Michael Vi/iStock Editorial through Getty Photos

Thesis

Veeva (NYSE:VEEV) is likely one of the larger high quality SaaS firms out there, with a novel mixture of benefits that make it tough to exchange in a tech-focused portfolio. Veeva’s valuation has been considerably rerated currently, so now is an effective time to purchase shares after a strong earnings report.

Veeva’s Benefits

Usually, I am an advocate of the “purchase what you realize” technique. I do not know a lot about healthcare and I’ve by no means used Veeva’s software program, so usually that will imply I would not wish to personal it. Nonetheless, I do know SaaS, and in terms of SaaS firms, Veeva appears like an awesome firm from a number of angles.

The primary angle is market share. Though Veeva has a number of merchandise, one in all its largest is buyer relationship administration software program, much like what Salesforce (CRM) and HubSpot (HUBS) supply. Veeva estimates that it has 80% market share of CRM in its goal market of life science firms. 81% of recent medicine permitted have been launched with Veeva CRM, which is an unbelievable quantity that for my part represents a digital monopoly.

As a result of healthcare is a fancy and extremely regulated trade, its wants – particularly because it pertains to regulatory compliance – are completely different from generic CRM. Due to the info and expertise obtained from Veeva’s market management and first mover benefit, no firm has a greater understanding of these wants than they do. This offers Veeva a large moat, which is bolstered by Salesforce – the general trade chief – having a standing 15-year partnership with Veeva that basically quantities to a noncompete settlement.

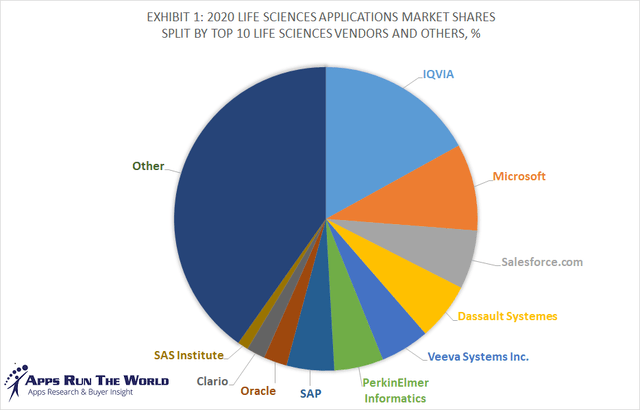

Apps Run The World

Whereas dominant market share is usually a combined bag as a result of it might restrict alternatives for future progress, that in all probability will not be the case with Veeva. As proven above, Veeva has a comparatively small share of the general life sciences software program market, which incorporates extra than simply CRM. This offers the corporate loads of room to increase into extra choices.

That brings us to the second favorable angle, which is diversification of income. Though life sciences looks like a small and concentrated market, Veeva has over 1,000 prospects and their prime 10 prospects accounted for an affordable 31% of income. Veeva has already expanded meaningfully past CRM and affords over a dozen merchandise by its business cloud, vault, and consulting segments, most of that are meant to assist life sciences firms carry medicine to market in a protected and compliant method. In line with Morningstar, the common Veeva buyer subscribes to 2.5-4 merchandise. So, traders haven’t got to fret an excessive amount of about Veeva being impacted by a slowdown in a single product or buyer.

The third favorable angle is the Rule of 40. This measure of a SaaS firm’s skill to steadiness progress and profitability – i.e. its high quality – places Veeva within the prime 15% of all SaaS firms I cowl. They at the moment rating 48 at the same time as they expertise a few of their slowest progress ever. The opposite shares that rating over 40 are principally newer firms that do not do as nicely in terms of diversification of income and dominant market share. Those that do – like Microsoft (MSFT), Adobe (ADBE), Synopsys (SNPS), and VeriSign (VRSN) – are all mature firms that in all probability haven’t got as a lot progress potential as Veeva and/or do not promote to industries which might be as defensive as healthcare.

Contemplating all of those factors – along with different bonuses like Veeva being founder led and my portfolio being underexposed to healthcare – I discovered it tough to cross on this firm regardless that I’ve by no means used their software program or identified anybody who did.

VEEV Q1 Earnings

Veeva lately launched Q1 earnings, which have been sturdy sufficient for shares to rebound barely, however they’re nonetheless 47% off their highs. The earnings revealed a 2% income beat, 7% EPS beat, and barely raised steerage, that are all respectable however not earth-shattering. It is about what I might count on from a gradual performer like Veeva.

The truth that shares have been up double digits the day after these outcomes may point out that traders obtained too pessimistic about Veeva, as the corporate continues to carry out steadily with none main unfavorable developments in its story.

