shapecharge/E+ through Getty Photographs

AeroClean Applied sciences, Inc. (NASDAQ:AERC) reviews an enormous goal market, and expects double digit gross sales development within the close to future. The FDA categorized the corporate’s expertise Pūrgo as a Class II Medical Gadget, which generated vital inventory demand. The inventory value lately elevated from lower than $2 to greater than $15. With that every one being mentioned, I consider that the corporate is overvalued as market individuals are too optimistic about future money flows. I devised a easy DCF mannequin and obtained a inventory valuation that’s considerably decrease than the present market value. Lastly, there’s a consumer focus danger, and the worldwide logistics and provide chain bottlenecks might decrease future manufacturing.

AeroClean: Large Goal Market, However Additionally Some Dangers

AeroClean presents inside house air purification expertise to battle dangerous airborne pathogens within the medical business, faculties, faculties, elevators, and different goal markets.

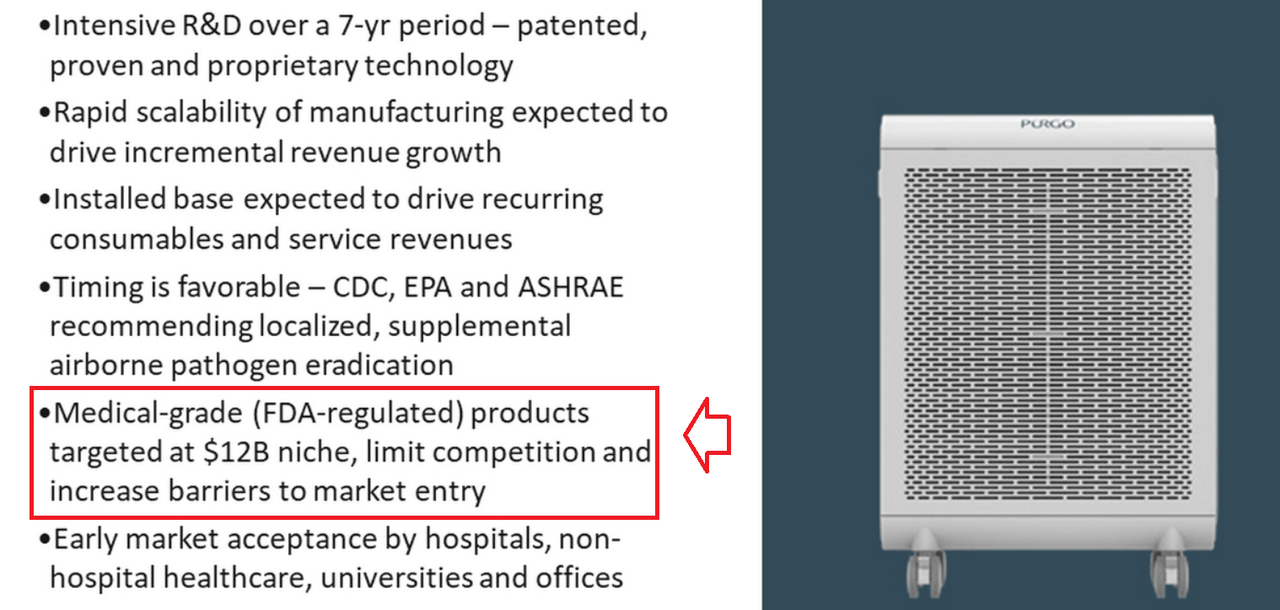

The corporate claims intensive analysis and improvement for a interval of greater than 7 years and an enormous goal market. Needless to say solely the medical grade units goal a distinct segment of $12 billion.

