[ad_1]

As a enterprise that accepts funds from different firms, a giant a part of safely exchanging cash is offering your prospects with a secure, environment friendly, and safe methodology of paying you.

Because of this, understanding every part there’s to learn about business-to-business (B2B) funds is essential. On this publish, we’ll cowl:

What are B2B funds?

B2B funds is the fee course of between a enterprise that has bought a services or products and one which has supplied the services or products. Frequent examples of B2B funds are buying stock, companies rendered, and even hire.

Not like B2C funds, which are typically smaller and for gadgets like retail merchandise, B2B funds are massive and might be recurring.

Tomake a B2B fee, sellers sometimes ship itemized invoices and wait to obtain fee from the customer. There are a number of methods promoting companies can settle for funds, and we’ll talk about them beneath.

B2B Cost Strategies

There are a number of methods patrons could make B2B funds, every with its benefits and drawbacks.

1. Wire Switch

A wire switch is a bank-to-bank transaction, and it is likely one of the most typical strategies for making B2B funds.

The principle draw to wire transfers is that they’re quick, safe, and might occur over the telephone by talking on to a financial institution or by way of a web based banking profile. A draw back is that the method can embody a charge for each events that varies by financial institution and kind of switch.

2. ACH Transaction

An ACH (automated clearing home) transactionis an digital switch between two banks, credit score unions, or different monetary establishments. A profit is that it’s often free or low value, however it might take a number of days to course of, which isn’t superb for time-sensitive transactions.

3. Card Funds

Card funds (credit score or debit playing cards) are a fast and straightforward method for companies to make B2B funds, they usually additionally provide the chance to earn rewards factors or money again on transactions.

Whereas debit playing cards don’t sometimes include charges, bank cards might be costly in the event you pay curiosity in your stability. You additionally must pay again your bank card stability, so there’s a further transaction to repay the stability you’ve paid to a different enterprise.

4. Test

Checks are a conventional fee methodology supplied by a financial institution. With a B2B fee, the customer would write a examine to the promoting enterprise to deposit at its monetary establishment.

Checks are a particularly safe fee methodology as they’re authenticated and supplied by a financial institution or monetary establishment, however they take longer to course of as you have to bodily obtain a examine.

5. Cost Gateway

Cost gateways are on-line cash switch instruments that bridge the hole between your online business’ monetary establishment and the patrons’ monetary establishment throughout a transaction. PayPal is a generally used fee gateway.

Do B2B Funds

Step one to B2B funds is to make sure you have a checking account or monetary establishment for your online business which you can hyperlink to all transactions.

The second step is to decide on a fee resolution that meets your wants. For instance, you possibly can go for a extra conventional fee methodology like solely accepting checks from shopping for companies.

These days, B2B fee processing is usually performed on-line by way of fee gateways.

B2B Cost Processing

B2B fee processing occurs by way of an organization that facilitates B2B funds. These firms automate the method and deal with many of the work, like logistics between banks, making the method easy for B2B transactions.

Under we’ll go over a few of the hottest B2B fee suppliers and the way they might help your online business.

B2B Cost Suppliers

1. HubSpot Funds

Worth: Credit score and debit playing cards 2.9% of the transaction quantity, .5% of ACH transactions, capped at $10

Cost varieties: Card funds (credit score and debit), financial institution transfers (wire and ACH)

Safety: PCI compliant, you received’t must confirm your online business.

Key Options:

- CRM fee solutionpowered by HubSpot CRM, so you possibly can immediately join your prospects’ buy historical past together with your information for reporting.

- Settle for funds immediately with fee hyperlinks which you can place in invoices or share immediately with prospects in your web site, touchdown web page, or e mail kinds.

- Automated workflows streamline the fee assortment course of and make it straightforward to receives a commission on time.

- Arrange recurring and one-time funds.

2. Sq.

Worth: Varies by kind of fee and yearly income

Cost varieties: Checks, financial institution transfers (wire and ACH), card funds (credit score and debit), worldwide transfers

Safety: PCI compliant, you received’t must confirm your online business.

