[ad_1]

For SaaS and subscription companies, buyer success is a key income driver.

Closing new contracts is vital, however retaining and growing income from current accounts is essential for sustaining and rising ARR.

So, how precisely do you measure if a buyer is “profitable” (and what does that even imply?)

On this article, you’ll learn to outline buyer success, and uncover crucial KPIs for measuring retention and progress (and different buyer success objectives) in addition to the worth patrons obtain out of your product.

Defining buyer success and measurements

Buyer success (CS) is a enterprise initiative (and hooked up division) that seeks to make sure prospects get most worth out of your product.

It’s about serving to patrons obtain their desired objectives and outcomes, with the concept being that if this may be attained, prospects will likely be much less prone to churn.

This raises the query, then:

How on earth do you measure “success”?

For particular person shoppers, we are able to ask, “What was it that the shopper wished to attain initially? Did we attain this aim?” That’s pretty easy.

However measuring buyer success throughout the board requires us to trace progress and enhancements in our numerous initiatives. In brief, we’re gonna must dive into the info.

That’s the place buyer success KPIs (key efficiency indicators) are available.

Buyer success KPIs are metrics that assist us to outline, measure, and observe progress in buyer success initiatives.

Take buyer churn charge (a generally used KPI amongst buyer success groups), as an illustration. If churn is reducing and fewer prospects are leaving every month, we are able to safely assume that our prospects are reaching their aims utilizing our platform.

These KPIs are a proxy for achievement measurement, certain, however they’re essential for understanding the place the gaps are in your CS course of, figuring out modifications and options, and driving recurring income.

