fotokostic/iStock through Getty Photographs

Funding Thesis

Nutrien (NYSE:NTR) may be very effectively positioned for prime fertilizer costs. I conclude with the argument that the latest worth weak spot right here is unjustified.

Since my earlier bullish protection of Nutrien, it seems that the bull case has damaged off.

Nonetheless, I contend that not solely is this isn’t the case, however that the funding case is definitely lots higher proper now.

To be clear, this isn’t simply me speaking my guide, provided that I am lengthy fertilizer shares, that is only a steadiness of info and customary sense.

Concretely, I consider that Nutrien’s 10.6% shareholder return may be very engaging and can add steam to those shares.

Here is why I charge this inventory a purchase.

Nutrien’s Current Efficiency

Perversely, it seems that since Nutrien had its investor day on 20 Could, Nutrien has been promoting off.

Now, keep in mind that correlation isn’t causation. There’s been a myriad of different components at play right here.

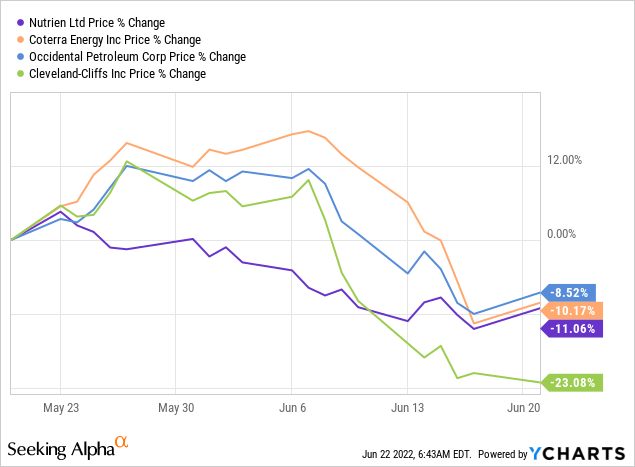

Within the graphic above I’ve purposely chosen a variety of commodity and power shares.

The general path may be very related for all of them. Traders’ capital has stepped again from this house. Consequently, I contend that Nutrien’s latest sell-off has almost nothing to do with its near-term outlook.

That is what we’ll talk about subsequent.

Nutrien’s Close to-Time period Prospects

The general theme for Nutrien shareholders has been that fertilizer firms are going to have a powerful 2022 and that all the pieces reverts again to regular beginning in 2023.

To that argument, Nutrien’s Traders Day opened with the next assertion:

Nutrien’s Investor Day

Nutrien is explicitly noting that the present fertilizer surroundings might final past 2022.

Needless to say for 2022, Nutrien expects roughly 50% of its adjusted EBITDA to come back from its potash enterprise. With nitrogen contributing roughly 35% to complete adjusted EBITDA. Whereas phosphate is the smallest contributor to complete adjusted EBITDA.

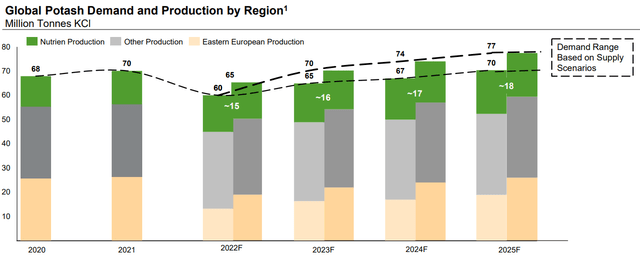

Subsequent, Nutrien went to nice lengthens to elucidate that there is a structural deficit within the supply-demand steadiness for potash.

Nutrien’s Investor Day

Certainly, Nutrien notes that the actual deficit in provide is more likely to enhance in 2023, somewhat than revert again to regular. This perception is opposite to what many traders have come to consider.

Subsequent, we’ll talk about what tangible facets traders can take into consideration in terms of constructing a bull case in Nutrien.

Deciphering Nutrien’s Capital Returns Coverage

Nutrien’s dividend yield stands at 2.2%. Clearly, there’s lots of room for enchancment. Nonetheless, Nutrien would a lot somewhat repurchase shares, somewhat than enhance its dividend.

The rationale is simple. Within the occasion that market circumstances deteriorate, Nutrien can at all times droop its share repurchases. However it will probably’t, not less than in sensible phrases, droop its dividend.

