[ad_1]

On 15 September, the ethereum blockchain is planning to modify off its mining rigs. If it occurs, it ought to scale back the carbon emissions of your complete ethereum ecosystem by orders of magnitude in a single day, leaving bitcoin as the one main cryptocurrency to be constructed on the harmful proof-of-work idea. However the switchover might additionally throw a number of the largest establishments within the sector into chaos, and appears more likely to evolve into a chilly warfare between the brand new model of ethereum and the diehard followers of the outdated. And that’s if it occurs in any respect.

A short refresher on cryptocurrencies. The 2 largest on this planet, ethereum and bitcoin, are based mostly on an thought referred to as proof of labor. This – and I’m simplifying – entails the networks outsourcing their safety to a decentralised community of miners, who compete to burn ludicrous quantities {of electrical} vitality to generate lottery tickets. Every time a successful lottery ticket is generated, the miner who did so will get a reward (for bitcoin, that’s at the moment 6.25BTC – about £110,000), and will get to confirm all of the transactions which have occurred for the reason that final winner, packaging them up right into a neat block, and including them on to the chain made up of all earlier blocks. They stamp the block with their lottery quantity and the method begins once more.

Almost the entire above paragraph is fake, so please don’t write to me. It’s true sufficient for what follows: this proof-of-work mannequin is on the root of the whole lot you’ve heard in regards to the environmental affect of cryptocurrencies. And ethereum is planning to drop it.

The substitute known as proof of stake. Conceptually, it’s extra advanced, however with the identical broad brushstrokes we are able to describe it like this: reasonably than burning electrical energy to generate lottery tickets, you as an alternative use your ethereum to purchase premium bonds, and the system picks a winner in proportion to the quantity of bonds they’ve purchased, who then will get to do all of the validation stuff as regular. You possibly can money out of your premium bonds, however the course of is gradual, so you might be motivated to not abuse your validation privileges.

A model of ethereum has been operating on these ideas for some time. It’s had totally different names through the years, from testnet to Eth2, however on 15 September it’s going to turn out to be merely ethereum. This switchover, dubbed “the merge” – as a result of the outdated and the brand new networks will likely be merged collectively – has shot at being the only largest technological occasion ever to occur within the crypto area. Which suggests it has shot at being messy as hell.

To start out, there’s the date. If you happen to’ve observed a soupçon of scepticism, it’s as a result of I’ve been burned earlier than. I wrote in regards to the forthcoming merge being “months away” – in Might 2021:

The change to proof of stake has been deliberate for a number of years, with a bunch of issues, each technical and organisational, delaying implementation. However now, in accordance with Carl Beekhuizen, a analysis and growth staffer on the Ethereum Basis … the change will likely be full “within the upcoming months”.

It was not.

However this time, the change is reasonably extra closing. For one factor, there’s an precise onerous date; for one more, the preparation for the merge is now reside within the code that runs the ethereum community. It might nonetheless be delayed, however the default case, if no additional motion is taken, is that the merge will occur as deliberate.

What’s at stake

That doesn’t imply the merge will likely be easy. The primary stumbling block would be the forks: clones of the outdated model of ethereum, spun as much as preserve the proof of labor system alive.

This gained’t be the primary time this has occurred. There’s untold bitcoin forks, with names like bitcoin money, bitcoin satoshi imaginative and prescient, bitcoin basic and bitcoin gold, however none have ever toppled the unique’s dominance.

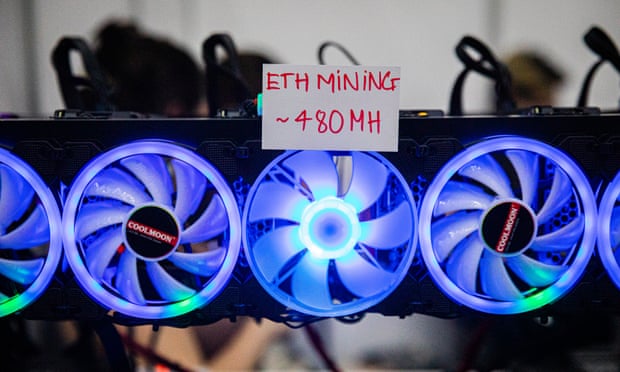

So why would possibly the ethereum fork have extra of an opportunity? As a result of it can virtually definitely have the backing of a strong constituency: ethereum miners. After years on the centre of ethereum infrastructure, the miners face their trade being merely switched off in a single day, and lots of of them aren’t proud of that proposal. They’ve actual, bodily belongings invested within the continuation of a proof-of-work cryptocurrency, from costly graphics playing cards to electrical hookups, and it’s not simple to repurpose it for one thing else.