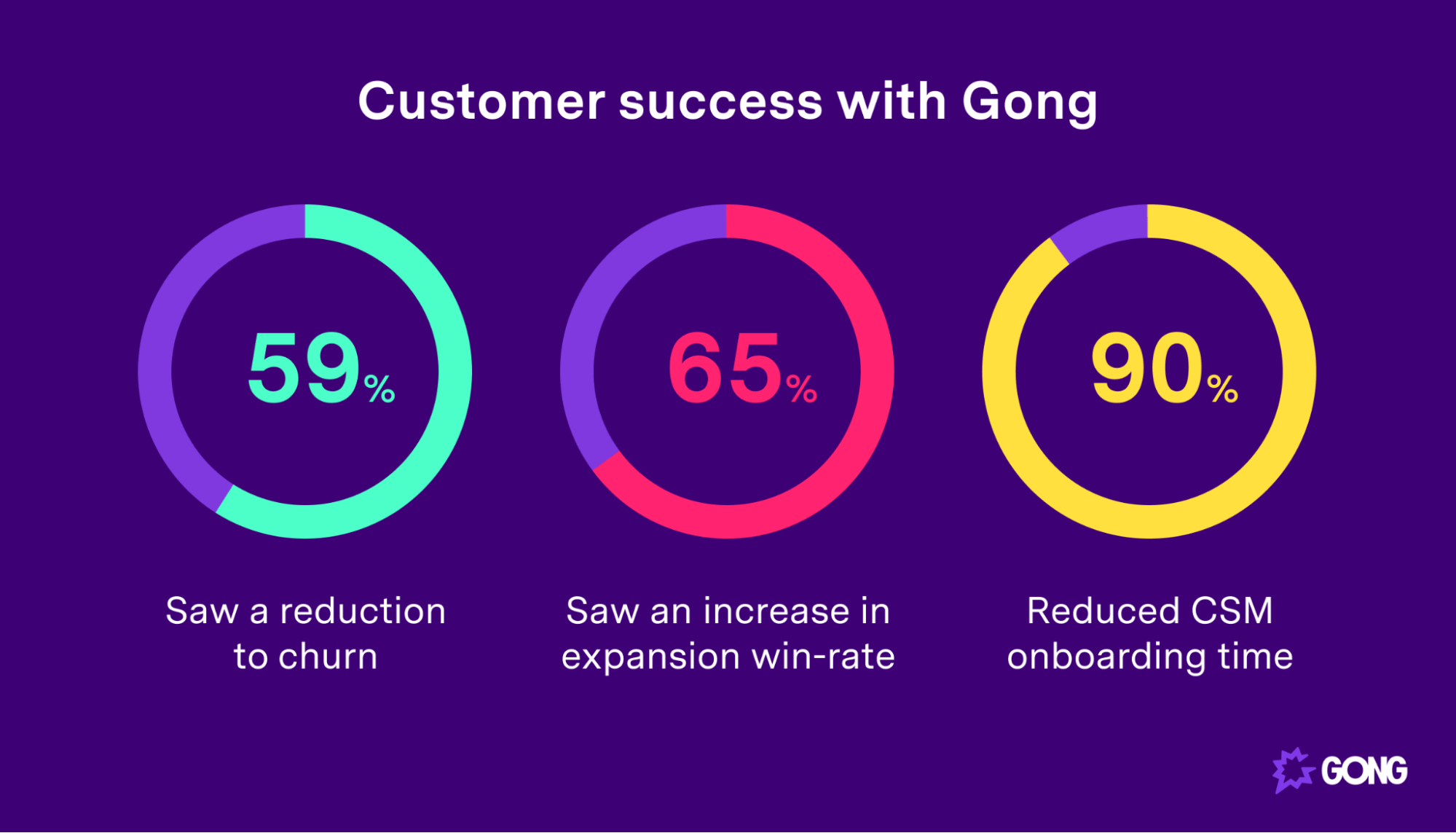

When you’re questioning what affect data-backed insights can have, simply take a look at what Gong’s shoppers have been capable of do with their buyer success efforts:

Buyer success leaders use these KPIs to trace engagement and inform enhancements in two broad areas, every of which is a significant milestone within the buyer lifecycle:

- Onboarding

- Retention and growth

Onboarding

Within the first stage, success groups take a look at buyer engagement all through their onboarding course of.

For product-led progress groups, onboarding sequences are typically automated. They’ll measure the share of shoppers who full the onboarding sequence and the common time it takes for brand new prospects to finish the onboarding sequence.

For enterprise gross sales, onboarding contains:

- Establishing and executing coaching periods with totally different consumer teams (i.e. frontline managers, particular person contributors, by division or by position)

- Collaborating with the customer’s IT group to get licenses provisioned for all customers and to arrange product integrations

- Implementing a evaluate assembly cadence (ending with QBRs each quarter to trace progress)

Retention and growth

Retention is the place SaaS and subscription-based companies make nearly all of their cash — prospects who churn after two months aren’t driving an entire lot of income.

Buyer success and account managers collaborate right here to maintain the customer glad and to determine alternatives for growth (by means of cross-sell and upsell conversations).

This includes figuring out new wants within the group (whether or not a brand new group or a brand new use case) and placing collectively a enterprise case to help deploying the product additional.

