ljubaphoto

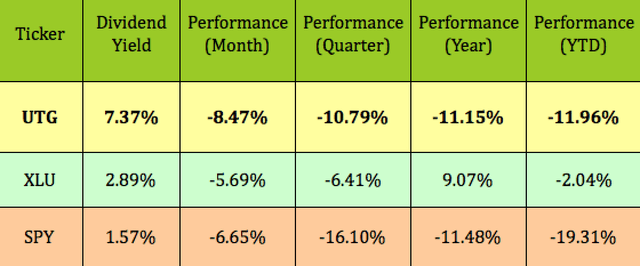

Utilities are boring, proper? Nicely, not in pullback years, just like the one we’re having in 2022. The truth is, the Utilities sector is the 2nd-leading sector to date in 2022, proper behind the Vitality sector. It has a YTD value efficiency of -2.04%, vs. -19.3% for the S&P 500 (SPY).

When you’d choose to not attempt to stock-pick, you will get broader Utilities protection by way of utility funds, such because the Reaves Utility Earnings Fund (NYSE:UTG), a closed-end fund (“CEF”).

Profile:

As the positioning states:

“The Fund’s goal is to offer a excessive degree of after-tax complete return consisting primarily of tax-advantaged dividend revenue and capital appreciation. It intends to take a position no less than 80% of its complete belongings in dividend-paying frequent and most popular shares and debt devices of firms inside the utility trade. The remaining 20% of its belongings could also be invested in different securities together with shares, cash market devices and debt devices, in addition to sure by-product devices within the utility trade or different industries.” (UTG web site)

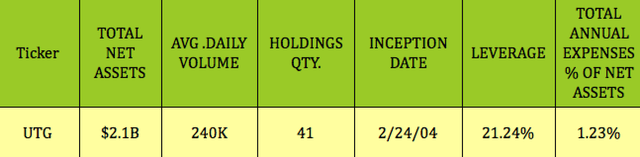

The fund has an extended observe report, having IPO’d on 2/24/2004. It has $2.1B in Web Belongings, with 41 holdings, and a 1.23% expense ratio, with common each day quantity of 240K. Administration makes use of some leverage, which was at 21.24% as of seven/6/22, up a bit vs. 19.14% in late April.

Hidden Dividend Shares Plus

Efficiency:

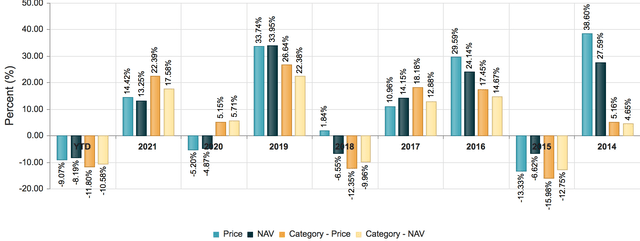

UTG outperformed the Morningstar U.S. Fairness CEF Sector in 2014 – 2016, 2018 – 2019, and has held up higher to date in 2022.

cefcnt

It has lagged the broad Utility sector, although, as represented by XLU, over the previous month, quarter, yr, and yr so far; and has outperformed the S&P over the previous quarter, yr, and yr so far:

Hidden Dividend Shares Plus

Dividends:

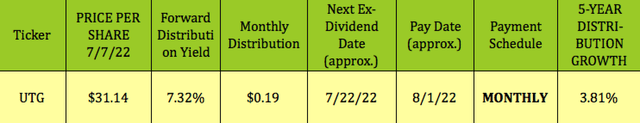

UTG pays a month-to-month distribution of $.19, with a 5-year distribution progress charge of three.81%. It has an extended historical past of dividend hikes, having raised its month-to-month payouts from $.1150 to $.1250 in 2011, with gradual hikes over the previous 10 years, together with its newest hike in July 2021, from $.18 to $.19. Its final particular distribution was $.92 in 2016.

At its 7/7/22 intraday value of $31.14, UTG yielded 7.32%. It ought to go ex-dividend subsequent on ~7/22/22, with a ~8/1/22 pay date.

Hidden Dividend Shares Plus

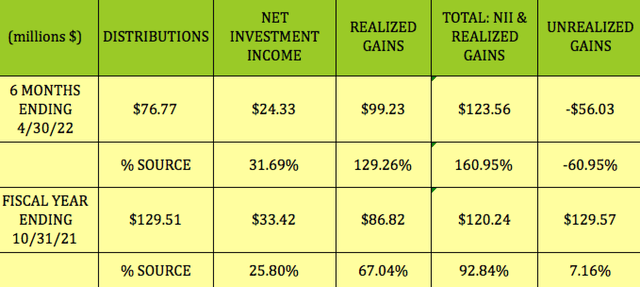

UTG’s fiscal yr ends on 10/31. It had ample distribution protection for the fiscal yr ending 10/31/21, with ~26% coming from NII, 67% coming from Realized Good points and the Steadiness from Unrealized Good points.