The dividend must be at a stage that may be sustained by the cycle. That is an apparent level, nevertheless it’s value remembering.

Nutrien needs to get long-term traders on board, and it’ll achieve this by having a stable by the cycle dividend. And that is Nutrien’s approach of speaking that message.

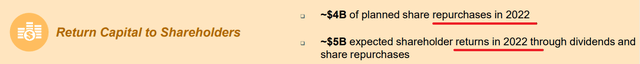

That being mentioned, Nutrien’s share buybacks are definitely substantial. Needless to say throughout Q1 2022, Nutrien returned $885 million.

Nonetheless, when Nutrien had its Investor Day it introduced a rise in its complete share repurchase program in order that it might deploy $4 billion into buybacks in 2022.

Whereas I have no idea simply how aggressive Nutrien’s capital return program was in Q2 2022, what I do know is that this means that from Q2 by This autumn, Nutrien will look to deploy $3 billion.

Usually, firms do not absolutely exhaust their share repurchase packages, but when we predict that Nutrien is on track to return about $1 billion of capital per quarter, I consider it is a honest evaluation.

That suggests that Nutrien goes to return to shareholders roughly 2.1% of its market cap per quarter. Notice, consider the forex exchanges when trying up Nutrien’s valuation.

Stated one other approach, Nutrien’s complete shareholder return is roughly 2.7% per quarter. Or 10.6% annualized.

Nutrien’s Investor Day

NTR Inventory Valuation — Priced At 5x EPS

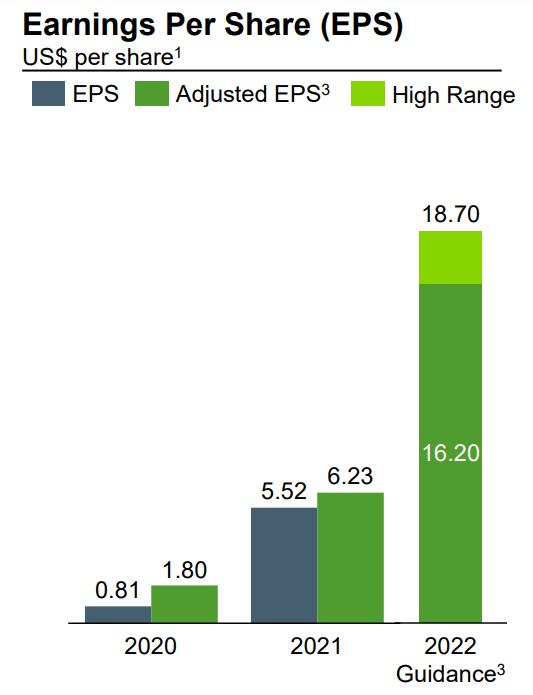

As implied all through, no person realistically expects that Nutrien’s EPS stays this excessive over a protracted foundation. There’s the potential for Nutrien to learn from excessive earnings into 2023, however almost everybody, together with Nutrien themselves, isn’t anticipating this excessive stage of profitability to take care of into 2024.

Nutrien’s Investor Day

Consequently, the inventory is being priced at 5x EPS, as a result of traders are considering to themselves that when we get additional into 2023 and the again finish of 2023, the fertilizer market stabilizes and Nutrien’s profitability reverts decrease.

And I haven’t got a crystal ball and I am not in a position to argue that a method or one other. What I’ll say is that paying 5x earnings implies that you solely want 5 years of those elevated earnings for the corporate to pay for itself.

The Backside Line

Keep in mind, Nutrien took place by the merger of PotashCorp and Agrium. PotashCorp was based in 1975, whereas Agrium was based in 1931. What number of fertilizer cycles have these two firms been by?

And extra importantly, what number of extra good years forward are there more likely to be? I consider that the percentages are substantial that fertilizer firms might have simply as robust a 2023 as 2022.

That may imply that traders paying 5x to EPS, would most likely want solely one other 3 good years for the enterprise to pay for itself.

All of the whereas, the shareholder could be accumulating double-digit shareholder returns in 2022, and possibly double-digit shareholder returns once more in 2023.

From many alternative angles, I consider that this funding might work out actually favorably. I charge the inventory a purchase.