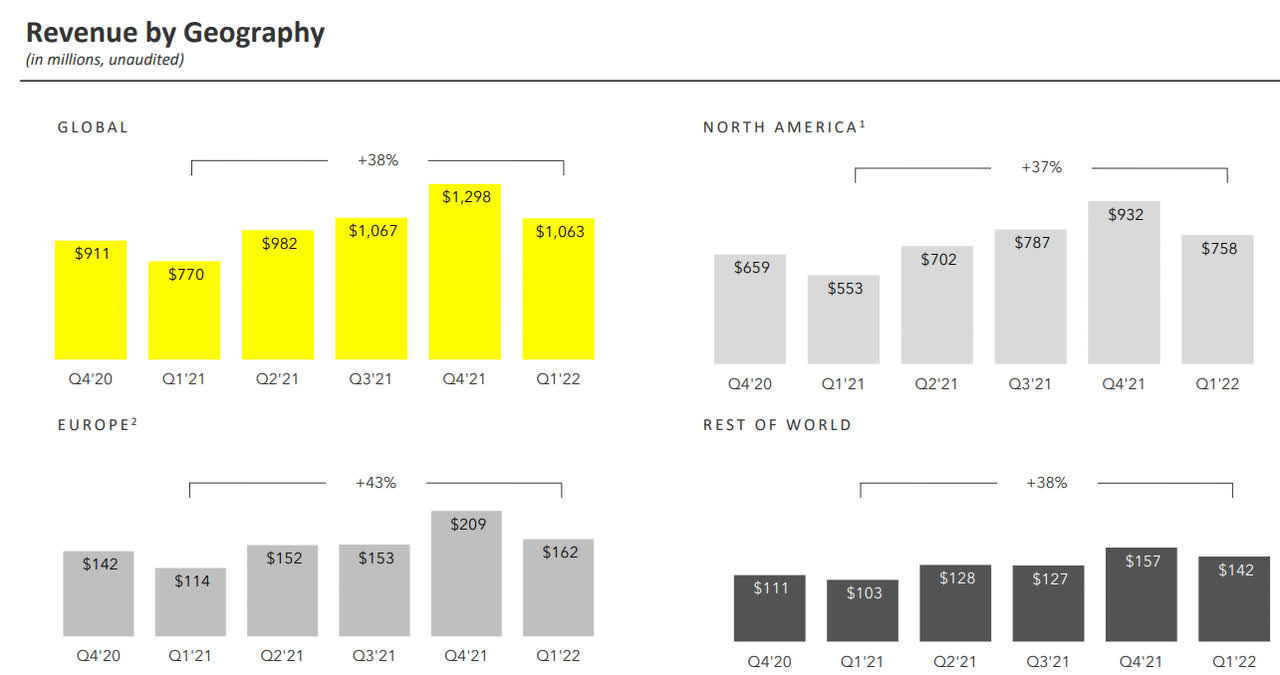

Snap’s revenues for Q1’22 surged 38% yr over yr to $1.06B with high line development most pronounced in Europe at 43% yr over yr. Nevertheless, Snap’s income efficiency was robust all through the world, together with North America and the remainder of the world.

Snap

Sturdy Outlook For Q2 2022

Snap sees income development of 20-25% yr over yr for Q2’22, which places Snap anticipated revenues into a spread of $1.18B to $1.23B. Momentum in income development signifies that advertisers proceed to see Snap as a robust promoting platform.

Common Income Per Consumer

Snap’s common income per person/ARPU — the second most necessary metric after day by day energetic customers for social media corporations — noticed a deceleration in Q1’22 with development slowing from 36% within the year-earlier interval to 17% within the first quarter. Coming off a robust fourth quarter relating to advert spending, the primary quarter sometimes sees weaker efficiency metrics.

Common income per person development has been moderating in all of Snap’s geographies during the last yr, however ARPU development was nonetheless removed from being weak at 17% in Q1’22. North America continues to be probably the most profitable marketplace for Snap as advertisers pay excessive advert charges to advertise their services on the platform.

|

SNAP |

Q1’21 |

Q2’21 |

Q3’21 |

This fall’21 |

Q1’22 |

|

ARPU |

$2.74 |

$3.35 |

$3.49 |

$4.06 |

$3.20 |

|

Progress YoY |

36% |

76% |

28% |

18% |

17% |

|

North America |

$5.94 |

$7.37 |

$8.20 |

$9.58 |

$7.77 |

|

Progress YoY |

66% |

116% |

49% |

33% |

31% |

|

Europe |

$1.48 |

$1.95 |

$1.92 |

$2.54 |

$1.93 |

|

Progress YoY |

36% |

76% |

34% |

33% |

30% |

|

ROW |

$0.93 |

$1.07 |

$0.98 |

$1.12 |

$0.95 |

|

Progress YoY |

(7)% |

20% |

3% |

1% |

2% |

(Supply: Creator)

