Andreyuu/iStock through Getty Pictures

Background

For individuals who are fascinated about John and Jane’s full background, please click on the next hyperlink right here for the final time I revealed their full story. The small print under are up to date for 2022.

- This is an actual portfolio with precise shares being traded.

- I’m not a monetary advisor and merely present steerage primarily based on a relationship that goes again a number of years.

- John retired in January 2018 and now solely collects Social Safety earnings as his common supply of earnings.

- Jane formally retired originally of 2021, and he or she is accumulating Social Safety as her solely common supply of earnings.

- John and Jane have determined to start out taking attracts from the Taxable Account and John’s Conventional IRA to the tune of $1,000/month every. These attracts are at the moment lined in full by the dividends generated in every account.

- John and Jane produce other investments outdoors of what I handle. These investments primarily include minimal-risk bonds and low-yield certificates.

- John and Jane haven’t any debt and no month-to-month funds apart from primary recurring payments similar to water, energy, property taxes, and many others.

I began serving to John and Jane with their retirement accounts as a result of I used to be infuriated by the charges their earlier monetary advisor was charging them. I don’t cost John and Jane for something that I do, and all I’ve requested of them is that they permit me to jot down about their portfolio anonymously in an effort to assist unfold information and to make me a greater investor within the course of.

Producing a secure and rising dividend earnings is the first focus of this portfolio, and capital appreciation is the least essential attribute. My major aim was to offer John and Jane as a lot certainty of their retirement as I presumably can as a result of this has been a continuing level of stress over the past decade.

Dividend Decreases

No shares in Jane’s Conventional or Roth IRA paid a decreased dividend through the month of Could.

Dividend And Distribution Will increase

One firm paid elevated dividends/distributions or a particular dividend through the month of April within the Conventional and Roth IRAs.

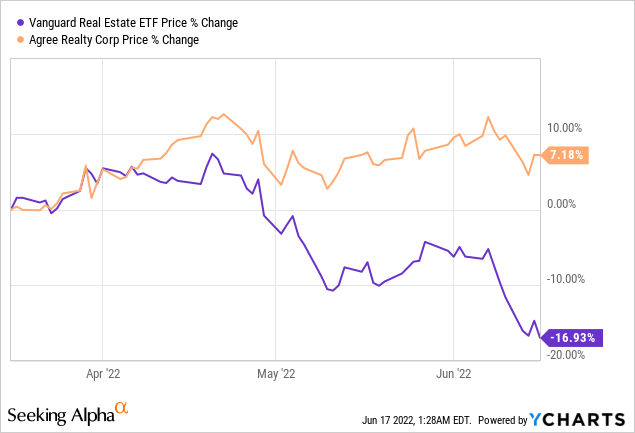

Agree Realty – REITs as a complete haven’t been spared from the latest market downturn that has pushed the Fed to lift the federal funds price by a staggering 75 foundation factors. Much more spectacular, ADC has seen its share worth recuperate over the past three months whereas common ETFs like Vanguard Actual Property Fund (VNQ) have carried out terribly. A part of the good thing about ADC is the flexibility to fight inflation within the quick and medium-term by updating leases and contracts with escalators that can permit them to maintain elevating the dividend. The dividend progress price within the final three years is roughly 7.20% which compares to the 10-year progress price of 5.36%. This means that the dividend is rising at a quicker tempo in newer years, which is a constructive indication of the route ADC goes. ADC may also profit from its latest public providing of 5 million shares – elevating capital now will assist as a result of any offers that require the usage of debt will now be dearer and will doubtlessly influence whether or not or not ADC engages within the transaction altogether.

I nonetheless preserve ADC a Purchase on shares when they’re under $65/share and a Sturdy Purchase at $60/share. ADC is one inventory that we’d think about accumulating extra of on this market.

The dividend was elevated from $.227/share per quarter to $.234/share per quarter. This represents a rise of three.1% and a brand new full-year payout of $2.808/share in contrast with the earlier $2.724/share. This leads to a present yield of 4.08% primarily based on the present share worth of $68.68.

