Mihaela Rosu

I just like the Oracle (NYSE:ORCL) valuation setup, however am leery of lacking progress drivers during the last decade. I just like the Intuit (NASDAQ:INTU) strong-growth profile, however the valuation remains to be a little bit costly. That is the dilemma for buyers researching these two leaders within the enterprise software program business, each with growing give attention to cloud-based synthetic intelligence [AI].

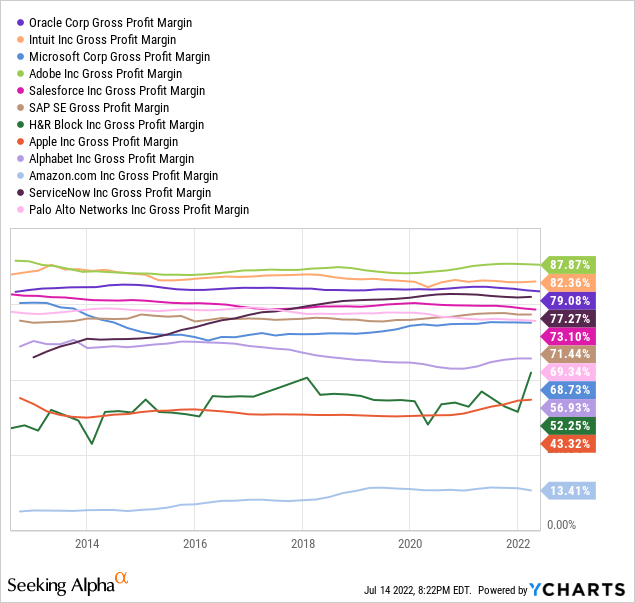

The 2 firms work at totally different ends of {the marketplace} (solely business-to-business gross sales for Oracle vs. extra of a retail mannequin for Intuit), however function with exceptional, equally excessive gross revenue margins. Gross margins for the 2 are almost the perfect of any Massive Tech peer or competing enterprise.

YCharts

Administration selections and focus appear to be conservative and deliberate at Oracle, whereas Intuit is a pacesetter in reviewing buyer surveys and rankings to reinvent its software program over time. Each have engaged in main merger offers lately to fill in gaps for choices and add new ranges of information for future AI endeavors.

Oracle is within the technique of digesting its $28 billion acquisition of Cerner, one of many world’s prime medical recordkeeping enterprises. The merger concept is medical care info will be extra successfully managed via Oracle’s cloud networks and working programs, with the mixed effort capable of develop sooner outdoors the U.S. For certain, co-founder and Government Chairman Larry Ellison has been looking for methods to extend Oracle progress charges.

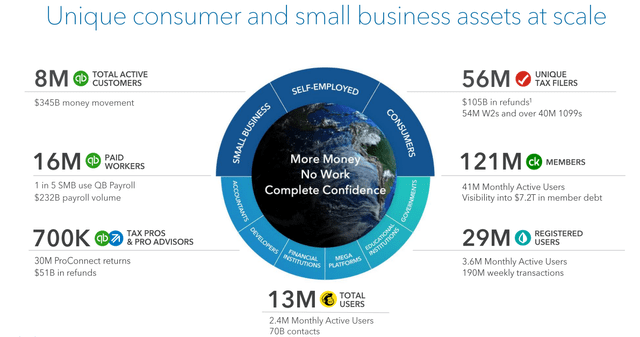

Intuit purchased Credit score Karma (a free to make use of monetary info web site) for $8 billion in 2020 and Mailchimp (e mail advertising for small enterprise) for $12 billion in 2021. Administration has been busy getting into new markets to supply small enterprise with helpful merchandise, and opening avenues to cross-sell current software program.

Working Highlights

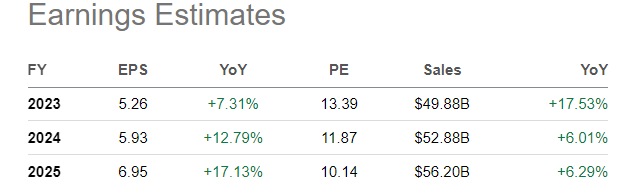

Oracle’s progress price estimates for gross sales and earnings are within the neighborhood of 9%-12% yearly. The Cerner deal was small compared to ORCL’s $190 billion inventory market capitalization, and should not transfer the needle a lot for accelerating investor curiosity.

