Caziopeia/E+ by way of Getty Photos

Funding thesis

In January 2021, I wrote an article about Nationwide Presto Industries (NYSE:NPK) the place I concluded that the pandemic was going to be a turning level in relation to gross sales, which had been in steady decline for a decade, as many households thought-about updating their residence home equipment resulting from necessary lockdowns, making them purchase extra of their merchandise. The corporate additionally made sturdy efforts to construct the protection merchandise section, which ought to in the end assist the corporate stabilize gross sales, though the section nonetheless represents a marginal a part of the corporate and is producing losses. Nonetheless, the share value appeared too excessive because the latest improve within the P/S ratio was not being accompanied by elevated margins whereas the money payout ratio reached ranges that made the particular dividends paid in recent times unsustainable resulting from reducing money from operations in 2020.

Definitely, the coronavirus pandemic disaster helped the corporate as web gross sales elevated by 14.3% in 2020, though the rise in 2021 was solely 0.89% in comparison with 2020 and the primary quarter of 2022 was considerably disastrous. However, the backlog of the protection section has considerably elevated throughout 2021, which anticipates a major rise in gross sales within the subsequent few years. Regardless of this excellent news that means that the corporate is recovering among the floor misplaced in recent times, revenue margins have been significantly affected by present macroeconomic occasions: provide chain points, rising uncooked materials, power, and transport prices, and labor shortages. This has prompted a pointy drop within the share value of ~25% since I wrote the final article, however a really versatile dividend coverage together with non-existent debt put the corporate in a really advantageous place to outlive these headwinds. Moreover, the Protection section, which is poised to develop considerably, historically loved a lot wider margins than the corporate’s general operations, so margins ought to enhance within the quick time period.

For that reason, I imagine that the present macroeconomic occasions, which I strongly imagine are short-term, current a possibility for buyers fascinated with buying shares at an inexpensive value, particularly long-term dividend buyers. On this sense, the worth of shares now seems rather more cheap in comparison with January 2021, so plainly it’s a good time to think about including this firm to comparatively conservative dividend portfolios.

A quick overview of the corporate

Nationwide Presto Industries is a designer, producer, and distributor of small electrical home equipment, weapon ammunition, cartridge circumstances, precision mechanical and electro-mechanical assemblies, detonators, booster pellets, launch cartridges, lead azide, and different army energetic units and supplies, in addition to progressive security expertise for organizations and people. The corporate was based in 1905 and insiders personal a whopping 28.26% of the corporate’s shares, which signifies that the administration actively participates as shareholders. Presently, the market cap stands at ~$470 million, making it a small-cap firm.

Nationwide Presto Industries merchandise (Gopresto.com/product)

The corporate’s operations are divided into three important segments: the Housewares/Small Equipment section, which offered 33% of consolidated gross sales in 2021, the Protection section, which offered 66% of gross sales in 2021, and the Security section, whose gross sales have been marginal in 2021 at 0.1% as the corporate continues to be constructing it by way of two startup corporations: Rusoh, Inc., which manufactures fireplace extinguishers, and OneEvent Applied sciences, Inc., which designs methods for early warnings to keep away from important losses.

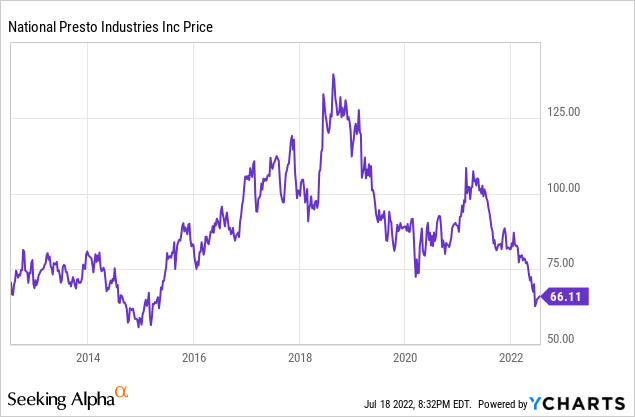

Presently, shares are buying and selling at $66.11, which represents a 24.39% decline because the final article I wrote and a 52.55% decline from all-time highs of $139.35 on August 21, 2018. This value has damaged the psychological barrier created after the coronavirus pandemic crash again in 2020, so I feel it is vitally necessary to think about the potential of buying shares for the long run at this level, particularly contemplating the corporate often pays very juicy particular dividends.

