Galeanu Mihai

CrowdStrike (NASDAQ:CRWD) has crashed alongside the remainder of tech. In contrast to many tech victims which have been arguably outright bubbles, CRWD is legitimately a high-quality firm that simply obtained a bit of too near the solar. The cybersecurity sector stays a high-growth secular story as evidenced by the corporate’s capability to maintain elevated progress charges. Whereas CRWD continues to be not as low cost as different tech shares even after the crash, the corporate’s secular progress, optimistic money movement era and powerful steadiness sheet make it a buyable risk-reward out there right now.

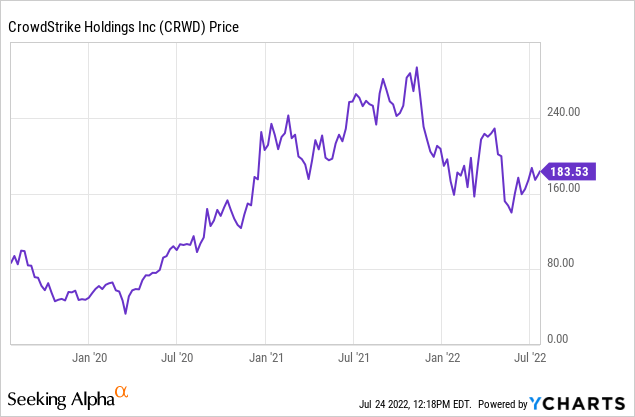

CRWD Inventory Worth

CRWD peaked at $298 per share in late 2021 and lately traded arms at round $184 per share.

I final coated CRWD in April after I known as it a purchase on account of the market-beating potential. The inventory has since fallen one other 21%, bettering the valuation proposition additional.

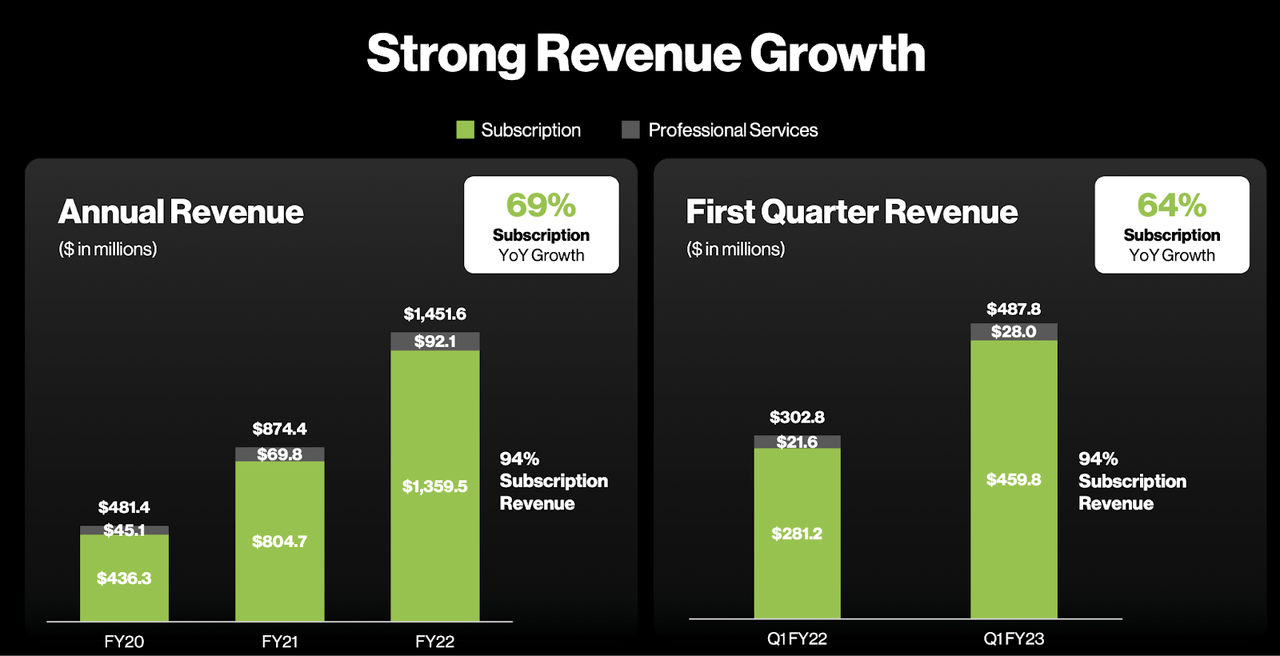

CRWD Inventory Key Metrics

CRWD is without doubt one of the few tech corporations that has not skilled a melancholy in progress charges post-pandemic. The corporate confirmed 64% progress within the newest quarter after posting 69% progress final yr.

