William_Potter

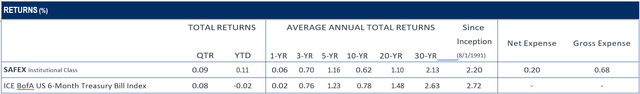

The Extremely Quick Authorities Fund returned +0.09% within the second quarter in comparison with a +0.08% return for the ICE BofAML US 6-Month Treasury Invoice Index (6-Month Treasury). 12 months-to-date, the Fund returned +0.11% in comparison with a -0.02% return for the index. In a 12 months the place constructive funding returns have been scarce, even for ultra-short-term buyers, we’re happy to report even modest ‹inexperienced’ (constructive) outcomes for the quarter and year-to-date.

The Federal Reserve continued elevating short-term rates of interest within the second quarter of 2022 in an effort to sluggish (and finally reverse) the relentless inflationary pressures within the U.S. economic system. The quarter skilled the primary back-to-back Federal Open Market Committee (FOMC) assembly hikes since 2006 and the biggest increments (0.5% in Could and 0.75% p.c in June) in 22 years.

The Federal Funds Fee, which was 1.75% as of June 30, 2022, is forecast to proceed rising meaningfully, with some economists predicting a Fed Funds fee as excessive as 4% by year-end.

The Federal Reserve’s financial coverage selections (e.g., modifications in short-term rates of interest) will proceed to have an effect on all investments inside our alternative set. Consequently, our yield and return will invariably observe the trail dictated by the Federal Reserve’s financial coverage, as we continuously reinvest maturities with holdings that mature in a brief time frame.

As of June 30, 81.5% of our portfolio was invested in U.S. Treasury notes, 5.8% in investment-grade asset-backed securities, and 12.7% in a high-quality cash market fund. The common efficient period decreased from 0.2 years on March 30, 2022, to 0.1 years on June 30, 2022. The Fund’s 30-day yield elevated roughly 32 foundation factors within the quarter to 0.56% as of June 30. A extra forward-looking information level is the Fund’s yield-to-worst (YTW), which stood at 1.4% as of June 30.

Given the Fed’s intentions to proceed elevating short-term rates of interest (presumably at every of their 4 remaining conferences in 2022), the Fund’s 30-day yield will seemingly improve within the months and quarters to observe as we re-invest maturing investments at seemingly extra favorable ranges. The Fund’s traditionally low period stage on June 30 (0.15 years) will support in actively benefiting from improved ahead return alternatives.

Below regular market situations, the Fund will make investments at the very least 80% of its internet property in obligations issued or assured by the U.S. authorities and its government-related entities. The stability of Fund property could also be invested in U.S. investment-grade debt securities. Moreover, the Fund will preserve a mean efficient period of 1 12 months or much less. Length is a measure of how delicate the portfolio could also be to modifications in rates of interest. All else equal, a lower-duration bond portfolio is much less delicate to modifications in rates of interest than a bond portfolio with the next period.

Over time, this shorter-term focus (period of lower than one 12 months) is meant to generate greater whole returns than money or cash market funds, whereas additionally taking much less rate of interest danger than a bond portfolio with the next period.

The Fund’s principal funding methods and aims of offering present earnings, defending principal, and offering liquidity stay our major objectives.

Thanks to your funding and confidence in our agency.

Authentic Publish

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.