Web gross sales continue to grow because the backlog elevated considerably

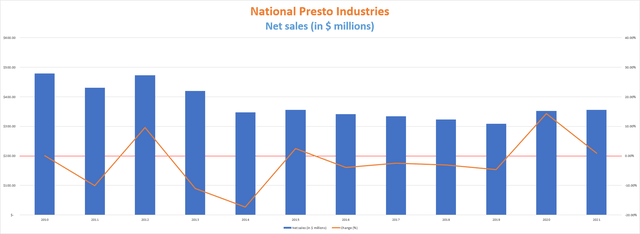

Web gross sales have skilled a steady decline during the last decade, partly because of a very beneficiant distribution of dividends that restricted a extra energetic coverage of mergers and acquisitions and expansions. Fortunately for the corporate, the coronavirus pandemic disaster represented a turning level as web gross sales elevated by 14.3% yr over yr in 2020 resulting from elevated demand from folks updating their houses and kitchens throughout necessary lockdowns.

Web gross sales (10-Okay filings)

In 2021, the rise was marginal at 0.89%, though this meant that the rise in gross sales skilled in 2020 managed to be sustained throughout 2021. The issue got here in the course of the first quarter of 2022, when the corporate reported a web gross sales decline of 25.02% in comparison with the identical quarter of 2021, which advised the lack of all the bottom gained in the course of the pandemic, on prime of the present concern of tighter margins.

The backlog of the protection section elevated by 43.9% in 2021 to $460.8 million, and these are anticipated to be translated into gross sales in an 18 to 36-month interval. This improve is way greater than the rise of three.17% yr over yr throughout 2020 for the section. Web gross sales within the Housewares/Small Equipment section declined by 1.5% in 2021 after a rise of 16.62% in 2020, however it was offset by a rise of two% yr over yr within the Protection section.

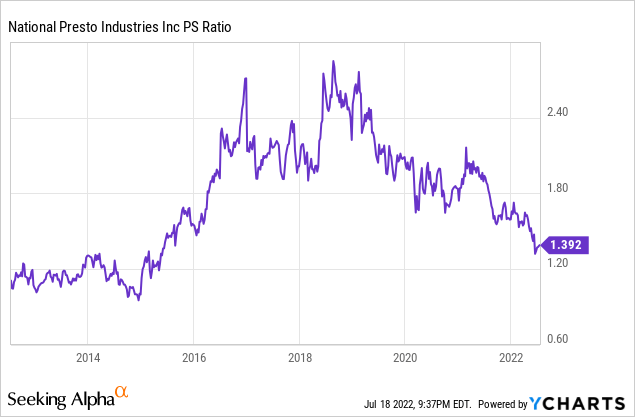

On this sense, the decline within the share value skilled within the final yr has prompted the PS ratio to plummet as gross sales are displaying critical difficulties to be elevated in a sustainable method. The PS ratio at present stands at 1.392, which suggests the corporate generates $0.71 in gross sales for every greenback held in shares, yearly.

On this sense, we now have two simultaneous headwinds for Nationwide Presto: reducing web gross sales within the quick time period, and tighter revenue margins, which signifies that these restricted gross sales will not be being translated into money from operations as simply as up to now resulting from elevated value of products bought.