Oracle Web site

Oracle Web site

Oracle Web site, 2022 Milestones

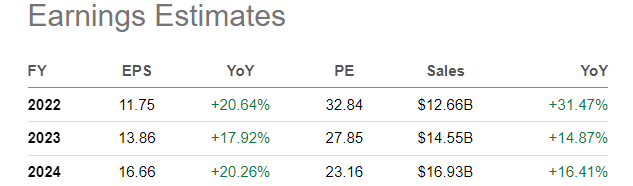

Whereas Oracle is a pacesetter in cloud and networking infrastructure, analytics, software program and options for giant enterprise, Intuit is the highest cloud software program and on-line supplier for small companies in America, operating QuickBooks, TurboTax, Mint (finances monitoring and monetary administration), Credit score Karma, and Mailchimp, amongst different in style names. Intuit has projected underlying progress charges of 15%-20% yearly the subsequent 5 years vs. an fairness capitalization of $105 billion immediately.

2022 Annual Shareholders Assembly Presentation

2022 Annual Shareholders Assembly Presentation

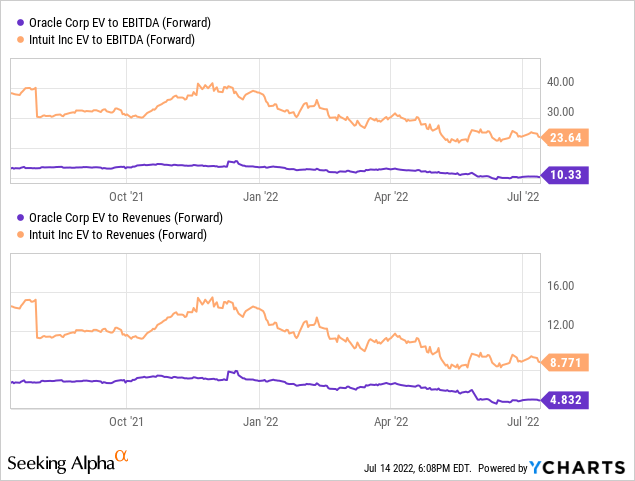

Valuations

Let’s shortly run via some investing information factors for comparability. In case your purpose is low upfront valuations of the working enterprise, Oracle seems just like the clear winner. Assuming a zero-growth future for each organizations, Oracle could be the higher selection, fingers down. Enterprise worth, together with fairness and debt capitalizations, to ahead projected EBITDA or Revenues favors Oracle as the discount selection.

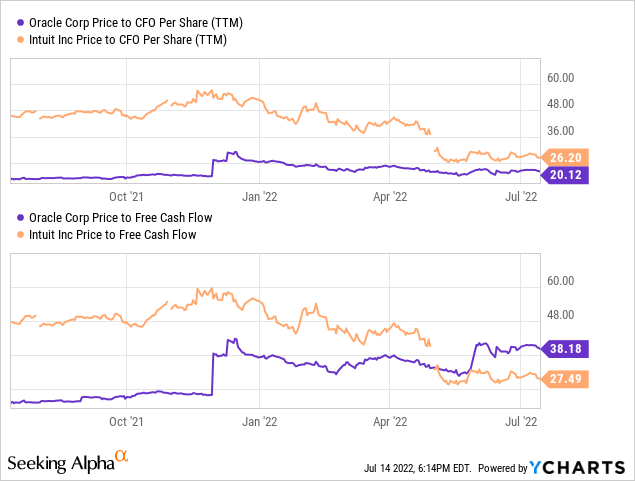

YCharts

Nevertheless, money move valuations are significantly nearer to one another. In truth, worth to “trailing” free money move technology favors Intuit (good for an almost 4% free money move yield at $385 per share).

YCharts

Enterprise Development and Funding Returns

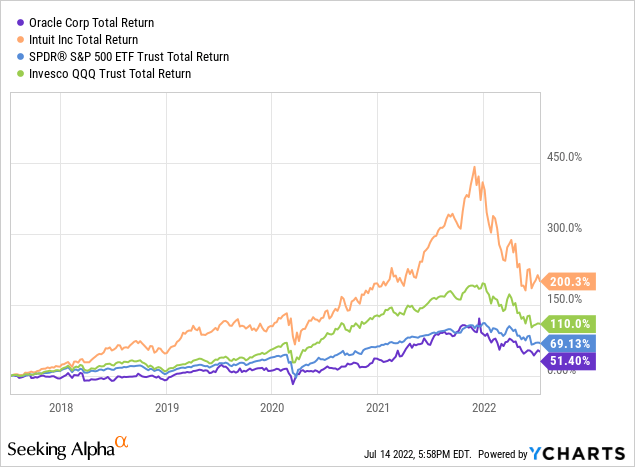

In case your funding purpose is maximized good points to your brokerage account, Intuit’s glorious degree of progress has pushed a fabric worth advance. Trailing whole returns have extra intently adopted progress charges within the underlying companies since 2020, with Intuit because the best choice.

