[ad_1]

After coming into the brand new fiscal yr on a constructive word, Adobe Inc. (NASDAQ: ADBE) maintained the uptrend within the second quarter, reporting sturdy outcomes. Nonetheless, the corporate issued cautious steering suggesting that progress would decelerate this yr in comparison with 2021.

The San Jose-based firm has remained a market chief in design software program and enjoys an edge over rivals supported by the recognition of its flagship Illustrator, Photoshop, and Premiere Professional software program suites. They proceed to be the popular purposes within the inventive world and amongst designers as a consequence of fixed innovation and portfolio revamp. These components would allow the corporate to beat potential challenges this yr and past.

Cautious Steering

Buyers weren’t impressed when the corporate revealed second-quarter outcomes and issued steering final week. The inventory skilled weak spot within the following classes however regained part of the momentum later. It’s buying and selling on the lowest degree in about two years, which is a brief downturn that may be linked to the overall market hunch. Adobe has at all times remained an traders’ favourite and has an excellent monitor file of overcoming market headwinds, due to its sturdy fundamentals and wholesome liquidity.

Learn administration/analysts’ feedback on quarterly experiences

Proper now, the valuation is good from the funding perspective, although some traders would possibly nonetheless discover the inventory unaffordable. ADBE presents a novel funding alternative that potential traders wouldn’t need to ignore. Market watchers, generally, are extremely optimistic in regards to the inventory, which is forecast to breach the $500-mark within the coming months.

Outcomes Beat

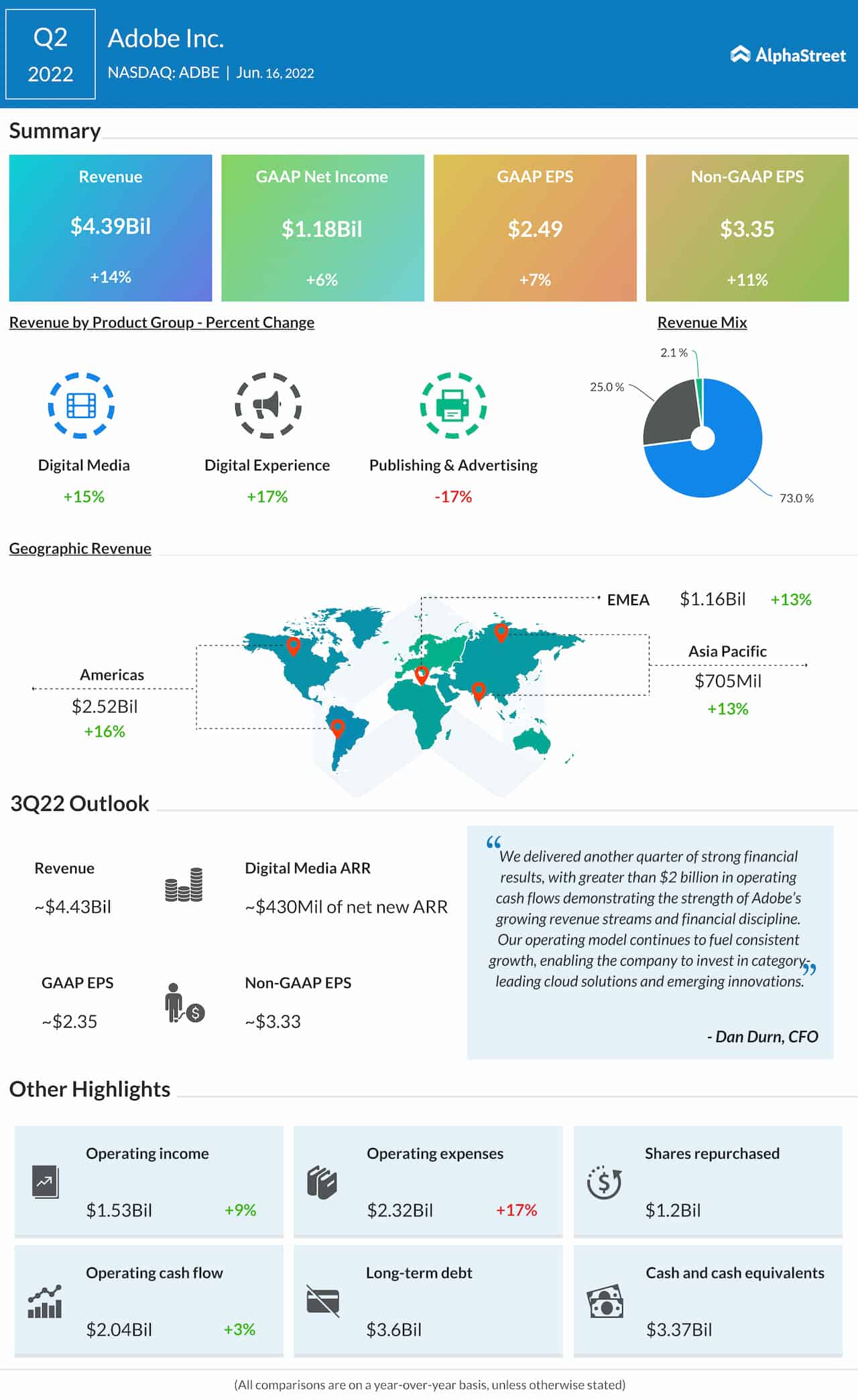

For the second quarter, Adobe reported stronger-than-expected revenue and revenues, because it did within the earlier quarter. Adjusted earnings rose in double digits to $3.35 per share throughout the three-month interval as sturdy progress within the core Digital Media and Digital Expertise segments greater than offset weak spot within the Publishing & Promoting division. The administration additionally issued steering for the third quarter and full fiscal yr.

“We delivered one other quarter of sturdy monetary outcomes, with larger than $2 billion in working money flows demonstrating the energy of Adobe’s rising income streams and monetary self-discipline. Our working mannequin continues to gas constant progress, enabling the corporate to put money into category-leading cloud options and rising improvements which are gaining traction within the market,” stated Adobe’s CFO Dan Durn.

ADSK Inventory: Is it an excellent time to put money into Autodesk now?

Whereas the whole lot appeared good within the second-quarter report, the full-year steering was a dampener for the market because the numbers missed Wall Road’s projection. However the sentiment recovered fairly rapidly and the inventory recovered from the preliminary decline. ADBE closed the final buying and selling session decrease however made modest features within the after-hours.

[ad_2]

Source link