MCCAIG/iStock through Getty Photos

Ranges of market volatility elevated this week because the S&P 500 declined 4.25% and Fed Chair Jerome Powell introduced a 75-basis level charge hike.

In flip the CBOE Volatility Index (VIX) touched as excessive as 35 and ended the week at 31.1. On the identical time, PriceVol, a proprietary instrument of market threat developed by ASYMmetric ETFs, maxed out on the week at 6.6 and closed at 6.5.

PriceVol was invented to offer a extra exact measurement of market volatility because it measures the realized volatility and value actions of 100% of the S&P 500, delivering buyers a extra granular view of volatility. Study extra about PriceVol.

The place Was Volatility Seen?

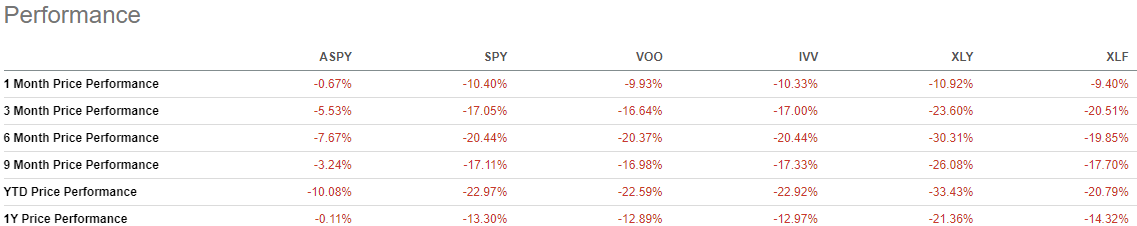

Benchmark ETFs that mirror the S&P, such because the SPDR S&P 500 ETF Belief (NYSEARCA:SPY), iShares Core S&P 500 ETF (NYSEARCA:IVV), and Vanguard 500 Index Fund (NYSEARCA:VOO), skilled elevated ranges of volatility throughout the board.

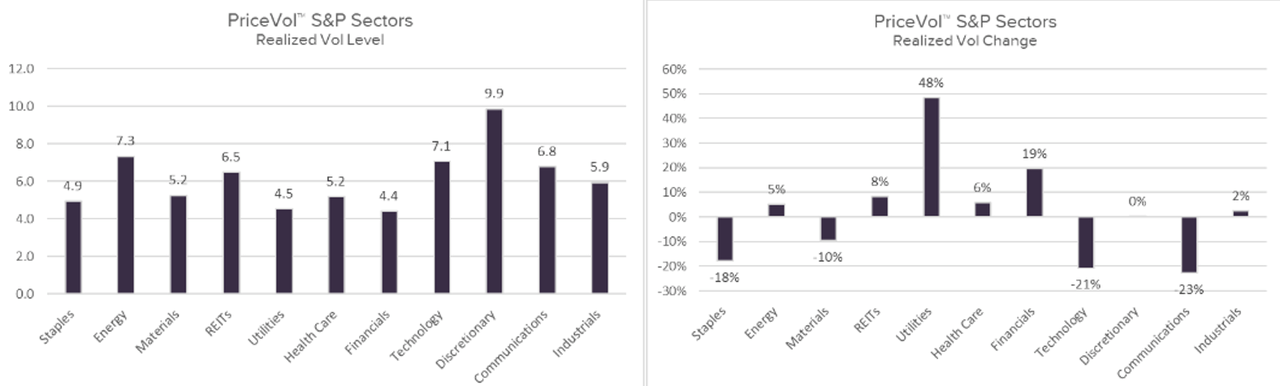

From a sector vantage level, the patron discretionary (XLY) market phase skilled the best realized volatility ranges at 9.9. On the identical time the monetary (NYSEARCA:XLF) phase of the market had the bottom stage of realized volatility at 4.4 however did expertise one of many largest charges of change from the earlier week at 19%. See visible illustration beneath:

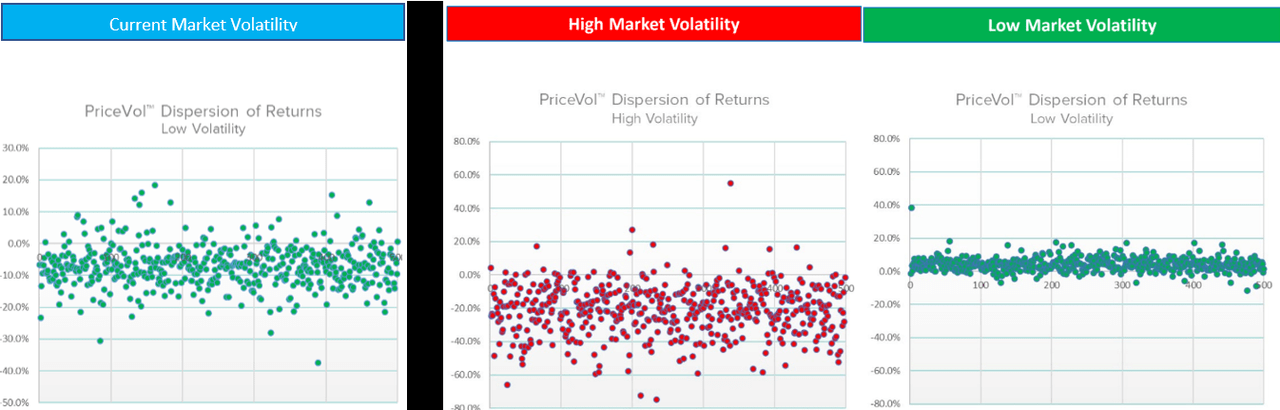

Moreover, since PriceVol measures all constituents of the S&P 500 it permits buyers to get a gauge of how the disparity of returns was noticed on the week. See beneath what the present dispersion of returns appeared like on the left in comparison with a standard high and low market volatility setting.

An ETF designed to guard towards market volatility is the ASYMmetric S&P 500ETF (ASPY). ASPY is a rules-based, quantitative lengthy/quick hedging technique that seeks to ship the monetary neighborhood a protect towards bear market declines, by being internet quick, whereas additionally seeks to seize nearly all of bull market features, by being internet lengthy.

See beneath the performances of all 5 ETFs mentioned throughout a number of time frames together with the entire PriceVol knowledge for the month of Could.