YCharts

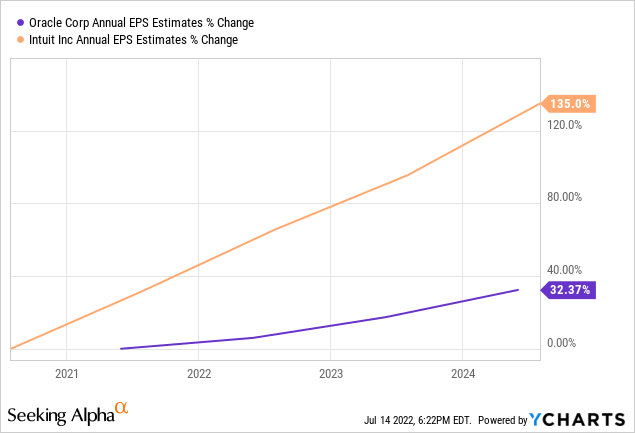

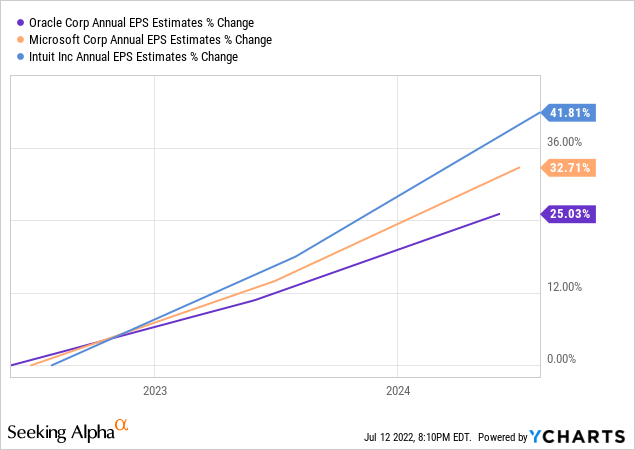

And, Intuit is projected to develop a lot sooner than Oracle for years to return, highlighted on the consensus estimate tables under.

ORCL, Looking for Alpha – Analyst Estimates – July thirteenth, 2022

INTU, Looking for Alpha – Analyst Estimates – July thirteenth, 2022

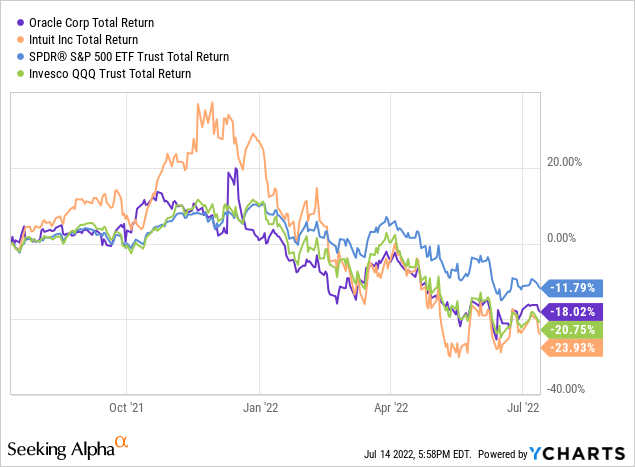

Since late 2021, each have suffered from the rise in rates of interest and a looming financial slowdown, identical to Wall Road equities usually or different Massive Tech choices. Funding losses over the previous 12 months are hovering round -20% for each Oracle and Intuit.

1-12 months Complete Returns, YCharts

But, the distinction in progress charges has made a huge effect on investor returns over longer intervals of time. On a 5-year efficiency chart, whole returns together with worth appreciation and dividends have favored Intuit’s fast progress. INTU has extensively outperformed Oracle, the SPDR S&P 500 ETF (SPY) and Invesco NASDAQ 100 ETF (QQQ).