Retirement Account Positions

There are at the moment 38 completely different positions in Jane’s Conventional IRA and 23 completely different positions in Jane’s Roth IRA. Whereas this will look like lots, it is very important do not forget that many of those shares cross over in each accounts and are additionally held within the Taxable Portfolio.

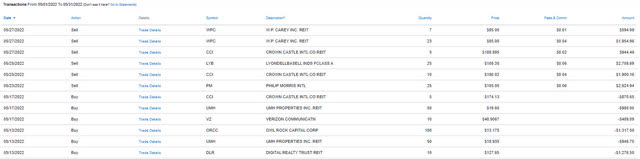

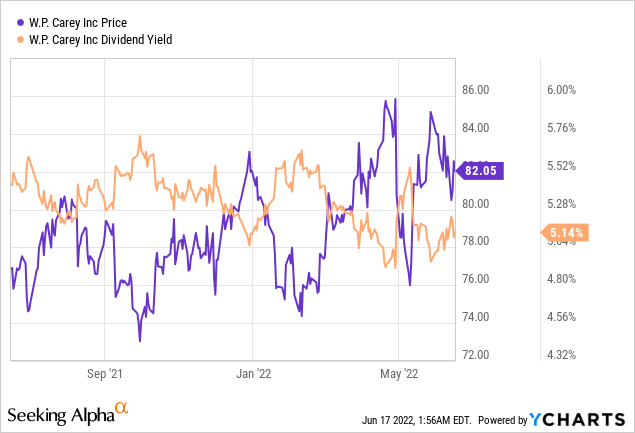

Under is a listing of the trades that befell within the Conventional IRA through the month of Could.

Conventional IRA – Could – Trades (Charles Schwab)

Under is a listing of the trades that befell within the Roth IRA through the month of Could.

Roth IRA – Could – Trades (Charles Schwab)

There was a big quantity of exercise in Jane’s retirement accounts resulting from the truth that one place was initiated and a number of positions reached worth targets the place we have been justified in eliminating high-cost shares to replenish money reserves. Alternatively, a number of shares have been out there at 52-week-lows that justified including further shares (additional growing the scale of the place that’s targeted on low-cost shares). I will not cowl each transaction that befell, however I’ll spotlight a number of the extra essential ones.

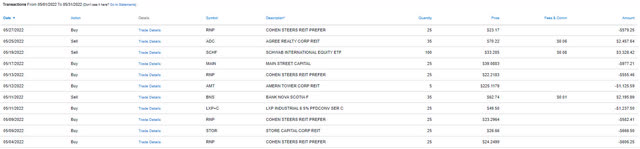

W. P. Carey (WPC) – Again in early Could, we set a restrict commerce to promote a small portion of Jane’s place in WPC that might expire in 60 days if a worth goal of $85/share was not hit. I discover that WPC pushes this worth goal on occasion and it is a sturdy indicator that shares have reached their peak. Promoting a number of the positions of those ranges for additional money readily available is a prudent factor to do.

Crown Fort (CCI) – We bought a small portion of higher-cost shares (paradoxically, we repurchased these shares within the month of June now that the inventory worth is pushing its 52-week low. Promoting these shares was solely as a result of we noticed the worth was transferring decrease and allowed us to attain a decrease value foundation.

Philip Morris (PM) – We set a restrict commerce at $105/share to final for 60 days. Sometimes, when PM hits this stage, shares are absolutely valued (no matter what buyers take into consideration the Swedish Match (OTCPK:SWMAY) acquisition). We have now been utilizing the $105 stage to promote small elements of the PM place after which repurchasing shares sometimes underneath $95/share.

Owl Rock Capital (ORCC) – Established a place within the BDC. In case you are to know extra about this funding, please take a look at my article Owl Rock Capital – Construct A Place Earlier than Q3 2022 For Most Upside for a deeper dive into why we added this to Jane’s portfolio.

Agree Realty – We bought a number of the high-cost place at $70/share and can be prepared to reinvest these funds into extra shares if the worth have been to drop into the low $60/share vary.