One level that I discovered notably encouraging is that Veeva is constant to rent aggressively, which means that they don’t seem to be anticipating demand to weaken regardless of the tough macro setting. Maybe that is a bonus of promoting to the defensive healthcare sector.

Veeva is at the moment guiding for 18% income progress and a really respectable 38% non-GAAP working margin in 2022. Whereas I want to see GAAP steerage, Veeva’s present GAAP working margin above 25% signifies that I am not too anxious about this firm being extremely worthwhile.

Valuation

In search of Alpha

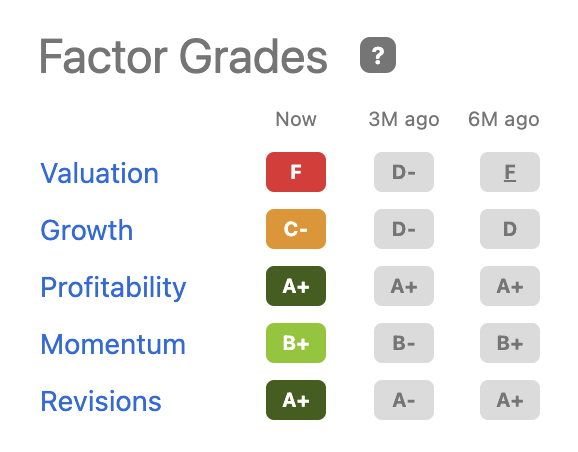

As with many prime quality blue chip kind firms, Veeva does nicely on most of In search of Alpha’s issue grades however will get a decrease rating for progress and valuation. After all, with a monopoly in one in all its main merchandise, Veeva’s progress can be slower than some friends’. However double digit progress continues to be meaningfully above the market common and sufficient to generate alpha contemplating that it comes alongside sturdy pricing energy and A+ profitability.

The most important threat with Veeva – and the most important sticking level for a lot of traders – is valuation.

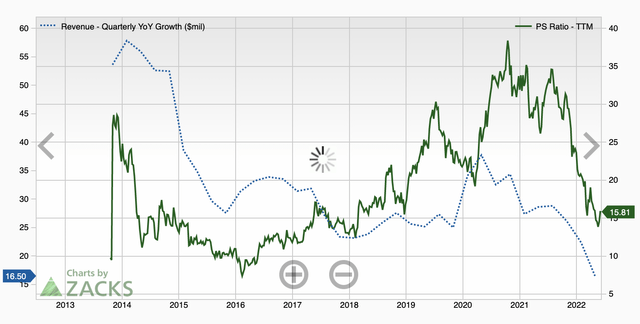

Zacks

Thankfully, as proven within the chart above, Veeva’s P/S has come down considerably after almost reaching 40 in 2020. At almost 16 P/S at this time, it is easy to see why Veeva will get an F for valuation, however that is concerning the common P/S ratio for Veeva because it went public in 2013.

Sadly, the opposite side to contemplate is slowing progress. Because the dotted blue line reveals, Veeva’s income progress has slowed from almost 60% after its IPO to only 17% at this time. Progress needs to be thought-about closely in a valuation mannequin, so considerably slower progress signifies that a decrease P/S a number of is warranted.

Due to sturdy profitability, Veeva has a PEG ratio a bit above 2 even with its excessive P/S a number of and slowing progress. That is nonetheless excessive, nevertheless it’s about common amongst prime quality healthcare shares in at this time’s market.

At present, I’ve a $191 worth goal on Veeva as a result of I consider that will be a good worth that will enable shares to double within the coming decade. That is based mostly on comparatively conservative assumptions of 16% income CAGR within the coming decade, terminal revenue margins of 28%, a terminal P/E of 25, and no dividends or buybacks. My worth goal is extra conservative than the common analyst goal of $224 and Morningstar’s goal of $275. That is possible as a result of I do not account for a discount in shares excellent, principally as a result of I have never seen proof of it but; Veeva is actually worthwhile sufficient to begin returning some money to shareholders by buybacks and that might result in additional upside.

Conclusion

Though Veeva at the moment trades close to my worth goal, I nonetheless suppose it is a purchase at this time for traders searching for a inventory with Veeva’s distinctive attributes. The healthcare sector is prone to maintain up higher than most throughout tough financial instances, and Veeva is a top quality firm with no main questions surrounding its management, moat, market place, or progress potential. You are in all probability not going to see stellar returns from Veeva, however from the present worth I do not count on main draw back threat both. Though Veeva continues to be a younger firm, I already view it as a blue chip, and most traders ought to make house of their portfolios for prime quality shares like Veeva.