Orietta Gaspari/E+ by way of Getty Pictures

Funding Thesis: I take the view that Swiss Re will see low progress within the quick to medium time period.

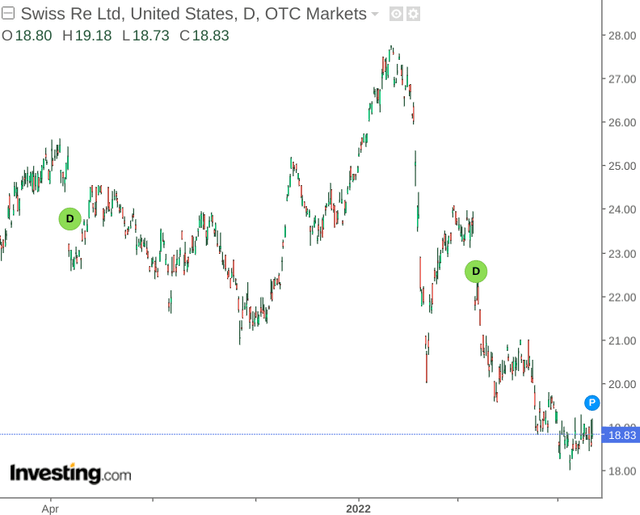

Swiss Re (OTCPK:SSREY) (OTCPK:SSREF) has continued to see draw back in 2022 – owing to broader macroeconomic dangers and continued uncertainty over the continuing scenario in Ukraine.

investing.com

Whereas I initially made the argument again in April that Swiss Re could possibly be able to learn from rising inflation as a result of appreciating actual property costs – I additionally cautioned extra just lately that this might show to be a double-edged sword, as increased rates of interest may as a substitute curb property demand and therefore demand for property insurance coverage.

The aim of this text is to look at Swiss Re’s enterprise from a extra holistic perspective, and decide whether or not the inventory has scope to rebound given the present macroeconomic circumstances.

Efficiency

Taking the rising macroeconomic pressures under consideration, traders are more likely to pay extra consideration to money circulation, with a view to be certain that Swiss Re can proceed to finance its short-term liabilities whereas remaining worthwhile.

When taking a look at money to short-term debt, we will see that whereas Swiss Re nonetheless has greater than enough ranges of money to cowl its short-term money owed, the money to short-term debt ratio has dropped. Lengthy-term debt has elevated barely, however Swiss Re has additionally managed to lift its money ranges accordingly.

| Merchandise | December 2021 | June 2022 |

| Money and money equivalents | 5051 | 5277 |

| Brief-term debt | 862 | 1539 |

| Lengthy-term debt | 10323 | 10633 |

| Money to short-term debt ratio | 5.859 | 3.428 |

| Money to long-term debt ratio | 0.489 | 0.496 |

Supply: Figures sourced from Swiss Re Half-12 months 2022 Report. Money ratios calculated by creator. All figures in USD thousands and thousands besides money ratios.

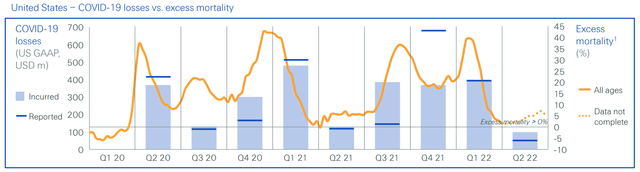

When taking a look at phase efficiency, we will see that the Life & Well being phase benefited considerably from a drop in extra mortality throughout the USA within the second quarter.

Swiss Re Half-12 months 2022 Outcomes Presentation

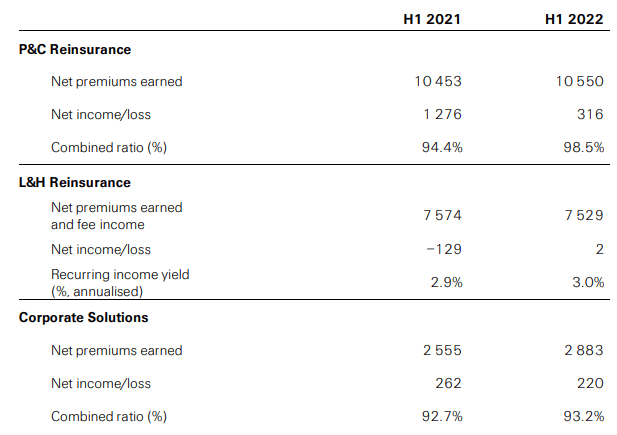

With that being stated, we did see a rise within the mixed ratio throughout the Property & Casualty phase – which means that the quantity of claims relative to premiums collected has elevated.

Furthermore, whereas we will see that the Life & Well being phase has returned to profitability – internet revenue as a complete nonetheless remained fairly low for H1 2022:

Swiss Re Press Launch H1 2022

From this standpoint, the Property & Casualty sector as a complete has turn out to be costlier to insure previously yr. Furthermore, whereas internet revenue has come again into optimistic territory throughout Life & Well being – this has solely been marginal and can’t compensate for the drop in internet revenue progress throughout P&C. Moreover, whereas extra mortality has dropped in the newest quarter – there’s a risk that this metric may enhance as soon as once more if the approaching winter leads to a larger diploma of COVID-related outbreaks.

Trying Ahead

Whereas the Life & Well being sector has seen an encouraging restoration, the potential of additional COVID outbreaks this winter may lead to an increase in claims and thus place strain on the sector.

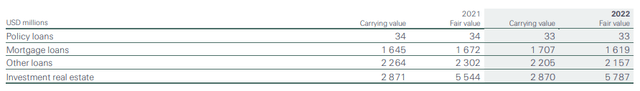

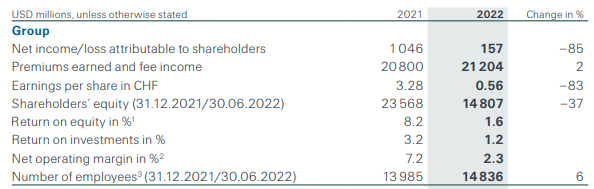

Moreover, inflation and better property costs imply that the price of insuring such properties will even rise. We will see that whereas the worth of actual property investments for Swiss Re has elevated from final yr, the general return on fairness for the group has been decrease – which might be anticipated given the broader decline that we’ve got been seeing within the fairness markets:

Funding Actual Property

Swiss Re Half-12 months 2022 Report

Monetary Highlights

Swiss Re Half-12 months 2022 Report

On condition that inflation reveals no indicators of abating for the foreseeable future – I take the view that this pattern may proceed as we head into the remainder of this yr, and Property & Casualty may turn out to be costlier to insure as a complete.

This, coupled with the potential for a larger variety of claims throughout Life & Well being may place strain on internet revenue progress general.

Conclusion

To conclude, I take the view that whereas Swiss Re stays a essentially robust insurance coverage firm – macroeconomic pressures, inflation and low fairness market progress may result in larger expense for the corporate going ahead.

For these causes, Swiss Re may see low to modest progress for the rest of this yr.