primeimages/iStock through Getty Photographs

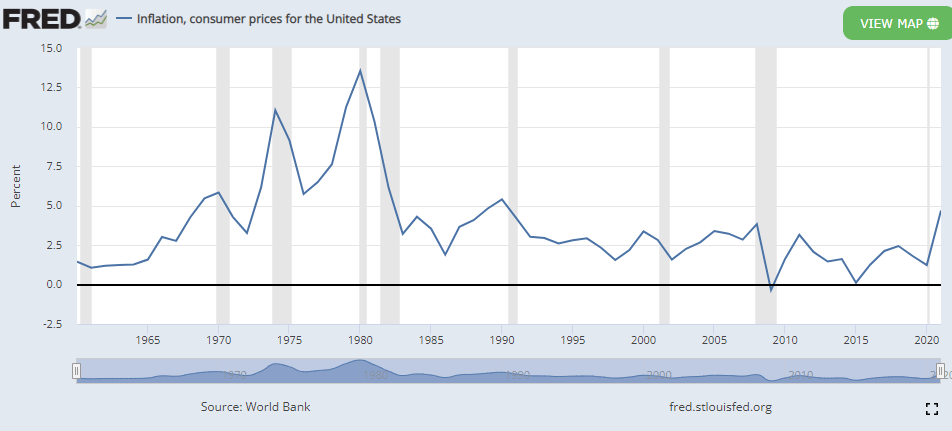

Final week’s inflation knowledge — July’s client value index and producer value index — began to point out some aid in rising costs, however the U.S. financial system remains to be a far approach off from reaching the Federal Reserve’s 2% inflation goal.

In abstract, client costs have been flat from June to July and the July producer value index unexpectedly fell 0.5% from June, in contrast with a +0.3%. On a Y/Y foundation, the CPI rose 8.5% vs. 9.1% a month earlier, and the PPI eased to 9.8% from 11.3%.

A lot of the aid got here from decrease gasoline costs. The unhealthy information is that the “stickier” costs equivalent to shelter prices saved rising.

“So this month-to-month 0% improve is best than what we have been seeing, however there’s nonetheless a number of worrying, underlying tendencies and inflation,” stated Robert Frick, company economist at Navy Federal Credit score Union, in an interview with Searching for Alpha.

“One of many extra troubling issues that I do not suppose acquired sufficient evaluation was meals prices,” he stated. International upward strain on grain costs is fueling baked items costs. The avian flu has scale back the hen flocks, and the U.S. milking herd may be very low. “So you are going to see a number of stickiness in meals prices,” which historically are pretty versatile — “however not this time round.”

Shelter prices, too, present no signal of moderating. “There simply aren’t sufficient models, both rental or housing, within the nation, and rents,” Frick stated.

Ryan Candy, senior director at Moody’s Analytics, sees rental inflation peaking “in all probability peak later this yr.” To offset that, items costs, the attire, electronics, new and used automobile costs — “they should begin declining to offset that rental inflation.”

The excellent news is that there a “fairly sturdy pipeline” of multifamily models, i.e., flats, within the works. “So there’ll finally be a rise in provide, which is able to put some downward strain on rents in about 12-18 months. However the subsequent few months are going to be fairly, fairly tough,” Candy stated.

Frick stated July’s inflation moderation resulted from world components, relatively than home ones, mainly the decline in vitality costs. International parts account for about three share factors of the 8.5%-9% CPI charge, he stated. So if these pressures subside, inflation can come down to five% or 6%.

Whereas the fairness markets cheered the lower-than-expected CPI print on Wednesday — the S&P 500 gained 2.1%, snapping a four-session dropping streak — the Federal Reserve is not anticipated to pause its charge hikes anytime quickly.

No celebrations but: “From the Fed’s perspective, they don’t seem to be popping champagne corks but,” Moody’s Candy stated. “Inflation remains to be very, very elevated.” Neither Frick or Candy, although, see a recession as imminent.

“So recession will occur in some unspecified time in the future, however I do not suppose it is imminent for this yr or early subsequent yr,” Candy stated. The inverted yield curve alerts a recession within the subsequent 12 to fifteen months. “However exterior the yield curve, the financial system look wonderful,” he stated.

“Recessions are inevitable,” Frick stated. And with this tightening cycle, “a gentle touchdown could be a miracle.” A best-case situation would have inflation come down by itself, leading to a light recession with a minimal lack of jobs. He places a 20%-30% likelihood of a recession throughout the subsequent yr, however after that “there’s a particularly excessive likelihood of recession in 2024.”

Sturdy jobs outlook: Whereas there have been worries in regards to the labor market, the unemployment charge remains to be very low at 3.5% in July. “Job progress may be very sturdy, so so long as the job market holds up, we’ll be capable of skirt a recession,” Candy stated.

He expects the Fed to spice up its key charge by 50 foundation factors in September, stepping down from the back-to-back 75-bp hikes in June and July. Then he sees 25-bp will increase for every assembly till the federal funds charge reaches 3.5%. “After which that is once I suppose the Fed’s going to pause,” Candy stated. “They take a deep breath, have a look round, make certain they did not break something within the financial system.”

What is the subsequent financial report to take a look at? The 2 economists will likely be trying on the July private consumption expenditure quantity, resulting from be launched on Aug. 26. Candy expects core PCE will improve by a tenth of a % month-over-month, slowing from the 0.6% M/M improve seen in June. That can convey the Y/Y progress to 4.6%-4.7%, in contrast with the 4.8% improve in June.

A number of housing experiences additionally come out this week. The August NAHB homebuilder sentiment index, consensus is flat M/M, comes out on Monday and July housing begins and permits (consensus is that each will slip) come out on Tuesday. July current dwelling gross sales (additionally anticipated to dip) will likely be launched on Tuesday.

Whereas Frick sees some cracks within the housing market, with dwelling value appreciation slowing, “the overarching macro issue of a number of demand and too few models goes to name the tune for shelter inflation for a while to return.”

SA contributor John M. Mason advises to take a look at what monetary markets are telling us and never simply hearken to Fed officers.