Andy Feng

NIO Inc. (NYSE:NIO), a Chinese language electric-vehicle agency, is going through vital issues, which may worsen in 2022. Regardless of benefiting from a supply bounce in June, NIO is coping with lowering supply progress prospects in China and could provide fewer electric-vehicles this yr than final.

The Securities and Trade Fee lately short-listed NIO as a possible de-listing contender.

Given the present macro background and progress constraints, I imagine NIO is overvalued and that the corporate has an inexpensive worth of not more than $10.

Causes For NIO’s Horrible Efficiency

As I discussed in my earlier submit ‘NIO: Shedding The EV Race – Half II’, NIO’s progress has slowed considerably in 2022, and NIO’s second quarter supply milestones have not helped issues.

NIO has underperformed when it comes to each supply progress and inventory worth efficiency in 2022. With elevated hurdles within the electric-vehicle market corresponding to rising competitors, strategies to slash electric-vehicle subsidies in China by as much as 30%, Covid-19 outbreaks, and supply-chain issues, NIO’s outlook for setting a brand new supply file in 2022 has drastically deteriorated.

NIO’s output volumes dropped considerably within the first and second quarters resulting from supply-chain difficulties and Covid-19 outbreaks. In consequence, NIO has underperformed each its electric-vehicle friends and market expectations.

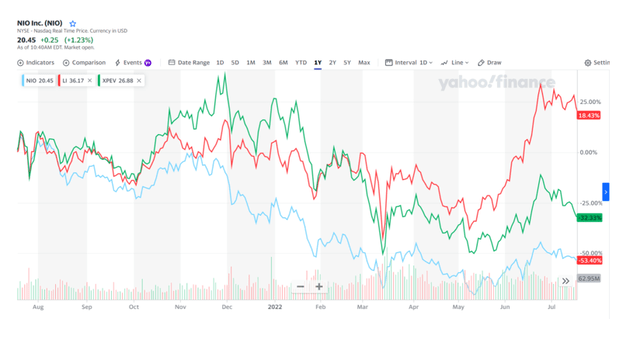

An funding in NIO made a yr in the past resulted in a valuation haircut of 53% of its worth, whereas friends corresponding to XPeng (XPEV) and Li (LI) fared much better. A yr in the past, for instance, an funding in Li yielded 18%.

Share Worth Comparability (Yahoo Finance)

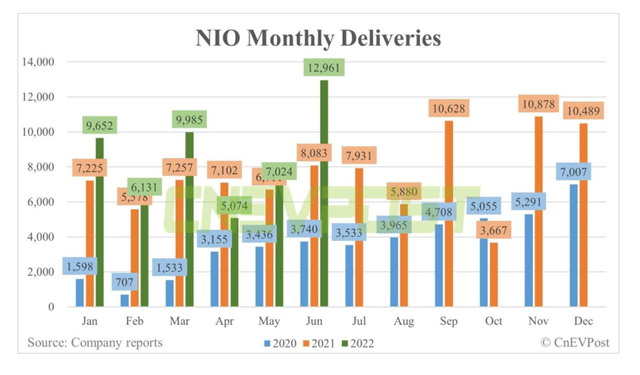

NIO delivered 5,074 and seven,024 electric-vehicles in April and Might, respectively, whereas progress slowed to five% YoY in Might. In the identical interval final yr, the expansion fee was 95%, indicating a major lower.

Even when NIO’s progress accelerated in June, with deliveries of 12,961 electric-vehicles, the query is how sustainable this fee of growth can be sooner or later.

Month-to-month Deliveries (CnEVPost)

NIO delivered 25,059 electric-vehicles within the three months ending June 2022, representing a pitiful 14% YoY progress fee. Within the three months ending June 2021, NIO delivered about the identical variety of electric-vehicles, 21,896, whereas rising deliveries by 111.9% YoY. The numerous lower in NIO’s progress fee from 111.9% to 14.4% signifies that final yr’s optimistic progress forecasts have been overstated.

