CHUNYIP WONG

Exxon Mobil (NYSE:XOM) is an American multination oil and fuel firm again as much as an nearly $400 billion market capitalization. The corporate now has a dividend yield of just about 4% and quite a few different avenues to generate shareholder returns. As we’ll see all through this text, money circulation is king, and Exxon Mobil’s money circulation will allow dramatic will increase in shareholder rewards.

The Market

Exxon Mobil is targeted on outperformance as the corporate continues to function in a troublesome market.

Exxon Mobil Investor Presentation

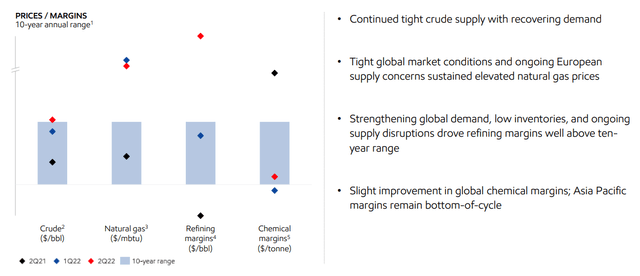

The corporate had sturdy margins in the newest quarter. The corporate had higher finish margins for crude and middle-end margins within the chemical markets. It noticed margins considerably above the 10-year vary for each pure fuel and refining. The continued power within the markets will allow more money circulation.

The market stays risky. The Ukraine-Russia battle continues placing stress on costs. Europe continues to try to drastically transfer demand away from Russia consequently. Nations proceed to develop in Asia and Africa growing their demand for vitality. Provide funding stays low because the long-term demand stays in query.

A risky market and the way that performs out for Exxon Mobil stays to be seen. Nonetheless, the corporate has among the strongest property and lowest breakeven within the trade.

Exxon Mobil’s Paid Out Investments

Exxon Mobil took benefit of large investments throughout a troublesome time interval.

Exxon Mobil Investor Presentation

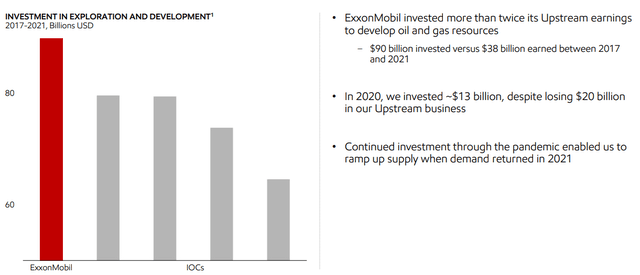

Exxon Mobil spent nearly $100 billion between 2017 to 2021 or greater than double its upstream earnings as the corporate labored to develop a large portfolio of property equivalent to Guyana. For instance, in 2020 regardless of dropping $20 billion, the corporate invested $13 billion. In the identical approach Chevron invested massively earlier than the mid-2014 crash.

That large funding implies that now that costs are extremely excessive, the corporate stands to generate extremely excessive returns. Considerably greater returns than the vast majority of the businesses friends which did not make investments the identical approach.

Exxon Mobil 2Q 2022 Outcomes

Exxon Mobil generated extremely sturdy 2Q 2022 outcomes on the idea of a worthwhile market.

Exxon Mobil Investor Presentation

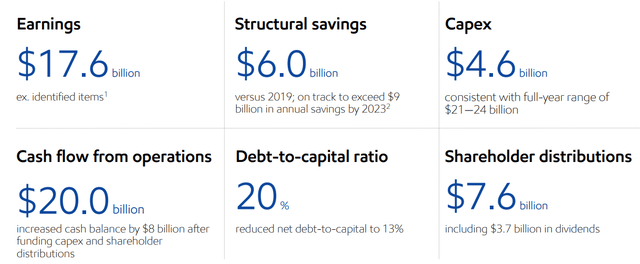

Exxon Mobil generated sturdy 2Q 2022 outcomes on the again of a blockbuster quarter. The corporate had $20 billion in CFO and $17.6 billion in earnings. Even with a full yr anticipated capital funding at a midpoint of $22.5 billion, the corporate’s FCF for the quarter was nonetheless above $15 billion, or $60 billion annualized.