Investor Presentation

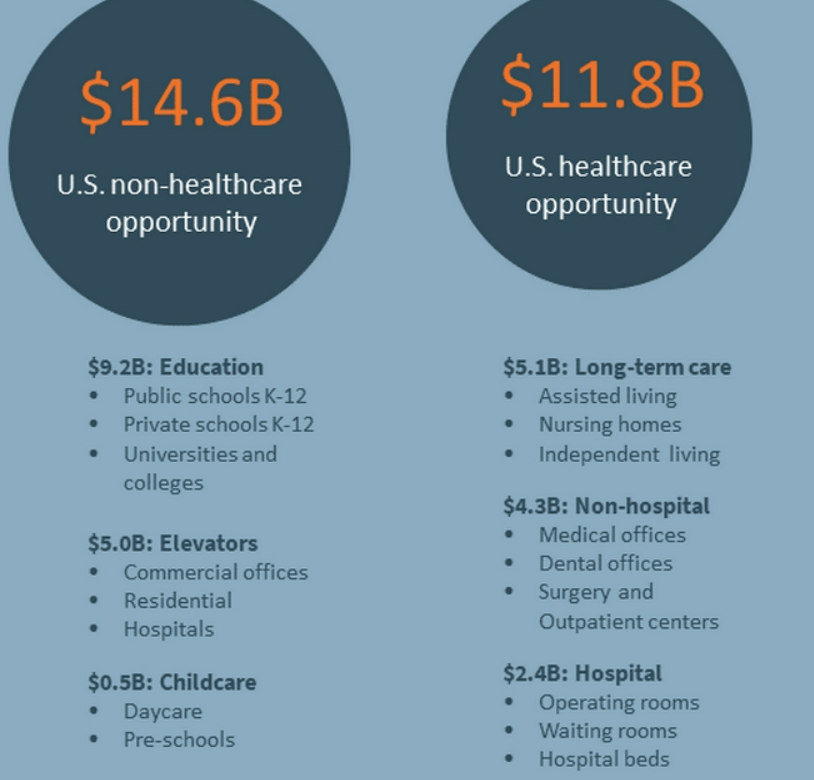

The non-healthcare alternative contains elevators, childcare, and training, which sums as much as $14.6 billion in gross sales. Contemplating that AeroClean makes lower than $100 million in income, there may be vital room for enchancment when it comes to income development. The goal market is massive.

Investor Presentation

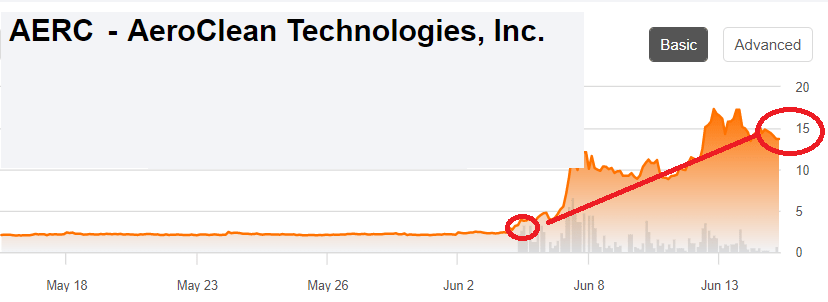

I’m proper now speaking about AeroClean as a result of very lately administration introduced that the FDA had formally categorized AeroClean’s Pūrgo expertise as a Class II Medical Gadget. Many merchants purchased shares, and there seems to be a big demand for the inventory. The inventory value spiked up from round $2 to greater than $15.

AeroClean Applied sciences introduced that the U.S. Meals and Drug Administration has granted AeroClean’s Pūrgo expertise 510k clearance, classifying it as a Class II Medical Gadget. Supply: AeroClean Receives FDA Clearance For Pūrgo Medical Grade Air Hygiene Know-how – AeroClean