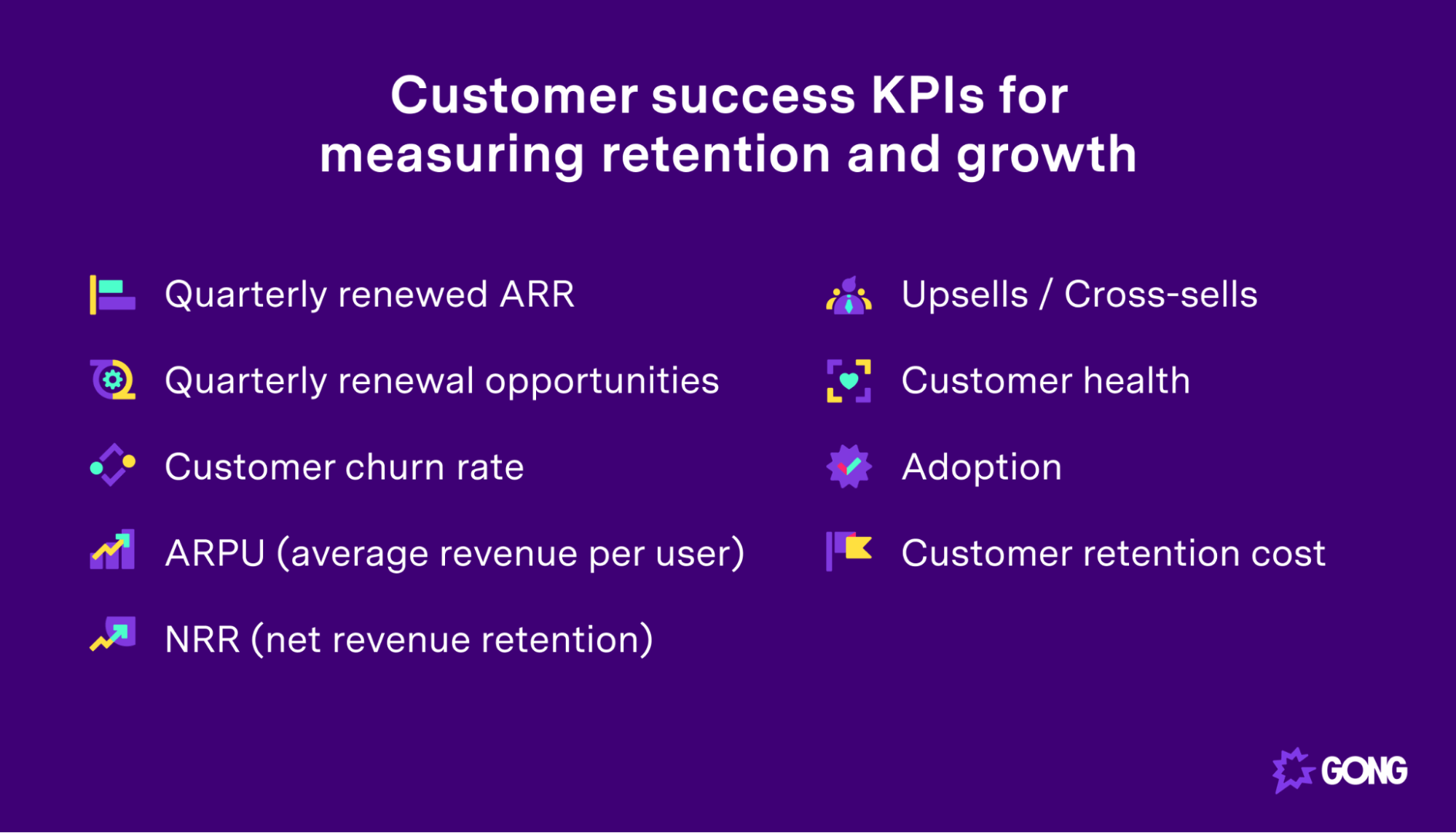

Buyer success KPIs for measuring retention and progress

Beneath, we cowl 9 buyer success KPIs tailor-made for monitoring progress and retention:

Quarterly renewed ARR

ARR (annual recurring income) is likely one of the most generally used metrics in SaaS and subscription income companies.

Buyer success managers have to look a little bit deeper, utilizing the KPI “Quarterly renewed ARR.”

Your quarterly renewed ARR is the share of annual income that rolls over every quarter. In a really perfect world, this may be 100%, that means all of our current prospects proceed to subscribe, and no person churns.

In fact, we don’t dwell in a really perfect world, so anyplace within the excessive 90s (e.g., 97%+) is an efficient place to begin, however ideally, you wish to hit the optimistic growth numbers (101%+).

The quarterly renewed ARR formulation is as follows:

(Quantity of income renewed this quarter / Quantity of income for final quarter) x 100

Let’s say, for instance, originally of quarter two, you might have an ARR of $1.5m. Firstly of quarter three, $1.49m of this income is renewed. Your calculation would seem like this:

($1.49m / $1.5m) x 100 = 99.33%

Quarterly renewal alternatives

Renewal alternatives happen when a buyer’s present contract involves an finish.

Say, for instance, you might have a two-year contract with a given consumer, ending in October 2023. Meaning you might have a renewal alternative within the fourth quarter of 2023.

Measuring quarterly renewal alternatives is vital for understanding gross sales efficiency, however extra vital is measuring the share of renewal alternatives gained.

To calculate:

(Variety of quarterly renewal alternatives gained / Whole variety of quarterly renewal alternatives) x 100

You probably have, say, 18 renewal alternatives in a given quarter, and your success group wins 16 of them, then you possibly can calculate it like this:

(16/18) x 100 = 88.89%

The significance of this metric is fairly easy: prospects who’re receiving worth out of your product and attaining their organizational objectives usually tend to renew.

Buyer churn charge

Your buyer churn charge is the share of shoppers who canceled their subscription inside a given time interval (month-to-month, quarterly, or yearly).

It’s a vital metric as growth-oriented corporations focus closely on churn discount. Clients who’re reaching their aims utilizing your product (i.e., these that may be outlined as “profitable”) aren’t prone to go away, so excessive churn is a sign that enhancements must be made within the CS division.

To calculate churn charge:

(Variety of misplaced prospects / variety of prospects originally of a time period) x 100

So, in case you have 1200 subscribers originally of June, and 24 of them go away throughout that month:

(24 / 1200) x 100 = 2%

Usually talking, the benchmark churn charge for SaaS companies is between 3% and 5%, however the supreme charge on your firm is dependent upon your business, sort of product, and different components.

