NiseriN/iStock by way of Getty Pictures

“When a person’s neck’s in peril, he would not cease to suppose an excessive amount of about sentiment.” ― Agatha Christie

The primary half of 2022 mercilessly ended final week. The S&P 500 was down roughly 20%, the worst opening six months for this index since 1970. The NASDAQ was off some 30% whereas the small cap Russell 2000 fell roughly 25%.

Shares crumbled all through the primary half of the yr due to the best inflation ranges for the reason that early 80s, document fuel and diesel costs, horrid client sentiment and rising rates of interest. The struggle in Ukraine solely added to these woes and this battle is prone to drag on for at the least the top of the yr and no severe peace talks are presently ongoing.

So what is going to the second half of 2022 carry for battered traders? 3 predictions are highlighted beneath.

Recessionary Fears Develop into Properly Based:

The U.S. Administration and different authorities officers maintain stating {that a} recession just isn’t ‘inevitable‘. Sadly, many of those identical officers have been articulating inflation was going to be ‘momentary‘ and ‘transitionary‘ as 2022 commenced as effectively. They seem like they are going to be simply as prescient this time round.

The very fact is that for many shoppers, the recession has already began. With wage progress operating 5 to 6 p.c yearly and inflation operating north of eight p.c, the common client has misplaced shopping for energy for 15 straight months. This has depleted financial savings as the common financial savings price is now again beneath 5 p.c, the bottom since 2008.

The decrease and center earnings rungs have been notably stung by rising costs as a big chunk of this inhabitants commutes and/or rents. With rents up within the center teenagers on common final yr, fuel up greater than 50% and grocery costs rising by greater than 10%; these shoppers have been put in a vice.

They are going to possible be joined by the higher earnings strata briefly order. The inventory market evaporated $11 trillion price of worth within the first half of the yr. It will result in a destructive ‘wealth impact‘. Layoffs can even improve within the months forward because the financial system enters a recession. Shopper sentiment, which is already at historic lows, will fall additional.

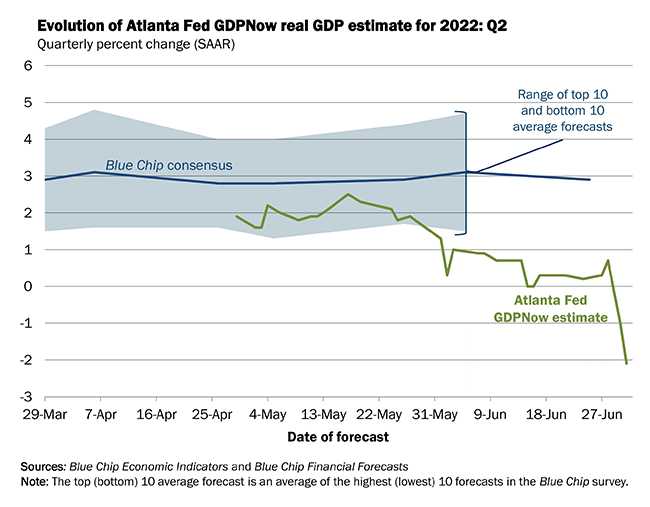

Blue Chip Financial Forecasts

With the patron making up practically 70% of the financial system, it’s simple to see why financial projections maintain getting revised down. The Atlanta Fed’s GDPNow simply radically decreased its projection of second quarter GDP progress to a destructive 2.1%. If this forecast is even near right, the nation is already in a technical recession after the destructive 1.6% efficiency within the first quarter of this yr, which the ‘consultants‘ attributed to ‘momentary changes‘. Sound acquainted? Acknowledgement that the nation is in recession can be a constant theme this summer time.