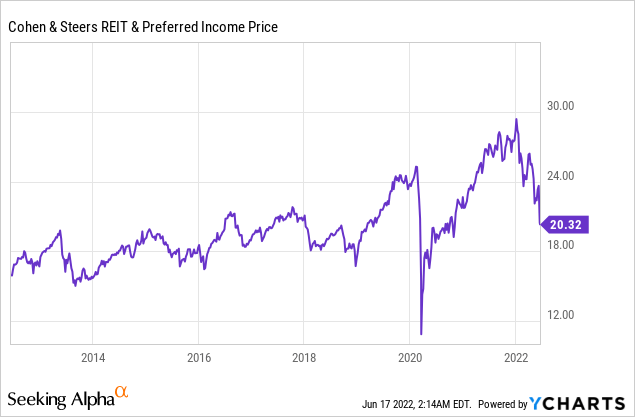

Cohen & Steers REIT & Most popular Revenue Fund (RNP) – Shares proceed to drop and we proceed to purchase. This can be a high quality REIT fund and holds many distinctive REITs that provide an amazing stage of diversification. Shares are as enticing now and $18/share has served as a robust help level (excluding COVID).

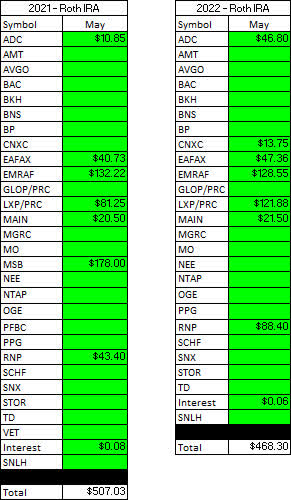

Could Revenue Tracker – 2021 Vs. 2022

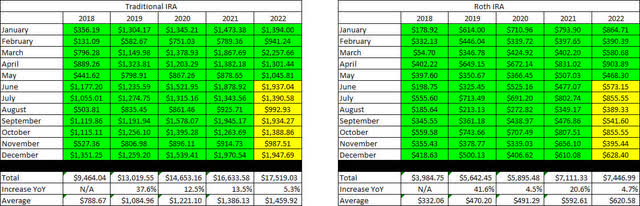

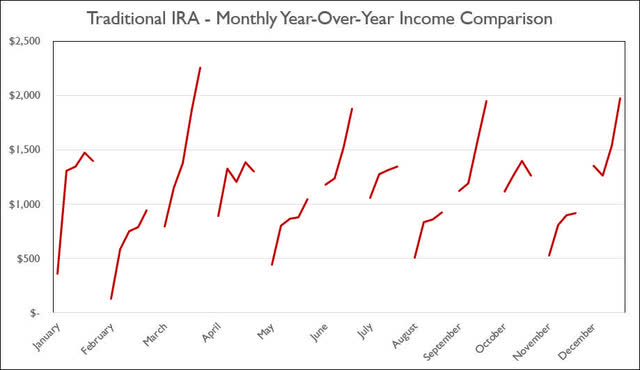

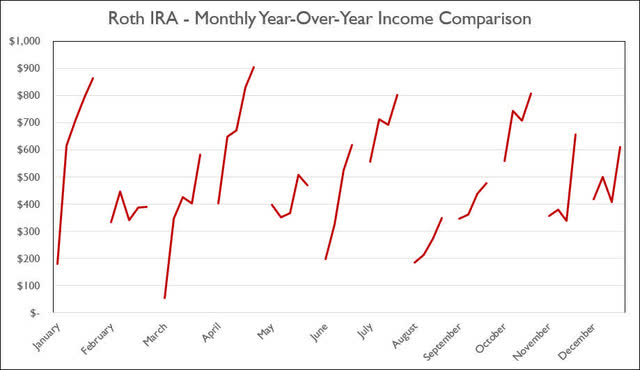

Revenue for the month of Could was up considerably year-over-year for Jane’s Conventional IRA and down barely for the Roth IRA. The typical month-to-month earnings for the Conventional IRA in 2022 is predicted to be up about 5.3% primarily based on present estimates and the Roth IRA is seeking to develop by 4.7%. This implies the Conventional IRA would generate a median month-to-month earnings of $1,459.92/month and the Roth IRA would generate a median earnings of $620.58/month. This compares with 2021 figures that have been $1,386.13 and $592.61, respectively.