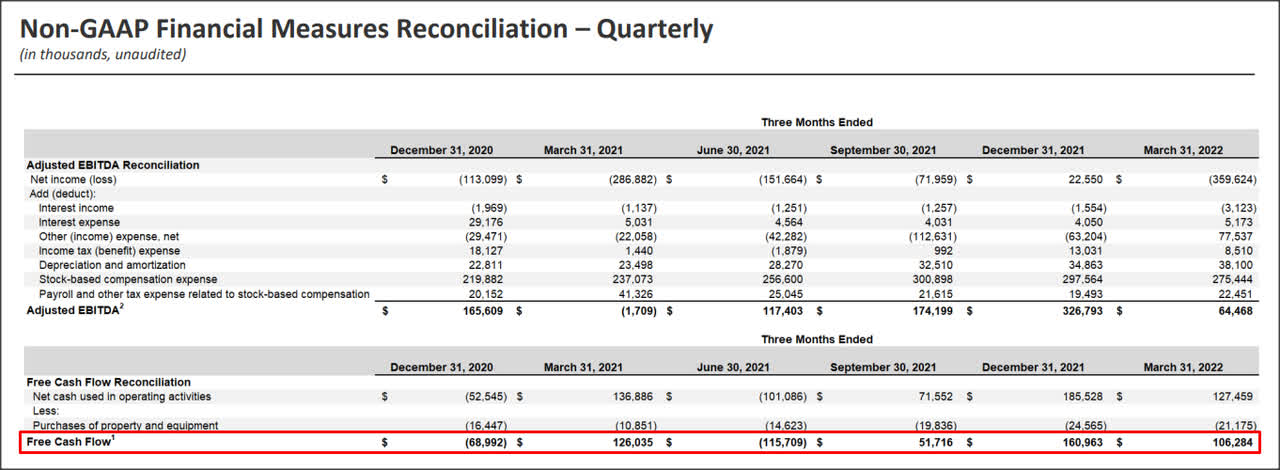

Free Money Circulation Is Constructive

Regardless of declines in common income per person development, Snap as soon as once more delivered constructive free money stream. Snap’s free money stream in Q1’22 was $106.3M and the agency reported three consecutive quarters of constructive FCF. Free money stream on a last-twelve-months foundation was $203.3M which calculates to a free money stream margin of 4.6%. Since Snap’s free money stream is ramping up, I anticipate FCF margins to enhance going ahead as Snap’s Augmented Actuality merchandise proceed to see rising advertiser adoption.

Snap

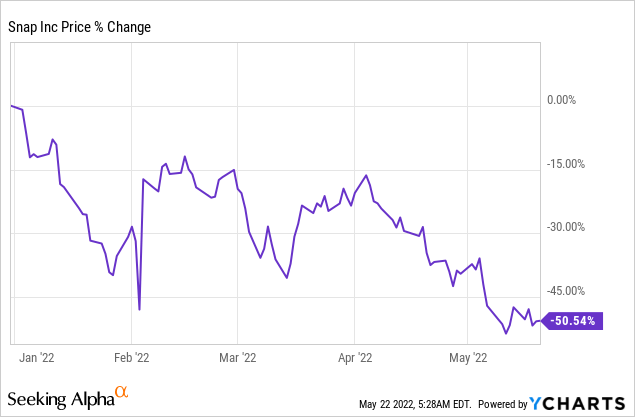

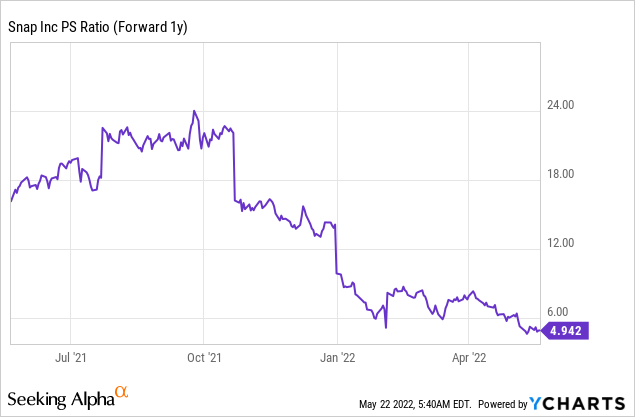

Snap’s Progress Is Discounted Once more

Snap has fallen again right into a down-trend in 2022 which creates a possibility to purchase the social media firm’s shares at a reduced valuation in comparison with its historical past. Based mostly off of FY 2023 anticipated revenues, shares of Snap have a gross sales multiplier issue of 4.9 X and revenues are anticipated to develop at the very least 33% in every of the following three years.

|

SNAP |

FY 2022 |

FY 2023 |

FY 2024 |

|

Gross sales |

$5.47B |

$7.70B |

$10.48B |

|

YoY Progress |

32.9% |

40.8% |

36.1% |

|

P-S Ratio |

6.96 X |

4.94 X |

3.63 X |

(Supply: Creator)

Traditionally, Snap has achieved a a lot larger valuation primarily based off of revenues.

Dangers With Snap

Clearly, a deterioration within the development outlook and cuts to promoting budgets signify massive industrial dangers for Snap’s platform enterprise in addition to the inventory. A decline in day by day energetic customers and weakening ARPU developments additionally pose dangers for the social media platform.

Remaining Ideas

Shares of Snap have proven weak point once more these days, which is basically the results of a deteriorating development outlook for the worldwide financial system. Nevertheless, Snap is seeing robust development in three of its most necessary key metrics – day by day energetic customers, revenues, ARPU — and the agency is now a free money stream constructive enterprise with potential to develop its FCF margins. I consider the chance profile at this level continues to be closely skewed upwards and shares of Snap are a purchase!