Power Sector Ends Its Outperformance:

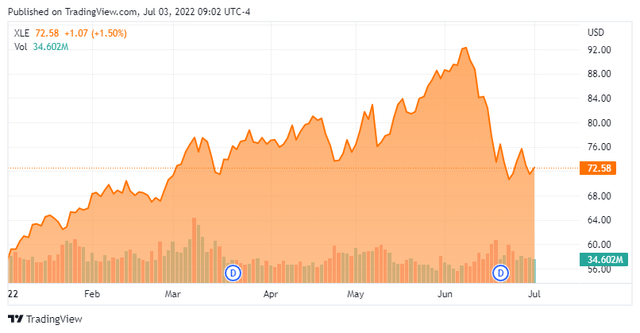

Power was one of many few brilliant spots available in the market throughout first half of the yr. The Power Choose Sector SPDR ETF (XLE) rose practically 25% whilst a lot of the remainder of the fairness universe was cratering. The sector benefited from hovering costs for crude oil and pure fuel. This the partially pushed by the struggle in Ukraine and western sanctions on Russian vitality exports.

These insurance policies, sadly however predictably, haven’t labored as designed. Russian is raking in document proceeds on the again of hovering vitality costs and the Ruble is at multi-year highs and is presently the very best performing foreign money on this planet. In the meantime, the western client has needed to take care of document fuel costs. Europe is especially susceptible to any type of pure fuel circulate stoppage as we get to winter.

In search of Alpha

There was piece on In search of Alpha this weekend stating how JP Morgan thought oil may soar to as excessive as $380 a barrel in a worse case state of affairs the place Russia reduce its output by 5 million barrels a day. Nonetheless, traditionally the remedy for prime oil costs is excessive oil costs. Oil spiked to over $145 a barrel in 2008, earlier than going into an enormous free fall because the western economies went right into a deep recession due to the monetary disaster. With recession looming right here and in Europe, vitality costs appear destine to go decrease by the top of 2022. That is already beginning to be mirrored within the steep sell-off within the vitality sector over the previous couple of weeks. I search for the vitality sector to underperform the general market within the second half of 2022.

Healthcare Sector Will Be A Winner:

Buyers are already gravitating to the ‘defensive‘ sectors of the market as financial exercise proceed to say no. Considered one of these is the healthcare sector whose revenues will maintain up significantly better than most industries in a recession state of affairs.

Recession or no recession, folks nonetheless have to get their prescriptions crammed, endure chemo remedies and have essential surgical procedures. I’ve not too long ago established lined name positions on large drug names like Merck (MRK), Gilead Sciences (GILD) and Pfizer (PFE) as I construct up publicity to this a part of the market. All three names are fairly valued, pay good dividends and have liquid choices accessible in opposition to their equities.

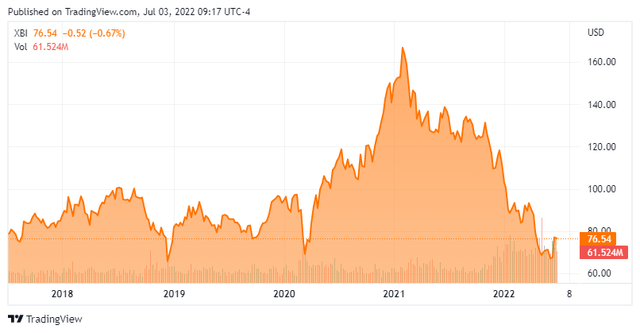

In search of Alpha

Biotech additionally seems to have bottomed not too long ago after an approximate 60% decline for the reason that starting of 2021. With a whole bunch of small biotech names promoting at or close to the online money on their stability sheets, it was onerous for the sector to go even decrease. There was additionally long run technical help creating. Given valuations and the massive money hoards at Large Pharma, I’d anticipate M&A exercise to choose up within the second half of this yr as effectively.

I do not suppose the second half of 2022 can be practically as dangerous as the primary half for traders. Barring a deep recession and/or a serious escalation within the Ukraine Warfare, in fact That mentioned, I do not consider the markets have hit backside but both. Falling financial exercise and hovering enter costs can have a considerably destructive influence on revenue margins. I anticipate second quarter earnings season to be one the place steerage will get lowered throughout most sectors of the market in addition to mirrored in downwardly revised revenue projections by analyst companies.

Subsequently, my money allocation is close to 25% and I proceed to make use of easy lined name methods throughout the vast majority of the holdings in my portfolio for added draw back danger mitigation.

And people are some ideas as buying and selling will get underway within the second half of what has been a brutal yr for traders so far.

“Any order is a balancing act of maximum precariousness.” ― Walter Benjamin