SA

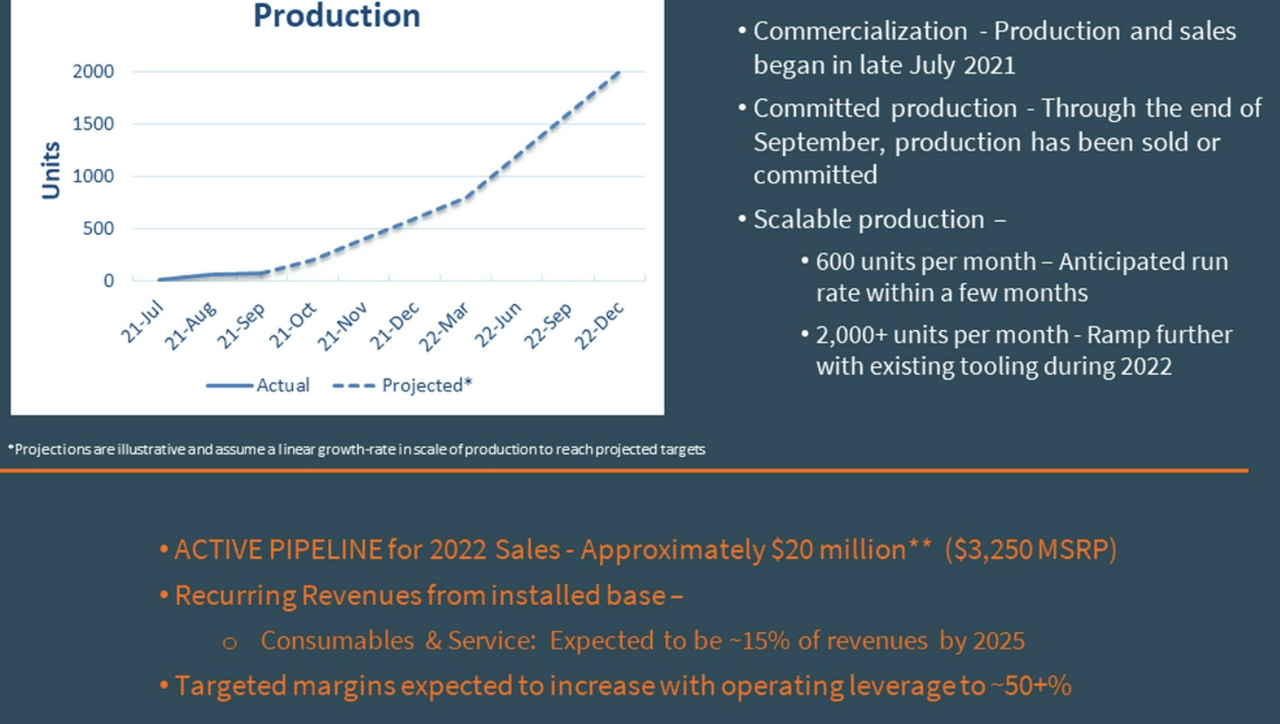

Additionally it is value contemplating that AeroClean expects vital enhance in manufacturing in 2022. Administration believes that gross sales development might stand at near $20 million.

Investor Presentation

With that concerning the goal market and the expectations for 2022, I might stay very cautious about this identify for a number of causes. Within the final quarterly report, AeroClean reported logistics and provide chain bottlenecks and shortages, which can create points in future manufacturing and manufacturing.

Whereas we’re being negatively impacted by the continued international logistics and provide chain bottlenecks and shortages that we highlighted in our fourth quarter 2021 earnings launch, our mission has been bolstered by quite a few initiatives and vital funding for governmental efforts to enhance indoor air high quality on the federal and state ranges and inside numerous regulatory our bodies. Supply: AeroClean Reviews First Quarter 2022 Monetary Outcomes – AeroClean

For my part, essentially the most severe issue is that AeroClean expects shortages to have an effect on future manufacturing. I ponder whether AeroClean might decrease its steering for the complete yr 2022. In that case, I consider that the inventory value might decline.

