[ad_1]

Shares of Starbucks Company (NASDAQ: SBUX) have been down over 1% on Friday. The inventory has dropped 27% year-to-date however has gained 11% over the previous three months. Earlier this week the corporate delivered a good earnings report for its third quarter of 2022 regardless of pandemic and inflation-related headwinds, which made traders blissful. Listed below are a number of factors to bear in mind when you have an eye fixed on this inventory:

Income and profitability

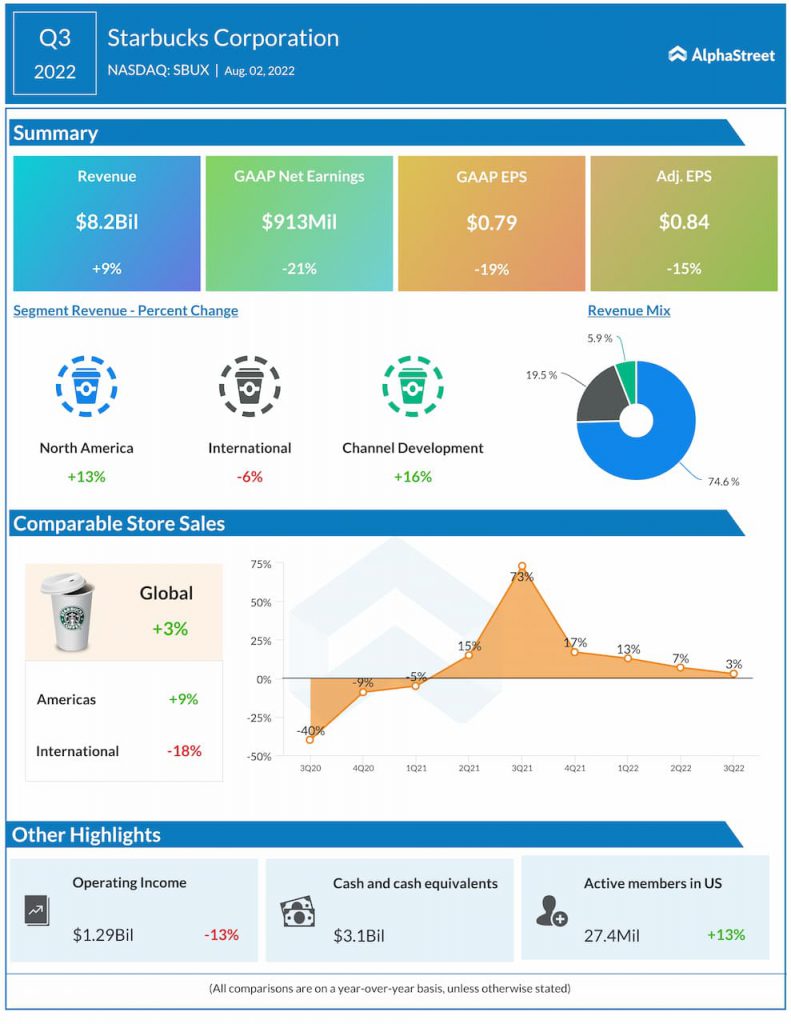

Starbucks delivered consolidated internet revenues of $8.2 billion for the third quarter of 2022, which was up 9% in comparison with the identical interval a yr in the past, pushed by sturdy demand and double-digit income development within the US in addition to nearly all main markets and channels throughout its international portfolio.

International comparable retailer gross sales have been up 3%, pushed by a 6% development in common ticket however partly offset by a 3% decline in transactions. Working margin contracted 400 foundation factors to fifteen.9% within the quarter as a result of impacts of inflation, pandemic-related lockdowns in China and investments in labor. Adjusted EPS declined 15% year-over-year to $0.84 however beat market expectations.

Retailer fleet

Starbucks opened 318 internet new shops in Q3, ending the quarter with 34,948 shops worldwide. 51% of Starbucks’ shops have been company-operated whereas 49% have been licensed. The North America section recorded internet new retailer development of two% whereas the Worldwide section recorded retailer development of 8% in Q3. On the finish of the quarter, the corporate had 15,650 shops within the US and 5,761 shops in China. The shops in each these nations made up 61% of Starbucks’ international portfolio.

North America

Revenues in North America rose 13% YoY to $6.1 billion in Q3, helped by a 9% enhance in comparable retailer gross sales and internet new retailer development. Comparable retailer gross sales have been pushed by single-digit will increase in common ticket and transactions through the quarter.

The US enterprise delivered 9% comp retailer gross sales development, pushed by development in common ticket, which in flip was fueled by strategic pricing and meals connect. Progress within the US licensed retailer enterprise contributed to the sturdy prime line efficiency in North America. Nevertheless, working margin in North America declined 250 foundation factors to 22.2% in Q3 on account of inflation and labor investments, partly offset by pricing.

China market

Throughout the third quarter, Starbucks witnessed extreme COVID-19-related disruptions to its operations in China. The corporate’s largest market, Shanghai, the place it has over 940 shops, confronted a whole lockdown for the main a part of the quarter. In Beijing, round one-third of its shops have been closed for nearly a month and a half.

The pandemic-related headwinds led to a 40% decline in internet income and a 44% drop in gross sales comp in China in Q3 versus the year-ago quarter. This in flip impacted the worldwide section’s efficiency resulting in an 18% drop in comp gross sales and a 6% drop in income for the quarter.

The corporate is seeing comps enhance in locations the place restrictions are slowly being lifted. It anticipates a powerful rebound in gross sales as soon as the lockdowns are over. Starbucks opened 107 internet new shops in China through the third quarter. The corporate stays on monitor to have 6,000 shops in China by the tip of this yr.

Outlook

Starbucks expects its margin and EPS for the fourth quarter of 2022 to be decrease than the third quarter. It additionally expects to face larger pressures as a result of later-than-expected begin of the restoration in China in addition to sure advantages from tax credit score and authorities subsidies gained in Q3 not persevering with in This autumn. Along with this, the fourth quarter might be impacted by a step-up in investments in addition to typical seasonality.

Click on right here to entry the total transcripts of the newest earnings convention calls

[ad_2]

Source link