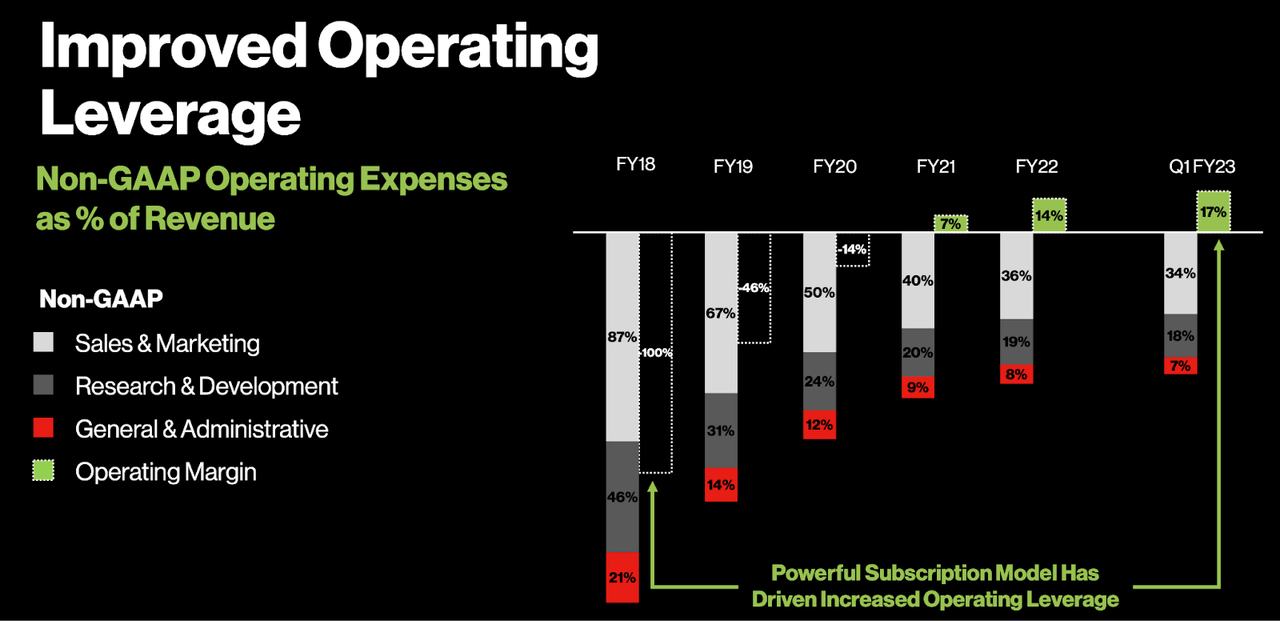

FY23 Q1 Presentation

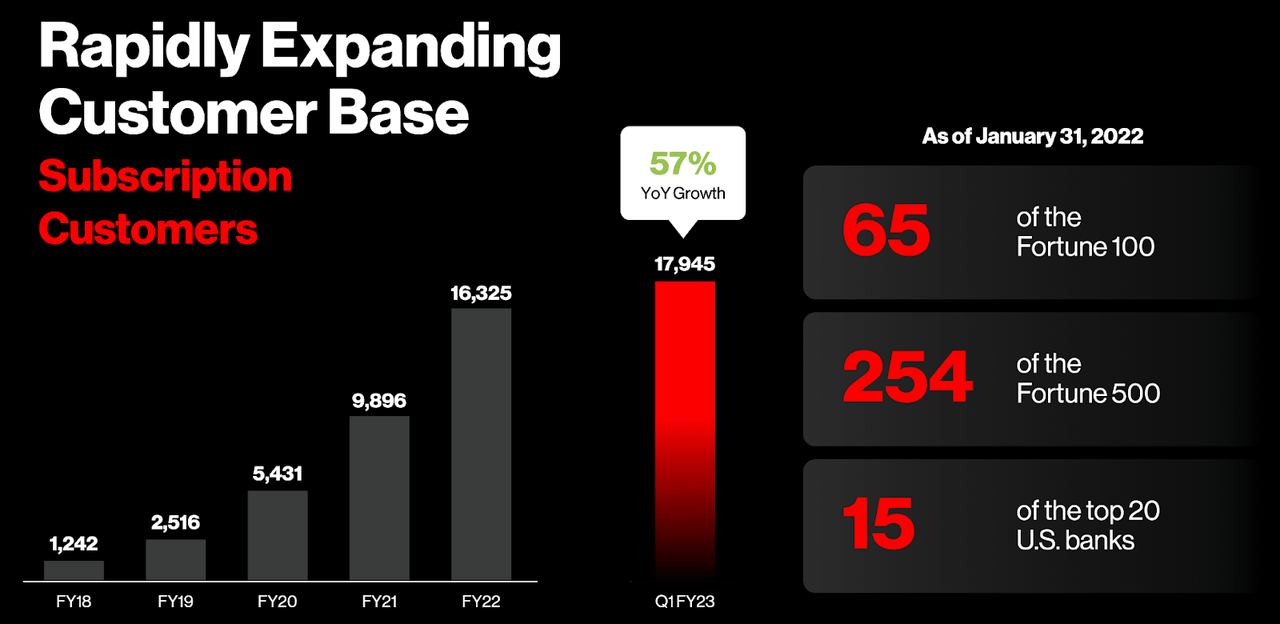

CRWD achieved this by two components. First, it continued to quickly develop clients, with its buyer rely rising 57% yr over yr. CRWD is a transparent market chief in cybersecurity as evidenced by its robust market share among the many largest corporations.