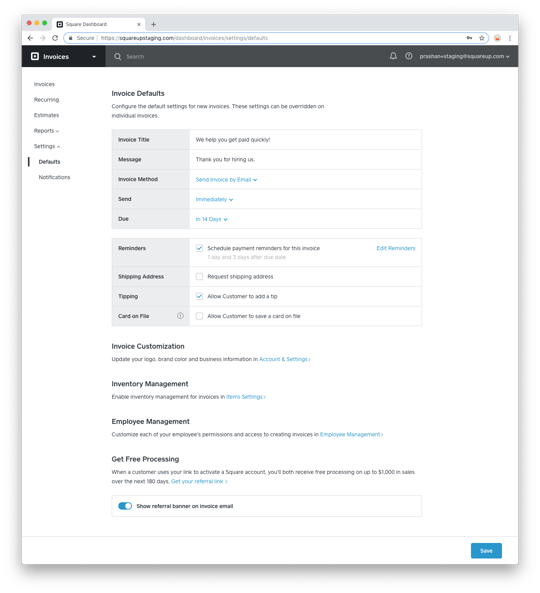

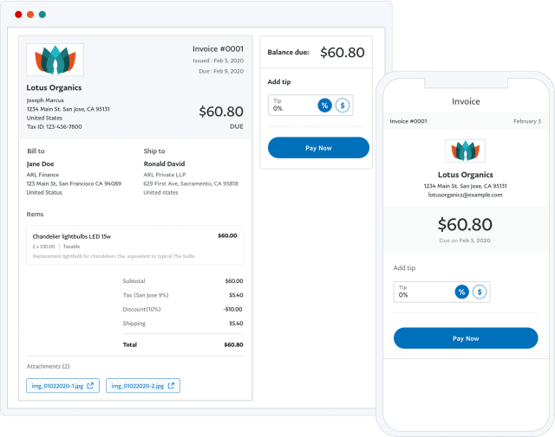

Picture Supply

What we like:

- Create and ship digital invoices to prospects and permit them to decide on their most popular fee methodology.

- Arrange single or recurring funds and use progress monitoring to make sure you’re paid on time.

- You’ll be able to create a web based fee web page for your online business or combine Stripe together with your present web site.

- Immediately entry funds out of your gross sales for a small charge.

3. PayPal for B2B

Worth: Charges differ by fee kind and forex

Cost varieties: Financial institution transfers (wire and ACH), card funds (credit score and debit), worldwide transfers, Pay with PayPal

Safety: PCI compliant, you received’t must confirm your online business.

Picture Supply

What we like:

- Ship free, customizable invoices to prospects or allow on-line funds in your website.

- Arrange subscription or recurring fee choices to skip the month-to-month bill course of and make sure you get your cash on time.

- Construct relationships with worldwide prospects as a result of PayPal accepts 10+ native fee strategies in over 100 currencies.

4. Chargebee

Worth: Varies by enterprise dimension

Cost varieties: Card funds (credit score and debit), PayPal, Amazon Funds, financial institution transfers (wire and ACH)

Safety: PCI DSS Compliant, you received’t must confirm your online business.

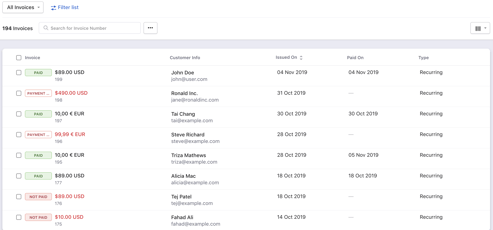

Picture Supply

What we like:

- The automated bill course of helps you create and ship fee notifications to patrons to make sure you obtain funds on time.

- Recurring billing workflows make it easier to arrange a subscription fee mannequin.

- The bill tab lists all invoices generated and helps you retain observe of fee progress.

- Select from 23 fee gateways and 100+ currenciesfor home and worldwide enterprise transactions.

- Chargebee integrates withHubSpot.

5. Stripe

Worth: 2.9% and $0.30 per profitable card cost, .8% ACH for financial institution debits and transfers

Cost varieties: Wire switch, paper examine, ACH funds, card funds, worldwide cash transfers

Safety: PCI DSS Degree 1, so that you don’t should confirm your online business.

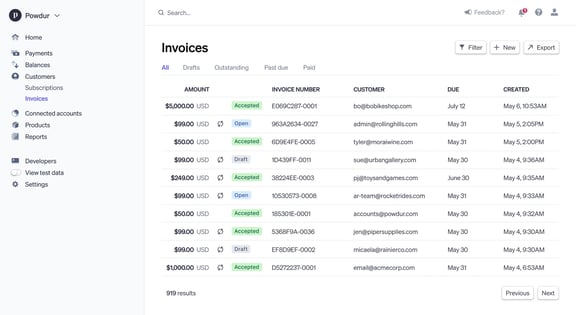

Picture Supply

What we like:

- Stripe Invoicing helps you create and ship hosted invoices which are configurable to any fee kind.

- Arrange billing for one-time funds or on a recurring foundation.

- Design a funds type in your web site with Stripe Parts.

- Helps over 135 currencies and fee strategies for transactions with world prospects.

Over to You

Making a B2B fee course of for your online business is important as a result of it ensures you’re paid for the services you provide and that transactions are performed safely and securely, defending you and your prospects.

[ad_2]

Source link