Because of the open-source nature of cryptocurrencies, it’s simple sufficient for the miners to easily decide up the place they left off, and keep on operating Nu-thereum, or no matter it will get referred to as, on 16 September as if the merge had by no means occurred. The query is, what occurs subsequent?

Everybody who has a steadiness of ETH will all of the sudden discover that they’ve two balances, one on every blockchain. And everybody who has a wise contract operating on ETH will all of the sudden discover they’ve two of them, as nicely: there would be the proof-of-work model of the Bored Ape NFTs, and the proof-of-stake model, and so forth.

A few of these duplicates could fortunately coexist. Others would possibly attempt to speak down the forked model, however by no means fairly kill it – how a lot would somebody who desires to personal a killer NFT pay for an “unofficial” model on the forked chain? If it’s not zero, then the commerce might proceed for a while, even when the builders of the Apes disown the forks.

However for different tasks, there can solely be one. Every USDC token is backed by $1 of onerous belongings held by Circle, the corporate that develops the stablecoin. If there are all of the sudden twice as many USDCs due to the fork, Circle doesn’t have twice as a lot money, and it must select one community to assist and the opposite to reject.

It appears unlikely that the massive stablecoins, like USDC and Tether, will again the insurgent chain. And that, in flip, means your complete insurgent ecosystem will come into existence in a slow-motion collapse, as forked tasks fail one after the other. However it can nonetheless present a base for brand spanking new creation, and one that’s in the end extra much like the ethereum builders know and love than the environmentally pleasant model it’s about to morph into.

What’s subsequent

The upstart miners aren’t solely performing out of self-interest. There’s a level of precept at stake, as nicely, which is the decentralisation that underpins the crypto economic system. That decentralisation is, at coronary heart, the one actual cause for cryptocurrencies to exist: a centralised standard database is quicker, cheaper and safer to run, however requires you to belief whoever is operating it.

A decentralised cryptocurrency can’t be interfered with by massive enterprise, or massive authorities, which makes them nice for – nicely, crime and evasion of presidency rules, in the principle, but additionally loftier ideas like “permissionless innovation” and “uncensorable speech”.

A number of the backers of the proof-of-work (PoW) idea – together with the bitcoin “maximalists” who look down even on upstarts like ethereum – fear that proof of stake (PoS) in the end ends in Dino: decentralisation in identify solely. The character of the system entails handing management of the community to these with probably the most cash held throughout the community. Worse, it fingers further energy to those that take care of different individuals’s cash: centralised exchanges like Coinbase or Binance, and centralised notbanks like Celsius or Voyager, in the event that they’d survived that lengthy. These exchanges can supply “staking” providers the place they do the onerous technical bit of constructing proof of stake work (shopping for the premium bonds, within the phrases of my unbelievable analogy), and their prospects get the rewards.

The rise of the Dinos is greater than only a theoretical concern. In a post-Twister Money world – nonetheless coping with the fallout of North Korea’s favorite decentralised app being accused of cash laundering and sanctioned by the US Workplace of Overseas Property Management (OFAC) – it isn’t in any respect clear whether or not it’s authorized below US legislation for a “validator”, the PoS substitute for miners, to approve a block that comprises a transaction to or from a sanctioned handle.

Ethereum’s builders are attempting to drive the matter, proposing a “credible dedication to punish censors”. What which means just isn’t but clear, however the hope is that it doesn’t should be – that the credible dedication signifies that organisations who should adjust to OFAC merely don’t stake ethereum within the first place.

It isn’t solely clear what an ethereum with no validators who’re attempting to stay in compliance with US sanctions would appear like. However that’s the world we’re heading to.

If you wish to learn the entire model of the e-newsletter please subscribe to obtain TechScape in your inbox each Wednesday.

[ad_2]

Source link