SNLH = Shares No Longer Held – Dividends on this row signify the dividends collected on shares which might be not held in that portfolio. We nonetheless depend the dividend earnings that comes from shares not held within the portfolio despite the fact that it’s non-recurring.

All photographs under come from Constant Dividend Investor, LLC. (Abbreviated to CDI).

Conventional IRA – 2021 V 2022 – Could Dividends (CDI)

Roth IRA – 2021 V 2022 – Could Dividends (CDI)

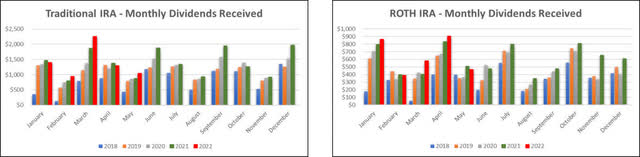

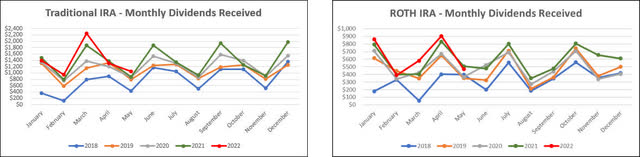

Here’s a graphical illustration of the dividends acquired on a month-to-month foundation for the Conventional and Roth IRAs.

Retirement Projections – 2022 – Could – Month-to-month Dividends (Bar Graph) (CDI)

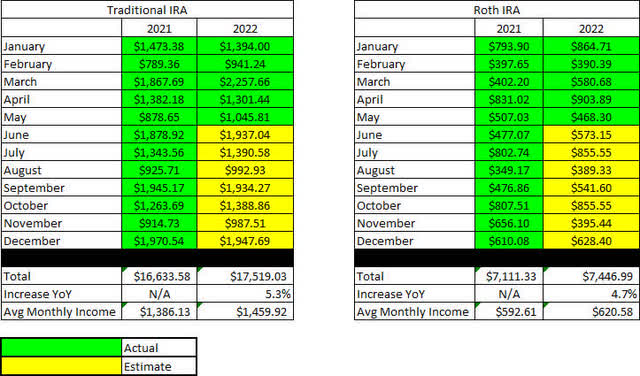

The desk under represents the precise full-year outcomes for 2022 and the prior 12 months.

Retirement Projections – 2022 – Could (CDI)

Under is an expanded desk that reveals the total dividend historical past since inception for each the Conventional IRA and Roth IRA.

Retirement Projections – 2022 – Could – 5 YR Historical past (CDI)

I’ve included line graphs that higher signify the traits related to Jane’s month-to-month dividend earnings generated by her retirement accounts. The photographs under signify the Conventional IRA and Roth IRA, respectively.

Retirement Projections – 2022 – Could – Month-to-month Dividends (CDI)

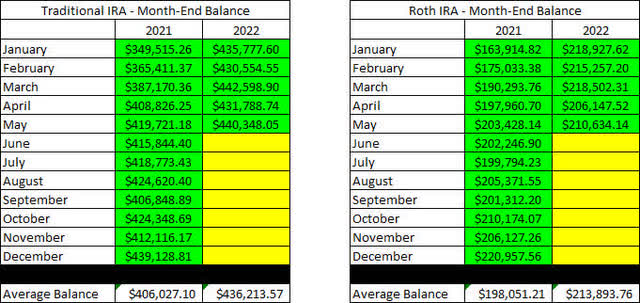

Here’s a desk to indicate how the account balances stack up 12 months over 12 months (I beforehand used a graph however imagine the desk is extra informative).

It’s price noting that with John and Jane Retired, there might be no further contributions to those accounts. The truth is, they’ve already begun to take common distributions from the Taxable Account and John’s Conventional IRA.

Retirement Account Balances – 2022 – Could (CDI)

The following photographs are the tables that point out how a lot money Jane had in her Conventional and Roth IRA Accounts on the finish of the month as indicated on their Charles Schwab statements.

Retirement Projections – 2022 – Could – Money Balances (CDI)

The following picture offers a historical past of the unrealized achieve/loss on the finish of every month within the Conventional and Roth IRAs going again to the start in January of 2018.