The continued shortages impacted the flexibility to fabricate items in the course of the first quarter, the weekly and month-to-month manufacturing run charges we anticipated to realize in the course of the first quarter and can possible impression the run charges we anticipated to realize for the rest of this fiscal yr. Supply: AeroClean Reviews First Quarter 2022 Monetary Outcomes – AeroClean

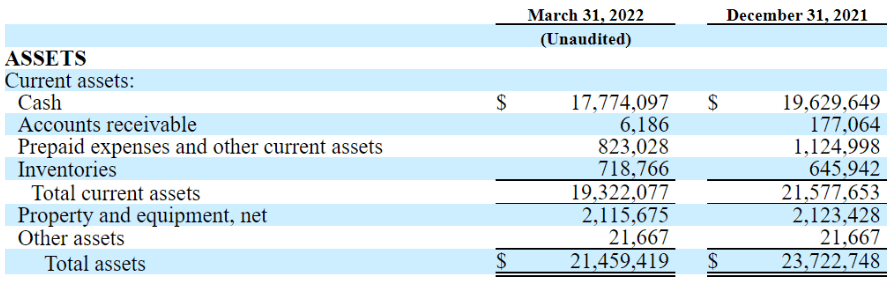

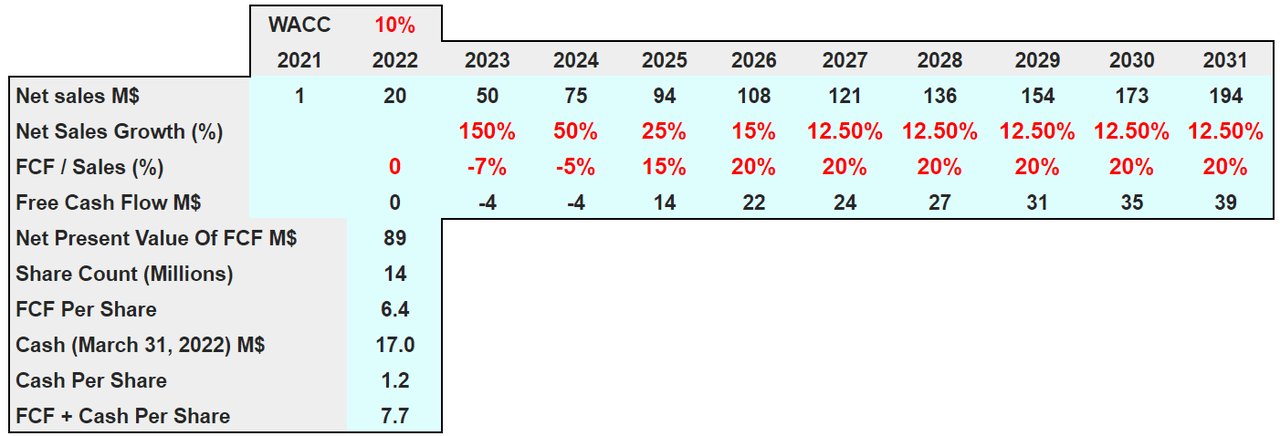

With $21 Million In Whole Belongings, AeroClean Seems Overvalued

With $17 million in money, $21 million in complete belongings, and $1.6 million in complete liabilities, AeroClean’s monetary scenario is wholesome. With that, I can not actually clarify how AeroClean might have a market capitalization of greater than $99 million in June 2022.

First Quarter 2022 Monetary Outcomes

I wouldn’t be fearful concerning the firm’s complete quantity of liabilities and long-term debt. As of March 31, 2022, AeroClean doesn’t appear to report debt. The biggest legal responsibility is accounts payable, which is value $0.4 million.