The inference is that NIO’s supply progress is falling in need of forecasts, pointing to additional difficulties for NIO’s inventory. At the moment supply fee, NIO could also be content material with delivering 100,000 electric-vehicles in 2022, and there’s a sturdy potential that NIO could fall in need of exceeding its 2021 deliveries.

NIO delivered 91,429 electric-vehicles in 2021, representing a 109.1% improve YoY. All it takes for NIO to disappoint right here is one other surge in Covid infections and supply-chain points to persist for a little bit longer.

Traders Nonetheless Ignoring De-Itemizing Dangers

As if NIO’s slowing supply progress wasn’t sufficient of a priority to justify the corporate’s worth, the Securities and Trade Fee named NIO within the second quarter as one in all 80 companies that probably threat de-listing of their ADR shares underneath the Holding International Corporations Accountable Act. In consequence, NIO listed its Class A strange shares on the Singapore Inventory Trade.

Below the Holding International Corporations Accountable Act, the Securities and Trade Fee can prohibit the buying and selling of ADR shares of an organization that has been audited, however whose working materials can’t be audited by the Public Firm Accounting Oversight Board. This subject seems to be primarily uncared for by U.S. buyers.

NIO’s Truthful Worth Is $10

Even with generosity, I battle to see a good worth a lot larger than $10. China is slashing electric-vehicle subsidies, which could gradual demand and dampen NIO’s supply prospects sooner or later.

NIO’s present gross sales a number of is unsustainable in gentle of a major slowdown in deliveries and gross sales, and the inventory is overpriced in my view. Regardless of threat elements that basically weaken belief in NIO’s capability to proceed its U.S. ADR de-listing and lowering supply prospects, buyers worth NIO’s electric-vehicle progress at 5.5 occasions gross sales.

If there’s proof that the supply-chain state of affairs will deteriorate extra in 2022 or 2023, NIO’s valuation would fall once more.

NIO PS Ratio (YChart)

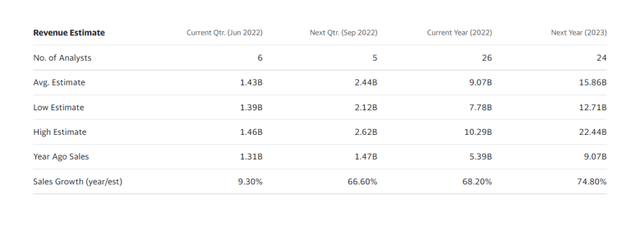

The market expects NIO to earn $15.9 billion in income subsequent yr. With a market capitalization of $35 billion, NIO has a gross sales a number of of two.2x based mostly on ahead gross sales.

Contemplating that NIO is experiencing a major slowdown in its operations, in addition to manufacturing difficulties and supply-chain points, NIO could barely exceed 2021 deliveries.

At 2.2x income, I imagine NIO continues to be considerably overvalued. On condition that the company is coping with so many different dangers on the similar time, paying 1.0-1.1x appears extra applicable. Based mostly on a 1.1x gross sales a number of, NIO’s inventory is value nearer to $10 than $20.

Income Estimate

Why NIO May See A Increased Valuation

Markets consistently revise their evaluation of an organization’s elementary value. And the prognosis for electric-vehicle corporations can shift very quick, relying on what subject of the day makes the information.

NIO’s inventory worth has fluctuated from $11.67 – $47.38 within the earlier yr, and the inventory will proceed to be risky. The funding thesis shifts if electric-vehicle producers resolve their manufacturing obstacles, which necessitates a supply-chain resolution. A rise in NIO’s gross sales would even be a constructive signal that the inventory is about to exit its downtrend.

My Conclusion

Given the present market surroundings and lowering progress, NIO’s prospects are costly, and the corporate may face a fair decrease gross sales a number of, particularly if buyers start to just accept solely a modest rise in deliveries relative to 2021.

The dangers are far greater than the market at the moment represents, implying that NIO’s inventory would possibly fall by 50%. Given the present risk-reward state of affairs, I do not imagine NIO has the next truthful worth than $10.