Margins are briefly depressed and it isn’t recognized till when, however we’ve got some clues

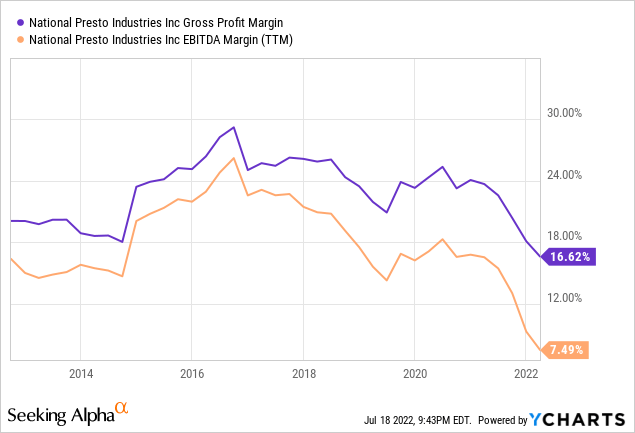

The corporate has traditionally loved very wholesome revenue margins, however the coronavirus pandemic and the next rise in the price of uncooked supplies, transportation, and power, in addition to provide chain points and labor shortages skilled all over the world, have taken a toll on the corporate’s skill to transform gross sales into precise money. And now, the struggle between Russia and Ukraine is additional complicating the threads that construct commerce relations across the globe.

Moreover, the truth that margins for the primary quarter of 2022 have been decrease than the trailing twelve months’ means that these difficulties are nonetheless getting worse as of not too long ago. Persevering with on this line, gross revenue margins of 15.98% in the course of the first quarter of 2022 are barely decrease than the trailing twelve months’ gross revenue margins of 16.62%, and EBITDA margins of 6.25% in the course of the quarter are additionally barely decrease than EBITDA margins of seven.69% over the past twelve months.

Nonetheless, we must always remember the fact that such a drop in margins is comparatively justified on condition that the world is at present going through excessive charges of inflation, and lots of consumer-focused corporations like Nationwide Presto have not had sufficient time to cross on the rise in prices to clients because of persistent inflation. For that reason, I imagine that after inflation eases, the discrepancy between the ultimate value of the corporate’s merchandise and the price of producing them will widen once more.

Moreover, and taking 2021 as a reference, the Protection section returned gross revenue margins of 25.55%, a lot greater than the 8.60% reported within the Housewares / Small Equipment section. Due to this fact, the rise within the backlog within the Protection section throughout 2021 might translate into important enhancements within the margins of the corporate’s operations as a complete within the medium time period.

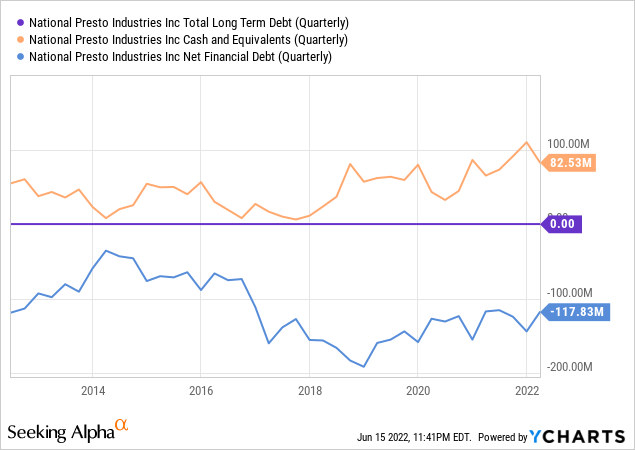

The corporate stays debt-free

One of many firm’s strongest factors is that it enjoys a destructive web debt because of the non-existence of debt. Regardless of all of the setbacks which can be at present hitting the corporate’s operations, the chance of chapter or critical issues is enormously diminished because of the truth that it doesn’t need to face the fee of curiosity on any debt.

As well as, the corporate has over $80 million of money readily available, so it nonetheless has reserves to proceed going through headwinds whereas investing in development initiatives. It is extremely troublesome right now to search out such established corporations with destructive web debt, and this maximizes the chances of enlargement of any firm whereas minimizing its dangers in troublesome occasions like the current.