First Quarter 2022 Monetary Outcomes

AeroClean’s DCF Mannequin Implies Vital Draw back Danger

The worldwide UV disinfection tools market is predicted to develop at a CAGR of 12.5% from 2019 to 2026. AeroClean is kind of small, and already reveals vital gross sales development, so I consider that the corporate will develop at a bigger tempo than the marketplace for a while:

The market was estimated at USD 2.5 Billion in 2019 and is predicted to succeed in USD 5.9 Billion by 2026. The worldwide UV Disinfection Tools Market is predicted to develop at a compound annual development charge of 12.5% from 2019 to 2026. Supply: At 12% CAGR, World UV Disinfection Tools Market

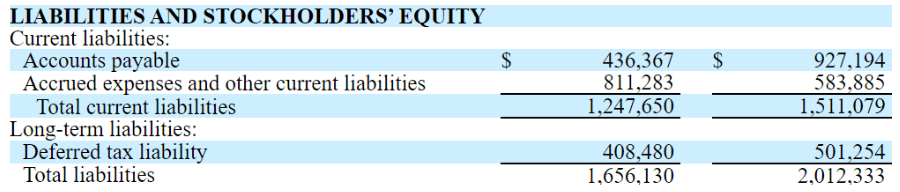

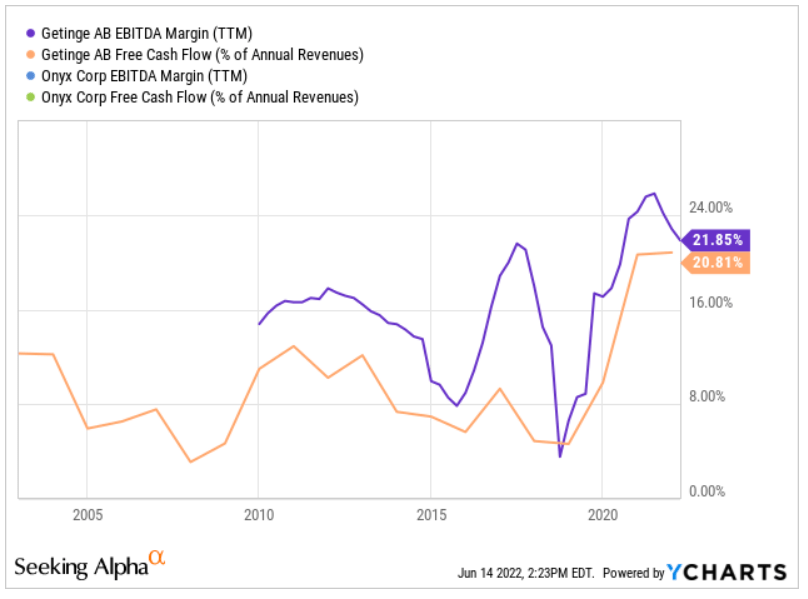

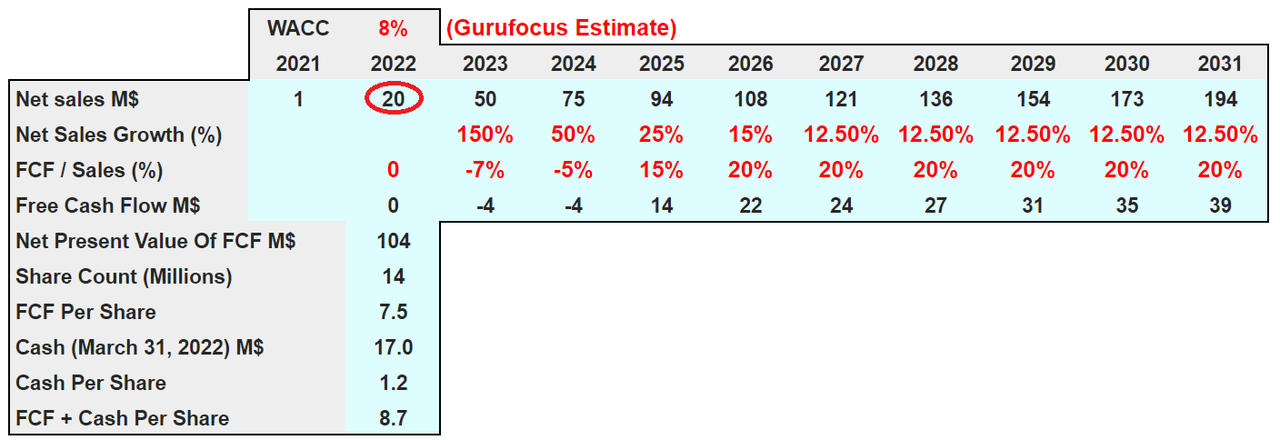

I included the assumptions of administration of $20 million in 2022 income and 12.5% gross sales development from 2027 to 2031. Opponents report free money movement margin shut to twenty%, so I used this determine in my mannequin.