5-12 months Complete Returns, YCharts.com

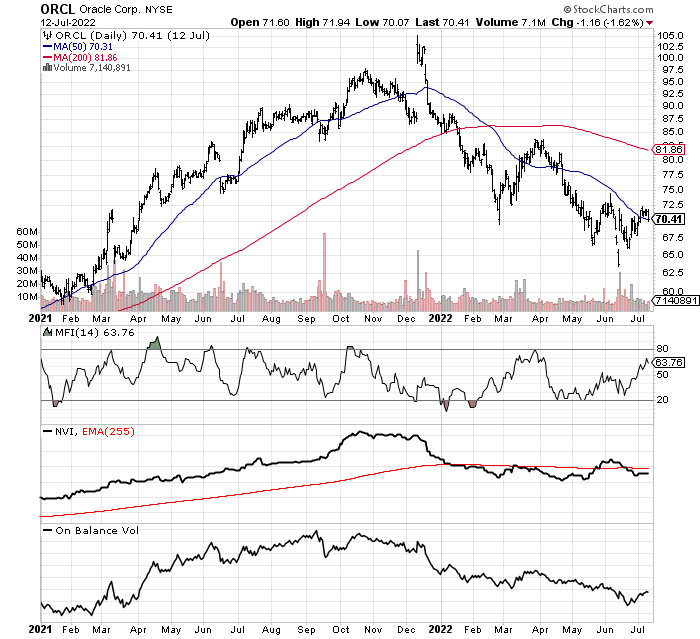

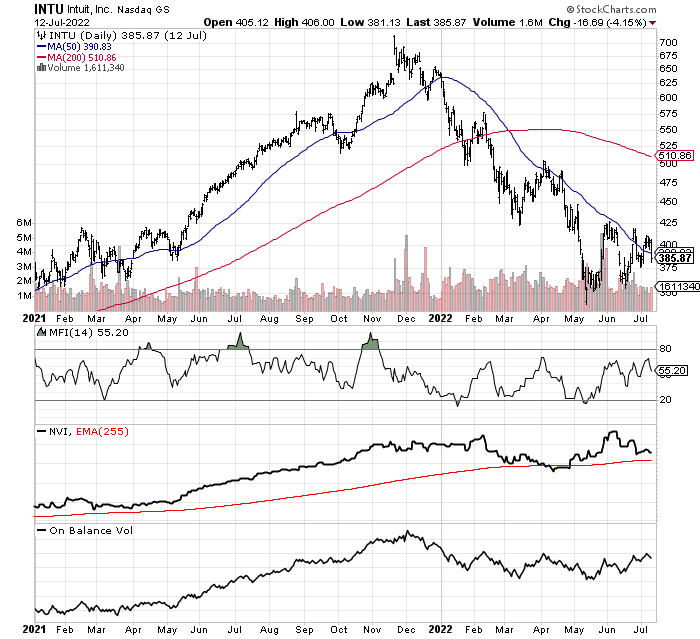

Momentum Tiebreaker

If you get down to some picks with simply as many professionals and cons to weigh vs. the opposite, I defer to the buying and selling momentum image to make my closing judgment. Total, I do discover Intuit’s underlying long-term technical indicators are holding up higher, a few of them drawn beneath the worth/quantity stats on the 18-month chart under. Particularly, the stronger Adverse Quantity Index and On Stability Quantity stats are noteworthy for Intuit, regardless of a steeper share worth decline. So, in my closing comparative evaluation, I imagine Intuit is the extra clever long-term purchase, no matter its greater upfront valuation immediately.

StockCharts.com

StockCharts.com

What If They Merged Operations?

When researching this text, I had a loopy thought. Placing the 2 collectively would create one of many world’s prime cloud and enterprise software program/options sellers for everybody within the working world, with cross-selling potentialities and future synthetic intelligence [AI] information gathering/parsing/studying to assist productiveness throughout the board. An instance of merger synergies, Oracle may lengthen its accounting software program attain with the QuickBooks identify as a starter bundle for extra superior company-specific functions.

Right here’s my theoretical proposal: Oracle may use assist with outside-of-the-box pondering on enabling enterprise buyer effectivity. Intuit may gain advantage from bigger information scale and a better introduction to worldwide markets with the precise associate. Oracle would have higher direct entry promoting its cloud merchandise to tens of tens of millions of current Intuit clients. The Intuit ecosystem is a a lot bigger pond and will finally funnel profitable enterprise clients to Oracle merchandise, a operate of current goodwill constructed over time.