Retirement Projections – 2022 – Could – Unrealized Acquire-Loss (CDI)

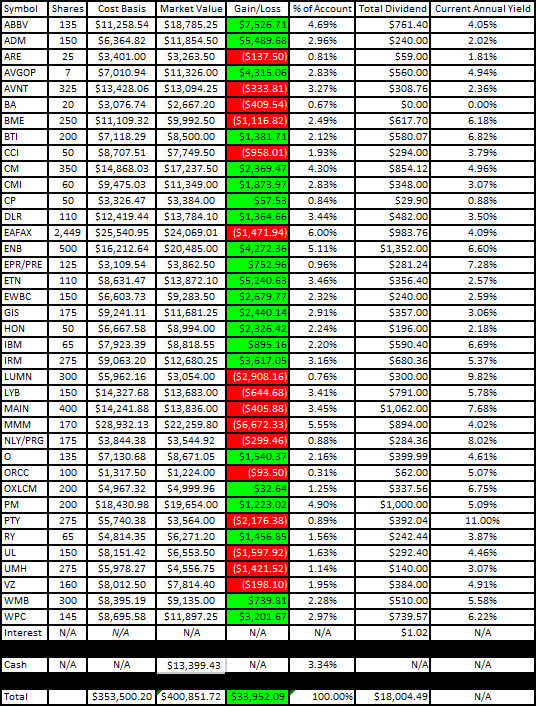

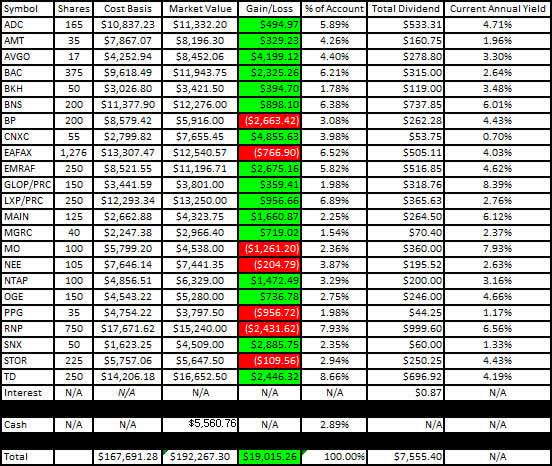

I like to indicate readers the precise unrealized achieve/loss related to every place within the portfolio as a result of it is very important think about that in an effort to develop into a correct dividend investor, it’s essential to discover ways to reside with volatility. The market worth and value foundation under are correct on the market shut on June sixteenth.

Right here is the unrealized achieve/loss related to Jane’s Conventional and Roth IRAs.

Conventional IRA – 2022 – Could – Acquire-Loss (CDI) Roth IRA – 2022 – Could – Acquire-Loss (CDI)

The final two graphs present how dividend earnings has elevated, stayed the identical, or decreased in every respective month on an annualized foundation. I imagine that the graph will proceed to develop into extra invaluable as extra years of knowledge develop into out there (with the fifth 12 months of knowledge being added, we will actually see the trajectory of the earnings change for every month).

Conventional IRA – 2022 – Could – Month-to-month 12 months-Over-12 months Comparability (CDI) Roth IRA – 2022 – Could – Month-to-month 12 months-Over-12 months Comparability (CDI)

Conclusion

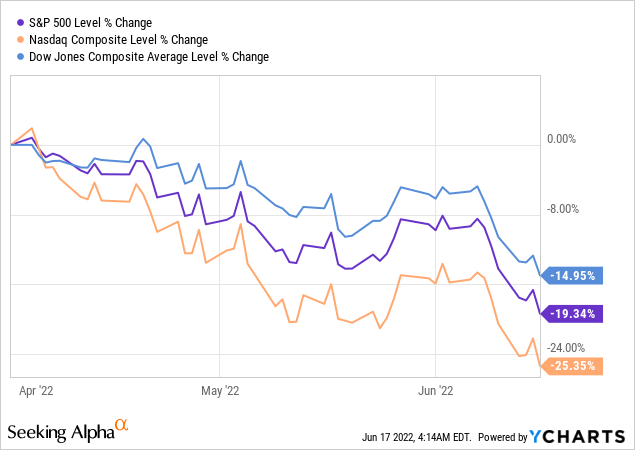

We have now made it by the midway level in June and there’s no denying that the market has been an absolute massacre. A few of this has been in anticipation of the Fed’s improve and a few of this may also be attributed to the truth that the rise was the biggest seen since 1994.