The dividend coverage may be very versatile

It is extremely necessary to know the corporate’s dividend coverage, which is strongly influenced by the excessive publicity of the administration to the inventory, earlier than investing if we intend to have a dividend stream. The corporate often pays a set dividend of $1 per yr plus a particular dividend which is variable relying on the outcomes of the corporate’s annual operations.

| 12 months | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

| Whole dividend (fastened + particular) | $5.05 | $4.05 | $5.05 | $5.50 | $6 | $6 | $6 | $6.25 | $4.50 |

In February 2022, the administration introduced a particular dividend of $3.50 per share along with sustaining the common dividend of $1. This represents a major discount in comparison with latest years, however a crucial transfer because of the excessive money payout ratio skilled throughout 2019, 2020, and 2021.

| 12 months | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Money from operations (in $ thousands and thousands) | $73.21 | $46.28 | $44.56 | $52.96 | $39.94 | $9.58 | $40.97 | $34.69 |

| Dividends paid (in $ thousands and thousands) | $34.95 | $28.11 | $35.16 | $38.41 | $41.99 | $42.09 | $42.17 | $44.08 |

| Money payout ratio | 47.74% | 60.75% | 78.90% | 72.52% | 105.13% | 439.18% | 102.93% | 127.08% |

On this sense, money from operations has been not sufficient to cowl dividend bills for 4 years in a row, which has pushed administration to be slightly extra conservative when declaring the particular dividend for 2022. This reveals how handy it’s to have a versatile dividend coverage the place extra earnings are added to a small common dividend.

You will need to word that the particular dividend will possible stay decrease than regular for so long as the present headwinds persist, and because of this I think about that Nationwide Presto is a guess for long-term dividend buyers, relatively than short-term yield seekers.

Dangers value mentioning

The corporate’s gross sales have suffered in the course of the first quarter of 2022, which means that the expansion skilled in 2020 and 2021 has really been short-term. Even so, the numerous improve of 43.9% within the backlog within the Protection section ought to translate into a rise in gross sales within the medium time period.

Along with the limitation in gross sales development, we should have in mind that the corporate has misplaced numerous capability to transform stated gross sales into precise money. Fortunately, the Protection section involves the rescue because it traditionally loved wider margins than the Housewares / Small Equipment section. Due to this fact, the rise in gross sales on this section resulting from elevated backlogs will very possible symbolize a breath of contemporary air for the corporate’s operations, which can enormously improve its resistance to present headwinds associated primarily to the present excessive inflation charges.

I might additionally like to say that over the past 4 years, the money payout ratio (the amount of money from operations used to pay dividends) has been above 100%, so buyers shouldn’t anticipate particular dividends as excessive as in earlier years within the quick and medium-term. For the time being, the corporate enjoys constructive money readily available, however in the long run, it’s unsustainable to proceed paying the particular dividends that buyers are used to. Even so, it is vitally possible, if we have in mind the dividends paid within the final decade, that there’ll proceed to be particular dividends within the coming years, though these will nearly definitely be smaller than up to now, one thing that has already begun to occur in 2022.

Conclusion

It is extremely necessary to know what an investor is uncovered to when buying Nationwide Presto shares. Within the first place, the corporate has an extended historical past behind it and the administration has a big portion of the shares, which ought to construct confidence amongst buyers. However alternatively, the present state of affairs is kind of delicate.

The administration appears to have a brand new alternative to develop gross sales, which have fallen once more after the enhance from necessary lockdowns in the course of the coronavirus disaster in 2020 and a part of 2021. On this sense, hopes now lie with the Protection section, which is experiencing a really important backlog spike. This is essential for the way forward for the corporate because the Protection section traditionally loved wider margins than the standard Housewares / Small Equipment section. Which means that the corporate has an awesome alternative to offset present headwinds associated to labor shortages and elevated manufacturing prices whereas growing its gross sales.

For these causes, and contemplating that the worth has continued to say no, I imagine that Nationwide Presto at present trades at enticing costs for long-term dividend buyers in comparison with January 2021.