pixeldigits/E+ through Getty Photos

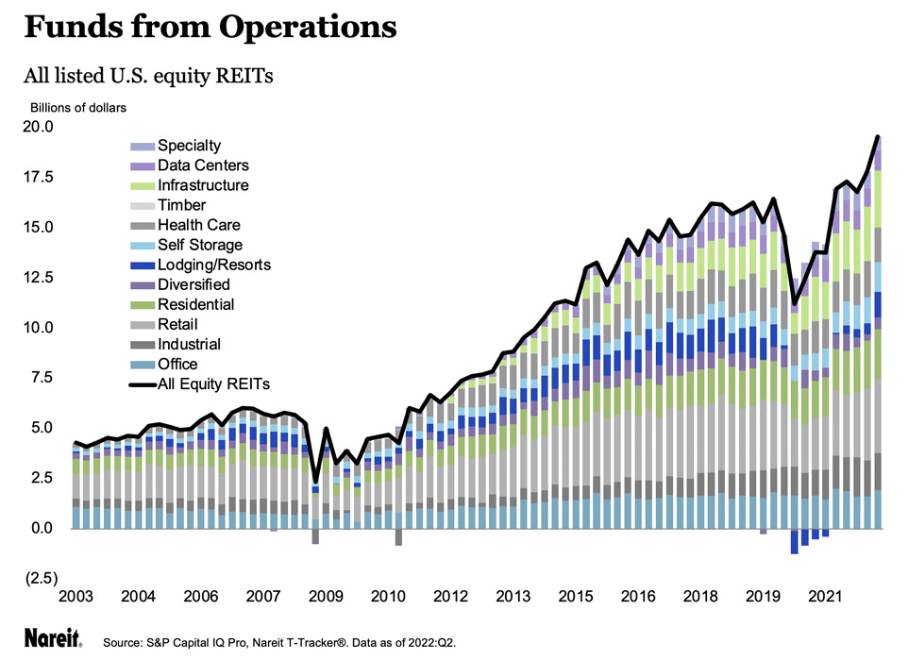

Actual property investments trusts turned in a better-than-expected Q2 as occupancy charges achieved and exceeded prepandemic ranges, serving to to push up funds from operations, in keeping with the Nationwide Affiliation of Retail Funding Belief’s T-Tracker knowledge.

For all listed U.S. REITs, Q2 FFO elevated 9.8% from Q1 to a file $19.6B and 15.4% from the year-ago stage. Nearly 84% of REITs reported elevated FFO from a yr earlier.

“Our first takeaway is that throughout the board REITs are actually performing properly no matter inflation danger, larger rates of interest and issues a couple of slowing financial system,” mentioned John D. Price, NAREIT govt vp, Analysis & Investor Outreach. “What we see is we have actually obtained the vast majority of the trade outperforming the place they had been pre-COVID.”

Probably the most dramatic enchancment was within the lodging and resort REITs. Q2 FFO greater than doubled from Q1 and, in contrast with a yr earlier, lodging/resort REIT FFO soared greater than 1,000%. Listed U.S. lodging/resort REITs’ Q2 FFO of $1.27B grew from $552M in Q1 and from $91M in Q2 2021.

When it comes to same-store web working revenue (“SS NOI”), self-storage, flats, and single-family houses noticed the strongest Q/Q progress. Self-storage REITs’ Q2 SS NOI jumped 20.8% after rising 22.4% in Q1.

Residence REITs’ SS NOI climbed 16.0% from the earlier quarter after a wholesome 12.1% increase in Q1. Single-family residence rental REITs registered an 11.6% enhance, its third straight quarter of greater than 11% Q/Q enchancment.

Solely three sectors are underperforming the place they had been previous to COVID, NAREIT’s Price mentioned. These are Diversified, Well being Care and Specialty. And even these are “not extremely far beneath” their pre-pandemic ranges, Price mentioned.

The workplace sector FFO has held up fairly properly with Q2 2022 FFO up 6 share factors from This fall 2019, he famous. “Early within the COVID interval, what we noticed was that rents had been getting paid although individuals weren’t going into the workplace Now that we’ve obtained individuals flowing again into the workplace, rents are nonetheless being paid, we’re beginning to see extra leasing exercise in 2022 than we actually noticed in 2021 and we’re seeing occupancy charges have actually bottomed out and have began to creep again up once more.”

Like many different sectors, larger rates of interest have impacted REITs’ M&A exercise. Internet acquisitions slowed in Q2 2022 to $11.0B from $16.7B within the earlier quarter, the NAREIT tracker exhibits. In the next rate of interest atmosphere, consumers are going to be in search of larger capitllzation charges, Price mentioned. (Capitalization price, or cap price, is the speed of return primarily based on the revenue that property is predicted to supply.) “We’re actually in a interval the place the market is discovering it’s option to new equilibrium costs and new equilibrium cap charges that mirror the prospect of upper rates of interest,” he mentioned. “It should take a while for these expectations to land.”

He additionally sees REITs as properly positioned to deal with the at present elevated stage of inflation. Wanting on the Q2 outcomes, REITs’ web working earnings rose sooner than inflation on a year-over-year foundation. “That’s one of many key parts of why actual property and REITs, particularly, could be good inflation protectors and are useful to have in a portfolio throughout a interval of excessive and reasonable inflation,” Price mentioned. “Traditionally, REITs outperform the broader inventory market in intervals of excessive or reasonable inflation,” he added.

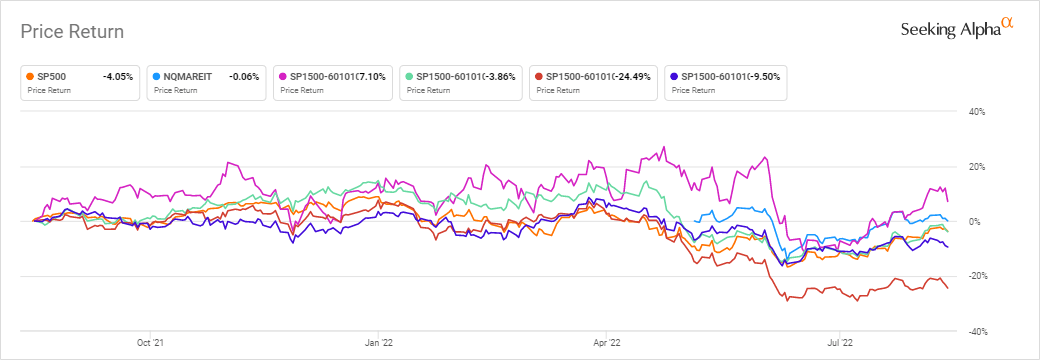

See efficiency of a number of REIT sectors over the previous yr in chart beneath. Greatest efficiency was from Motels & Resorts (magenta line), Nasdaq Multi-Asset REIT index (blue) got here in subsequent, adopted by Residential REITs (inexperienced), Healthcare (darkish blue), and Workplace (crimson). The orange line is the S&P 500 Index.

SA contributor Austin Rogers takes an in depth take a look at NetLease Company Actual Property ETF (NETL), noting peak inflation is a tailwind for web lease REITs