In Jane’s portfolio, we count on to see unrealized beneficial properties drop considerably (greater than reduce in half from the place they have been on the finish of Could) together with account balances in a similar way. On the identical time, we don’t see any issues concerning the dividend payouts related to every place and can proceed to scale back publicity and add to present positions when it is smart.

Wanting on the picture above is a vital reminder of why we concentrate on dividend-paying shares for John and Jane’s portfolios. If John and Jane have been required to promote shares in an effort to fund their subsequent retirement distribution, we cut back and severe hesitancy to liquidate an asset that’s dropped 15, 20, or 25% (which is precisely what the three essential indexes present have occurred since April 1, 2022). As a substitute, we’re capable of liquidate shares anytime however for far more sensible causes similar to decreasing the variety of high-cost shares and reallocating that money to undervalued shares when the time is smart.

On the identical time, the dividends proceed to do the work that’s wanted to make John and Jane snug of their retirement.

Could Articles

I’ve supplied the hyperlink to the Could 2022 Taxable Account under.

The Retirees’ Dividend Portfolio: John And Jane’s Could Taxable Account Replace

In Jane’s Conventional and Roth IRAs, she is at the moment lengthy the next talked about on this article: AbbVie (NYSE:ABBV), Agree Realty (NYSE:ADC), Archer-Daniels-Midland (NYSE:ADM), Broadcom (NASDAQ:AVGO), Avient (NYSE:AVNT), Broadcom Most popular Sequence A (NASDAQ:AVGOP), Boeing (NYSE:BA), Financial institution of America (NYSE:BAC), Black Hills Corp. (NYSE:BKH), BlackRock Well being Sciences Belief (NYSE:BME), Financial institution of Montreal (NYSE:BMO), Financial institution of Nova Scotia (NYSE:BNS), BP (NYSE:BP), British American Tobacco (NYSE:BTI), Canadian Imperial Financial institution of Commerce (NYSE:CM), Cummins (NYSE:CMI), Concentrix (NASDAQ:CNXC), Digital Realty (NYSE:DLR), Eaton Vance Floating-Charge Benefit Fund A (MUTF:EAFAX), Enbridge (NYSE:ENB), EPR Properties Most popular Sequence E (NYSE:EPR.PE), Eaton Company (NYSE:ETN), Emera Inc. (OTCPK:EMRAF), East West Bancorp (NASDAQ:EWBC), Basic Mills (NYSE:GIS), GasLog Companions Most popular C (NYSE:GLOP.PC), Honeywell (NASDAQ:HON), Worldwide Enterprise Machines (NYSE:IBM), Iron Mountain (NYSE:IRM), Lexington Realty Most popular Sequence C (NYSE:LXP.PC), Lumen Applied sciences (NYSE:LUMN), LyondellBasell (NYSE:LYB), Predominant Road Capital (NYSE:MAIN), McGrath RentCorp (NASDAQ:MGRC), 3M (NYSE:MMM), Altria (NYSE:MO), Annaly Capital Most popular Sequence G (NYSE:NLY.PG), NextEra Vitality (NYSE:NEE), NetApp (NASDAQ:NTAP), Realty Revenue (NYSE:O), OGE Vitality Corp. (NYSE:OGE), Oxford Lane Capital Corp. 6.75% Cum Purple Pdf Shares Sequence 2024 (NASDAQ:OXLCM), Philip Morris (NYSE:PM), PPG Industries (NYSE:PPG), PIMCO Company & Revenue Alternative Fund (PTY), Cohen & Steers REIT & Most popular Revenue Fund (NYSE:RNP), Royal Financial institution of Canada (NYSE:RY), TD SYNNEX Corp. (NYSE:SNX), STORE Capital (NYSE:STOR), Toronto-Dominion Financial institution (NYSE:TD), Unilever (NYSE:UL), UMH Properties (UMH), Verizon (NYSE:VZ), Williams Firms (NYSE:WMB), W. P. Carey (NYSE:WPC).