[ad_1]

| Picture Credit score: DepositPhotos

Amsterdam Delta was lately topped as the highest startup ecosystem within the European Union by Startup Genome. Now, Dealroom has launched its personal evaluation that additional proves the strides made by the Dutch capital to turn out to be the second main startup ecosystem in Europe. The evaluation of Amsterdam as a startup ecosystem for the primary half of 2022 by Dealroom reveals how the tech sector has advanced.

The rise of Amsterdam to turn out to be the second largest startup ecosystem in Europe, second solely to London, could be owed to a whole lot of elements. A few of these elements are an open and enthusiastic tech group, a vibrant investor ecosystem, together with native buyers and household based mostly trusts, sensible accelerators, and tech entrepreneurs. Here’s a have a look at a few of the key takeaways from Dealroom’s evaluation of Amsterdam’s startup ecosystem.

Has the Dutch workforce mastered all digital abilities? Discover out

Amsterdam sees second highest funding in first half of 2022

The analysis by Dealroom reveals that Amsterdam-based startups raised €698M in 2022 YTD. This funding comes after a document yr in 2021 however is a 75 per cent decline yr on yr. Regardless of yr on yr decline, the primary half of 2022 is the second highest H1 for Amsterdam VC funding.

Compared to H1 2021, VC funding in Amsterdam was largely restricted to startups elevating between €100m and €250M. The analysis reveals that 40 per cent of the overall raised in 2022 up to now have come through early and mid stage rounds. That is 2.8x larger than within the first half of 2021.

VCs had been additionally curious about startups elevating €15M to €40M as a part of Collection B and people elevating Collection A with a ticket measurement between €4M to €15M. That is in stark distinction to earlier years when VC funding in Amsterdam based mostly startups noticed rounds with a ticket measurement larger than €250M.

![]()

Dealroom says Leyden Labs, Backbase, Pyramid, Transfer, Dott, and ParkBee noticed the highest funding rounds in Amsterdam through the first half of 2022. Dott is valued at €386M whereas ParkBee is valued between €20M and €30M.

Amsterdam-based VCs have raised document funding

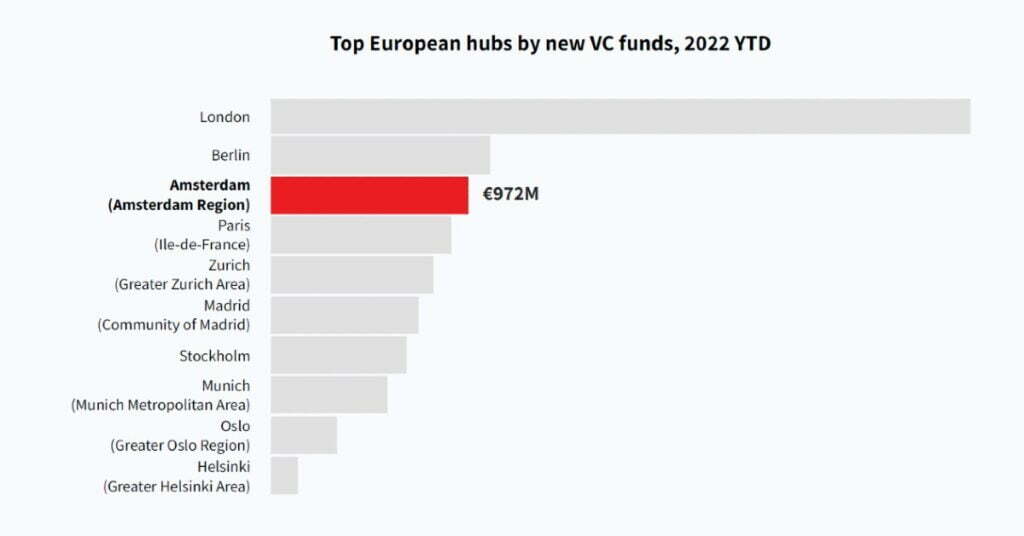

Amongst European hubs for VC funding, Amsterdam lags behind the likes of Paris, Helsinki, and Zurich however it finds silver lining within the type of Amsterdam-based VCs. The native buyers have raised a document €972M in new funds in 2022 already. This funding surpasses the earlier document set by native VCs in 2016.

Amongst native buyers, Dealroom notes that Endeit Capital has raised €303M adopted by Anterra Capital with €236M. Related Capital and Shift have raised €154M and €110M, respectively.