FY23 Q1 Presentation

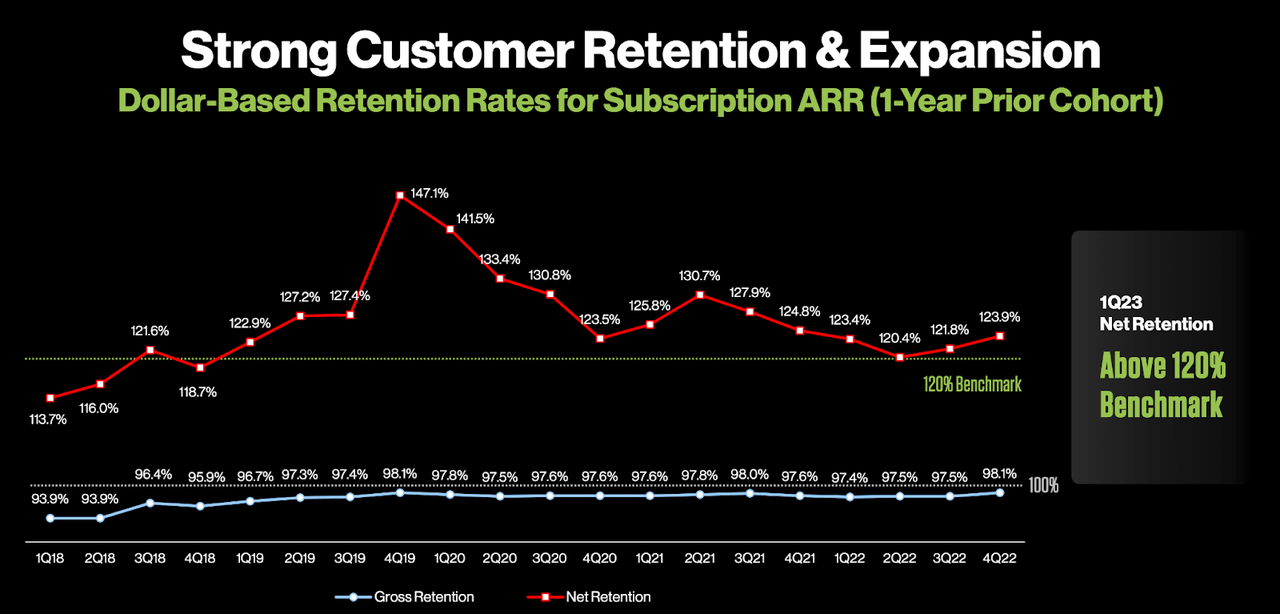

Subsequent, CRWD delivered robust dollar-based retention charges above 120% for the sixteenth consecutive quarter.

FY23 Q1 Presentation

That prime and constant dollar-based retention charge has arguably helped CRWD maintain a premium a number of relative to tech friends, because it helps guarantee better readability into the expansion outlook.

In contrast to cash-guzzling friends, CRWD is worthwhile albeit on a non-GAAP foundation.

FY23 Q1 Presentation

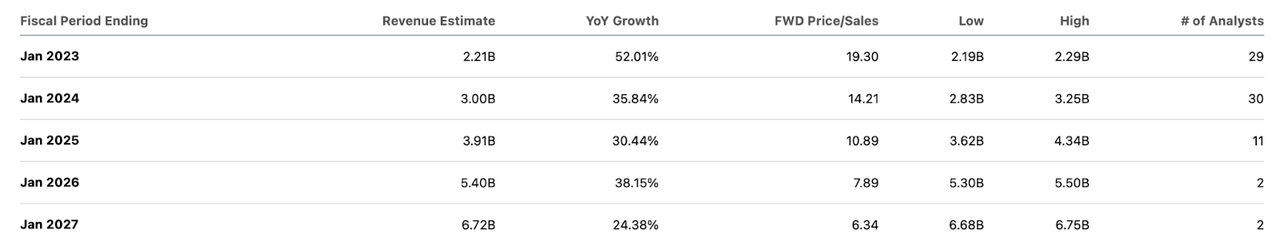

CRWD guided for the following quarter to see as much as $516.8 million in revenues and for the yr to see as much as $2.2058 billion