For the 6 months ending 4/30/22, NII lined 31.7%, and Realized Good points greater than lined the steadiness:

Hidden Dividend Shares Plus

Taxes:

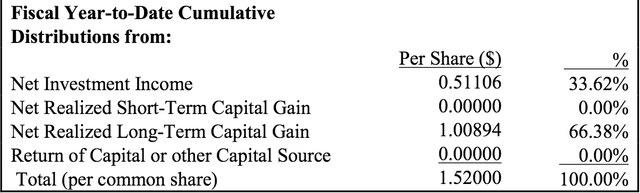

Administration estimated that 66.38% of the November ’21 – April ’22 distributions had been from long-term capital features and that 33.62% had been from NII:

UTG web site

NAV Pricing:

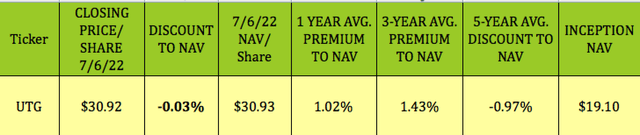

Since NAV/Share is calculated on the finish of every buying and selling day, it’s a must to have a look at the newest closing values to find out the present NAV low cost or premium.

Shopping for CEFs like UTG at a deeper low cost than its historic common reductions/premiums generally is a helpful technique, on account of imply reversion.

At its 7/6/22 closing share value of $30.92, UTG was nearly even with its NAV/Share of $30.93. That is cheaper than its 1-year common premium of 1.02%, and its 3-year 1.43% common premium, however costlier than its 5-year -0.97% low cost.

Hidden Dividend Shares Plus

Holdings:

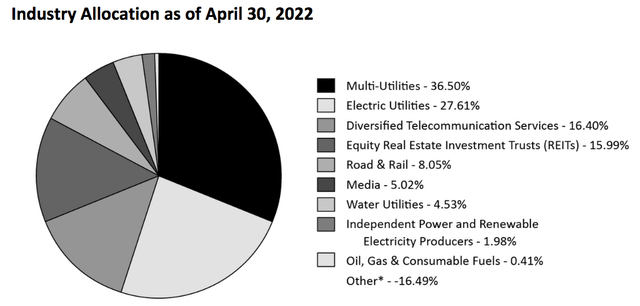

As of 4/30/22, 12/31/22, ~69% of UTG’s portfolio was comprised of Utilities, up from 55% on the finish of 2021, with Multi/Diversified and Electrical Utilities within the high 2 slots. REITs and Diversified Communications Companies had been each close to 16%. Street & Rail was ~7% and Media at 5%, respectively.

UTG web site

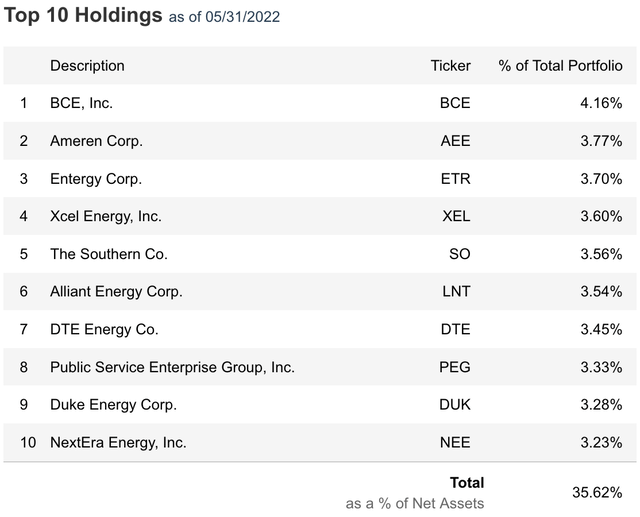

As of 5/31/22, UTG’s high 10 positions fashioned 35.62% of its portfolio, similar to 3/31/22. The one huge change within the high 10 was that CMS Vitality dropped out of the highest 10. BCE Inc. (BCE) and Ameren (AEE) remained the highest 2 positions whereas NextEra (NEE) dropped from #3, at 3.53%, to #10, at 3.23%:

UTG web site

Parting Ideas:

When you’re in search of some defensive income-generating publicity, UTG can fill the invoice. Administration has constructed up the NAV/share since inception, from $19.10 to $30.93, whereas additionally paying out engaging month-to-month distributions.

When you’re fascinated with different high-yield automobiles, we cowl them each weekend in our articles.

All tables by Hidden Dividend Shares Plus, besides the place in any other case famous.