ARPU (common income per consumer)

ARPU is fairly self-explanatory — it’s the quantity of income you possibly can anticipate to obtain from the common consumer.

The ARPU formulation is equally easy:

Whole income / complete variety of prospects

The affect of promoting and gross sales on ARPU is fairly apparent, however how does this KPI relate to buyer success?

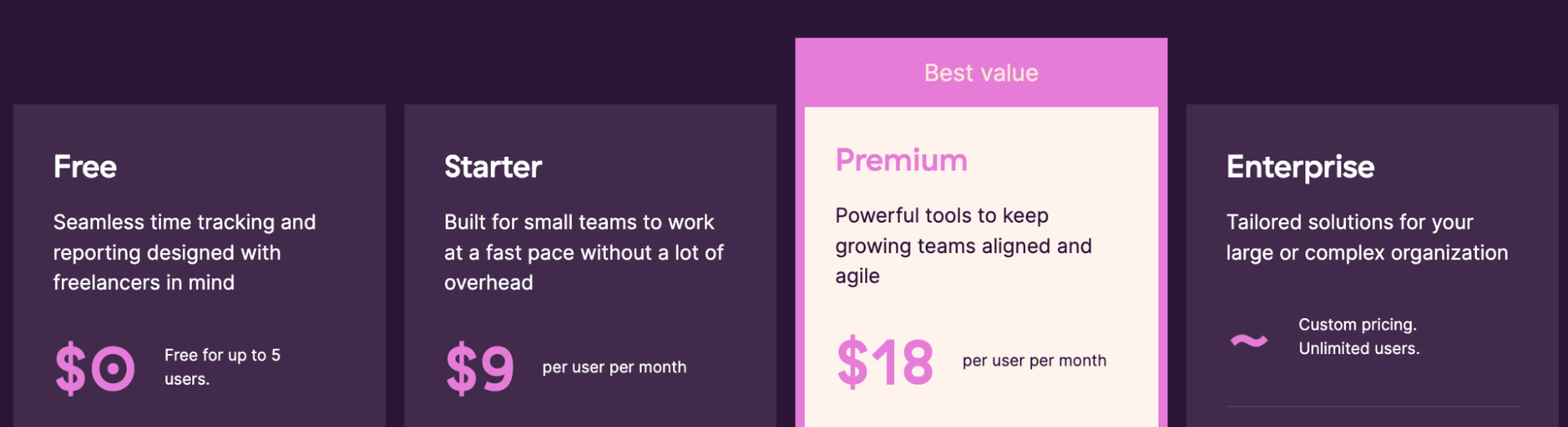

Within the SaaS world, it’s fairly widespread to mix tiered and per-user pricing fashions.

See, for instance, Toggl Observe’s pricing mannequin.

(Picture Supply)

With a pricing mannequin like this, we are able to affect ARPU in two key methods:

- Growing the variety of customers per buyer

- Bringing extra prospects as much as greater pricing tiers

Buyer success has a hand to play in each. If prospects are receiving nice worth out of your product, they’re extra prone to roll it out throughout departments and enhance their customers. Plus, in case your product may help them develop, they’ll enhance customers naturally.

Secondly, in case your CS group is expert at demonstrating the worth prospects will obtain from upgrading to a higher-tiered plan, you’ll enhance ARPU.

NRR (internet income retention)

Web income retention demonstrates your group’s means to maintain (and probably develop) income, regardless of the existence of churn.

To calculate NRR, you want the next metrics already calculated:

- MRR (month-to-month recurring income) at first of the month

- Enlargement income

- Income churn

- Income misplaced to downgrades

Then, the formulation is as follows:

((MRR at first of the month + growth income – income churn – income misplaced to downgrades) / MRR at first of the month) x 100

NRR is a strong buyer success metric as a result of it contains growth and upsell income. Meaning it’s reflective of your CS group’s means to promote into current accounts.

In case your group is outstanding at this, NRR can truly be above 100%, regardless of churn. That’s the aim, anyway.

Upsells and cross-sells

Upsells and cross-sells are measured as a greenback worth, they usually’re a mirrored image of your buyer success group’s means to broaden income from current accounts.

Income growth can come from pricing tier upgrades, including new customers, or promoting product add-ons.

There’s no actual calculation right here. You simply add up the whole income gained from upselling into every account.

Adoption

Adoption is often measured on a function foundation.

For instance, you possibly can measure the adoption of recent options by current prospects, utilizing the next formulation:

(Variety of prospects who’ve used the brand new function / complete variety of current prospects) x 100

Alternatively, you may as well measure the adoption of current options by new prospects, or the share of options adopted by every consumer.