Collectively, the AI potentialities sooner or later are fairly mindboggling, with an lively shopper/person footprint as excessive as 200 million in 5 years (Intuit’s purpose quantity vs. 430,000 present clients for Oracle). Why not use Intuit’s excessive rankings by clients to your benefit?

A “New” Microsoft?

If you’ll, Oracle/Intuit may turn into the “new” Microsoft (MSFT), with a full complement of choices for each a part of the enterprise neighborhood. For a theoretical buy worth, I’m assuming an all-stock Oracle bid with a slight 20% worth premium paid for Intuit (extra of a merger of equals).

You’ll suppose including a considerably totally different enterprise software program agency with a retail focus vs. Oracle’s networking software background may alter administration decision-making in a damaging manner. Maybe, however Microsoft’s energy is providing every thing from client software program and working programs on the retail degree all the way in which as much as cloud and networking providers for giant enterprise. The enlargement of brand name identify consciousness and cross-selling of providers is the great thing about Microsoft’s enterprise mannequin. Apple (AAPL), Alphabet/Google (GOOG) (GOOGL), and Amazon (AMZN) are operating the identical method to a lot greater enterprise progress charges and investor returns than Oracle. To a level, Oracle’s legacy enterprise is caught in a slower progress place, because it competes with a brief record of well-heeled multinationals for a similar massive enterprise pie of cloud and networking spend.

Trying ahead, a wedding of estimated progress charges the subsequent two years would get the mixed firm nearer to Microsoft’s top-tier forecast within the cloud and software program providers space of Massive Tech.

YCharts

On a 20% premium supply for Intuit, mixed enterprise worth on ahead revenues could be an estimated 6.9x a number of. For this greater margin enterprise, the relative valuation could be a stable 20% low cost to the analyst estimated 8.5x a number of for Microsoft. (Keep in mind: each Oracle and Intuit generate far greater gross revenue margins on gross sales within the 80% vary vs. Microsoft’s present 69%.)

EV to ahead EBITDA for the merged firm could be about the identical as Microsoft’s estimate. Nevertheless, my proposed mixed worth to ahead 1-year earnings a number of of 17.5x would roughly stand at a 15% low cost to Microsoft’s 20.5x ratio.

The purpose of this train is a mix of Oracle and Intuit belongings would initially be priced at a reduction to Microsoft’s valuation, with an outlook simply as vibrant. Greater than doubtless, establishments and mutual/hedge funds could be very excited to personal an equal progress price, greater margin blue-chip enterprise than Microsoft within the U.S. excessive tech area.

Remaining Ideas

Intuit is sweet for a starter place at $385, however I’m nonetheless in search of decrease quotes within the weeks/months forward. I price INTU between a Purchase and Maintain presently. My view is additional outsized weak spot in Intuit ought to completely be purchased by long-term buyers. Costs nearer to $300 a share could be robust purchase territory. I price Oracle extra of a market-performer or Maintain in a weakening financial surroundings, as at the moment positioned. After all, decrease pricing would carry a extra compelling bullish argument.

Nonetheless, a totally built-in cloud options/software program firm capable of promote to each and any enterprise outfit in America (via each back-office and retail gross sales) could possibly be really fascinating to personal. Whereas Intuit is just not the plain selection for a takeover play by Oracle, I imagine it provides a novel likelihood to kick-start working progress charges and Wall Road curiosity. A mix of progressive providers/platforms for small enterprise with Oracle’s give attention to massive tech, massive enterprise, massive information may open all types of cross-selling alternatives and improve the Oracle model identify with customers/clients.

As AI problem-solving turns into extra widespread in our data-driven world, the merged organizations would have distinctive choices and scale to assist companies develop all through their lifecycle. Entry to very large quantities of Intuit information on small enterprise actions could be the AI icing on the cake to focus on larger efficiencies and new merchandise for American enterprise success. The mixed effort would rival Worldwide Enterprise Machines (IBM), Meta Platforms (META), Microsoft, Apple, Amazon and Alphabet for potential AI income success.

What are the chances of my psychological train taking place in the true world? I might guess the chances are low, however the concept is worth it to ponder. I’m assured an Oracle/Intuit marriage would drastically enhance and diversify the prospects for both set of shareholders vs. a standalone setup.

Thanks for studying. Please think about this text a primary step in your due diligence course of. Consulting with a registered and skilled funding advisor is advisable earlier than making any commerce.