Dan Krauss/Getty Pictures Information

The bear market is making retail {and professional} buyers nervous, however the market won’t be down without end. For individuals who have lived by means of the dot-com crash and sub-prime mortgage disaster, we all know bear markets can final many months, however inventory markets finally reverse course. Nevertheless, the bear market creates alternatives for a lot of to observe a dividend progress investing technique. Equally, buyers in search of earnings from high-yield shares are seemingly to purchase too.

One inventory that must be close to the highest of your checklist to purchase is Cisco Methods, Inc. (NASDAQ:CSCO), the networking large. The corporate is now yielding 3.5%+, and the dividend continues to develop yearly. Cisco is a Dividend Contender with 12 years of raises. The bear market, mixed with weak Q3 2022 outcomes and steering, has punished the inventory, which is down (-32.5%) year-to-date. The valuation is down 12.7X. I view Cisco as a long-term purchase.

Overview of Cisco

Cisco traces its founding again to 1984, when it created its first router. The corporate snowballed and had the very best market capitalization in the course of the dot-com growth. Right this moment, Cisco designs, manufactures, and sells Web Protocol networking tools. Its merchandise embrace routers, storage, switches, wi-fi, cybersecurity software program, and so on. The corporate sells its merchandise in a number of classes: Safe, Agile Networks, Web for the Future, Collaboration, Finish-to-Finish Safety, Optimized Software Experiences, Different Merchandise, and Companies. The corporate operates globally and is the market chief for networking. Interbrand ranks Cisco because the No. 16 international model.

Whole income was $49,818 million in fiscal 2021 and $51,581 million within the final twelve months. Income is roughly divided into 75% product and 25% service.

Current Quarterly Outcomes

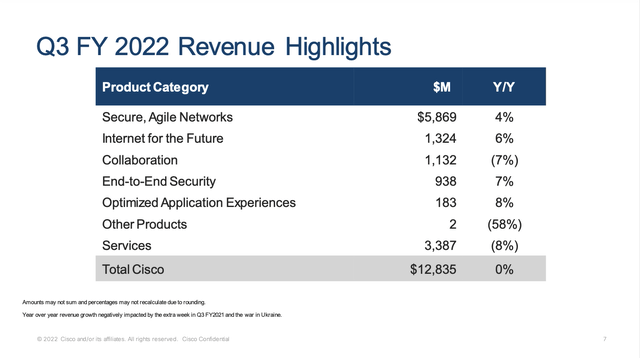

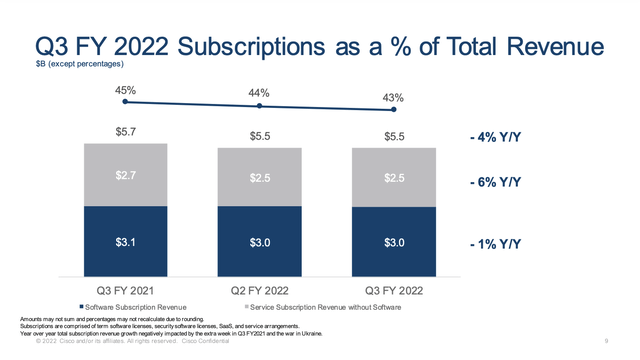

The corporate reported Q3 2022 outcomes beneath expectations. Cisco nonetheless reported progress in some product classes, however income was flat, as seen within the chart beneath. As well as, whole subscription income declined and was a decrease share of whole income, suggesting prospects weren’t renewing subscriptions and migrating to rivals.

CSCO Investor Relations CSCO Investor Relations

The principle downside was that progress was slowing and ahead steering for the fiscal yr was decrease. Cisco’s whole orders for the quarter had been up 8% however had been decrease than the 33% improve within the second quarter. Even after accounting for the lack of demand in Russia and COVID-19 lockdowns in China, this decline was vital. Moreover, Cisco’s enterprise product orders confirmed no progress. Demand will seemingly be lowered additional in This autumn FY 2022 due to the battle in Ukraine and continued lockdowns in China which might be solely now being lifted.

Moreover, Cisco lowered its FY 2022 steering to $3.29 to $3.37 per share from $3.41 to $3.46 per share, including to investor issues.

Cisco’s Progress

Regardless of the slowing demand, Cisco continues to develop organically and by acquisitions over longer durations. The corporate is the market chief for IP networking {hardware} and software program. Few firms can present complete end-to-end options for networking like Cisco. Nevertheless, natural progress is difficult to come back by as a result of the market just isn’t rising as quick because it as soon as was. Competitors from different networking or safety firms is intense. Arista Networks and Juniper have more and more offered merchandise which might be attracting prospects. Moreover, cloud service suppliers supply overlapping providers, lowering organizations’ must function information facilities.

Therefore, Cisco has grown primarily by means of acquisitions. The corporate makes use of its prodigious money circulate to make tuck-in acquisitions filling out its {hardware} and software program traces. In 2020, Cisco made 9 acquisitions, together with Dashbase, Slido, IMImobile, Banzai Cloud, Portshift, BabbleLabs, Modcam, ThousandEyes, and Fluidmesh Networks. In 2021, it acquired six firms, together with Reflex, Epsagon, Involvio, Kenna Safety, Socio Lab, and Sedona Methods. To date, in 2022, Cisco has made one acquisition, Opsani.

The result’s that Cisco’s income, working earnings, and operational money circulate are rising slowly.