That is a FCF yield of just about 16% for 2022 that is anticipated. The corporate distributed $7.6 billion in shareholder distributions, or an nearly 8% annualized yield which included $3.7 billion in dividends and nearly $4 billion in share buybacks. Nonetheless, even that and capital spending, it nonetheless added $8 billion to the money place.

These extremely sturdy outcomes imply that considerations concerning the firm’s money owed are lengthy behind it.

Exxon Mobil Outlook

Exxon Mobil has the power to generate even stronger earnings within the coming quarters.

Exxon Mobil Investor Presentation

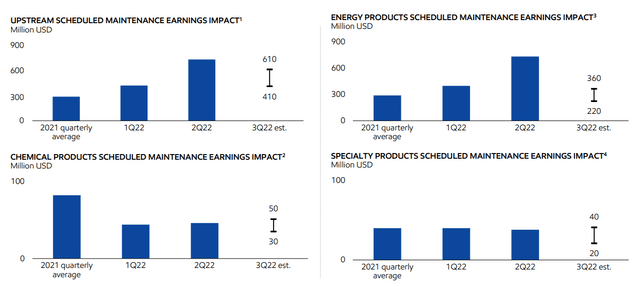

Exxon Mobil had risky bills within the 2Q 2022, nonetheless, many of those bills are anticipated to return down within the upcoming quarters. On the similar time, to date costs have remained sturdy. That’ll allow the corporate to extend earnings within the upcoming quarters versus prior quarters. The discount in upkeep alone is anticipated to save lots of the corporate $1 billion.

The corporate expects 3Q 2022 quantity to stay flat on account of divestments. Nonetheless, the corporate has just lately discovered 2 new discoveries in Guyana and lots of of 1000’s of barrels in manufacturing will come up within the subsequent a number of years. The corporate’s outlook will proceed to allow rising manufacturing.

Exxon Mobil Shareholder Return Potential

Exxon Mobil has the power to generate large shareholder rewards.

The corporate has the power to proceed its dividend with an annualized yield of just about 4%. On the similar time, the corporate’s share buyback fee is sort of 5%. We wish to see the corporate speed up its share repurchases and proceed to put money into its enterprise earlier than growing its dividend additional. Paying down debt to save lots of on curiosity would even be prudent.

On the similar time, the corporate hasn’t made any large investments in a considerable period of time. Loads of different firms stay low cost and this is able to be a superb time for the corporate to make a considerable funding. No matter how the corporate spends the cash, we anticipate high-single digit direct shareholder returns.

The corporate’s large money circulation era in a risky market helps to spotlight how the corporate is a beneficial funding.

Thesis Danger

Exxon Mobil is an built-in oil producer that means that it advantages from not solely excessive oil costs but in addition from greater downstream costs. The corporate noticed that with the current power in downstream costs. The corporate’s largest threat is pricing weak point particularly in upstream crude. To this point, the corporate has remained worthwhile, nonetheless, traditionally that is been identified to alter.

Buyers ought to pay shut consideration not solely to market costs, however tendencies. A recession might shortly drive down costs.

Conclusion

Exxon Mobil has a novel and spectacular portfolio of property. The corporate spent $10s of billions on capital progress throughout a troublesome time for the markets, and now the corporate is reaping the rewards of these important investments. Its most up-to-date FCF annualized means a double-digit dividend yield for the corporate.

The corporate is producing future shareholder rewards by quite a lot of avenues. It is persevering with to take a position closely in capital progress. It has an nearly 4% dividend yield. It has an nearly 5% share buyback yield. And it is including greater than $30 billion to its backside line. It is debt yield is manageable. No matter how the corporate spends cash it generates excessive shareholder rewards.