in revenues (representing 52% yr over yr progress). The corporate ended the quarter with $1.8 billion of internet money, although I word that the big money steadiness is essentially as a result of $1.2 billion of deferred income.

Is CRWD Inventory Undervalued?

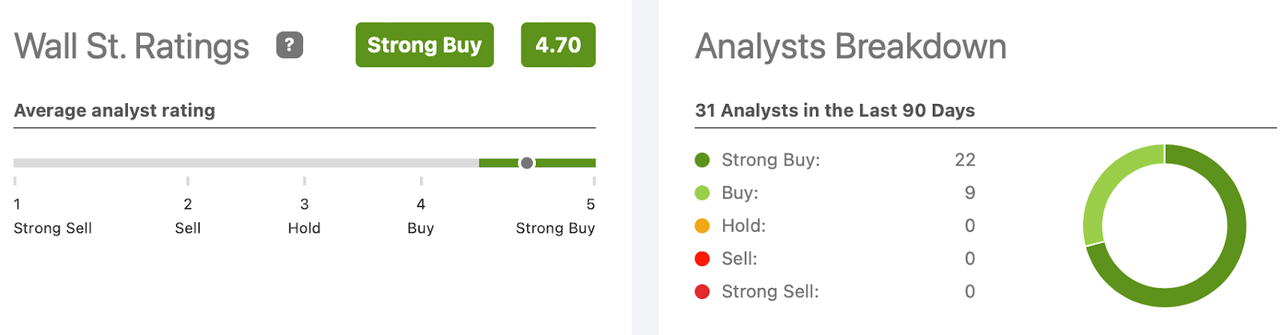

Wall Road analysts appear to suppose so, with a mean 4.7 out of 5 robust purchase score.

Looking for Alpha

The typical worth goal of $232.57 per share represents 27% potential upside.

Is CRWD Inventory A Purchase, Promote, or Maintain?

At its April investor seminar, CRWD guided for $5 billion of ARR by FY26. Consensus estimates name for $5.4 billion of revenues as an alternative.