Dividend Evaluation

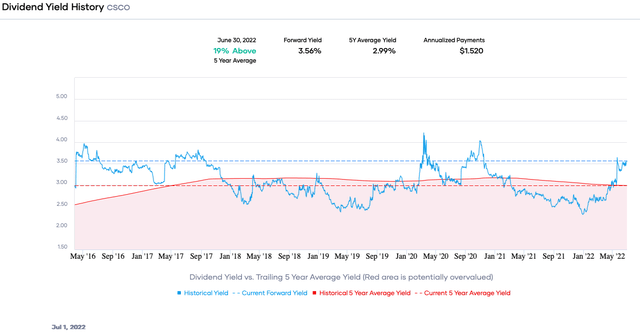

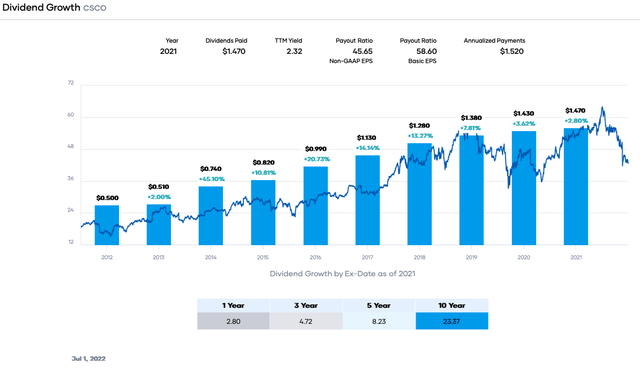

Cisco is a dividend progress inventory with a 3.5%+ dividend yield. As well as, the corporate has raised the dividend for 12 years after initiating one in 2011, making the inventory a Dividend Contender.

The ahead dividend yield is now roughly 3.56%, based mostly on an annual dividend price of $1.52 per share. The mixture of dividend yield and progress makes the inventory engaging for a lot of.

Portfolio Perception

Cisco final raised the quarterly dividend in February 2022 to $0.38 from $0.37 per share. The trailing dividend progress price is 8.23% CAGR up to now 5 years and 23.37% up to now ten years. After a excessive preliminary progress price, it slowed because the payout ratio elevated. Nevertheless, the comparatively conservative payout ratio of ~46% means future will increase are in all probability in retailer.

Portfolio Perception

Cisco has strong dividend security from the context of earnings, free money circulate (FCF), and the stability sheet.

Consensus estimates in fiscal 2022 for Cisco are $3.36 per share, and the dividend is $1.52 per share. These numbers produce a payout ratio of ~46%. Our cutoff payout ratio is 65%, which means Cisco’s dividend is protected with a good buffer.

Cisco had roughly $13,553 million in FCF up to now 12 months. The dividend required round $6,219 million, giving a dividend-to-FCF ratio of ~46%. This worth is effectively beneath our cutoff of 70%, which means there’s little threat of a dividend minimize based mostly on FCF.

Considered one of Cisco’s strengths is its rock-solid stability sheet. On the finish of Q3 FY 2022, Cisco had $1,000 million in present long-term debt and $8,425 million in long-term debt. Each whole and internet debt have declined up to now 5 years. Whole debt was offset by $6,952 million in money and equivalents and $13,156 million in short-term investments giving a internet money place. Curiosity protection is roughly 39X. Cisco has an AA-/A1 excessive grade/upper-medium grade funding credit standing from S&P World and Moody’s. Debt just isn’t regarding from the angle of dividend security.

Valuation

Cisco’s inventory value has struggled in 2022, down greater than the S&P 500 Index and Nasdaq. Nevertheless, the corporate has strong dividend and return views. Cisco is buying and selling at a ahead P/E ratio of about 12.7X, on the decrease finish of its common vary up to now ten years and beneath its vary up to now 5-years.

The consensus analyst 2022 earnings is now $3.36 per share. We are going to use 14X as an inexpensive worth for earnings a number of. This worth is beneath the typical up to now decade. Nevertheless, we account for problem rising income and earnings per share mixed with probably decrease demand in fiscal 2023.

Our truthful worth estimate is $47.04. The present inventory value is ~$41.93, suggesting that the inventory is undervalued based mostly on earnings.

Making use of a sensitivity evaluation utilizing price-to-earnings (P/E) ratios between 13X and 15X, we get hold of a good worth vary from $43.68 to $50.40. Thus, the present inventory value is ~76% to ~89% of the cheap worth estimate.

Estimated Present Valuation Based mostly On P/E Ratio

|

P/E Ratio |

|||

|

13 |

14 |

15 |

|

|

Estimated Worth |

$43.68 |

$47.04 |

$50.40 |

|

% of Estimated Worth at Present Inventory Worth |

96% |

89% |

83% |

Supply: dividendpower.org Calculations

How does this examine to different valuation fashions? An EV/EBITDA a number of evaluation from finbox offers a good worth estimate of $54.46 per share. The mannequin assumes a ahead a number of of 11.2X. Portfolio Perception’s blended truthful worth mannequin accounting for the P/E ratio and dividend yield offers a good worth of $50.55 per share. Lastly, the Gordon Progress Mannequin offers an estimated truthful worth of $50.67, assuming an 8% desired price of return and a 5% dividend progress price. The dividend progress price estimate is conservative and beneath the typical over the previous 5-years.

The common of those 4 fashions is ~$50.68, suggesting Cisco is undervalued on the present value.

Remaining Ideas

Cisco’s excessive progress years are effectively behind it, however the firm remains to be the dominant market chief for networking. Income grows slowly, and bolt-on acquisitions are serving to. Furthermore, the corporate’s prodigious FCF permits it to pay a rising dividend and decrease the share depend. The web money place on the stability sheet supplies flexibility to return money to shareholders. Cisco is yielding greater than 3.5%, the dividend seemingly has many extra years of progress, and the inventory is undervalued on the present value. I view Cisco as a long-term purchase.