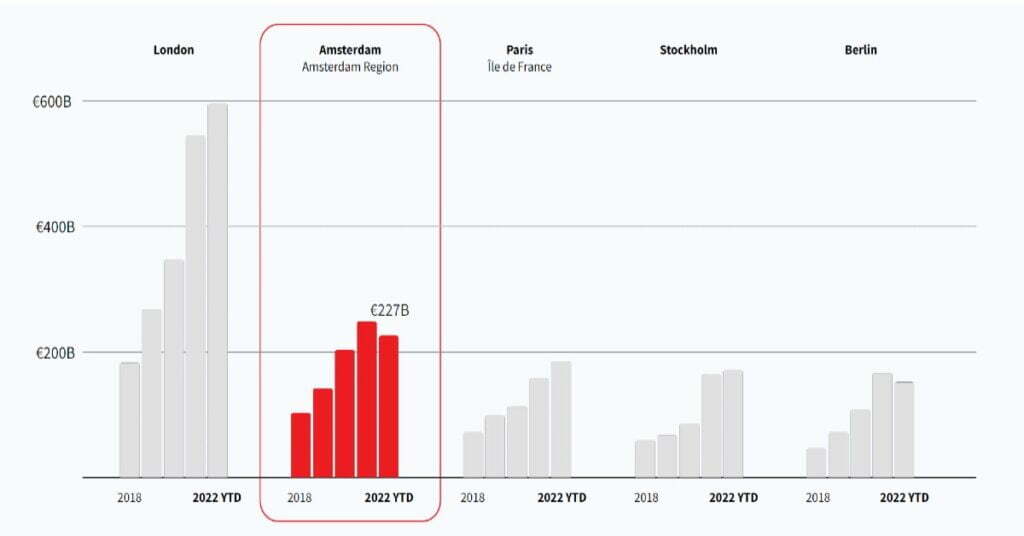

Amongst new VC funds raised up to now in 2022, the Dutch capital follows London and Berlin because the third main metropolis in Europe. The brand new funding takes the worth of the Amsterdam tech ecosystem to €227B and it’s second solely to London in Europe however leads within the European Union.

Amsterdam startups appeal to worldwide VC funding

The evaluation of Amsterdam’s startup ecosystem for the primary half of 2022 reveals a powerful curiosity from worldwide VC companies. For the primary half of 2022, Amsterdam has seen a big portion of funding come from US-based enterprise capital companies. American VCs have surpassed home and European VC companies through the first half of this yr.

Amongst worldwide buyers, Sequoia Capital and Accel Companions high the listing. EQT Ventures, BioMed Companions, Eir Ventures, and Power Impression Companions had been additionally lively amongst worldwide VC companies. Dealroom says 90 per cent of Amsterdam VC funding has come from overseas buyers through the first half of 2022.

Safety tech and Mobility tech are rising

Amongst industries, fintech continues to dominate as the highest sector for VC funding. The fintech trade noticed €189M in funding, which is 14 per cent decrease from half-year common since 2017. It was adopted by well being with €161M in funding and a development of 96 per cent.

The transportation trade was the quickest rising with funding of €129M and 144 per cent development in comparison with half-year common since 2017. The training, e-commerce, and meals industries raised €28M, €19M, and €12M, respectively. The safety trade registered 128 per cent development and introduced in €15M in funding.

Impression funding sees slowdown in Amsterdam

Through the first half of 2022, the affect funding was equal to €79.5M, which is equal to 11 per cent of whole funding. That is the bottom first half for affect startups for the reason that first half of 2017.

The primary half of 2022 noticed affect startups increase €436M and there may be room for affect startups to see additional funding. The important thing startups in Amsterdam’s affect rounds for 2022 included Dott, ParkBee, Verify, Quicargo, Packaly, and Willicroft.

Amsterdam tech ecosystem is second in worth

The worth of the Amsterdam tech ecosystem accounts for €227B in 2022 up to now, based on Dealroom. This makes the tech ecosystem in Amsterdam second by way of worth in Europe and first within the European Union. The Amsterdam tech ecosystem lags solely London by way of worth in Europe.

In 2022, Amsterdam has produced two unicorns and now has a complete of 20 unicorns. Backbase, with a valuation of €2.5B, and Azerion, valued at €1.7B, joined the elite membership this yr. In Europe, London leads with a complete of 81 unicorns, adopted by Berlin with 31, Paris with 30, and Stockholm with 24 unicorns.

Amsterdam startup ecosystem in numbers:

- Ecosystem worth: €227B

- Whole funding in 2022 YTD: €698M

- New funds raised in 2022 YTD: €972M

- 40 per cent funding pushed by early and mid-stage rounds

- Fintech startups: €189M

- Impression funding in 2022 YTD: €79.5M

- Variety of unicorns in 2022 YTD: 2

- Future unicorns: 3

Catch our interview with Paul Down, Head of Gross sales at Intigriti.

[ad_2]

Source link