Looking for Alpha

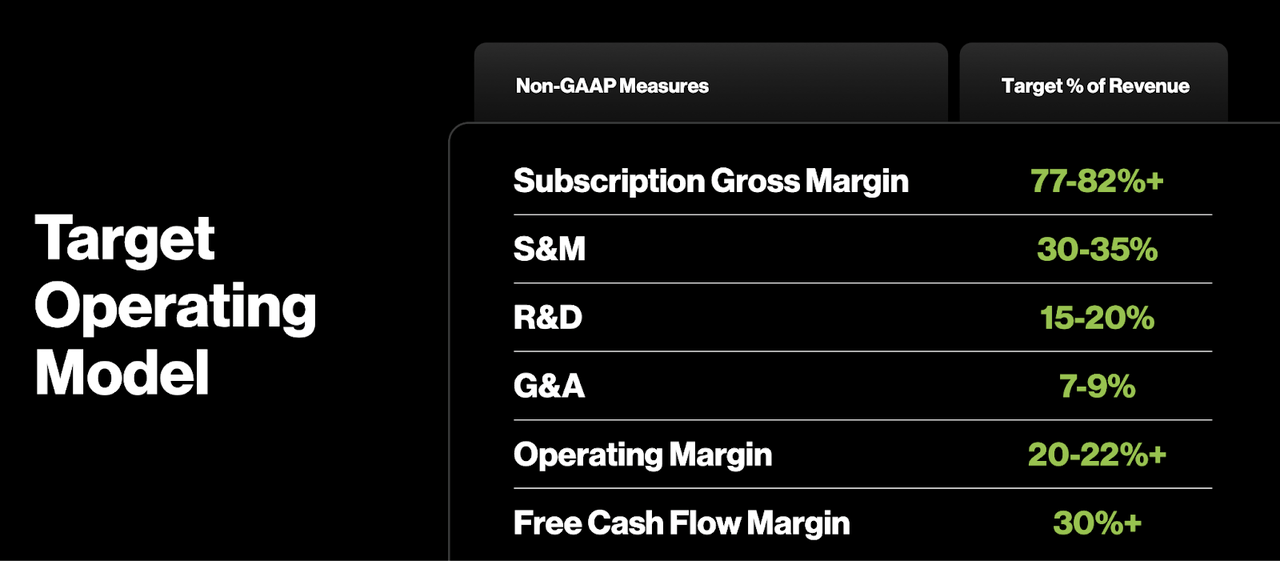

CRWD has guided for not less than 22% working margins over the long run.

FY23 Q1 Presentation

At 19x gross sales, CRWD is just not almost the most cost effective choose within the tech sector. But that premium is arguably deserved contemplating the corporate’s robust monetary place and talent to maintain elevated progress charges over the long run. Assuming a 2x worth to earnings progress ratio (‘PEG ratio’) and 25% long run internet margins, I might see CRWD buying and selling at 12.5x gross sales by 2026, representing a inventory worth of $291 per share. Based mostly on that concentrate on, the inventory has round 14% annualized return upside over the following 3.5 years. That is sufficient to beat the market, however I might see CRWD outperforming my assumptions for profitability and sustaining progress for longer than many count on. Given the premium valuation, the important thing threat right here is failure to over-deliver. If CRWD seems to be simply an “abnormal” tech inventory, then I might see its valuation compress to the 1x PEG ratio based mostly on the place different tech shares are buying and selling. The inventory may commerce all the way down to as little as 9x gross sales or $114 per share, representing almost 40% draw back. I discover such a state of affairs unlikely as a result of hyper-growth cybersecurity story, however it’s at all times attainable that competitors from the likes of SentinelOne (S) or others decelerate the expansion engine. I’m much less involved about monetary threat as the corporate is flowing money and has a money wealthy steadiness sheet – the primary situation is valuation. One other threat is that if the corporate suffers a cyberattack that damages its popularity – the corporate has the unappetizing place of being judged for failure and never essentially for stopping assaults. I charge the inventory a purchase for these seeking to put money into the cybersecurity sector however word that there are way more compelling alternatives elsewhere within the tech sector.