YCharts

In a mannequin that features a low cost of 10% and a free money movement margin shut to twenty%, the web current worth of free money movement stands at $89 million. If we additionally add money value $17 million and the present share depend, the overall sum stands at $7.7 per share.

Arie Funding Administration

I attempted to be a bit extra optimistic, however I couldn’t receive the present market value. With a reduction of 8%, which is utilized by different monetary advisors, the free money movement and the money per share stand at $8.7. In June 2022, the inventory value exceeded $14 per share. I consider that AeroClean seems fairly overvalued.

Arie Funding Administration

Dangers: Decrease Income Progress Than Anticipated And Focus Of Purchasers

AeroClean can not assure that the Pūrgo gadget will report vital gross sales development. If clients do not acknowledge the necessity for AeroClean’s applied sciences, income development could also be decrease than anticipated. Beneath the worst-case situation, I consider that low gross sales development would push the inventory value down:

In 2021, we generated gross sales of roughly $0.6 million of the Pūrgo gadget and, whereas we intend to advertise gross sales of this product throughout 2022 and past, we can not assure that we’ll reach these efforts. As well as, we will not be profitable in growing or buying further merchandise. Any failure to broaden gross sales of our Pūrgo gadget, or any failure to acquire market acceptance of our product, would have a fabric opposed impact on our monetary situation, outcomes of operations and enterprise. Supply: 10-k

AeroClean is working with an exterior producer known as Mack Molding for the manufacturing of the Pūrgo gadget. Many medical gadget firms on the market do that. Nevertheless, for my part, it’s value mentioning that AeroClean’s EBITDA margin could be bigger if AeroClean would produce its personal units. The corporate seems to personal solely Pūrgo’s mental property. Apart from, if Mack Molding can not manufacture the product, the corporate might not discover one other producer that does it for the same value.

We should not have our personal manufacturing amenities or capabilities. We’ve got engaged Mack Molding, an FDA-regulated subsidiary of the privately held Mack Group, to fabricate the Pūrgo gadget.

There additionally could be no assurance that we might be capable of safe one other producer for our merchandise or achieve this on phrases much like these with Mack Molding. The shortcoming to have our merchandise manufactured in a well timed method might have a fabric opposed impact on our enterprise, monetary situation and outcomes of operations. Supply: 10-Ok

In 2021, AeroClean reported vital income focus, which can be fairly a danger. If one among these clients decides to go away the corporate, the income decline might be fairly vital. Consequently, the share value might decline.

Through the yr ended December 31, 2021, our largest and second largest clients accounted for about 45% and 12% of the Firm’s revenues, respectively. As we roll out the Pūrgo gadget to a wider group of potential clients, we count on our largest clients might fluctuate from interval to interval. Nevertheless, as we proceed to market our merchandise and search to develop and develop our buyer base, our revenues and working leads to any given interval going ahead might materially depend on one or just a few vital clients. Supply: 10-k

Conclusion

AeroClean is focusing on an enormous goal market and expects to report double-digit gross sales development within the close to future. The current details about its conversations with the FDA made the inventory value enhance considerably. With that, I consider that future free money movement doesn’t justify the present market value. Assuming double digit FCF/Gross sales margin and in addition double-digit gross sales development, the implied valuation stands at near $7.7-$8.7. Apart from, the corporate already famous that the continued international logistics and provide chain bottlenecks might hurt the manufacturing of recent units. With all these in thoughts, for the second, I’ll stay cautious concerning the inventory.