As a normal rule, excessive adoption is a sign of buyer success. Conversely, low adoption can be utilized as a churn sign.

Buyer retention price

Buyer retention price is the sum of money you’ll have to spend (on common) to retain a buyer.

The formulation is fairly easy:

Whole price of buyer retention / variety of prospects

Buyer retention bills embrace issues just like the manufacturing price of onboarding supplies, buyer success agent salaries, and extra.

However it may be difficult attempting to determine how a lot your buyer retention efforts are affecting your buyer lifetime values. LTV can fluctuate based mostly on buyer sources, like advertisements over suggestions, and lots of different components, so that you’ll have to make an informed guess.

Your buyer retention price needs to be decrease than your buyer acquisition price (CAC). In any other case, you would possibly as nicely give attention to new consumer acquisition.

Typically, acquisition prices round 5x as a lot as retention, so in case your CRC isn’t near a fifth of your CAC, it’s possible you’ll have to rethink the way you strategy buyer success and retention.

Enlargement income

Enlargement income is the quantity of income generated from promoting into current accounts. To calculate growth income, merely take away current income and income from new prospects:

MRR at finish of month – MRR at starting of month – income from new prospects = growth income

Say, for instance, originally of the quarter, you’re making $1.5m in MRR.

On the finish of the quarter, you’ve elevated this to $1.8m, $200,000 of which got here from closing new prospects. Utilizing the formulation above, you possibly can calculate that the opposite $100,000 got here from growth, by means of wins comparable to:

- Promoting new product add-ons

- Growing the variety of customers per buyer

- Upgrading some prospects to greater pricing tiers

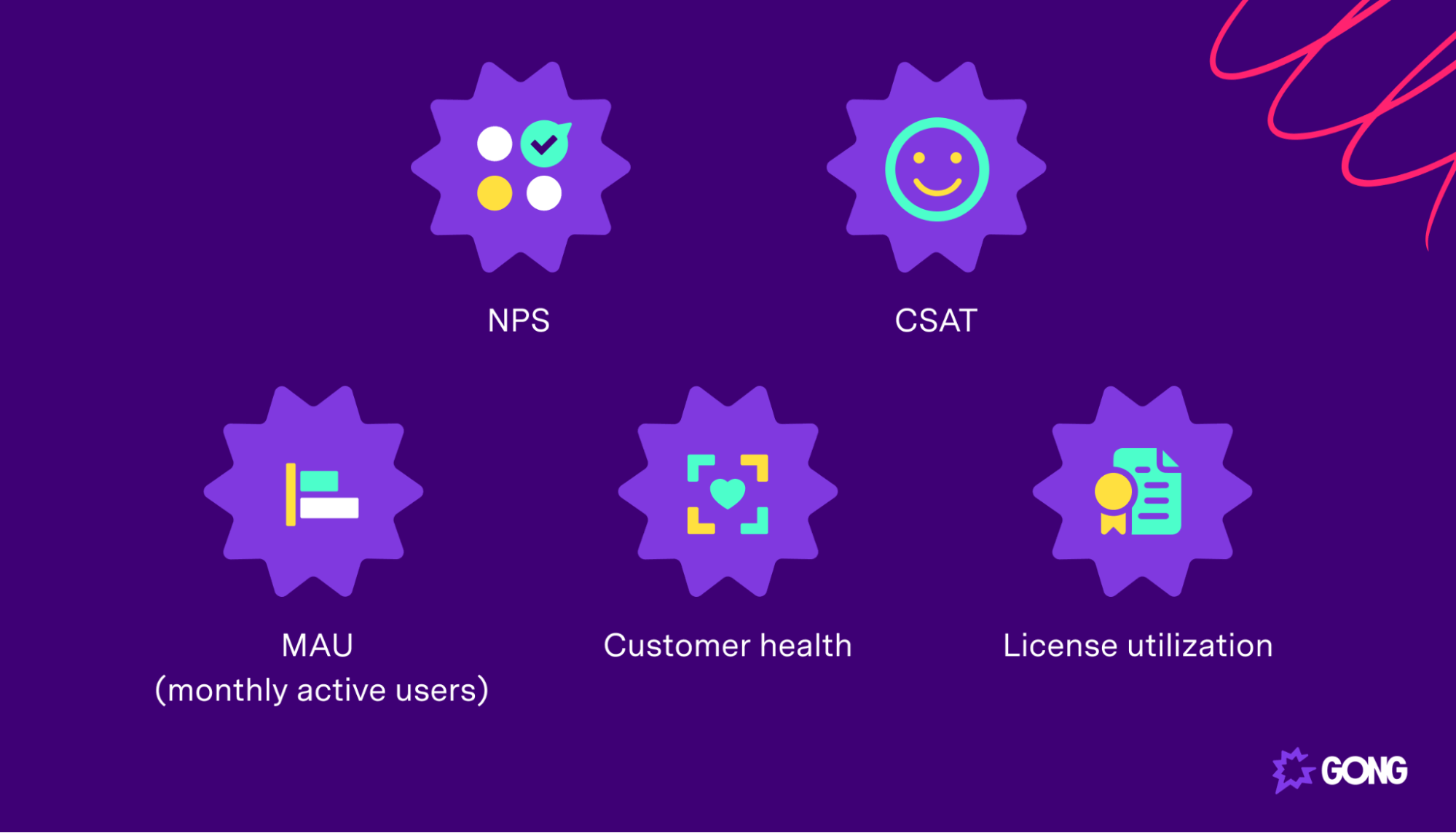

Buyer success KPIs for measuring engagement and relationships

Subsequent up, let’s discover some buyer success KPIs you should utilize to measure the well being of your buyer relationships.

NPS

Web promoter rating (NPS) is extensively thought of the holy grail of buyer success metrics.

It’s a easy course of: you ask prospects one query (“On a scale of 1-10, how doubtless would you be to advocate us to pals or colleagues?”) after which allocate respondents into three teams:

- Promoters (those that scored you 9 or 10)

- Passives (those that scored you 7 or 8)

- Detractors (those that scored you 6 or beneath)

Then, you apply the NPS calculation:

Proportion of promoters – Proportion of detractors

Success groups use NPS to grasp buyer sentiment and probability to churn. Usually talking, scores between 30 and 70 are thought of fascinating.

License utilization

License utilization is an efficient indicator of buyer engagement, and it’s fairly simple to calculate:

Variety of lively customers / variety of complete customers bought x 100

Let’s say, as an illustration, you’ve bought a buyer a plan with 100 customers. Nonetheless, solely 80 of these customers have truly logged on within the final month. You might have a license utilization charge of 80%.

We wish license utilization to be as near 100% as doable. If some customers aren’t using their subscription, your buyer is much less prone to see worth in your product and extra prone to churn.

CSAT

CSAT (buyer satisfaction) is one other metric that you should utilize as an indicator of engagement and total buyer happiness.

To calculate CSAT, you first have to run some type of buyer satisfaction survey. This generally is a easy “How did we do?” asking patrons to rank you on a scale of 1-10.

Then, we calculate:

(Variety of glad prospects [those who scored 9 or 10] / Whole variety of respondents) x 100

CSAT can be utilized to measure success at totally different levels within the buyer expertise, based mostly on whenever you distribute the survey. As an illustration, a CSAT survey delivered instantly after a purchase order is useful for understanding how patrons really feel concerning the buy course of.

Buyer well being

Buyer well being scores differ by group, that means the way you calculate this metric will depend upon the alerts you determine that show buyer success.

As an illustration, you would possibly take a look at three alerts for measuring buyer well being:

- Frequency of utilization (how typically a buyer logs in)

- Breadth of utilization (the variety of customers a buyer has)

- Depth of utilization (the variety of contains a given buyer makes use of)

Then, you’d assign values to every sign (maybe utilizing a scale of 1 to 10). For instance, prospects who use your product each day would possibly rating 10, whereas those that log in lower than as soon as monthly rating 1.

On this instance, you’d measure your buyer well being rating out of 30, after which common that throughout your total buyer base.

MAU (month-to-month lively customers)

Month-to-month lively customers is a superb buyer engagement metric for subscription software program corporations.

MAU tells you what number of of your paying prospects truly log in and use your product each month. Low MAU numbers are an indication that your product isn’t partaking, is difficult to grasp, or that your onboarding sequence wants work.

Conclusion

Buyer success KPIs are essential for measuring progress in direction of CS objectives, influencing retention, and in the end driving recurring income.

In fact, KPIs can’t be considered in a vacuum — you’ll have to implement modifications, evaluate and analyze particular buyer tales, and put a training and growth follow in place on your buyer success workers.

Wanna find out how?

Momentive used Gong to develop a complete buyer success teaching program and drive engagement and retention.

Get all of the secrets and techniques and stage up your buyer success initiatives right here.

[ad_2]

Source link